Maximising your Tax Savings & Retirement Funds with SRS in Singapore November 2, 2023

With the festive season around the corner, many are gearing up for holidays and celebrations. Yet, this is also the crucial period when financial planning takes precedence. Among the many tools available to Singaporeans, the Supplementary Retirement Scheme (SRS) stands out as an effective tool for tax relief and retirement planning. Let’s explore the intricacies of SRS, understand its tax benefits, and explore ways to optimise these contributions for a more secure retirement.

What is the Supplementary Retirement Scheme (SRS)

In Singapore, the SRS is a tax relief and tax deferral plan that incentivises saving for retirement. Contributions made to an SRS account are tax-deductible, which means you can reduce taxable income by the amount contributed, up to an annual contribution cap. The current cap for Singaporeans and PRs is S$15,300 and S$35,700 for foreigners respectively.

For example, if you have a taxable income of S$72,000 before tax-relief from SRS, tax payable on S$72,000 = S$550 (on first S$40,000)* + S$2240 (7% X S$32,000)* = S$2,790.

If you contribute S$15,300 in SRS by 31 December in the same year, you can claim S$15,300 of tax relief in the next Year of Assessment (YA). Your taxable income would be = S$72,000 – S$15,300 (tax relief claimed) = S$56,700

Tax payable on S$56,700 = S$550 (on the first S$40,000)* + S$1169 (7% X S$16,700)* = S$1,719

Your tax savings with SRS = S$2790 – S$1719 = S$1,071.

*Based on IRAS’ current income tax rates and brackets.

**Please note that from the Year of Assessment 2024 (when income earned in 2023 is assessed to tax), there is a personal income tax relief cap of $15,300.

SRS has a withdrawal age which depends on whether you opened your SRS account before or after 1 July 2022. If the account was opened before 1 July 2022, the retirement age is 62. If the account was opened after 1 July 2022, the retirement age is 63. If anyone wants to withdraw their SRS funds before the retirement age, there will be an early withdrawal penalty which is 5%.

In 2022, the number of SRS accounts in Singapore stood at 387,000. This marks a 25% increase from the previous year. However, according to the Ministry of Finance, 21% of the funds in SRS accounts are not being utilised for investments.

Maximise growth of your SRS by investing it. SRS funds with investment can potentially gain compound returns and yearly compound returns can grow your funds faster. To reduce tax, set up and allocate funds into your SRS account. Subsequently, invest the funds in SRS-approved investments or savings plans to maximise returns since the SRS only gives 0.05% p.a.

The key question is: how does one utilise the money from the SRS? One option is to make a withdrawal.

