Safe Haven – Gold or Bond? April 18, 2017

Geopolitical events & Risks

We all know about the U.S. missile strike 2 weeks ago, in which they launched 59 missiles on a Syrian government airbase. Last Thursday, they dropped the largest non-nuclear bomb in Afghanistan. And last but not least, multiple senior U.S. intelligence officials have said that the U.S. is prepared to launch a pre-emptive strike if they become convinced that North Korea is about to test a nuclear weapon. The failure of the North Korea’s missile test yesterday have alleviated the tension but the risks are still there.

This series of military actions seem to signal that President Trump has taken on a more hawkish geopolitical tone. We know that geopolitical instability is bad for businesses. This will no doubt cast some fear in investor’s mind and we should see more of them shifting funds into less risky asset classes.

Less risky asset class like bonds will see a drop in yield due to the increase in demand. The prices of gold and gold-related equities are also expected to continue to increase as it is usually seen as a hedge against volatility.

Bonds

Bonds pay a fixed coupon or interest rate to the holder at a set interval on the principal amount over the duration of the bond. Some bond issuers are safer than others, and some bonds are backed by collateral.

If the issuer is unable to do so, it will result in the default of the bond and the investor may lose all his principal amount.

As such, bonds issued by companies or governments with high credit rating (a measure of the ability to fulfil financial commitments) are usually sought after by investors.

It is also worthwhile to note that bonds are also considered as debts and are placed higher in the hierarchy than equities when receiving pay-outs in the event of company liquidation.

Gold

This shiny precious metal has been regarded as a financial safe haven for centuries. Holding physical gold, unlike bonds or equities, does not pay the holders any interest or coupon. Investors actually have to pay a fee to hold gold in safe vaults.

So why do investors still pay to hold gold? Other than the mentality of gold being a safe haven, gold price has demonstrated inverse relationship to share prices in times of volatility, making it a good hedge for it. Investors are banking on the capital appreciation of gold to exceed the cost of holding it.

An alternative to holding gold will be purchasing gold-related equities product. Some examples of such equities are CNMC goldmine, a mining company for precious metals and GLD $US, a gold ETF.

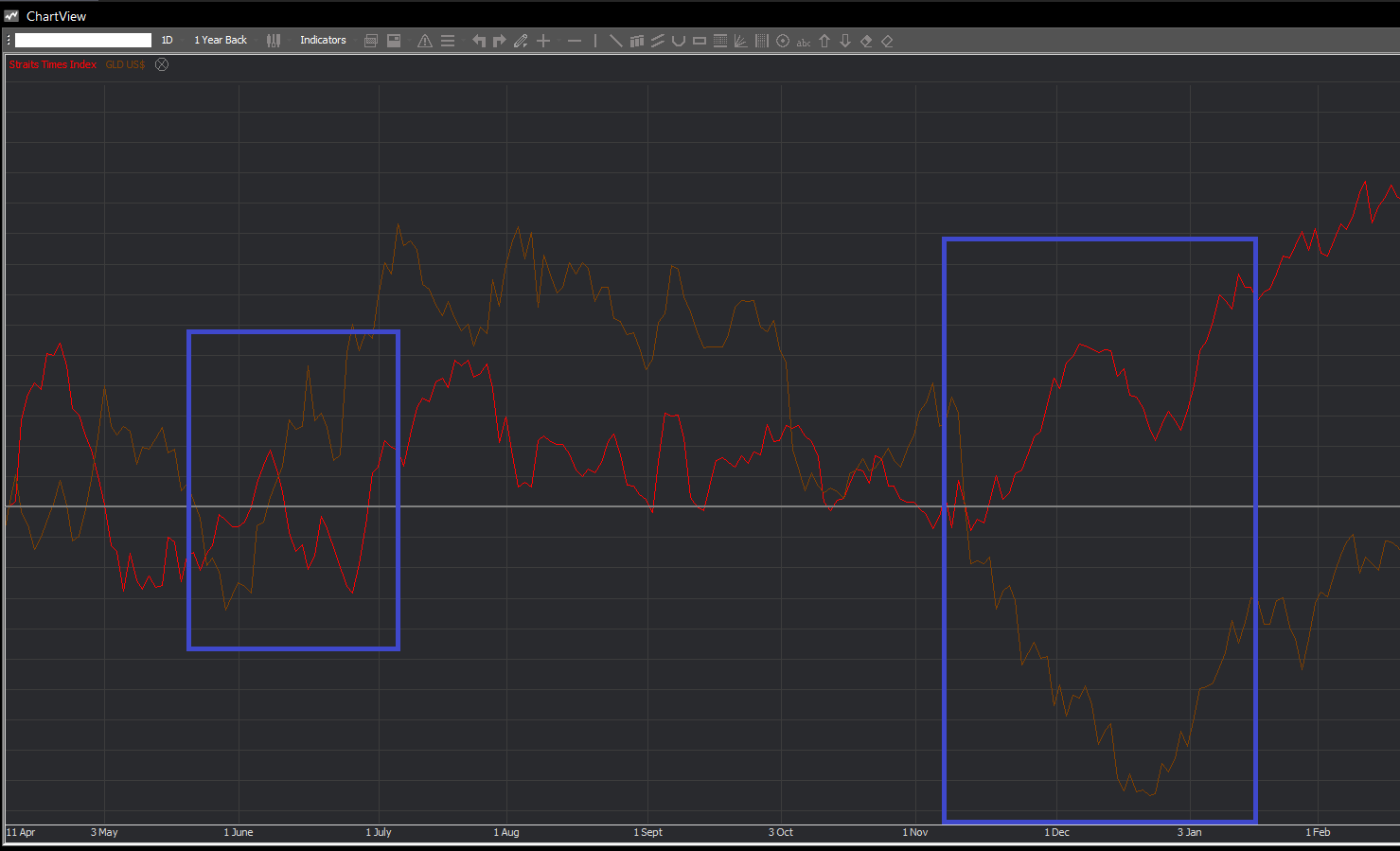

1 year price movement of STI vs GLD US$ on POEMS Mercury

We can see from the above chart that there is inverse relationship in the movement of STI and GLD US$ during late June 16 (Brexit) and Dec 16 (U.S. president election), which are well known periods of market volatility.

In summary, holding bonds or gold each have their own advantages and risks. Investors will have to gauge their portfolio and time horizon before deciding which one is more suitable for their needs.

If you wish to know more information about ETFs or any other stocks, you can speak to your designated Trading Representatives or a Dealer at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chong Kai Xiang (Kai)

POEMS Dealer

Raffles City Dealing Team

Chong Kai Xiang (Kai) is an Equities Dealer in the Raffles City Dealing Team, and currently provides dealing services to over 35,000 trading accounts.

Kai frequently conducts seminars to enrich his clients' trading and financial knowledge. Apart from this, Kai also provides weekly market updates to his clients to keep them informed and up to date on their stock holdings.

Kai holds a Bachelor Degree of Finance from the SIM University – UniSIM and was awarded the CFA Singapore Gold Award and CFP® Certification Achievement Award in 2015.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It