Are Singapore REITs still a good buy? December 9, 2022

Planning to ride on the re-opening of Singapore’s borders? Which sectors should you invest in?

The most obvious choices here would be stocks from sectors such as tourism, retail, logistics, industry, health care and information technology. However, the process of picking stocks from each individual industry can be daunting, considering the wide range of choices and the sizeable amount you have to commit to. One alternative worth considering is an investment that covers all the sectors that are likely to benefit from the re-opening.

S-REITs are one of the many investment options that can ride the “re-opening growth” wave. Their property portfolios cover investments in all the sectors likely to benefit like tourism, retail, logistics, industry and healthcare and information technology. Furthermore, S-REITs give investors exposure to properties globally.

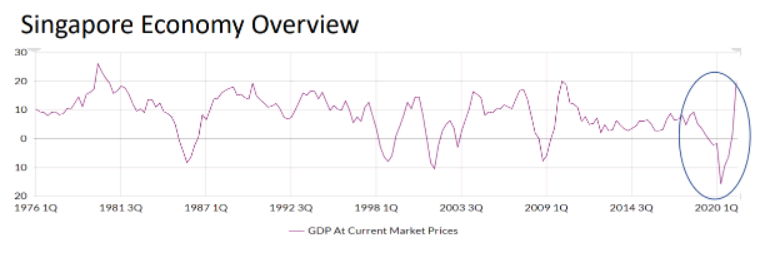

Singapore’s economy is showing definite signs of recovery in the last few months as the city-state in particular, and the world in general, come to grips with COVID-19, and move on to deal with other economic and geopolitical challenges.

On the economic front, Singapore began re-opening its borders from May 2022, and has continued to open up to more business activities and travel since then. The economy has rebounded at one of the fastest rates globally. Q2 2022 showed a 4.4% growth in GDP. The revision of the consensus GDP growth forecast for 2022 now projects Singapore to grow at 3-5%, according to the Ministry of Trade and Industry.

The iEdge S-REIT Index, which looks at REITs in Singapore, recovered 5.7% in total returns in November 2022, after a 5.6% decline in October 2022. It outperformed the FTSE EPRA Nereid Developed Index, which gained 3.5% during the same period. Interest rates and economic growth in key Asian markets continued to be key drivers in the month.

Top performing sub-segments within the S-REITs sector in November 2022 were data centres and diversified and industrial S-REITs, which saw average total returns of 12%, 8% and 4% respectively. All hospitality trusts with Singapore assets observed significant improvements in occupancy and RevPAR (Revenue Per Available Room) in Q3 2022, driven by the return of large-scale events and the MICE (Meetings, Incentives, Conventions and Exhibitions) industry, alongside pent-up demand for overseas travels.

Six S-REITs recorded double-digit total returns in November 2022:

- Digital Core REIT: DCRU +4.27% (+18.1%)

- CapitaLand China Trust: AU8U +1.75% (+16.5%)

- Daiwa House Logistics Trust: DHLU -1.55% (+16.1%)

- OUE Commercial REIT: TS0U 0% (+12.3%)

- SPH REIT: SK6U -1.11% (+10.4%)

- CapitaLand Integrated Commercial Trust: C38U -0.49% (+10.1%)2

Now, let us look at some of the reasons why you should consider adding S-REITs to your portfolio.

