Forex Trading: A Comprehensive Guide to the Foreign Exchange Market March 8, 2024

Introduction

Dive into the dynamic world of Forex trading, where the potential for profit mirrors the pace of global news and economic events. In this article, we will explore the ins and outs of the foreign exchange market, providing insights that are vital for both novice traders and seasoned investors alike. Understanding the intricacies of how the Forex market operates is not just beneficial; it’s crucial for anyone looking to succeed in this vast financial arena.

In this guide, we will cover:

- What is Forex trading?

- The various types of transactions

- The pros and cons of trading in the Forex market

What is Forex Trading?

Source: FreePik Image [1]

Source: FreePik Image [1]

The foreign exchange market, also known as FX, acts as a global marketplace for the exchange of national currencies. It is the largest and most liquid market in the world, with trillions of dollars changing hands every day. Unlike other financial markets, the Forex market operates without a centralised location for 24 hours a day, five days a week.

Understanding the Forex Market

The Forex market is characterised by an electronic network of banks, brokerages, institutional investors, and individual traders. These participants trade currencies through brokers or banks, using currency pairs as the trading instrument.

A currency pair consists of two currencies, with one currency being bought and the other being sold.

Traders aim to profit from the fluctuations in exchange rates by buying a currency when they believe its value will increase and selling it when they expect its value to decrease.

Forex Market vs. Other Markets

The Forex market differs from other financial markets in several key aspects:

Decentralisation

Unlike traditional markets that operate through a centralised exchange, the Forex market is decentralised. Trading occurs over-the-counter (OTC) via an electronic network of banks, brokerages, and other participants, without a singular physical location for transactions.

Round-the-Clock Trading

The Forex market’s operations span 24 hours a day, commencing with the Asian market opening on Sunday evening and concluding with the New York market’s close on Friday afternoon. This continuous cycle allows global traders to engage in trading activities at their convenience, irrespective of their geographical time zones.

High Liquidity

Characterised by its high volume of trading activity and extensive participant base, the Forex market is notably liquid. This liquidity facilitates the rapid execution of trades, enabling traders to enter and exit positions swiftly and at prices that reflect the market’s current state.

Types of Forex Transactions

Traders in the Forex market engage in different types of transactions, each varying in complexity, risk, and purpose.

Spot Transactions

Spot transactions are the most common form of Forex transaction. In a spot transaction, two parties agree to exchange currencies at the current market rate, with the transaction settled “on the spot”.

These transactions are particularly common among businesses and individuals who need to convert one currency into another for immediate use, such as paying for goods or services in a foreign country.

Forward Transactions

Forward transactions are agreements to exchange currencies at a specified future date and at a predetermined exchange rate. Unlike spot transactions, forward transactions are not settled immediately but rather at a future date, typically ranging from a few days to several months.

Forward transactions are used by businesses to hedge against currency fluctuations. For example, a company that knows it will need to convert currency in the future can enter into a forward contract to lock in an exchange rate, protecting itself from potential losses due to currency volatility.

Futures

Futures are standardised derivatives that offer traders the opportunity to speculate on the future price of currency exchange rates. These financial contracts are traded on exchanges and have standardised terms and conditions.

In a futures contract, traders agree to buy or sell a specified amount of currency at a predetermined price and future date. Futures contracts are legally binding and are settled on the exchange where they are traded.

Options

Options offer traders the right, but not the obligation, to buy or sell a currency at a specified price and within a specific time frame. Traders pay a premium for the option contract and can choose whether or not to exercise their right. Options trading incorporates complex terms such as theta (time decay), gamma (rate of delta change), vega (sensitivity to volatility), and delta (rate of change in price), making it somewhat more intricate than other Forex transactions.

FX CFD

For those interested in capitalising on the price movements of foreign exchange, Forex Contracts for Differences (FX CFD) enable traders to speculate on the price fluctuations of underlying Forex pairs without the need to own them directly.

FX CFD trading is known for its simplicity and the opportunity it offers for capital to be used more efficiently through leverage. This means traders can potentially achieve larger gains (or losses) relative to their initial investment. Many brokers provide FX CFD trading services, often simplifying their offerings under the term ‘FX’ to avoid confusion.

It’s crucial for traders to verify with their brokers whether the FX offering is a spot transaction or a CFD, as this distinction might not always be explicitly stated. The primary focus for traders is usually on engaging in price movements and benefiting from tight spreads.

Pros and Cons of Forex Trading

Source: FreePik Image [2]

Source: FreePik Image [2]

Like any financial instrument, Forex trading has its pros and cons depending on the different types of market participants. Here are some of the key pros and cons to consider:

Pros of Forex Trading

- High liquidity: The Forex market’s high liquidity ensures that buyers and sellers are always available, facilitating quick entry and exit from positions.

- Accessibility: The Forex market is accessible to individual traders, allowing anyone with an internet connection to engage in trading activities.

- Diversification & Hedging: Forex trading allows traders to diversify their investment portfolio by adding currency exposure. This diversification can help mitigate risk and safeguard against losses in other markets.

