Ezra and Starhub – The CNY “Red Bomb” February 8, 2017

After getting myself fat with all the Chinese New Year Goodies over the long weekend, I turned my attention back to the local market. February is traditionally a period with more movements in the market due to the release of Financial Year report for many companies.

Red bomb 1: Starhub – The ailing dividend machine

Starhub had been paying out a consistent 20 cents yearly dividend since 2010, making it one of the favorite dividend blue chip stocks for local investors. However, on 3rd February after market hours, Starhub released its 4Q16 and FY16 results – along with a guidance to pay out a dividend of 16 cents for FY17.

This reduction of dividend guidance is the first time in more than 6 years, and represents a 20% drop from the previous FY.

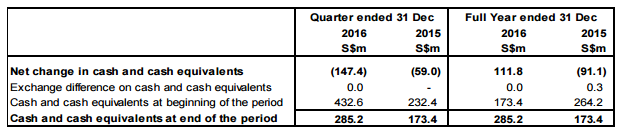

For close observers of Starhub, this reduction of dividend will not have come as a surprise, with obvious signals like negative cash flow for the 3rd quarter and declining revenue from heavy subsidies on handsets and adjustment of price package in anticipation of the entry of the 4th telco.

Source: Extracted from Starhub FY16 annual report. Starhub ended the year on positive cash balance due an issuance of $300m medium term notes earlier this year.