SRS Withdrawals

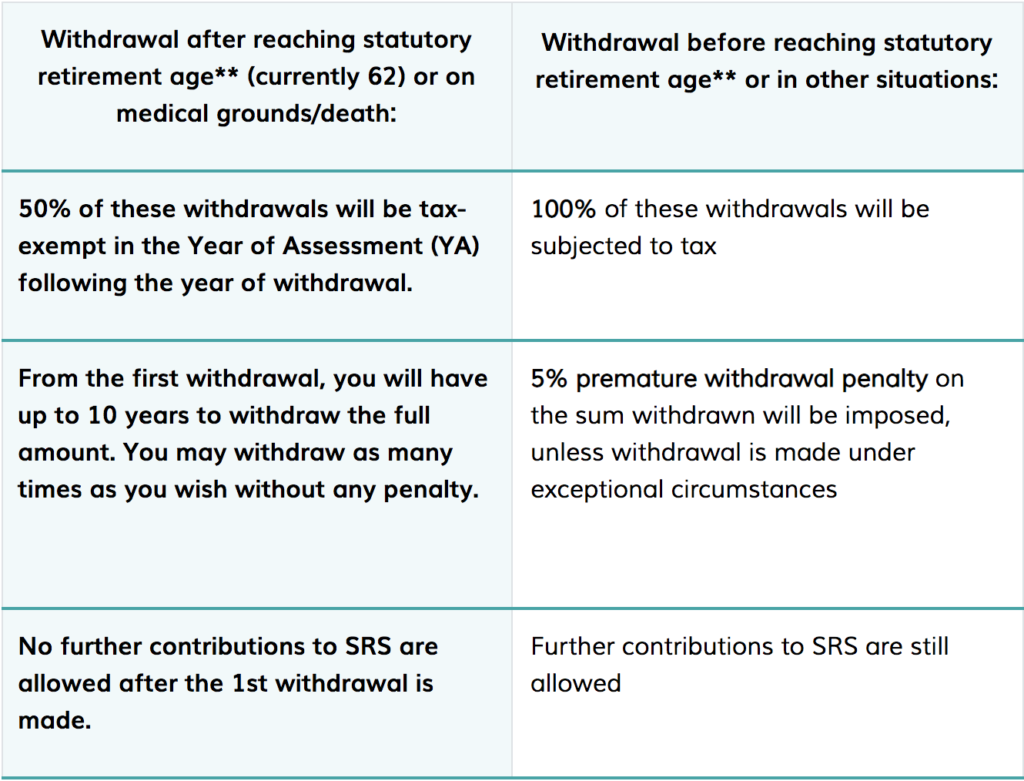

Here are detailed steps outlining the specifics of SRS withdrawals based on different circumstances:

But, what are the options available if you don’t want to withdraw the money from your SRS account?

Ways to maximise your SRS funds for retirement needs:

1.Shares, ETF & Bonds

SRS funds can be invested in Stocks and Exchange Traded Funds (ETFs) listed on the Singapore Exchange (SGX).

ETFs are investment funds traded and listed on a stock exchange. They track the performance of an index and give investors access to a range of markets and asset classes like Equities, REITs, Bonds and Commodities. Instead of buying a handful of individual stocks and bonds, investing in ETFs offer investors the opportunity to build a well-diversified portfolio with a relatively small capital outlay.

Recommended List of ETF products to invest with SRS:

- SPDR STI ETF

- Lion-OCBC Securities Hang Seng Tech ETF

- SPDR S&P 500 ETF

- Lion Phillip SREIT ETF

- SPDR Gold ETF

2.Endowment Insurance Plans

Your SRS funds can be used to purchase selected endowment insurance plans. These plans allow you to grow your SRS funds while providing insurance coverage against death and total permanent disability (TPD) during the policy term. Other life insurance plans such as critical illness, health and long-term care are excluded.

As SRS funds can only be withdrawn without penalty on or after the statutory retirement age, it makes sense to grow these funds using a medium-term endowment insurance plan.

Here are some of the endowment plans available through PhillipCapital’s Insurance Partners: AIA Smart Wealth Builder II, Income Gro Saver Flex Pro and Manulife ReadyBuilder (II).

3. Endowment Annuity Plans

Endowment Annuity Plans are single premium savings plans. After making a one-time payment, you’ll be eligible to receive a monthly payout upon reaching a specified age. This payout can either last for a entirety of your life or be spread out over a predetermined set of years, based on the specifics of the plan you select.

By default, Singaporeans are covered by a national annuity plan known as CPF LIFE that provides monthly payouts for life when we reach our payout eligibility age. But can we depend on it solely as a source of income in our golden years?

Here are some of the best Endowment Annuity Plans available, namely Income Gro Retire Pro, AIA Retirement Saver (III), Aviva MyLifeIncome II, and Manulife RetireReady Plus III.

Another reason why the Endowment Annuity Plan is a popular option is because it allows us to withdraw from the plan on a yearly basis, beyond the 10-year withdrawal period. According to the Inland Revenue Authority of Singapore (IRAS), before the SRS account is closed or deemed to be closed*, annuity payments will be made to the SRS account and will not be taxed if no SRS withdrawal is made. After the SRS account is closed or deemed closed, 50% of the annuity payments will be subject to tax.

*SRS account is deemed closed on the 10th year of the 10-year withdrawal period.

