Made in Singapore: 5 Stocks Flying the Singapore Flag High August 4, 2020

From its humble beginnings as a small fishing village to becoming one of the world’s wealthiest countries, Singapore has grown from strength to strength over the years. Despite having limited natural resources to fuel growth, Singapore managed to transform itself from a third world to a first world country. To commemorate the nation’s 55th birthday, we will be looking at 5 stocks that have shaped the nation’s growth and left an indelible mark on its history.

DBS (SGX: D05)

History:

DBS was founded in 1968 with the purpose of financing Singapore’s fledgling industries, before eventually becoming a full-fledged financial institution. The bank was involved in the development of some of Singapore’s most iconic buildings, such as Plaza Singapura and Raffles City, as well as lead-managing IPOs for Singtel and Singapore Airlines (SIA). Over the years, DBS has expanded by acquiring several banks and setting up overseas subsidiaries. Today, DBS is holding its own on the world stage, being recognised as the Best Bank in the World in 2018 by Global Finance[1] and World’s Best Bank in 2019 by Euromoney[2].

Present:

To mitigate the economic shock brought on by the COVID-19 pandemic, central banks around the world have lowered interest rates to record low levels. Singapore lending rates fell in tandem and look set to stay lower for longer. The share price has also dropped by more than 20% since the start of 2020.

Outlook:

With the US Federal Reserve committing to loose monetary policies until specific unemployment targets are met, interest rates are likely to stay low at current levels. Banks are expected to see Net Interest Margin (NIM) fall to 2013 levels when similar interest rates were last observed. With the Circuit Breaker measures in place, business loans growth slowed and consumer loans shrunk. As Singapore opens up the economy gradually, we expect to see consumer spending ticking up, but business loans may remain weak as companies may be cautious in taking up loans amidst the negative business sentiments caused by the COVID-19 pandemic.

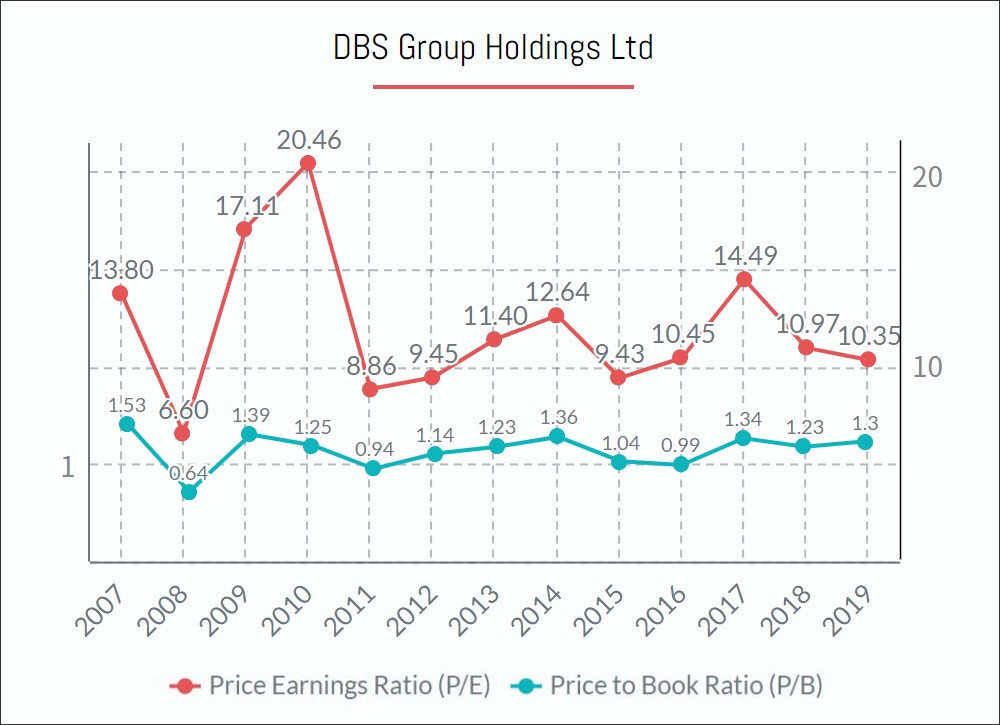

Figure 1: P/E and P/B ratio for DBS

City Development Limited (CDL) (SGX: C09)

History:

CDL was founded in 1963 as a property company and started out with 8 employees in Amber Mansion on Orchard Road. Over the years, CDL has grown into a Singaporean multinational real estate operating organisation and developed many types of properties ranging from shopping malls to integrated developments.

