Old Pillar of US Economy – Industrials October 30, 2020

This article is part of the US Election series brought to you by POEMS. #USElection2020.

Summary outline:

- Transportation infrastructure and construction are expected to thrive in a Biden victory.

- Airlines to stay depressed regardless of election outcome, until a vaccine is available.

- A Trump win is potentially positive for aerospace and defence sectors.

As Industrials covers a wide range of sub-sectors, this article focuses on the sub-sectors that would form the spotlight of discussions in the run-up to the US presidential election on 3 November 2020.

1. Transportation Infrastructure & Construction

What has been done during Trump’s administration

Trump’s most popular promise during his presidential campaign in 2016 was to increase infrastructure spending. He had proposed allowing more infrastructure funding from individual states and the private sector, with a relatively low federal budget. His plan made little progress as individual states were unable to cater to the sky-high costs due to rapidly ageing infrastructure.

In addition, Trump allowed a one-year infrastructure funding extension for FAST Act (2015) which was originally set to expire on 30 September 2020. The Act was signed into law by former president Obama to provide federal funding of up to US$305bn for surface transportation projects for five years. The one-year extension only provides temporary support for infrastructure spending as both the Senate and Congress still don’t see eye to eye on a long-term highway policy bill.

Meanwhile, the Highway Trust Fund – a traditional fund that taxes fuel consumption for infrastructure spending – is losing its effectiveness due to improving energy efficiency. New long-term infrastructure plans are urgently needed as infrastructure spending is known to combat economic recessions.

Infrastructure spending plan

| Plan details | US$2tn Climate Plan Budget:1. US$50bn in first year for roads, highways and bridges, expected to total US$300bn.2. US$100bn for modernization and renovation of schools.3. US$40bn for large-scale transformational projects such as water-conservancy projects.4. US$20bn for rural broadband construction.5. US$10bn for public transportation in poverty areas.6. US$10bn for rejuvenation of troubled cities.7. US$1bn for Smart City Project every year | Considering US$1tn budget:Mainly for traditional infrastructure such as roads and bridges. Rest of the funds for building a 5G network and Internet services in rural areas.Spending and funding plans remain vague.Trump expressed this as a once-in-a-decade opportunity to implement a mega-spending bill given low interest rates. |

| Expected impact on infrastructure sector | Biden’s US$2tn Climate Plan includes a substantial budget for infrastructure spending, which would outweigh the negative impact of tax increases.According to the Tax Policy Centre, Biden’s proposal would increase federal tax revenue by US$2.4tr over next decade. We foresee new spending from increased tax revenue.Spending also produces higher fiscal multipliers, potentially paving the way for higher long-term sector growth. | Trump’s push for his mega-infrastructure plan was interrupted by his impeachment and bipartisan disagreements.Although corporate tax cuts will increase infrastructure companies’ after-tax income, they produce lower fiscal multiplier effects that limit long-term sector growth. |

Companies to look out for:

| Event | Stock | % of revenue contributed by US government |

| Biden’s victory | Aecom (ACM) | 53% |

| Jacobs Engineering (J) | 27% | |

| % of revenue from Construction | ||

| Caterpillar Inc (CAT) | 44% |

2. Airlines

As one of the hardest-hit industries by the pandemic, the sector has managed to survive only because of government aid. The US$25bn support from the CARES Act, however, is running out and continuous support plans are urgently needed. However, a recent HEROES 2.0 stimulus bill was rejected by the Republican Senate after it was passed by a Democratic House. Both parties were unable to agree on the scale and purpose of the stimulus.

Airlines’ bailout and support plan

| Biden | Trump |

| If Biden is elected and the Democrats gain a majority in Senate, the HEROES 2.0 stimulus bill may be passed by the Senate quickly. The US$25bn will provide financial aid and potentially stop the layoff of airline employees. In addition, US$3bn is for contractors that service passenger airlines.Biden pledges to improve US airports by increasing investment through the Federal Aviation Administration (FAA) Airport Improvement programme.Biden also pledges to finance the development of low-carbon aviation via US$400bn clean energy innovation investments. | Trump signed CARES Act in March 2020 to provide loan support and protection to airlines.However, when CARES’ financial aid was running out, the Republican Senate failed to pass the HEROES Act. Instead, Trump pushed for a smaller “skinny” relief bill which provides direct payments and bailouts to struggling airline companies. |

In a Biden victory, we can expect more airline infrastructure funding with more regulation.