4.Investment-linked plans

Investment-linked plans with SRS are single premium (SP) whole life investment-linked plans which offer a wide range of investment options to capture potential market growth, as well as balance the risk of investment portfolios across different sectors and markets. These plans additionally death coverage.

Investment-linked plans are popular options among SRS investors primarily because of their features. Certain plans provide a capital guaranteed feature while allowing investors to stay invested. More importantly, it allows investors to have exposure to different Accredited Investor funds, not just limited to retail funds.

Here are some popular investment-linked plans by PhillipCapital’s Insurance partners:

AIA Platinum Retirement Elite, AIA Elite Secure Income with Capital Guaranteed feature, HSBC Life Wealth Invest and Tokio Marine #goElite Secure.

5.Unit Trusts

A unit trust is an investment vehicle that comprises a pool of funds from many investors and is managed by a fund manager. The fund manager will invest the pooled money into assets such as stocks, bonds, money market instruments or a combination of these investments. By investing in unit trusts, you gain exposure to all the investments within that particular fund. The collective holdings of the assets held in trust will form the total portfolio of a unit trust fund.

You can also invest in unit trusts and mutual funds with your SRS funds. This extends to unit trusts outside of the three SRS administrators (DBS/POSB, OCBC & UOB) – which means we are not limited to only investing in unit trusts that are sold by them.

PhillipCapital offers more than 2,000 funds. Currently, there are transfer-in benefits and beyond that, there are many good reasons why you should transfer-in your assets to POEMS. You can consolidate your holdings in a single view and save more on your investments. Transferring in your assets is completely FREE of charge. What’s more, get rewarded when you invest and accumulate your assets with your POEMS account.

Why wait? Transfer in your Unit Trust holdings and enjoy the following benefits:

- Be rewarded up to S$1,000

- 0% Platform Fees, 0% Sales Charge, 0% Switching Fee when you trade via POEMS

- Wide selection of almost 2,000 funds

- 24/7 access to your investments via POEMS

6.Advisory Unit Trust Wrap Account

With the Advisory Unit Trust Wrap account, you will receive professional advice on unit trust investments from your Representative who will perform a financial review, propose and tailor-make an investment portfolio according to your financial needs and investment objectives.

7.Smart Portfolio (Robo)

SMART Portfolio (Robo) is a discretionary investment service that matches a best-fit portfolio with your online risk analysis. It combines technology and our investment expertise to build and manage a portfolio, making investing effortless for you. Start from as low as S$300.

8.Managed Account

Managed Account Services (“MA”) are individually managed investment portfolios that are beneficially owned by the individual investor and managed on a discretionary basis.

How can you get started?

Here are the steps:

Step 1: Open an SRS account with three main SRS operators (DBS, OCBC or UOB) and contribute cash to your SRS account.

Step 2: You can invest your SRS in shares, bonds, unit trusts, fixed deposits and insurance products from financial institutions. Funds stored in the SRS account earns an interest of 0.05% p.a. currently as offered by the 3 banks.

Step 3: IRAS will grant the tax relief to you automatically, based on information provided by the SRS operators

From 2 October to 31 October 2023, POEMS is running a campaign for investing SRS funds in ETFs. Every S$5000 worth of ETFs’ purchased using SRS funds is eligible for one S$50 CapitaLand Voucher. You may even get up to S$200 in cash rewards by the end of the campaign. All you have to do is fulfil the one month minimum holding period! If you invest through POEMS, no platform fees will be charged.