Present:

CDL’s profit for the first half of this year has been dragged down by its hotel operations segment amid the COVID-19 pandemic. CDL’s hotel operations segment is mainly led by its wholly-owned subsidiary, Millennium & Copthorne Hotels (M&C). The share price has also collapsed by more than 30% since the start of 2020.

Outlook:

Taking a more detailed look at their operational segments, hotel operations make up around 16% of earnings before interest, tax, depreciation and amortisation [3]. The impact might not seem significant in Financial Year 2019. While CDL is likely to face near term headwinds, it is trading at an attractive price to book ratio that makes it attractive to investors. With its strong balance sheet and branding coupled with an experienced management team, CDL is likely to emerge stronger from this crisis.

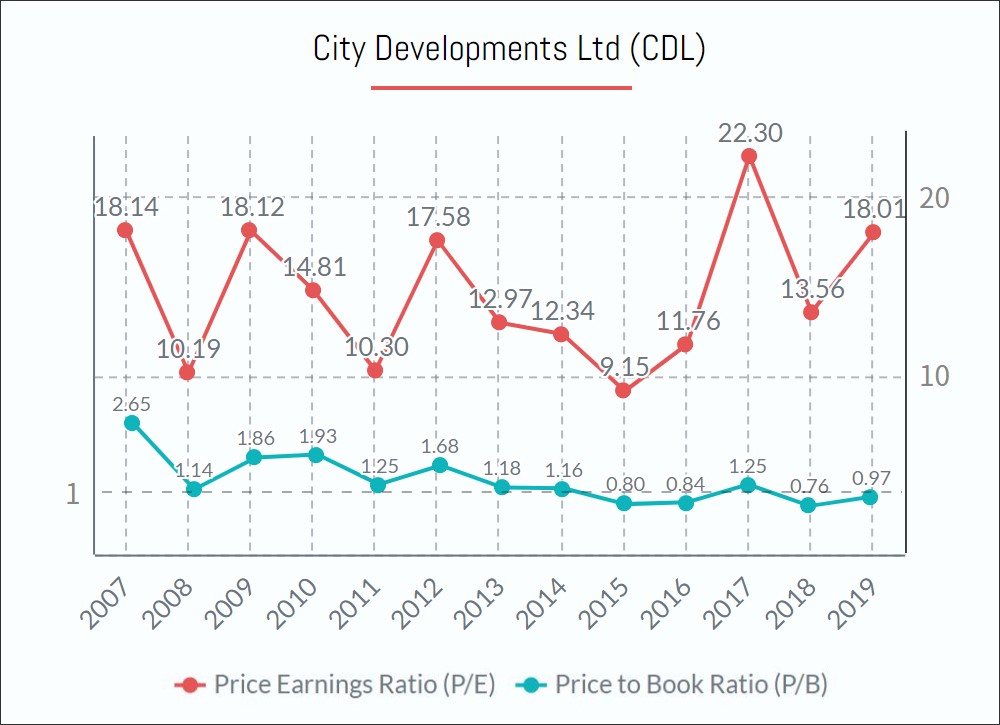

Figure 2: P/E and P/B ratio for CDL

SATS (SGX: S58)

History:

SATS is a home-grown company that started out with commercial aviation in Singapore in 1947. Over the past 55 years, SATS has grown in tandem with Singapore to become a global business and aviation hub. They have two major business segments, namely gateway services and food solutions. The company is largely recognised as one of the global leaders in food solutions for air travel.

Present:

In FY19, SATS operated across over 60 locations and 13 countries, serving a total of 167 million meals. [4] Due to the COVID-19 pandemic, SATS reported its first ever quarterly loss in 4Q20 since its listing [5]. This comes as no surprise as it has been affected significantly by the travel and flight restrictions around the world. There is much uncertainty in the current state of the aviation sector as countries struggle to recover from this crisis. SATS has reacted to the current situation by redeploying resources and manpower to other roles and activities within the group that are less affected by the crisis. SATS also mentioned that it is expecting its food trading and distribution businesses to grow.

Outlook:

Globally, the near term outlook of the airline industry looks grim. There are fears that a second wave of COVID-19 will hit and economies will be shut off again. We expect the outlook to ultimately depend on the development of vaccines for COVID-19 as well as the recovery of the tourism sector. There may be a larger than expected jump in booking of flights when countries lift travel restrictions, albeit unknown sustainability.

