Did you sell in May? July 8, 2020

Well, if you want to be successful, you should study history, because history will teach you that things are always changing. Everything you know today is not going to be true in 15 years, which is an extremely important lesson to learn, because most people get up every day and think that whatever is going on is the way the world is and always will be.

Jim Rogers; Co-Founder of the Quantum Fund

Did you sell in May? With the benefit of hindsight, I sure hope you did not! Through the span of May, we saw a 4.5% recovery in S&P 500 Index which softly validated the thesis that the market is going to experience a V-shaped recovery. As of writing on 23 June 2020, the NASDAQ crossed above 10,000 points for the first time ever!

What does “Sell in May and Go Away” (#SIMAGA) mean actually? #SIMAGA suggests that markets tend to underperform during this half of the year as compared to the six-month period starting from November to April of the following year.

In this article, we will make use of historical data to investigate this phenomenon and why #SIMAGA matters to you. Lastly, we will be sharing with you how you can utilise CFDs during such volatile times.

Without further ado, let us present our findings!

Performance Data for Major Indices (May to October 1990 to 2020)

| S&P 500 | Straits Times Index (STI)(from 1999) | Hang Seng Index (HSI) | |

| Average MoM Return (1990) to 2019) | 0.70% | 0.24% | 0.88% |

| Average Mom Return – May to October | 0.31% | -0.34% | 0.63% |

| Average MoM Return – November to April | 1.08% | 0.72% | 1.04% |

| Worst Average Return Month | August | August | August |

| Best Average Return Month | April | April | October |

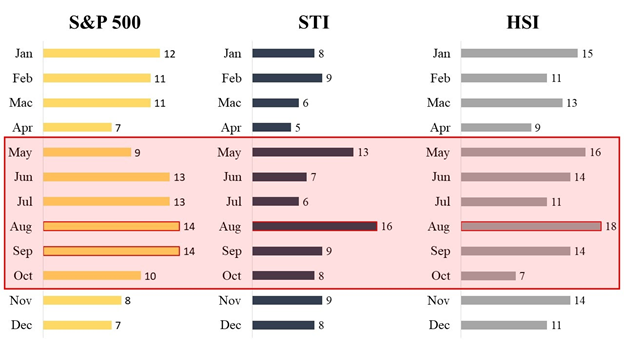

Number of Negative MoM Returns for each Month (1990 to 2019)

Figure 2

Figure 2

Lo and behold, the #SIMAGA hypothesis prevailed!

The average returns from May to Oct 1990 to 2020 presented in Figure 1 were indeed lower for the 3 indices we studied in Figure 2 which presented similar findings too. When taking data from 1990 to 2019, May to October were the months with the most negative returns.

Coincidentally, many of the events that caused a spike in volatility (listed below) happened during the periods from May to October.

Example of such events include:

– Wall Street Crash 1929

– Black Monday 1987

– Global Financial Crisis 2008

– 2011 and 2015 Stock Markets selloff

[1][2]

Analysis

In order to see how a potential crisis is played out, it is always ideal to study past crises and events. Based on the historical data analysed, the periods from May to October under-performed when compared to the periods from November to April.

However, in our opinion, the COVID-19 pandemic is an unprecedented global crisis.

Why do we say so?

The U.S. subprime crisis of 2008-2009 was a U.S.-centric crisis which primarily involved the U.S. housing market and the U.S. financial system. This damage subsequently spilled over to the European Banks. At that point in time, Asian banks had little or no exposure to the subprime market, credit default swaps or mortgaged backed securities. The crisis affected Asian countries that borrowed heavily in USD. Therefore, not all countries in Asia were affected.

In Q1 2020, the COVID-19 pandemic triggered unusually high volatility in the financial markets. Governments and Central banks around the world have been taking drastic measures to revitalise the economy.

Locally, the Singapore Government introduced 4 four budgets, dedicating a total of S$92.9 billion, approximately 20% of GDP to assist local businesses and individuals to weather through the COVID-19 crisis. The latest S$33 billion Fortitude budget is aimed to help businesses and individuals to adapt and build resilience during the pandemic [3].

In U.S., the Government introduced a stimulus package through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This is the largest-ever economic stimulus package in U.S. history, amounting to more than US$2 trillion in economic relief. This act aims to assist workers, families, businesses as well as preserve jobs. [4] The US Fed also announced unlimited Quantitative Easing (QE) for the first time in history and lowered interest rates to 0% -0.25% level [5]. Furthermore, with U.S. president Donald Trump seeking re-election, the Trump administration will strive to keep the economy growing to strengthen their support base.

