Advanced Trading Tools

Wide Market Access

Wide Market Access

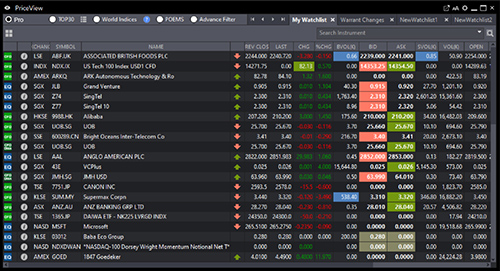

Access to Stocks, ETFs, CFD and CFD (DMA) across 12 global exchanges, including SGX, NYSE, AMEX, NASDAQ, HKEX, SET and BURSA. Your orders and watchlists are in-synced with the POEMS suite of trading platforms.

Fully Customisable Setup

Fully Customisable Setup

Personalise your dashboard and workspace to suit your individual workflow and preferences with our fully customisable set-up.

- Conveniently dock and link multiple modules

- Supports multi-screen and dual language

- Enable fat-finger checks and more

Frequently Asked Questions

POEMS Pro is an application-based advanced trading platform, designed for active traders. It is available to all existing POEMS customers.

No. POEMS Pro shares the same login credentials (Account number and password) as the rest of the POEMS platforms.

Yes! Your watchlists are automatically synced across the POEMS suite of platforms (POEMS 2.0 and POEMS Mobile 2.0, excluding POEMS Mobile 3 App).

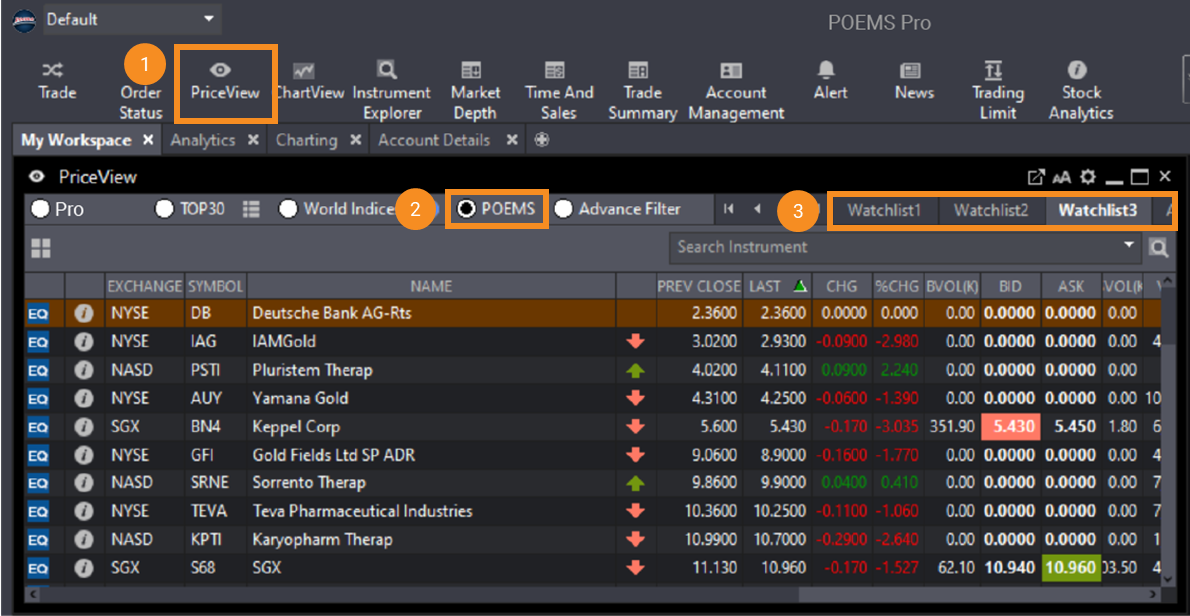

To view your POEMS 2.0/POEMS Mobile 2.0 watchlist(s) on POEMS Pro, simply follow these steps:

1. Open PriceView

2. Select the POEMS radio button

3. Choose the watchlist you would like to view

For SGX market, you are only able to view, amend and/or withdraw SGX Limit and Stop Limit day orders placed through POEMS Pro on POEMS 2.0, POEMS Mobile 2.0 and POEMS Mobile 3.

To view the orders, simply go to the ‘Order Status’ tab, under ‘Today’s Orders’. Likewise, the orders placed using POEMS 2.0 or POEMS Mobile 3 App will be reflected on POEMS Pro. You may view, amend and/or withdraw these orders using POEMS Pro.

However, for foreign markets, only working Limit Orders placed through POEMS Pro will be shown on POEMS 2.0 and POEMS Mobile 2.0 and POEMS Mobile 3. For the advanced order types, it will be reflected in POEMS 2.0, POEMS Mobile 2.0 and POEMS Mobile 3 only when the orders are triggered as a Limit Order. CFD Synthetic Orders placed through POEMS Pro will not be reflected on other platforms until the order is filled.