Airline travel regulation

| Biden | Trump |

|

|

As the US has the most coronavirus cases and deaths on earth and COVID-19 continues with its rampage, we expect US airlines to remain depressed, until a vaccine is found.

Their fate is likely to hinge more on the development of a vaccine than the outcome of the US elections. This is because room for stimulus support is limited and airlines would need to regain their wings themselves for longer-term sustainability. As of now, their prospects are hard to determine given a lack of visibility in vaccine development.

3. Aerospace & Defence

Trump’s blunders in foreign policies had put to vain the US’ arms control efforts with military superpowers such as North Korea, Iran and Russia. During his first term, he had taken the US out of three arms control agreements. The first was its nuclear deal with Iran in 2018. The second an Intermediate Range Nuclear Forces treaty with Russia. The most recent was the Open Skies Arms Control Treaty with Russia.

In the event he is re-elected, the global arms race is likely to continue.

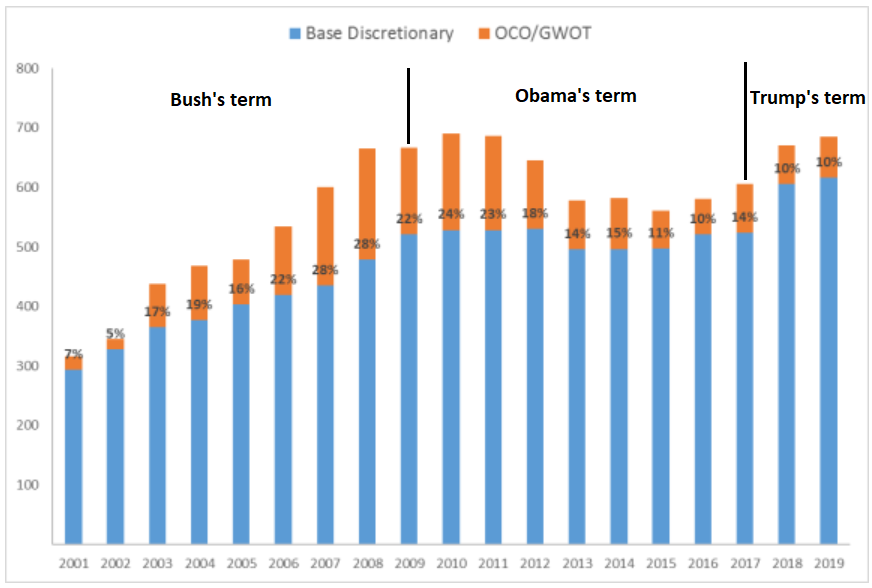

Moreover, since Trump took office, there has been a sharp build-up of defence spending, after years of steep cuts under Obama. The chart below shows the Department of Defence’s yearly budgets in nominal dollar in billions, not adjusted for inflation. OCO/GWOT stands for Overseas Contingency Operations/Global War on Terrorism.

Source: Department of Defence

Source: Department of Defence

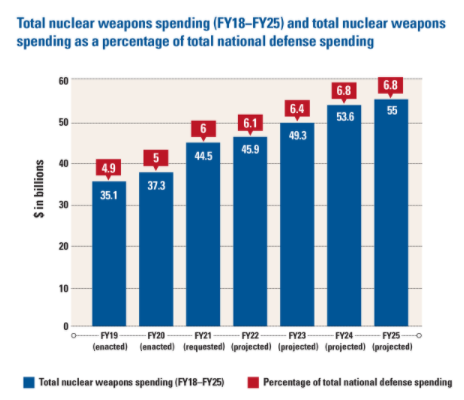

In addition, for nuclear weapon budgeting, the Trump administration requested for US$44.5bn for FY2021 to sustain and modernise the US nuclear delivery system. The chart below shows projected nuclear arsenal spending up to FY2025. The nuclear weapon portion of the total national defence spending is projected to rise throughout the late 2020s.