The steep sell-off in March 2020 may have already priced in most of the negative market sentiment. The stock market may recover in stages under the assistance of various monetary and quantitative easing policies. Therefore, the “Sell in May and Go Away” slogan may not hold in 2020, as most markets are currently in recovery mode.

What can you do?

Truth be told, this pandemic has created an environment of great uncertainty. No one truly knows how the growing tensions between the U.S. and China will play out. However, whether you believe in a V-shaped recovery or further worsening of the economy, we believe that Contracts for Differences (CFDs) have a part to play in your investment arsenal.

Will the next crash come?

If you believe the worst is yet to come and that information has not been factored into certain markets/counters, you may consider using CFDs to short sell!

CFDs are commonly used by investors who prefer shorting the market via stocks/indices. Most markets generally impose restrictions on short selling for stocks. Furthermore, it is inconvenient to initiate a short position in the cash equity market. In such situations, the investor would have to check with their broker on the availability of the share for borrowing before initiating the short trade, and subsequently inform the broker again to return the borrowed share after they have bought back the shares.

However, you can circumvent this issue by using CFDs. All you need to do is focus on what you want to short and place your trades!

Fun Fact: We offer more than 5,000 global counters for short selling!

How do we find counters to short sell?

We focus on companies with one or all of the given conditions:

1) Companies caught between the crossfire of the intensifying U.S.-China trade war.

2) Companies with highly leveraged and weak balance sheets with low probabilities of recurring earnings in the near future.

3) Companies whose bulk earnings are derived from the travel, hospitality and retail sectors.

Hedge your Portfolio against rising Global uncertainties?

Contrary to popular opinion, Contracts for Differences (CFDs) are not just for technical traders. Long term investors can utilise CFDs to hedge their positions against unforeseen events and uncertainties. When one foresees rising uncertainty and volatility in the market, the investor can enter into a CFD contract to hedge their positions.

One can use CFDs as a hedge in the following two possible scenarios:

1) When the price of your existing positions has already moved/is moving against you.

2) When you anticipate future gains in your existing positions to be marginal due to an increasingly negative market sentiment.

One can look into assets that are historically uncorrelated with equities, such as precious metals and Japanese Yen (JPY). For a detailed description on how to hedge your exposure, check out our article here.

Conclusion

Based on the latest macroeconomic data, the future does not look rosy. There have been numerous queries on whether it would be a better option to liquidate holdings due to the recent stock market rise and pick them up later when the market recovers. However, there are many uncertainties in the global economy and financial markets at the moment to see how far the stock market will decline or whether the recent V-shaped recovery is not a dead cat bounce.

As quoted by investing legend Peter Lynch, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections.” In our opinion, it would be better to time the market based on valuations and not on news flows. We sincerely hope that you have found value in this article, be sure to check out our other articles and the courses that we offer. Till next time!

Reference:

- [1] https://www.bls.gov/news.release/pdf/empsit.pdf

- [2] https://www.forbes.com/sites/sergeiklebnikov/2020/03/10/heres-when-the-stock-market-will-recover-according-to-historical-sell-offs/#1417526856d8

- [3] https://www.theedgesingapore.com/news/covid-19-fortitude-budget/fourth-fortitude-budget-singapore-emerges-circuit-breaker

- [4] https://home.treasury.gov/policy-issues/cares

- [5] https://www.bloomberg.com/news/articles/2020-03-23/fed-signals-unlimited-qe-adds-aid-for-companies-municipalities

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Shern

CFD Dealer

Yong Shern is a passionate Contracts for Difference (CFD) dealer who has always aspired to discover trading opportunities using a blend of different research methodologies. Prior to joining PhillipCapital, he was an intraday equity trader in one of the top brokerage firms in Malaysia. He graduated with First Class Honours in Business Administration with a major in Banking and Finance from the University of Malaya. Yong Shern is experienced in both trading and research in various financial products. These products include equities, indices, commodities, forex trading. He has successfully crafted trading strategies to navigate this volatile oil environment.In his free time, Yong Shern enjoys following the latest market news with the aim of helping clients navigate through various market conditions.

Unveiling Opportunity: Exploring the Potential of European Equities

Unveiling Opportunity: Exploring the Potential of European Equities  Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading  Crude Realities: Understanding oil prices and how to trade them

Crude Realities: Understanding oil prices and how to trade them  Gold at All-Time Highs: What’s Fuelling the 2025 Rally?

Gold at All-Time Highs: What’s Fuelling the 2025 Rally?