- SGX (Singapore Stock Exchange)

- HKEx (Hong Kong Stock Exchange)

- SSE (Shanghai Stock Exchange)

- SZSE (Shenzhen Stock Exchange)

- Bursa (Kuala Lumpur Stock Exchange)

- NYSE (New York Stock Exchange)

- NYSE MKT (formerly known as AMEX)

- NASDAQ

- SET (The Stock Exchange of Thailand)

- FWB (Frankfurt Stock Exchange)

- LSE (London Stock Exchange)

- TSE (Tokyo Stock Exchange)

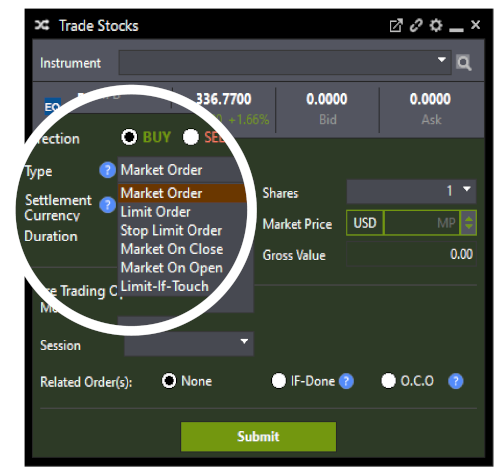

- Limit Order

- Stop Limit Order

- Limit-If-Touch

- IF-Done Related Order

- One-Cancels-The-Other (OCO)

- Market Order

- Market-On-Open (MOO)

- Market-On-Open (MOC)

- Fill-Or-Kill (FOK)

- Immediate-Or-Cancel (IOC)

(1) Day OrderThe order is only valid for the day that it is entered into the order book. Unexecuted orders will automatically expire at the end of the trading day.

(2) Good-till-Date (GTD) Clients can specify up to a maximum of 28 days for their orders to stay active.

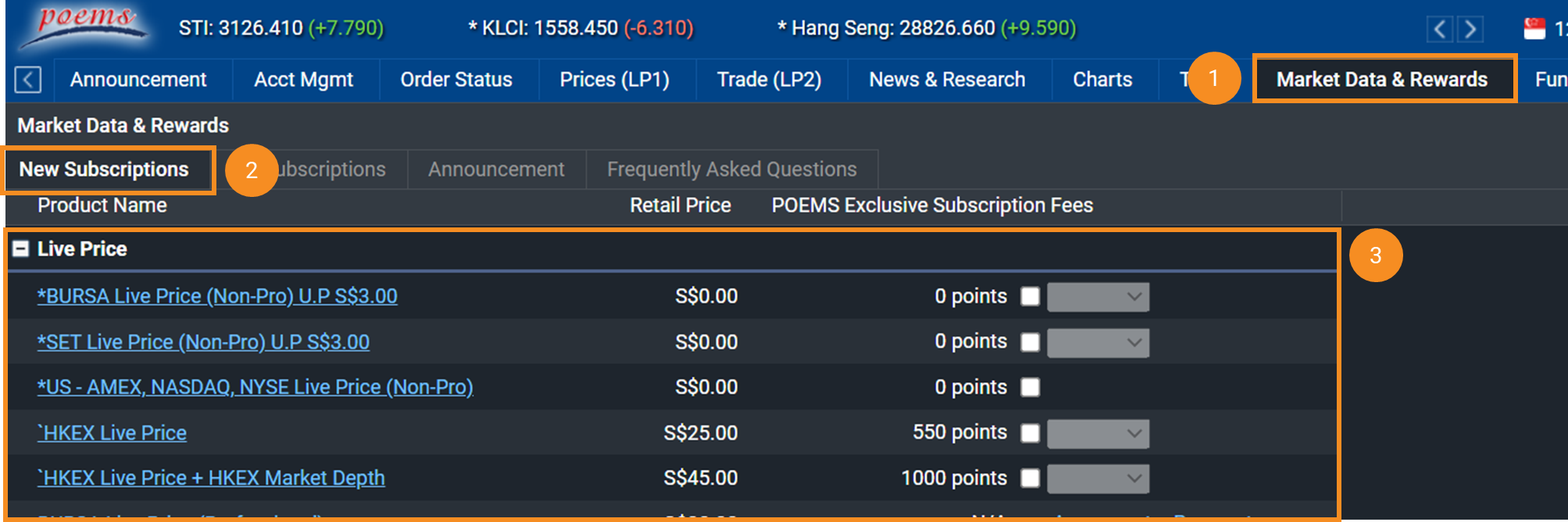

If you are receiving delayed prices for foreign markets, it is likely that your POEMS Account does not have live price access for the respective market.

To subscribe for live price, simply log in to POEMS 2.0, go to ‘Market Data & Rewards’ tab, select ‘New Subscription’ and locate the live price you wish to subscribe.

| Market | ||

|---|---|---|

| SGX | Subscribe from the Rewards tab in POEMS 2.0 | |

| HKEx | Available with the HKEx Live Price + HKEX Market Depth subscription, subscribe from the Rewards tab in POEMS 2.0 | |

| Bursa | Available with the Bursa Live Price subscription. Subscribe from the Rewards tab in POEMS 2.0 | |

| Market Depth for these exchanges are not available: | NYSE / NYSE MKT / NASDAQ / SZSE / SET / FWB / LSE / TSE |

To view the user guide, simply log in to POEMS Pro, click on the "Help" icon located at the top right corner, and select "User Guide".

Please note the following recommended and minimum requirements. Using the software on a system that falls below the recommended system requirements may result in less than optimal performance.

Recommended System Requirements:

- Windows 7, 8, 10 or 11

- Multi-core Intel® or AMD® processor at 3 GHz or faster

- 8 GB or more RAM

- 1 GB or more available hard disk space or more

- Screen Resolution of 1024 by 768 pixels or higher

- Cable Broadband Internet Connection of 200Mbps or better

- To achieve best performance, a dedicated PC should be used for POEMS Pro only.

Minimum System Requirements:

- Window 7

- Single-core Intel® or AMD® processor at 1.5 GHz or faster

- 4 GB RAM

- 500 MB or more available hard disk space

- Screen Resolution of 1024 by 768 pixels or higher

- Cable Broadband Internet Connection of 50Mbps or better