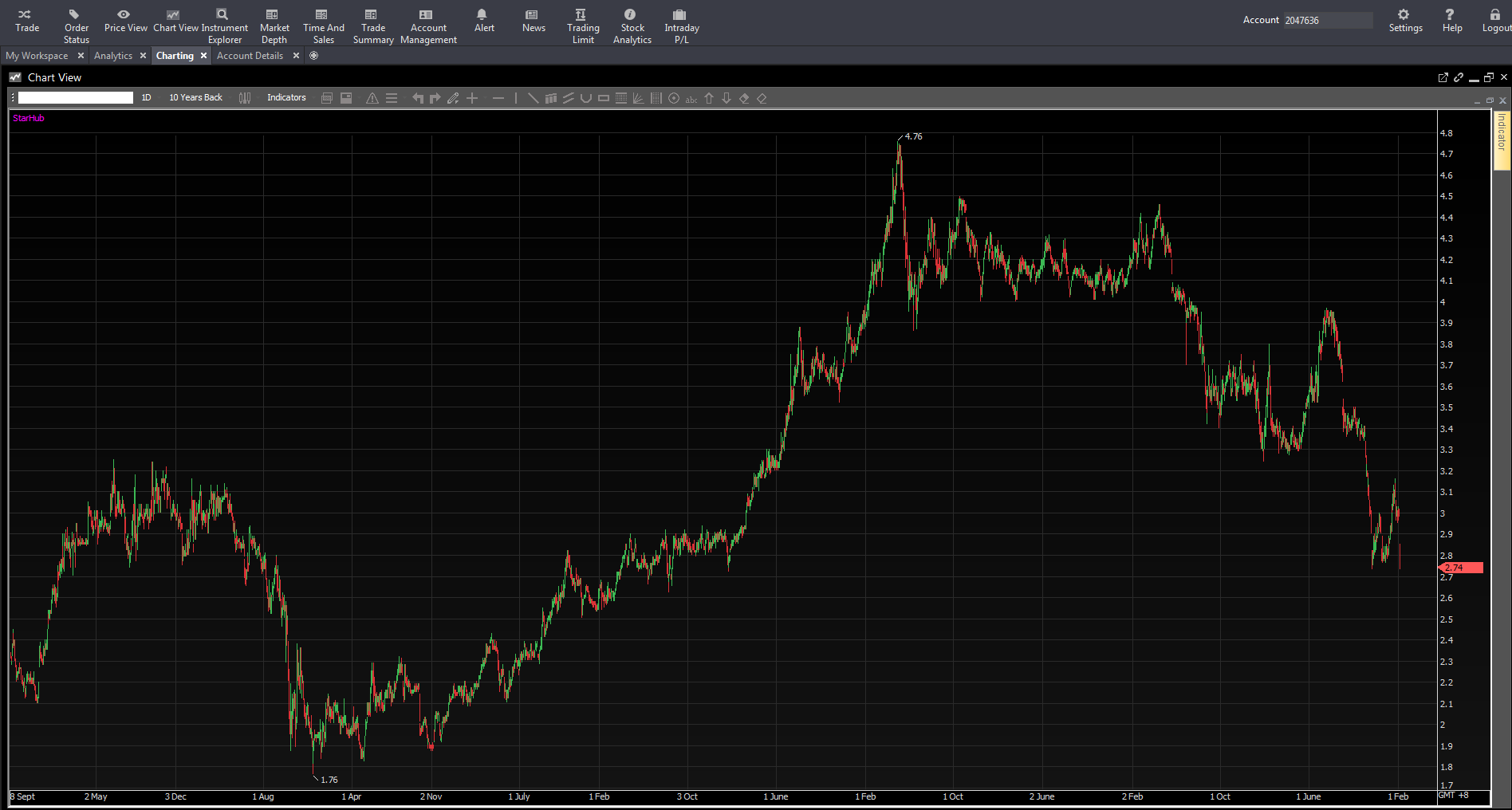

Nonetheless, the share price of Starhub still took a heavy hit on 6th February, the first trading day after the results were announced. The share closed at $2.80, down 6.66%. Investors can watch out for a potential support level of around $2.75-$2.78. An entry at the stated support level may yield an annual return of about 6%.