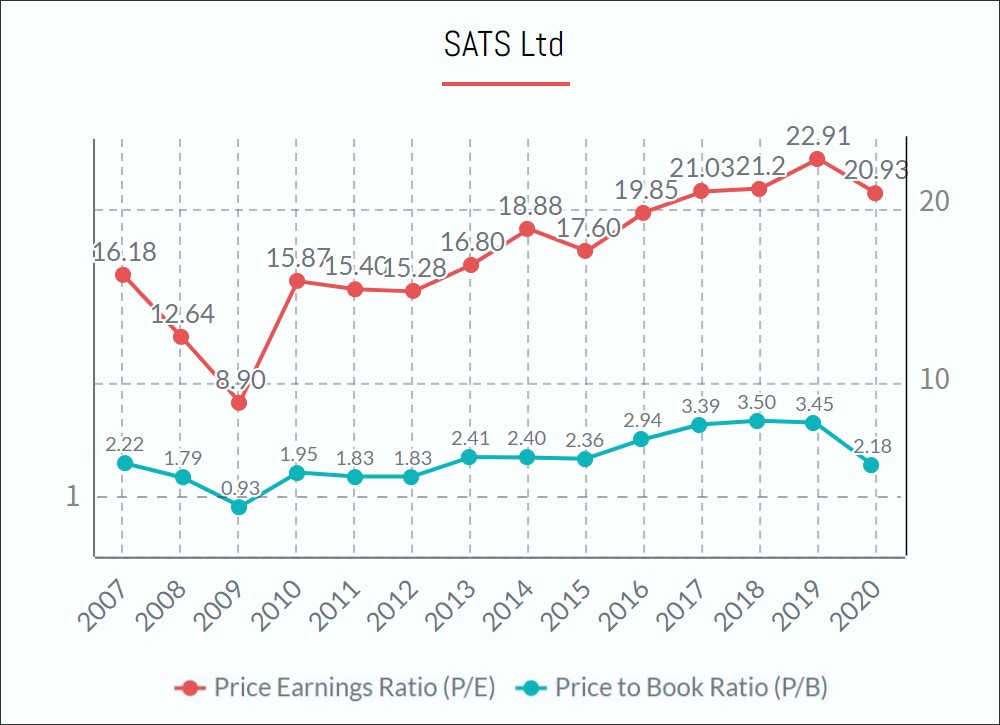

Figure 3: P/E and P/B ratio for SATs

Singtel (SGX: Z74)

History:

Did you know that Singtel’s roots can be traced back to the 1800s? In 1879, when the telephone was first introduced to Singapore, it was reported that we were one of the first cities in the East, if not the first to have a telephone system. Today, Singtel, as Singapore’s largest mobile operator has a 50.4% market share of the local mobile market [6] with over 4.3 million customers.

Present:

Singtel has aggressively expanded its business overseas and it now boasts a customer base of over 705 million customers in 21 countries. Its revenues are diversified geographically, with over 60% of revenues coming from overseas subsidiaries and operations. While investors have historically looked to Singtel as a strong dividend play, that status was called into question earlier this year. Due to the intensive mobile competition in its various overseas ventures and a drop in the average revenue per user (ARPU), its net profit dipped by 25.7% to S$574.4 million for 4Q ended March 2020 [7]. As a result, Singtel slashed its final dividend by close to half, from 10.7 cents to 5.45 cents.

Outlook:

The telco landscape is constantly changing, and we have seen in recent times that competition and price wars between telco companies can be extremely disruptive to earnings growth. Fortunately for Singtel, it still retains large market shares in major markets like Australia / Indonesia / India / Thailand through overseas ventures. Moving forward, the resumption of travel and opening of economies should bode well for Singtel, as that should allow some recovery from the loss of roaming revenue and some revenue from their enterprise businesses. We also expect Singtel to hoard more cash during this period in preparation to roll out key 5G investments, so we are not optimistic on Singtel raising its dividends anytime soon.

