Need A Safer Investment Option? Consider Dollar Cost Averaging December 23, 2022

Regardless of whether you are planning for retirement, saving for your children, or attaining that financial goal, you will require a sound investment plan with the right products to see you through. However, investing in the market can be stressful, especially for investors who have just begun their investing journeys. Buy-in too quickly and you might risk regret if the price drops, wait too long for the price to go up and you might feel like you’ve missed out on a deal.

Uncertainty deters lots of people from investing every year. Yet interest income alone is simply not enough to fulfill our needs, especially with the rapidly increasing inflation rates. Is there a way that generates an earning higher than the interest rate that also incorporates minimal market risk? Dollar Cost Averaging is a common investment strategy that invests equal dollar amounts into securities at regular intervals. Rather than attempting to time the market, you instead buy-in at a range of different prices.

Here is an example to understand how it works:

If you plan to invest $1200 in STI ETF in one year, you have two choices: (A) You can invest $1200 at one go, or (B) you can invest $100 each month.

Consider the following two scenarios – (1) price of the ETF rises (Nov 2020 – Oct 2021) and (2) price of the ETF falls (May 2019 – Apr 2020).

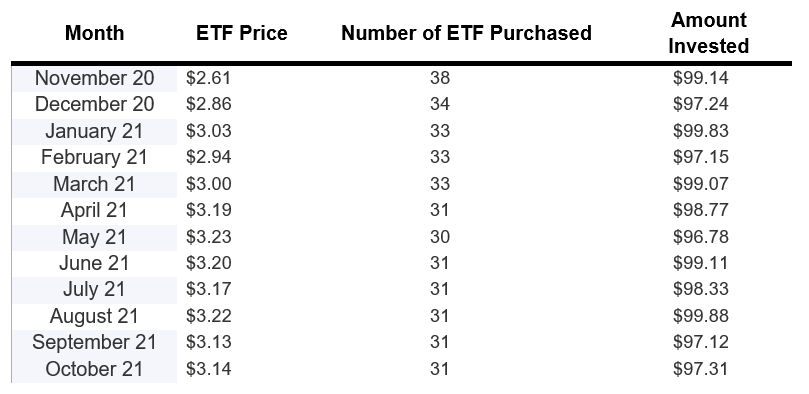

Scenario 1: Price of the ETF rises (Nov 2020 – Oct 2021)

In the scenario above, if you invested $1200 in STI ETF at a price of $2.6090 in November 2020, you would have $1200 / 2.6090 = 459 ETF. Or if you invest $1200 in STI ETF at a price of $3.1390 in October 2021, you would have $1200 / 3.1390 = 382 ETF

However, if you invest $100 in STI ETF per month, for 12 months, your total holding would be 387 ETF.

In this example, when the price rises, dollar cost averaging is more costly as compared to a lump sum investment at the beginning.

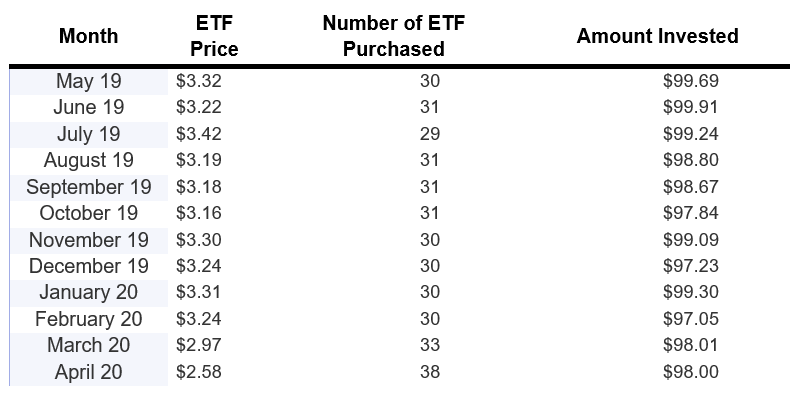

Scenario 2: Price of the ETF falls (May 2019 – Apr 2020)

In the scenario above, if you invested $1200 in STI ETF at a price of $3.3230 in May 2019, you would have $1200 / 3.3230 = 361 ETF. Or if you invest $1200 in STI ETF at a price of $2.5790 in April 2020, you would have $1200 / 2.5790 = 465 ETF

However, if you invest $100 in STI ETF per month, for 12 months, your total holding would be 374 ETF.