Source: MTI, SingStat as of April 2022; MOH as of 30 September 2022

Source: MTI, SingStat as of April 2022; MOH as of 30 September 2022

- continues to re-open up for more business activities and open-borders travel

- rebounding at one of the fastest rates

- 4.4% growth in GDP for Q2 2022

- revision in consensus GDP growth forecast of 3-5% for 2022

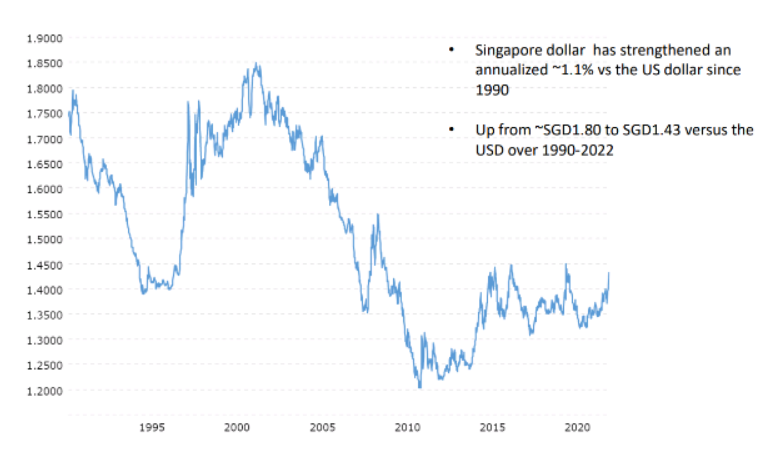

Stable Singapore dollar

Source: PCM. Macrotrends.net 3rd Oct 2022

Source: PCM. Macrotrends.net 3rd Oct 2022

- strengthened an annualised ~1.1% vs the USD since 1990

- up from ~SGD1.80 to SGD1.43 versus the USD over 1990-2022

Singapore REITs

One of the largest REIT market in the Asia Pacific Region

- over 40 REITs / Stapled REITs listed on the Singapore Exchange

- diversified assets from different sub-industries

- consists of Singapore and global assets. Singapore REITs hold crown jewel assets such as

- Retail – Ngee Ann City, Paragon, Plaza Singapura

- Office – Marina Bay Financial Centre, One Raffles Place, Raffles City

- Industrial – Nexus@One-north, Viva Business Park, Changi Business ParkHospitality – Mandarin Orchard Hotel, Ascott Raffles Place

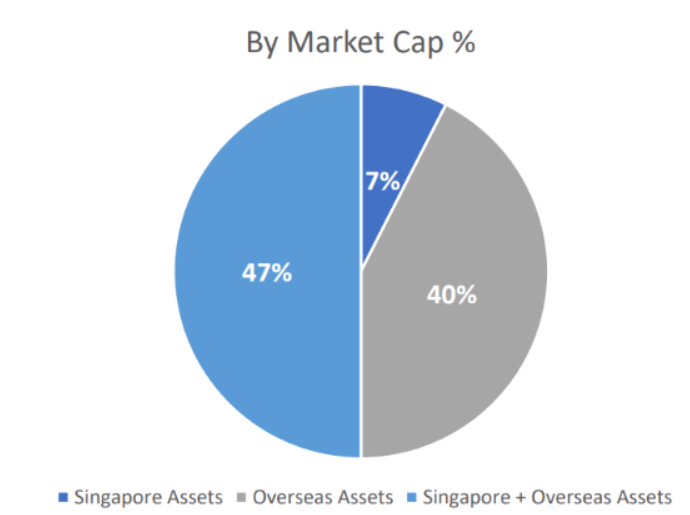

‘Internationalisation’ of S-REITs

Source: Bloomberg, SGX (31 October 2022)

Source: Bloomberg, SGX (31 October 2022)

- increasing number of S-REITs have started to acquire properties outside of Singapore

- increasing number of overseas REITs listing in Singapore

- Singapore REITs allow investors to get exposure to properties globally

Benefits of investing in REITs

- liquid & flexible – cash-out any time, no stamp duty, lock-in period & cooling measures

- peace of mind – owning properties without worrying about the plumbing, roof leaking & property maintenance issues.

