Decoding FX CFD February 7, 2024

The foreign exchange market commonly known as the forex or FX market, is a cornerstone of the global financial markets. It is the most active market in the world, with global traded value hitting a record high of US$7.5 trillion a day in April 2022 [1]. This dynamic market serves as a platform for price discovery, offering opportunities for traders to capitalise on the fluctuations in currency prices to make profits. In this article, we will explain the fundamentals of forex to help guide you in your trading journey and explore its mechanics.

What is forex?

The forex market is a decentralised global marketplace where all world currencies are traded. This massive network operates round the clock connecting all the forex market participants. The main objective of forex is to exchange one currency for another, at a mutually agreed rate.

Features of forex market

A. Market Participants

The forex market is diverse and accommodates a broad range of participants. At one end, central banks, large commercial banks, brokers and corporates conduct substantial transactions; on the other end, individual retail traders and institutional investors engage in speculative trading or hedging activities. This blend of participants not only adds to the market’s rich liquidity but also contributes to its inherent volatility, making the forex market a uniquely vibrant financial arena.

B. Accessibility

Accessibility in the forex market is a key feature that enables individuals to participate in currency trading, regardless of their geographical location or financial background. This has empowered a new generation of traders and transformed the landscape of global finance. The rise of online trading platforms has revolutionised access to the forex market, making it possible for participants with an internet connection to trade using their desktop or mobile device, from anywhere. In the past, currency trading was largely restricted to financial institutions and high net worth individuals.

At Phillip Securities, we offer forex trading in the form of Contracts for Difference (CFD), on various platforms, POEMS 2.0, POEMS Mobile 3 App and POEMS CFD MT5 for trading at your fingertips.

CFD is an Over-the-Counter (OTC) derivative financial product that allows you to trade the price movement of the underlying asset. CFD is traded on margin and you do not own the underlying asset when you trade CFDs. CFDs are available on a range of underlying assets, such as equities, indices, FX and commodities. To learn more about CFD, please refer to this “Understanding Contract for Difference (CFD)” Article [2].

C. 24-Hour Market Operation

The forex market operates round the clock, 24 hours 5 days a week due to its global nature and the involvement of various financial centres across different time zones. This continuous operation benefits traders globally, as it accommodates different schedules and allows them to participate in the forex market at their convenience.