In this example, when the price falls, dollar cost averaging is less costly as compared to a lump sum investment at the beginning.

To conclude, as with most investment strategies, dollar-cost averaging is not for everyone. There will be times where the strategy works out, and times where it does not. In the long term, dollar cost averaging can at times underperform lump sum investing. Dollar-cost averaging can provide an alternative for investors who may not have a large amount of money saved up or those who feel that waiting might result in them missing out on potential gains. It can also be stressful to invest a large sum of money at once. Dollar-cost averaging can be a powerful tool for removing some of the emotional barriers of investing. It also helps to factor in market movements so that your investments will be less risky. These can be extremely helpful, especially if you have no clue about what and when to invest.

At POEMS, we offer a variety of regular fixed amount investment plans called Recurring Order(s), which enables you to buy shares by investing a fixed amount consistently at an interval of your choice: weekly, monthly, or quarterly. You will eventually buy more when products prices are low, and lesser products when prices are high. Over time, this dollar-cost averaging strategy reduces your exposure to price volatility, you will no longer have a need to predict market movements. Instead, you are in it for the long haul.

Recurring Plan

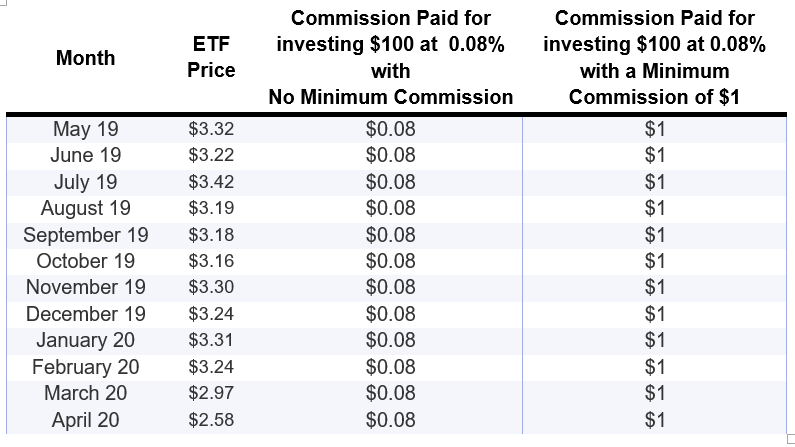

Our Recurring Plan is highly flexible. You can choose from any stocks or ETFs in the Singapore, US and Hong Kong exchanges, as well as the frequency and period for investing. It is also cost efficient when compared to other providers as it only charges 0.08% of the total investment value. In addition, if you decide to invest in smaller sums, it is not subjected to a minimum commission.

Here are some illustration depicting charges with and without minimum commission.

Note that exchange fees and GST are not included in this computation.

However, POEMS does not have any hidden fees, e.g. Platform Fees or Settlement Fees. You will build your portfolio gradually over a period of time through a fixed amount of regular investments of your own accord.

Not only is the entire pool of stocks and ETFs listed in SGX available for you to choose from, you can also choose to do dollar cost averaging with US and Hong Kong stocks. You also get to decide your own investment frequency, ranging from – daily, weekly, monthly or quarterly – giving you even greater flexibility.

Opening a Cash Plus Account allows you to enjoy the flexibility and cost efficiency to start Dollar Cost Averaging, to build a portfolio without missing any market opportunities.

Start early, be patient, and let your money grow. As Warren Buffett once said: “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

How can you Setup a Recurring Plan?