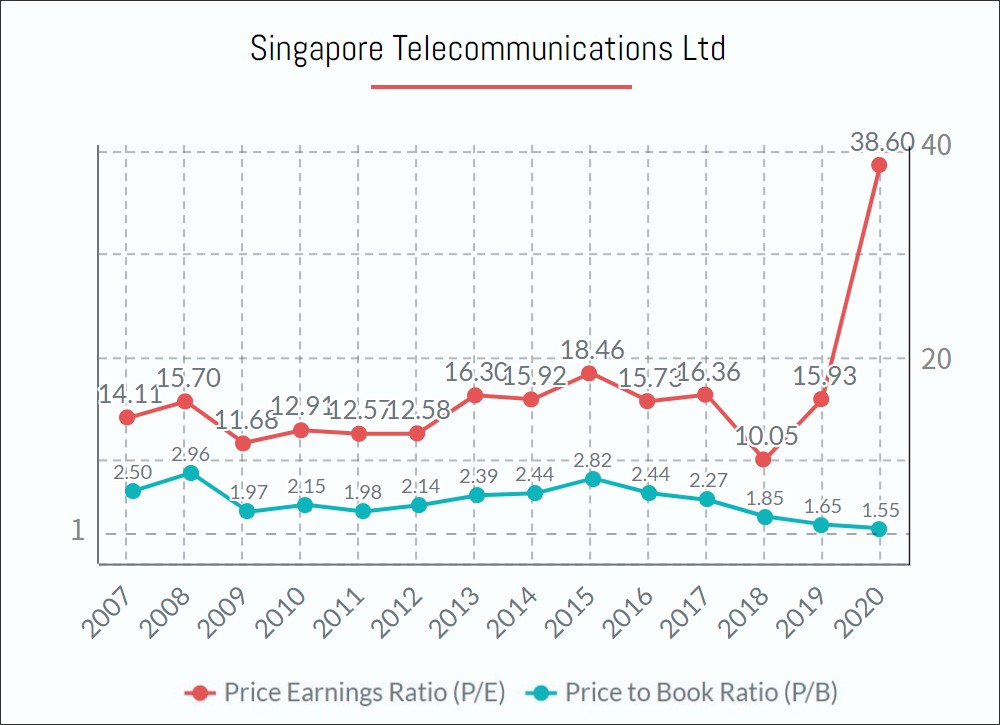

Figure 4: P/E and P/B ratio for Singtel

Ascendas REIT (SGX: A17U)

History:

Ascendas REIT is Singapore’s first business space and industrial REIT that was listed in 2002. It has grown from 8 properties valued at around S$600 million in 2002 to 171 properties valued at around S$11.1 billion as at 31 March 2019 [8]. It has a range of portfolios from Singapore, Australia and the United Kingdom across sectors like business and science parks properties, hi-spec industrial properties, light industrial properties, logistics and distribution centres as well as integrated development, amenities and retail properties.

Present:

Ascendas REIT just announced on 23 July 2020 that their first half net property income rose by 11.2% due to the contribution from US and Singapore portfolio properties [9]. However, there is a drop in the Defects Per Unit (DPU) due to the higher number of units arising from the Rights Issue in December 2019. Ascendas REIT has also recently announced the acquisition of a new logistics property to be developed in Sydney, Australia. Following the acquisition of the land, development of the logistic property is expected to complete in the second quarter of 2021.

Outlook:

With the ongoing COVID-19 pandemic, some tenants will continue to ask for rental rebates that will likely affect the revenue in the coming quarters. However, Ascendas REIT has an experienced management team doing acquisitions and asset enhancement initiatives (AEIs) that contribute to its growth. It also has healthy leverage and debt headroom to acquire attractive assets. Ascendas REIT is likely to weather through this difficult time and continue to shine in the future.