Understanding FX CFD

A. FX CFD Currency Pair Structures

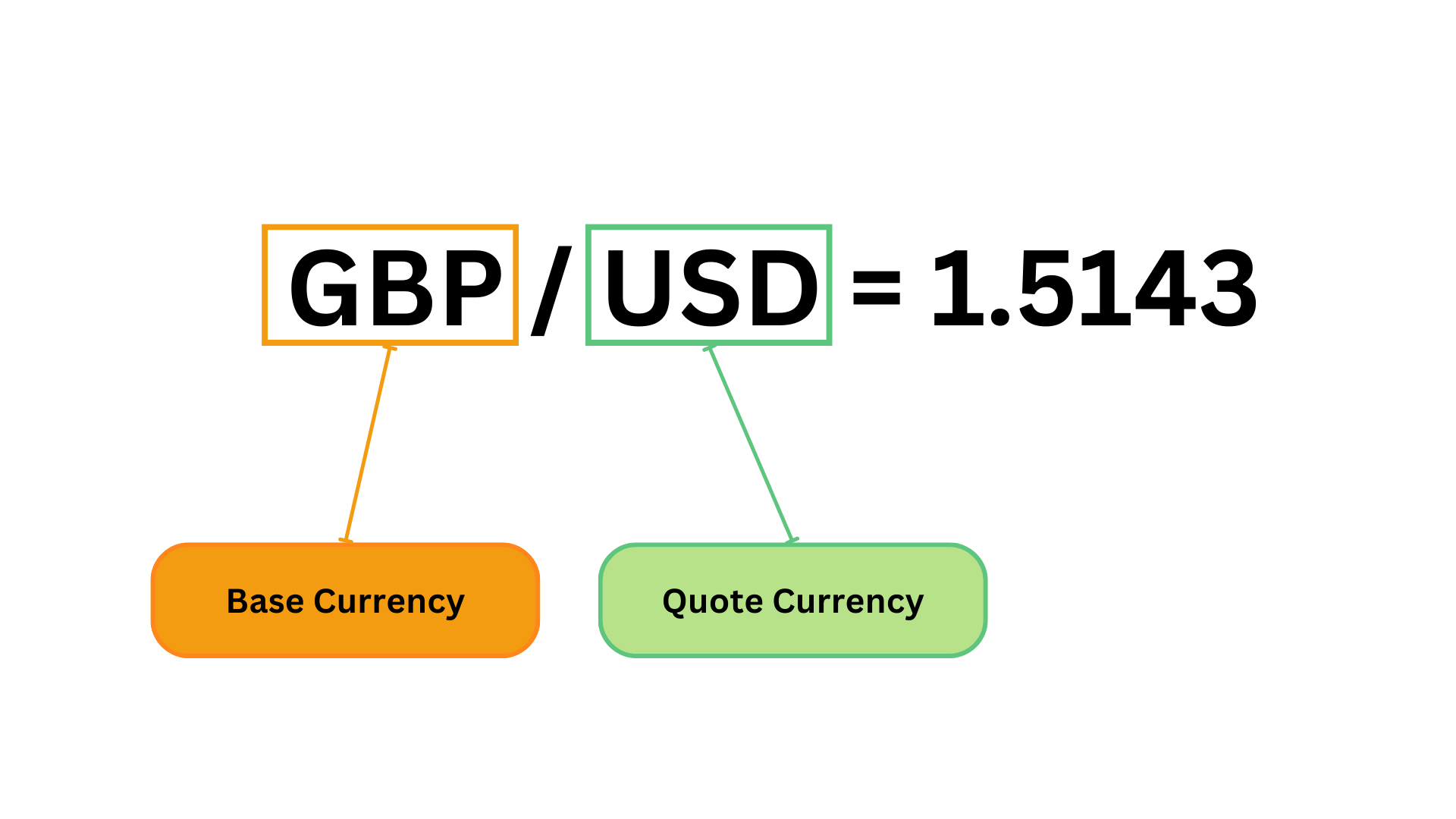

In the forex market, currencies are represented by 3 letter codes and are quoted in pairs. For instance, EUR/USD, USD/JPY and GBP/USD are common symbols. From the image above, GBP is the “base currency” while the USD is the “quote currency”.

The first currency listed in the forex pair is the base currency where it serves as the reference point for the exchange rate. The second currency listed is the quote currency which represents the value of one unit of the base currency in terms of the quote currency.

The 1.5143 exchange rate in the image indicates how much of USD (quote currency) is needed to purchase one unit of GBP (base currency). This rate reflects the relative strength or weaknesses of the two currencies in the pair. Therefore, 1 GBP is equivalent to 1.5143 USD. Based on this quotation, profit and loss will be reflected in USD, the quoted currency.

Pip on FX CFD

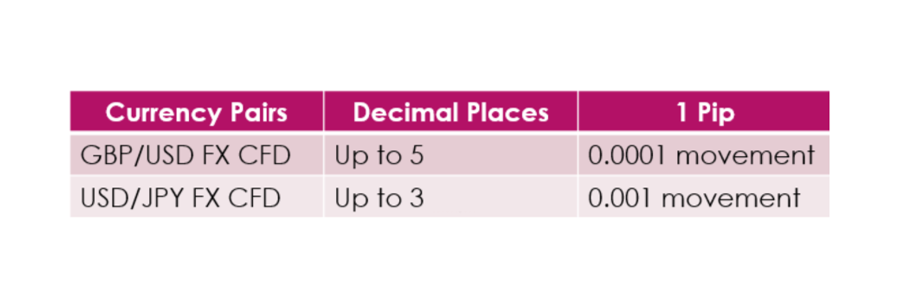

A ‘pip’ is a standardised unit that refers to the movement in the 4th or 2nd decimal places for most currency pairs.