Strategising on SRS withdrawal:

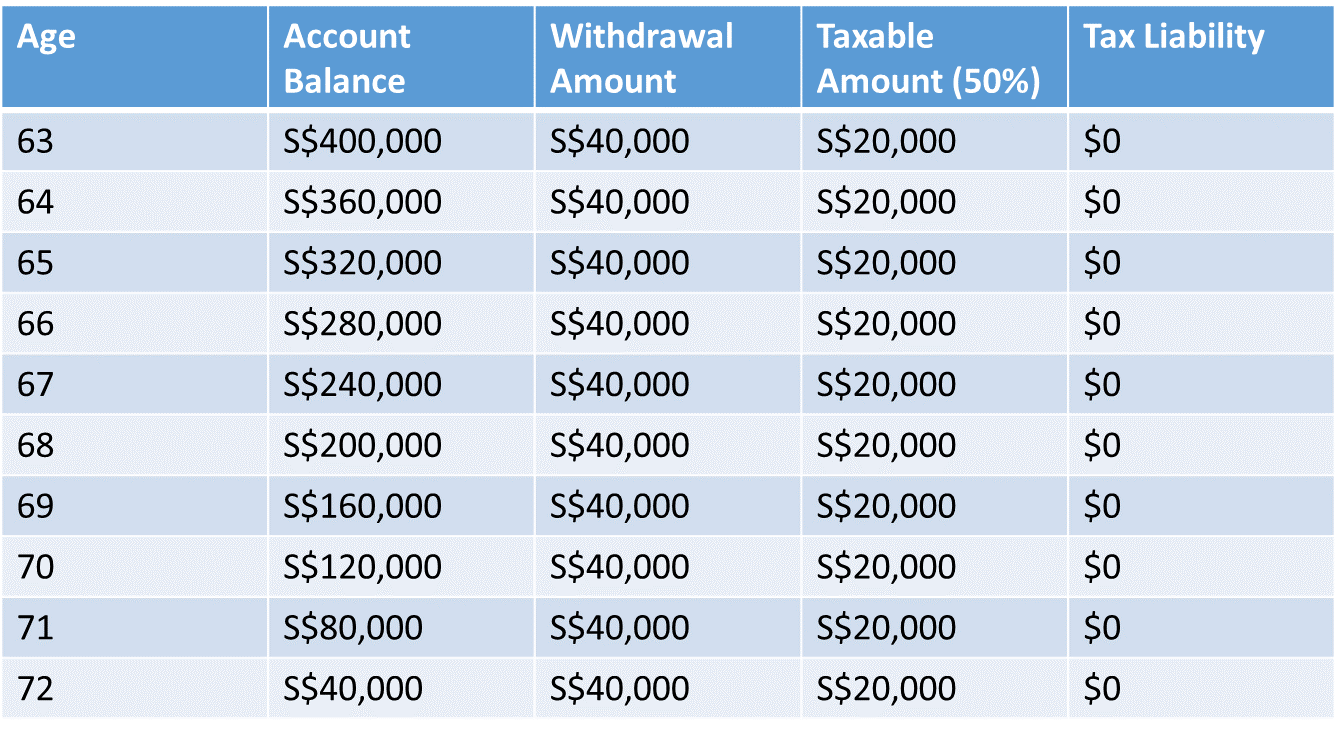

As illustrated in the table above, it’s imperative to plan your SRS withdrawals strategically. Starting from the age of 63, if you opt for a consistent annual withdrawal of S$40,000, only half of that amount, S$20,000, is taxable. However, as observed, the tax liability remains at S$0. This approach not only provides you with a steady stream of income for ten years but also optimises your tax benefits.

Understanding how your SRS withdrawals can impact your overall financial well-being post-retirement is crucial. As with any financial strategy, it is advisable to seek counsel from financial professionals or your personal financial advisor to ensure that your withdrawal plan aligns with your retirement goals and financial needs.

With proper planning, your SRS account can serve as an effective tool to augment your retirement savings, providing you with financial stability and peace of mind during your golden years. Remember, early planning and informed decision-making are key to making the most of your SRS funds.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Roshan Gidwani

Elston Soares

Wilson Lee, Jason Fu

Wilson Lee: Relationship Manager, Phillip Investor Centre, Bukit Batok

Roshan Gidwani: PhillipCapital’s Media Host and Presenter

Elston Soares: Editor, Phillip Securities Research

Jason Fu: Deputy Head, Global Markets

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Investing in Unit Trusts with POEMS

Investing in Unit Trusts with POEMS  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?