Cons of Forex Trading

- Volatility: The Forex market is known for its high volatility, which can lead to significant price fluctuations and potential losses. Traders need to be prepared for rapid and unpredictable movements in exchange rates. However, this volatility can also present opportunities for quick profits.

- Complexity: Forex trading requires a solid understanding of economic factors, geopolitical events, and technical analysis. It can take time and effort to develop the necessary knowledge and skills.

- Risk of leverage: While leverage can amplify profits, it also increases the risk of losses. Traders must exercise caution when using leverage and have a risk management strategy in place.

Forex Terms

Understanding the following terms is crucial for navigating the Forex market. Here are some of the important terms you must know:

Pip

A pip represents the smallest price movement in the Forex market and varies between currency pairs. It is usually quoted to the fourth decimal place for most pairs, with a single pip equating to 0.0001.

Spread

This term refers to the difference between the bid (sell) and ask (buy) prices of a currency pair, essentially the cost of the trade. Spreads are typically measured in pips.

Leverage

Leverage enables traders to hold larger positions in the market with a relatively small amount of invested capital, expressed as a ratio (e.g. 1:20), allowing greater market exposure.

Margin

This is the initial investment required to open and maintain a leveraged position, expressed as a percentage of the full position value.

Common Forex FAQs

Q: How much money do I need to start Forex trading?

A: In PhillipCFD, you only need a few hundred dollars to start trading FX CFD.

Q: Is Forex trading risky?

A: The level of risk associated with Forex trading varies. While the market’s volatility can offer opportunities, it is important to be well-informed and cautious. Trading should only be done with funds you can afford to lose, and implementing risk management strategies, like stop-loss orders, can help mitigate potential losses.

Conclusion

Forex trading offers both profit opportunities and risks. A solid understanding of Forex fundamentals, coupled with a well-crafted trading strategy and up-to-date knowledge of economic and geopolitical developments is essential for achieving success in Forex trading.

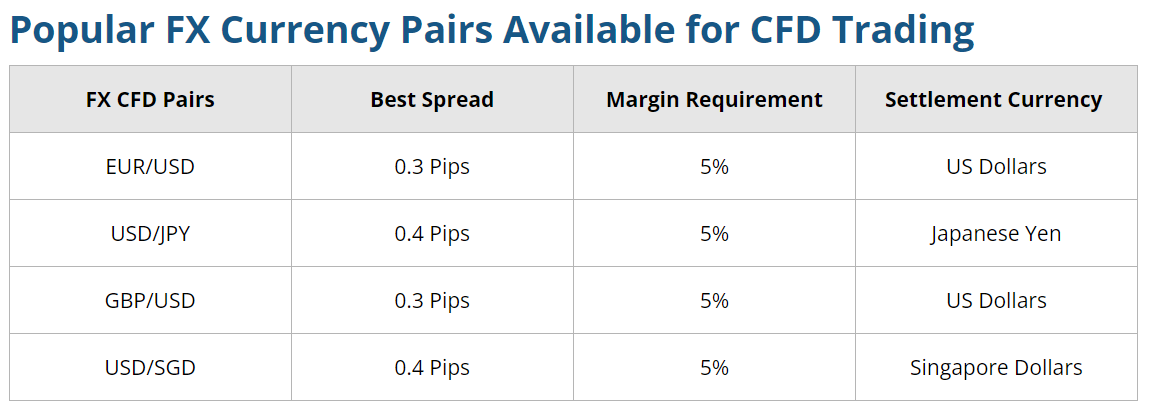

Check out our popular FX offerings below. The spreads are highly competitive and no commissions are charged!

Source: https://www.phillipcfd.com/products/fx-cfd/

Source: https://www.phillipcfd.com/products/fx-cfd/

As with any form of investment, it is important to conduct thorough research, seek advice from professionals, and practice proper risk management.

If you would like to learn how to use our poems CFD MT5 platform, check it out here: https://www.phillipcfd.com/learn/

Trade safe!

Promotions

From now till 31 March, stand a chance to get S$88 Cash Credits and a chance to win a 43” Prism TV when you fund and trade with us! *Terms and Conditions Apply.

For more information, click here.

How to Get Started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account and are interested in trading, you may visit here to open an account with us today.

Lastly, investing in a community can be a highly rewarding experience. Here, you will have the opportunity to interact with us and other seasoned investors who are enthusiastic in sharing their experience and expertise whether it’s through listening or answering questions.

In this community, you will also gain exposure to quality educational materials and stock analysis, to help you appreciate the mindset of seasoned investors and apply concepts you have learned.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

Reference:

- [1] https://www.freepik.com/free-photo/collage-finance-banner-concept_51400803.htm#

- [2] https://www.freepik.com/free-photo/blurry-woman-holding-cons-pros-post-its_23994335.htm#

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chua Minghan

CFA | Senior Manager

Dealing

Chua Minghan graduated from the National University of Singapore with a Bachelor’s degree in Economics. He is passionate about education and went on to get a post-grad Diploma in teaching. His vision is to educate clients to make informed decisions for their trading and investments.

Minghan enjoys learning fundamental analysis, technical analysis, and strives to use data analysis to improve his trading skills.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  Playing Defence: Diversification in Forex Trading

Playing Defence: Diversification in Forex Trading