In pairs like GBP/USD, 1 pip corresponds to a movement up to five decimal places, which is 0.0001.t. However, for currency pairs involving the Japanese Yen (JPY), such as the USD/JPY in the image above, 1 pip equates to a movement up to three decimal places, or 0.001. This subtle difference is crucial for accurately calculating profits and losses in FX CFD trading.

B. FX CFD spread

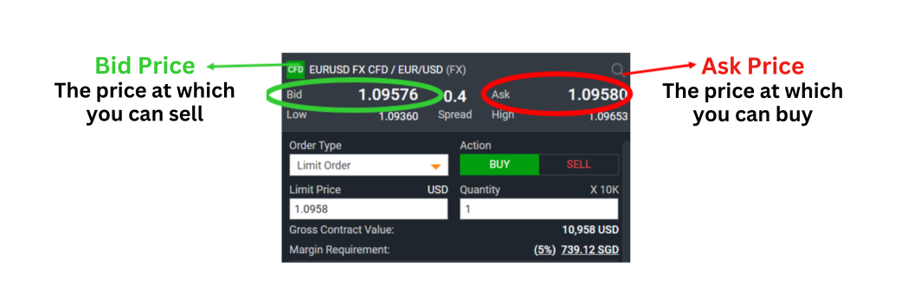

In forex trading, the ‘spread’ is the fundamental concept that refers to the difference between the bid and ask prices of a currency pair. It is essential for traders to understand this as it directly influences the cost of entering and existing trades.

Source: Poems3

Source: Poems3

Spreads are usually measured in pips, which is the smallest price movement that a currency exchange rate can make. When placing a market order, traders execute the order at the best available price in the market. The execution price will be the current ask price for a buy order and the bid price for a sell order. The difference between the bid and ask price at the time of execution is the spread.

Bid price = The price at which you can sell

Ask price = The price at which you can buy

Spread = Ask Price – Bid Price

In the example from POEMS 2.0 shown in the image, we can see the order ticket for EUR/USD FX CFD, where the bid and ask prices are shown on both sides, with a spread of 0.4 in the middle.

C. Ability to Long and Shorts

One significant advantage of FX CFD is the ability to go both long and short on currency pairs. This flexibility allows traders to profit from both bullish or bearish market movements. In volatile markets, the ability to short allows traders to profit from price declines, giving them opportunities in both trending and ranging market conditions. Effective long and short strategies require a deep understanding of market analysis, including technical and fundamental factors that influence the currency pair movements.

D. Leverage in FX CFD

Leverage is a powerful tool that allows traders to establish a larger position with a relatively smaller amount of capital. This involves putting up a margin, the required funds in a trading account to open and maintain a position.