Step 1:

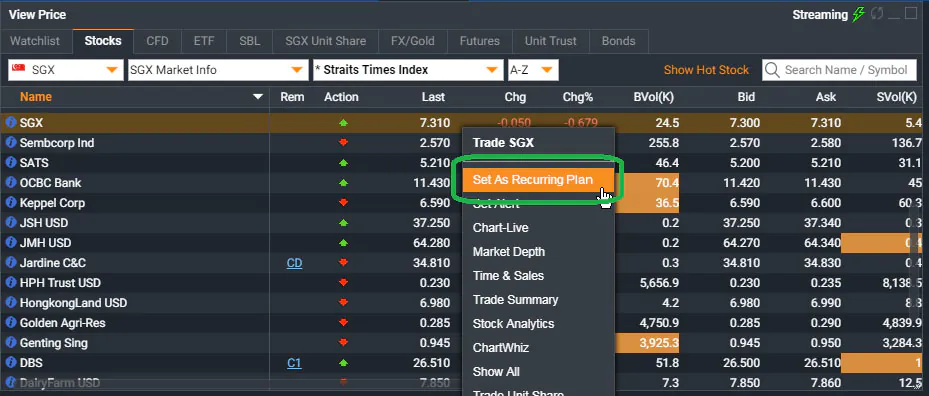

Open the Recurring Plan widget. There are 2 ways you can create a Recurring Plan.

Method 1:

Search for your desired counter that you wish to set a Recurring Plan for. Right click on the selected counter and click on “Set as Recurring Plan”.

Method 2:

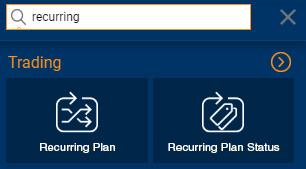

Create a new widget and search for “recurring”. Select “Recurring Plan” and search for the counter using the search bar function.

Step 2:

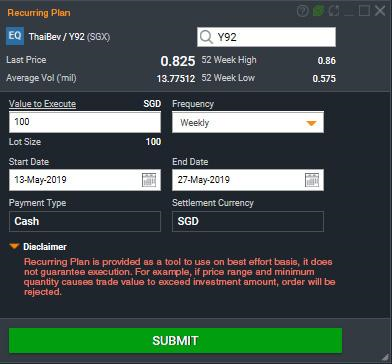

Key in the value, frequency, start date and end date of the Recurring Plan you wish to place. Key in your password and submit.

Step 3:

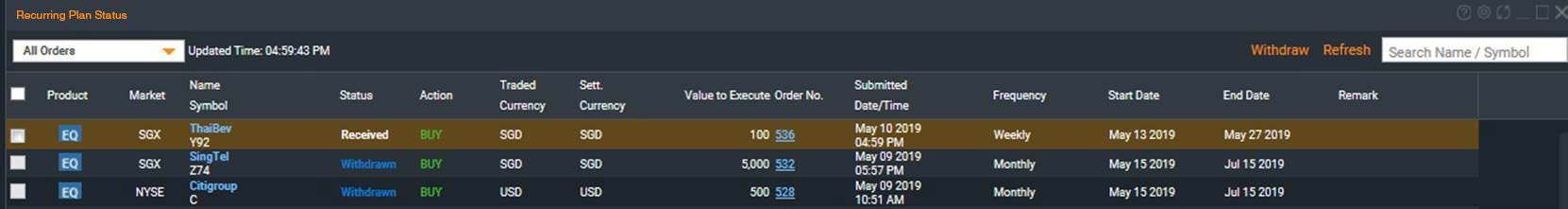

Check the order status under the “Recurring Plan Status” widget to ensure that the details are correct.

Step 4:

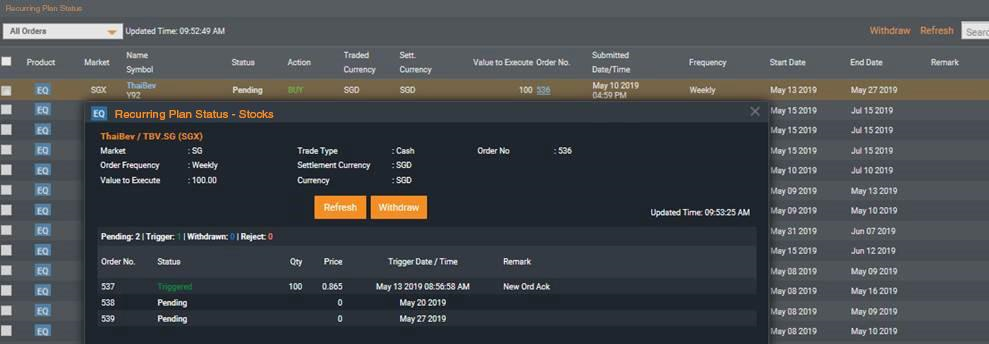

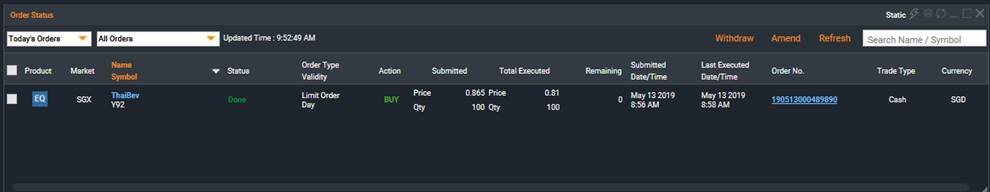

Click on the Parent Order number to view details of the Child Order status. The Child Order status will indicate “Triggered” if the order has been successfully sent to the market on the actual trigger date.

Step 5:

Open the Order Status widget to view the quantity and actual price executed for the Child Order. The contract will be created the next day, and you will be able to view it under the Account Management Widget.

Remember to fund your account. You can refer to poems.com.sg/payment for more details about our funding methods. While the amount is not invested, you can earn interest through your idle funds if you opt-in for our Smart Park Excess Funds Management facility. For more information, refer to poems.com.sg/excess-funds-management.

Here is a summary of why you should consider Dollar Cost Averaging

Good for Beginners

New to investing? If you are conservative and would like to start small, we have plans that could be ideal for you, starting from as low as S$100.

Setting Goals

The most important thing about setting goals is having one. Whether you are planning for retirement, saving for your children’s education or aiming to achieve other financial objectives, a Regular Savings Plan (“RSP”) could offer a potentially fuss free way to help you reach your goals.

“Time in the Market”, rather than “Timing the Market”

It is difficult to time the market where prices fluctuate all the time. However, by incorporating dollar-cost averaging, you are less prone to be affected by market fluctuations. Instead of investing a lump sum at one go, you are building your portfolio gradually over a period of time, with a fixed amount of funds at an interval of your choice.

If you are still waiting to time the market, why not just start with a product that may average out the market’s peaks and troughs? Let time work to your advantage.

Dollar Cost Averaging

By investing a fixed amount of funds consistently every month over a period of time, dollar cost averaging benefits you regardless of the fluctuations in prices. You purchase more units when the price is low and fewer units when the price is high.

Invest through Dollar Cost Averaging with us:

We offer three different types of products under our Regular Savings Plan

| Recurring Plan | Share Builders Plan | Unit Trust Regular | |

| Counters Available | All US, Hong Kong and Singapore counters | More than 50 counters (click here to see the complete list:https://www.poems.com.sg/rsp/#counters& https://www.poems.com.sg/docs/SBP-Infosheet.pdf) | More than 500 funds |

| Frequency | Daily, Weekly, Monthly or Quarterly | Monthly | Monthly or Quarterly |

| Minimum Amount | Minimum lot size value (has to be higher than $100) | $100 | $100 |

| Payment Mode | Fund Transfer, Debit from ledger/ Money Market Fund(MMF), Paynow | GIRO | GIRO |

| Account Type | Any Phillip Investment Account | SBP Account | Any Phillip Investment Account |

| Charges / Handling Fees | Prevailing account brokerage rates apply, 0.08% no minimum | S$6 (≤2 counters) S$10 (≥3 counters) | 0% Sales Charge |

| Set Up a Recurring Plan | Opt in for SBP | Opt in for UTRSP |

- wide range of investment products to choose from, including stocks and Unit Trusts

- hassle-free subscription with auto GIRO deduction (for SBP & Unit Trust RSP)

- start with a minimum of S$100 a month (for SBP & Unit Trust RSP)

- adopts the Dollar Cost Averaging concept

- no lock-in period

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Helena Wang

Helena is a Management Associate and a licensed trading rep in Phillip Securities

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It