- regular income – annual yield of 4~5% p.a. – higher than actual tenant rental

REITs that PhillipCapital offers

- Phillip SGX APAC Dividend Leaders REIT ETF (listed 2016) (First Dividend Focused Asia Pacific REIT ETF; Tracks SGX APAC ex-Japan Dividend Leaders REIT Index; Most Innovative ETF Awards, SGX 2016)

- Lion-Phillip S-REIT ETF (listed 2017) (Collaboration with Lion Global Investors, one of Singapore’s largest fund managers; First ETF to focus solely on Singapore REITs; Tracks the Morningstar® Singapore REITs Yield Focus IndexSM)

- Phillip SING Income ETF (listed 2018) (Encompasses stocks of 30 high-quality Singapore listed companies; Tracks the Morningstar® Singapore Yield Focus IndexSM 2020)

- Phillip Global Rising Yield Innovators Fund

- Phillip SGD Money Market ETF 2021

- Phillip Quality Fund (January 2021)

- Phillip Leveraged and Inverse Products (September 2021)

For more information, go to Home – Phillip Capital Management (phillipfunds.com)

Singapore REITs Market

Quality Sponsors and Assets – The REITs’ property portfolios tend to have good quality assets such as iconic buildings with resilient occupancy rates. Parent sponsors with strong balance sheets or government affiliations provide financing or asset injections.

Regulatory Framework – REITs are legally obligated to pay out 90% of earnings to investors, in order to qualify for tax-incentives. The REITs leverage limit has increased from 45% to 50%, dividend income received by local unitholders is exempt from tax.

Catalysts – Increased regulatory measures in the residential sector have diverted interest towards commercial and industrial segments. The low interest rate environment has driven investors towards higher yielding yet relatively stable asset classes, e.g. Asian bonds and REITs.

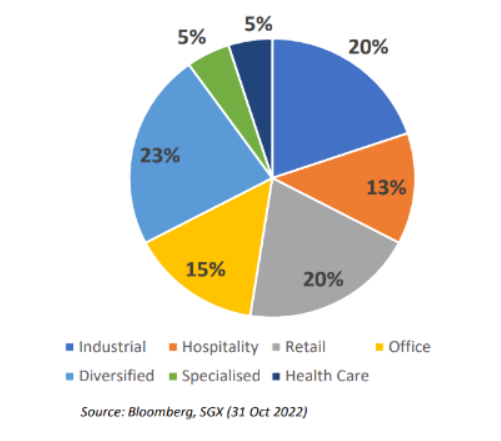

S-REITs have diversified property sub-segments

- Sector exposure of S-REITs is well distributed

- Diversified REITs account for the largest proportion at 23%. Exposure to the remaining sectors is evenly distributed.

- S-REIT portfolios provide substantial diversification, both geographically and through sub-sectors.

Sub-Sector Outlook: Industrial

- as at Q3 2022, the occupancy rate of all industrial space stood at ~90%

- rental index was up 2.1% Q3 2022

- new completions picked up in 2022, quickly absorbed by market demand as Singapore’s economy rebounded strongly in 2022.

- potential and further rise in occupancy rate is tempered by new supply as new completions come on stream

Sub-Sector Outlook: Industrial (Potential new supply)

- as at Q2 2022, 1.54 million sqm was under construction – expected to come on stream by end of 2022

- 44% of new supply is single-user factory; 36% is for multi-user factory; 17% for warehouse; and 3% for business parks

- expect potential tempering of rents and prices for single/multi-user factories

Sub-Sector Outlook: Retail

- Q2 2022 onwards saw a recovery; occupancy rate in retail S-REITs remained strong at 95% vs Singapore retail occupancy of 92%. Vacancy grew more prevalent in strata malls.

- shopper traffic in suburban CapitaLand Integrated Commercial Trust (CICT) and Frasers Centrepoint Trust (FCT) malls hovered at 50-65% of the 2019 pre-COVID averageHowever, tenant sales $psf/month (price per square foot) for CICT and FCT suburban malls have recovered to 80-94% pre-COVID average.