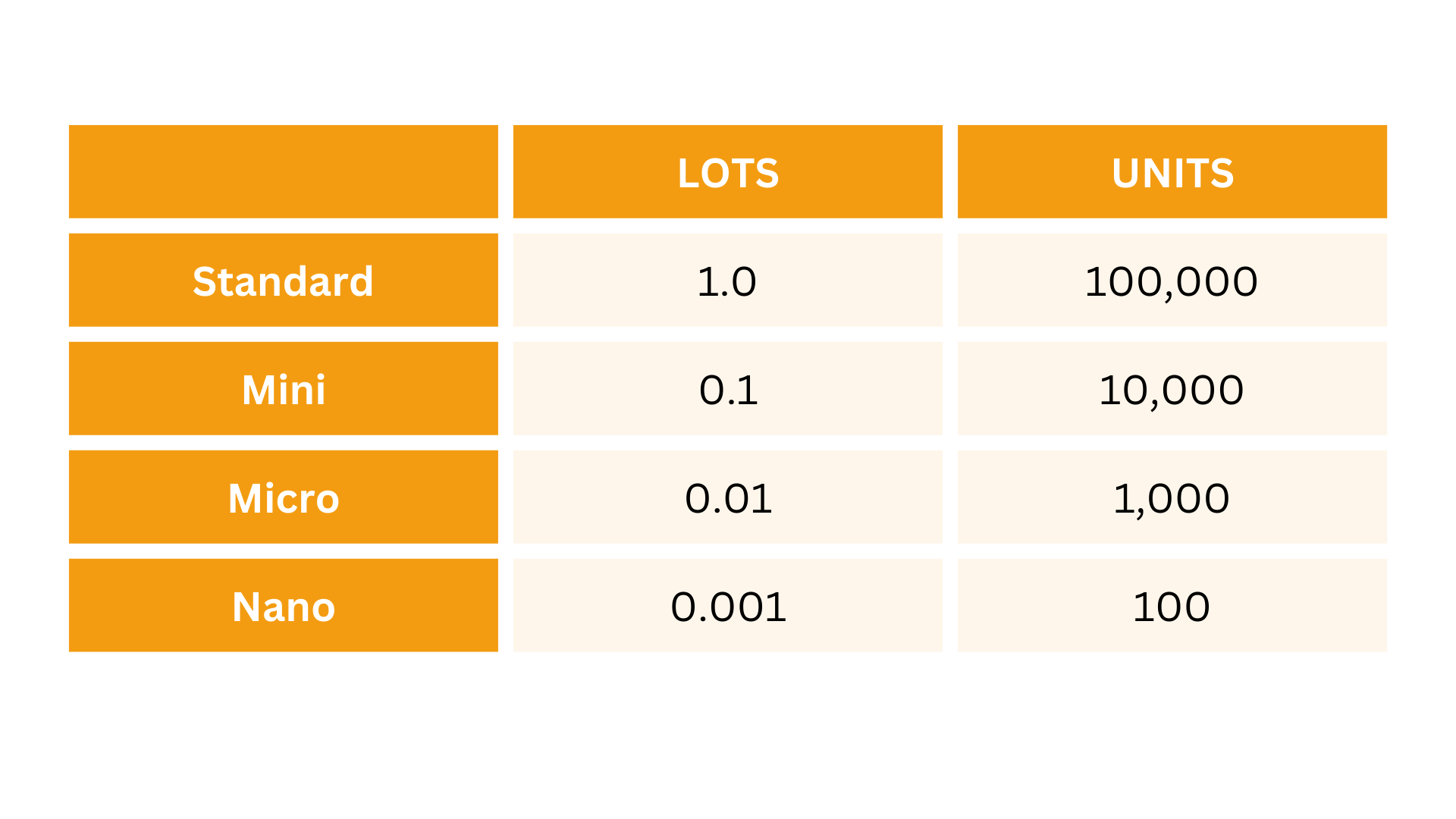

Normally, 1 standard lot is equivalent to 100,000 units, but at Poems CFD, our FX CFDs are offered in mini lots which is 10,000 units for a FX currency pair. For a 10K contract, 1 pip movement is equivalent to USD$10.

Mini lots offer traders enhanced flexibility in risk management, allowing them to precisely control the size of their positions, for more accurate risk calculations. This enables traders to manage their exposure more granularly as traders with mini lots can diversify their portfolios more effectively, spreading capital across multiple smaller positions instead of concentrating on a few large ones, thereby reducing the risk associated with individual trades.

While leverage in FX CFD trading can amplify potential profits, it also comes with certain risks and drawbacks. Trading with leverage involves using borrowed funds, and this comes with the requirement for maintaining a margin. If the market moves against you, your losses will be amplified and you might be issued with a margin call, which will require you to deposit more funds into your account or reduce your positions.

Why Trade FX CFD with us?

Enjoy ZERO commission and NO finance charge for all 39 FX pairs available for CFD trading from as low as 5% margin.

On top of this, there are also NO Platform fees and NO Market Data fees!