Source: Arms Control Association

Source: Arms Control Association

On the other side of the fence, Biden is known to favour arms control. He has signalled he would reverse Trump’s military build-up. Not only is he willing to renew the New START agreement with Russia for another five years without preconditions, he has also promised to re-join the Iran nuclear deal.

Biden might also face pressure from the progressive wing of the Democratic Party to implement budget cuts at the Pentagon. Whether he can fulfil this remains uncertain due to external political exigencies and spending on military necessities.

Companies to look out for:

| Event | Stock | % of revenue contributed by US military spending |

| Trump’s victory | Lockheed Martin (LMT) | 70% |

| Raytheon Technology (RTX) | 67% |

Exchange Traded Funds (ETFs) to look out for:

| Name | Ticker | Top Holdings |

| Industrial Select SectorSPDR Fund | XLI | Lockheed Martin (LMT)Boeing (BA)Raytheon Technology (RTX) |

Follow us on our US election series as we bring you through the detailed breakdown of the various sectors leading up to the US election on 3 November 2020.

References:

1. https://home.kpmg/xx/en/home/insights/2018/02/rebuilding-infrastructure-in-america.html

2. https://www.channelnewsasia.com/news/business/trump-team-prepares-us-1-trillion-infrastructure-plan-to-spur-economy-12842068

3. https://www.phillipcfd.com/us-election-technology/?utm_medium=referral&utm_source=poems-uselections&utm_campaign=articles-us-tech&_ga=2.214918231.1548955401.1602464460-1465797022.1579592166&_gac=1.188877273.1600327738.CjwKCAjwkoz7BRBPEiwAeKw3qzTSkn_Us0ZGUK8uahYDOwuF4zkRhHbB2KJR9QcOBkF9jecSWiOM1RoCIWgQAvD_BwE

4. https://www.ttnews.com/articles/fast-acts-yearlong-extension-signed-law

5. https://www.cnbc.com/2020/10/19/election-2020-stimulus-goldman-sachs-democratic-sweep.html

6. https://thepointsguy.com/news/biden-versus-trump/

7. https://www.airport-technology.com/features/us-2020-election-trump-biden-plans-aviation/

8. https://viewfromthewing.com/how-transportation-policy-will-change-in-a-biden-administration/

9. https://www.lexology.com/library/detail.aspx?g=eab01ea7-66a9-40c0-a2bd-96339e1faee5

10. https://www.reuters.com/article/health-coronavirus-trump-talks/trump-calls-for-skinny-coronavirus-relief-bill-spokeswoman-idUSW1N2E102C

11. https://www.theguardian.com/us-news/2020/oct/14/us-foreign-policy-trump-biden-election-world

12. https://www.theguardian.com/world/2019/aug/01/inf-treaty-us-russia-arms-control-to-end

13. https://www.armscontrol.org/issue-briefs/2020-03/surging-us-nuclear-weapons-budget-growing-danger

14. https://www.everycrsreport.com/reports/R44519.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Choo Li Rui Hansel

Equities Specialist

Mr Choo Li Rui Hansel joined Phillip Securities as Equities Specialist (Dealer) and handles over 13,000 trading accounts. As an Equities Specialist, he handles trade execution and equity-related operation. He also provides market insights, corporate action, securities & portfolio advisory services. In addition, Li Rui also regularly conducts webinars to educate public with trading & financial knowledge. He acknowledges the importance of financial literacy in optimizing wealth growth, be it active trading or passive investing. Li Rui obtained Bachelor of Engineering Degree from Nanyang Technological University, majoring in Civil Engineering. Despite his academic background, Li Rui's interest lies in securities & derivatives market. His engineering academic background had equipped him with analytical skills which are the essential transferable skills in finance industry.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?