- shopper traffic in downtown malls hovered at 56.9%, while tenant sales $psf/month were 75.7% of pre-COVID average

- attractive dividend yield

- tenant sales have improved since 2Q 2022

Sub-Sector Outlook: Office/Commercial

- near-term new supply low: Only 70,000 sqm in gross floor area coming in from pipeline for 2021, representing 0.86% of existing supply

- Rising office vacancy rate to 11.7% as of Q3 2021, near the level of Q4 2017

- Geographic exposure not limited to Singapore. More than 60% of Office S-REITs exposed to other countries by market cap

- Fundamentals for office space remain weak as businesses continue to ‘right-size’ physical office space along with more ‘hybrid’ style of working (WFH-WFO)

- Continued downward pressure on rental yields; with limited offset from resilient occupancy

Sub-Sector Outlook: Hospitality

- average occupancy rate increased 26% to 85% in October 2022; 20.6% YoY growth from 2021

- YoY has been positive for 14 consecutive months since September 2021

- since re-opening of borders from 1 April 2022, an increase in occupancy rate past 60% and a continuous increase to 85% in October 2022

- as at October 2022, RevPAR stood at $239.1, a 132.8% YoY increase and it is above the pre-Covid level (September – October 2022)

- occupancy rate ~79%

- RevPAR has surpassed pre-COVID levels in September & October 2022 ~S$239.10

- RevPAR is expected to increase in 2023 when China opens up further

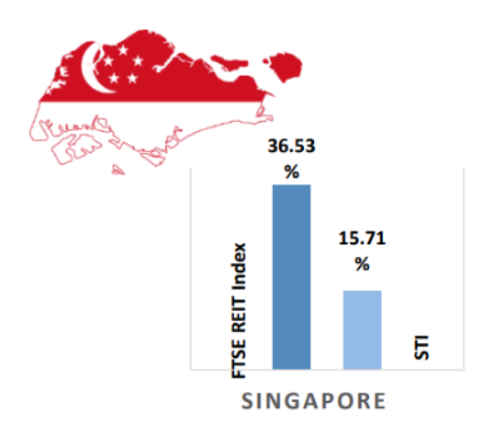

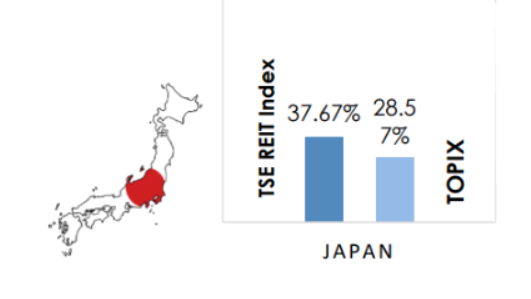

REITs have outperformed wider markets

- major Asia Pacific REITs markets have outperformed general markets in respective countries

- total Returns (local currency) Jun 2017- June 2022

source: Bloomberg

REITs and the volatile market

- REITs are generally well prepared for the rising interest rates

- markets and REIT managers alike, expect relative gradualism in the rate hike environment

- many experienced REIT managers have locked in funding costs on fixed rates taking advantage of the existing interest rate environment

- rate rises are not expected to significantly impact their ability to pay dividend

Key Takeaways

- Singapore 2022 GDP Growth: 3-5%

- longer-term opportunities in the logistics, data-centres, business parks and healthcare sectors

- Overweight – Industrial, Retail

- Neutral – Hospitality, Office

- significant new supply in pipeline for industrial sub-sectors

- stable occupancy in retail S-REITs; rental yields show resilience for suburban malls

- ocal office space shows rising vacancy; office S-REITs are geographically diversified

- changing demand drivers as companies continue to right-size

- re-opening in hospitality sub-sector as air travel begins to rebound

Reference:

- [1] https://www.businesstimes.com.sg/companies-markets/transport-logistics/s-reits-rebound-6-november

- [2] https://www.businesstimes.com.sg/companies-markets/hospitality-s-reits-ride-pent-travel-demand-and-return-events-q3-2022

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Elston Soares

Elston Soares is an editor with Phillip Securities Research.

Introduction to unit trust

Introduction to unit trust  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close