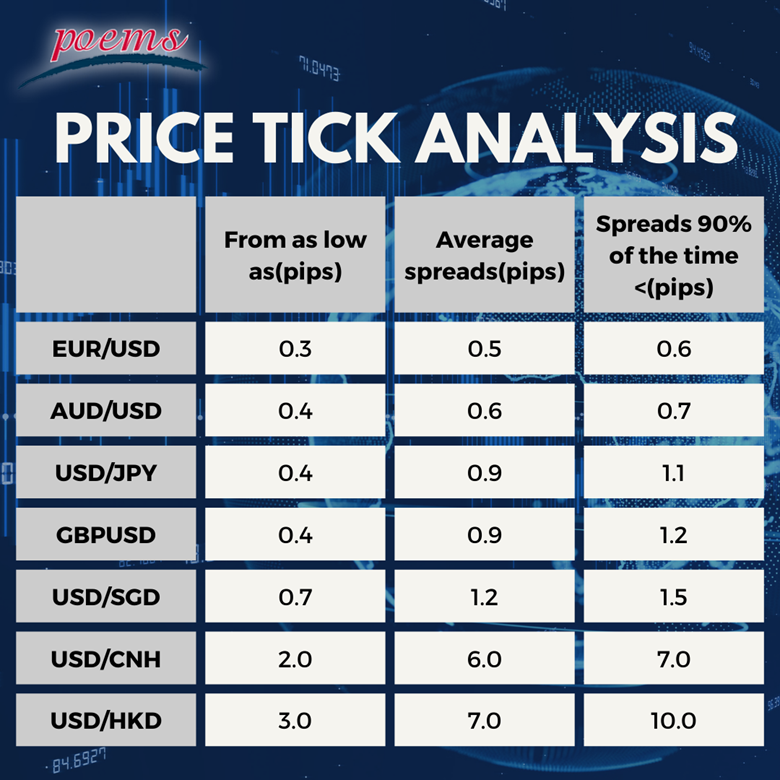

We offer competitive spreads that are usually as low as 0.3 to 0.4 pips. This means that you can enter and exit positions with reduced expenses contributing to overall cost efficiency.

For traders engaged in strategies like scalping or day trading where positions are opened and closed within short time frames, competitive spreads are very crucial where narrower spreads facilitate quicker and more frequent traders which align with the rapid pace of these trading styles.

The FX market is the largest and most liquid market in the world, with trillions of dollars traded daily. With FX CFD, you can now access the largest financial market, 24 hours a day, 5 days a week.

Enjoy a hassle-free trading experience with a single CFD trading account that enables you to access different currencies and asset classes such as Equities, Commodities and Indices. Choose from an extensive selection of over 5,000 counters, all available from just 1 account!

If you are an existing POEMS account holder, you can simply opt-in for the CFD Trading facility on POEMS 2.0 and POEMS Mobile 3.0. If you are new to Phillip Securities Pte Ltd, create a new account now!

As per the regulatory requirement, all investors are required to complete and pass the Consumer Knowledge Assessment (CKA) and acknowledge the Risk Fact Sheet in order to trade CFD.

We hope this article has enhanced your understanding of forex trading. For more information on our FX CFD, kindly refer to the contract specification page. There are also FREE FX CFD seminars that you can attend to learn more about this derivative product!

Promotions

Now is a great opportunity to try Equities CFDs. Fund S$5000 into your CFD account and trade 8 Equity CFDs to get S$88 Cash Credits and a chance to win a 43″ TV worth S$999!

For more information, click here.

References:

- 1 https://www.bis.org/statistics/rpfx22_fx.htm

- 2 https://www.phillipcfd.com/understanding-contract-for-difference-cfd/

- 3 https://www26.poems.com.sg/Main

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Onisha Thye

Dealing

Phillip Securities Pte Ltd

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities that are available to grow one’s wealth, either through trading or investment.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  Playing Defence: Diversification in Forex Trading

Playing Defence: Diversification in Forex Trading