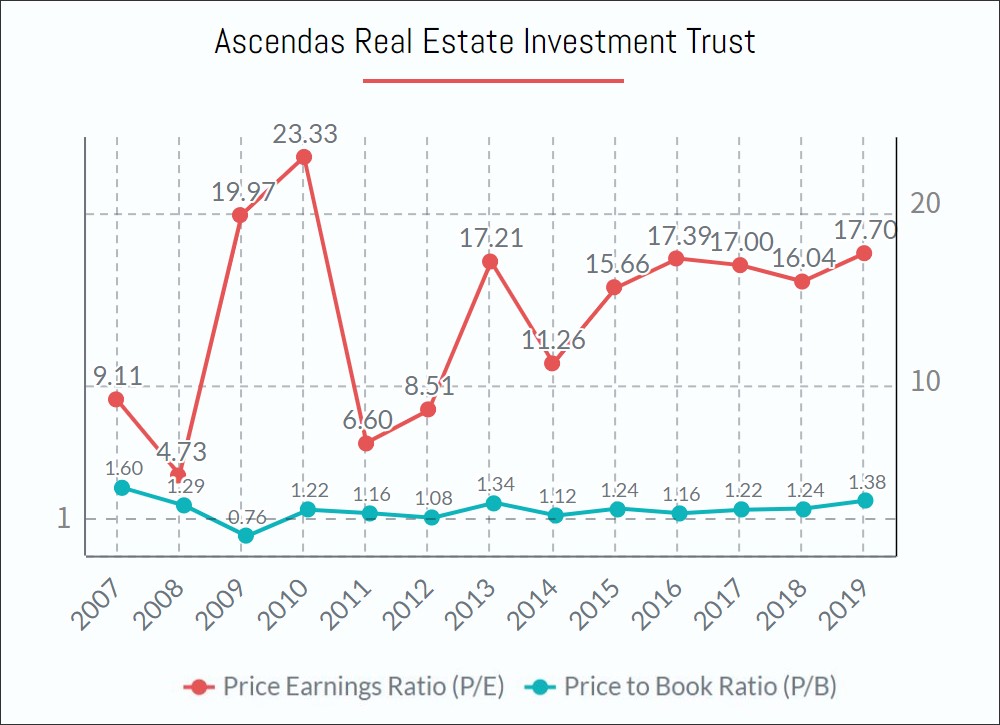

Figure 5: P/E and P/B ratio for Ascendas REIT

Straits Times Index (STI) CFD

In addition, these 5 Singapore stocks are all components of the Straits Times Index (STI). STI is a capitalisation-weighted stock market index which tracks the performance of the top 30 largest and most liquid blue-chip companies listed on the Singapore Exchange (SGX). With STI CFD, you are able to diversify your portfolio and participate in the price movements of the entire stock index as a whole.

To take opportunities in the market, you can either trade single stock CFDs like the ones mentioned above or consider a diversified portfolio index like STI CFD. We are proud to be the only broker in Singapore offering STI CFD for trading!

Conclusion

The 5 companies we have covered above have all been affected by the ongoing pandemic. However, we do believe that their businesses will improve at some point in the future once the COVID-19 pandemic fears blow over.

If you’re interested to trade Equities CFD, we have a brand new promotion running from 1 July 2020 – 30 September 2020, “ Trade Around the World with Equities CFD” where you can receive up to S$88* CFD Trade Rebates. To capitalise on trading opportunities in the Singapore market, we have further extended the SGX Enhance Market Depth Access till 30 November 2020! If you have any questions on trading or investing, feel free to drop us an email at cfd@phillip.com.sg and we will be glad to assist you.

Reference:

- [1] DBS Annual Report 2018

- [2] https://www.euromoney.com/article/b1fmmkjyhws0h9/world39s-best-bank-2019-dbs

- [3] City Developments Ltd Annual Report 2019

- [4] SATs Annual Report 2018 – 2019

- [5] https://www.sats.com.sg/investors/financial-reports

- [6] Singtel Q4FY20 Fact Sheet

- [7] Singtel Q4FY20 Fact Sheet

- [8] https://ir.ascendas-reit.com/faq.html

- [9] https://www.morningstar.com/news/dow-jones/202007234690/ascendas-reit-first-half-net-property-income-rose-112

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mike Ong, Gek Han and Edwin Choo

Mike is a member of Phillip Securities’ largest dealing team that specialises in Equities, ETFs, CFDs & Bonds. The team manages >50,000 client accounts. He evaluates stocks using fundamentals and believes in investing long-term for passive income. He is currently the chief editor of the HQ education series that aim to equip clients with tools & skillsets to make better investing and trading decisions.Gek Han is a securities dealer in the largest dealing team in Phillip Securities, specialising in Equities, ETFs and CFDs. As a securities dealer, he provides equity-related advisory for clients. He looks at securities from a technical and fundamental perspective, and wants to explore managing investments using a portfolio approach. Gek Han holds a Bachelor of Science (Economics) degree with double majors in Economics and Finance from Singapore Management University.As a securities dealer, Edwin specialises in providing equity-related advisory for clients. His personal objective is to ensure that all clients are able to make sound investment decisions to maximise their investment returns. He applies a wide range of techniques to analyse securities, both technical and fundamental, and he believes that only with a combination of both can an investor make informed investment decisions. Edwin holds a Bachelor of Business Degree (Hons), majoring in Banking and Finance from Nanyang Technological University.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  Playing Defence: Diversification in Forex Trading

Playing Defence: Diversification in Forex Trading  Demystifying Forex Trading – Technical Analysis

Demystifying Forex Trading – Technical Analysis