Source: 10 year daily chart for Starhub from POEMS Mercury

Red bomb 2: Ezra – The fallen star

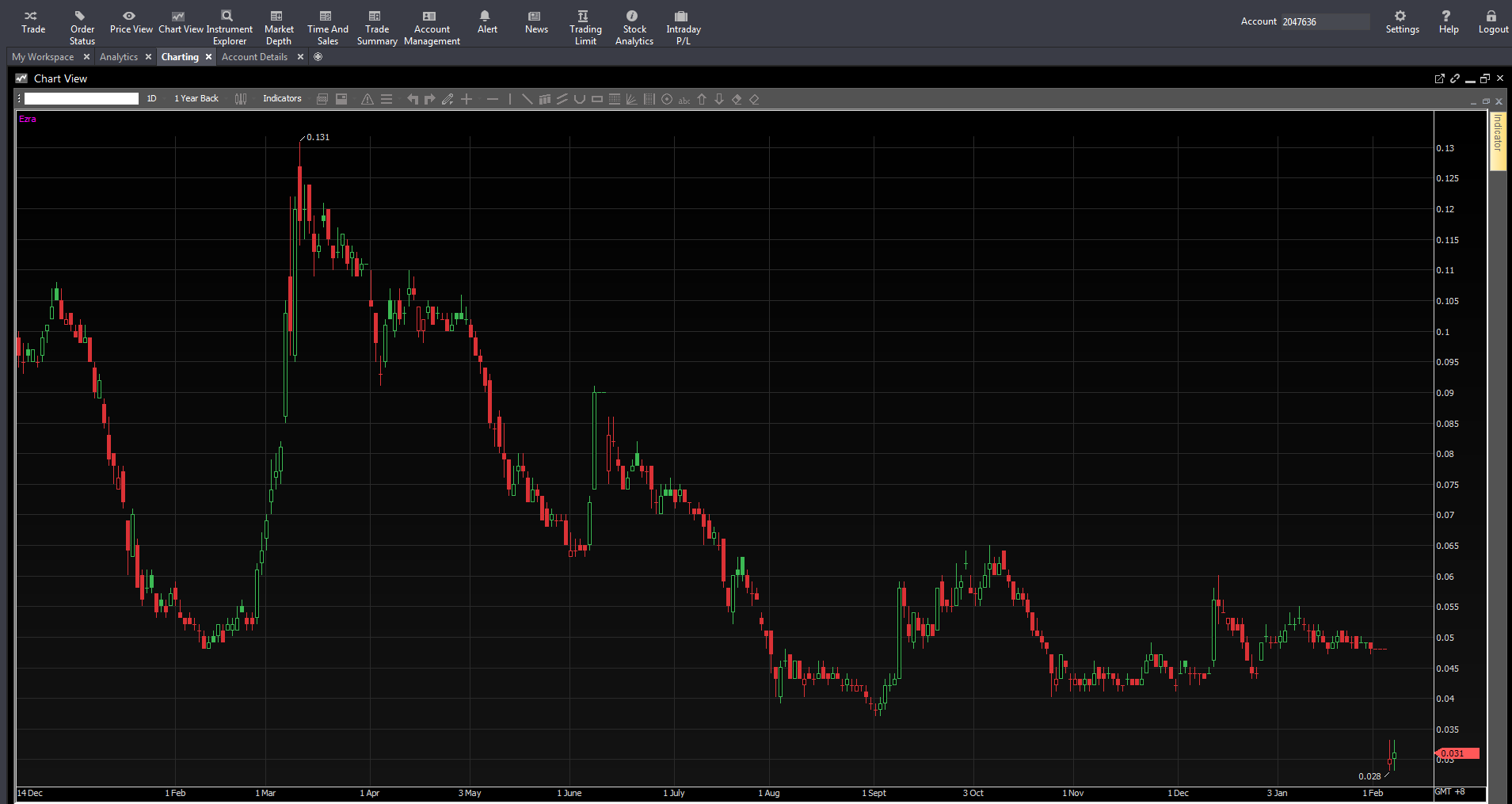

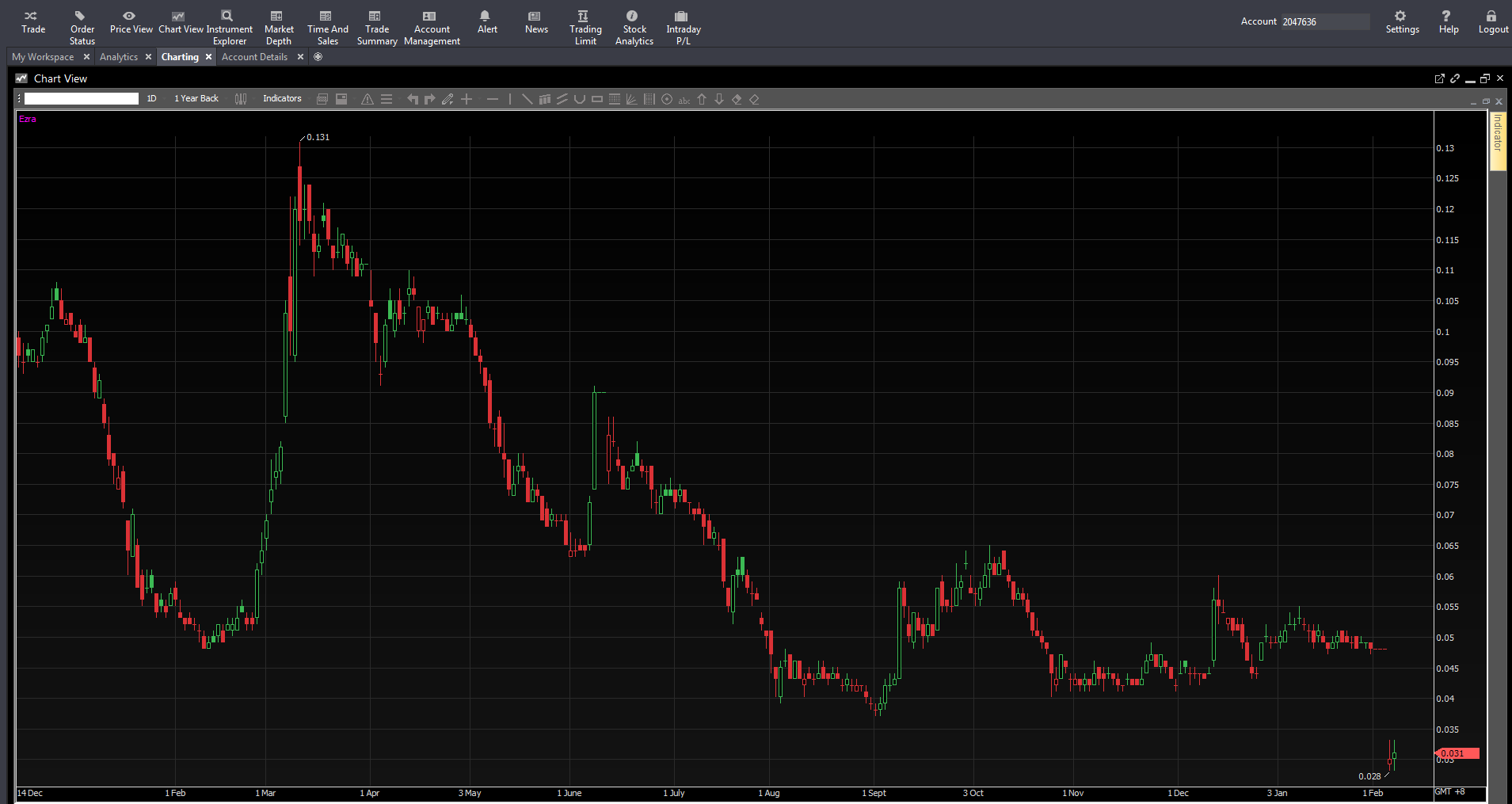

Source: Daily chart for Ezra from POEMS Mercury

At the height of its glory in 2007, Ezra was trading at the price of $3.66. Fast-forward 10 years to 6th February 2017, Ezra share price closed at $0.028. At the price of $0.028, the peak of $3.66 is approximately 130 times away.

Almost right after Chinese New Year Holidays, on 1st February, Ezra requested for a trading halt; a minute before the market opened.

The reasons for the halt came two days later and can be broken down into two major parts:

Firstly, Ezra announced a potential impairment of US$170 million for its interests in the Emas Chiyoda Subsea (ECS) joint venture. To understand the magnitude of this potential write-down, Ezra’s net current liabilities stand at around US$887 million. The impairment represents an amount equivalent to 19% of the current liabilities.

Secondly, Ezra acknowledged that it has occasionally received letters of demand and reservation-of-rights letters from counterparties, including a statutory demand issued by one of its lenders. This piece of news further fueled the doubts of investors over Ezra’s ability to maintain its solvency.

Unsurprisingly, Ezra’s share price gapped down on 6th February to close at $0.028, about 41% drop from the previous trading session.

At the moment, Ezra’s future will hang strongly on its ability to convince creditors to support its ride through this liquidity crisis.

Source: 1 year daily chart for Ezra from POEMS Mercury

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chong Kai Xiang (Kai)

POEMS Dealer

Raffles City Dealing Team

Chong Kai Xiang (Kai) is an Equities Dealer in the Raffles City Dealing Team, and currently provides dealing services to over 35,000 trading accounts.

Kai frequently conducts seminars to enrich his clients' trading and financial knowledge. Apart from this, Kai also provides weekly market updates to his clients to keep them informed and up to date on their stock holdings.

Kai holds a Bachelor Degree of Finance from the SIM University – UniSIM and was awarded the CFA Singapore Gold Award and CFP® Certification Achievement Award in 2015.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It