Short Selling – The Good, The Bad and the Ugly January 10, 2023

In this article, we will explore the idea of Short Selling:

- Legendary Trades done by hedge funds

- Importance of Short Selling

- Strategies

- How to gain short exposure

The Idea of Short Selling

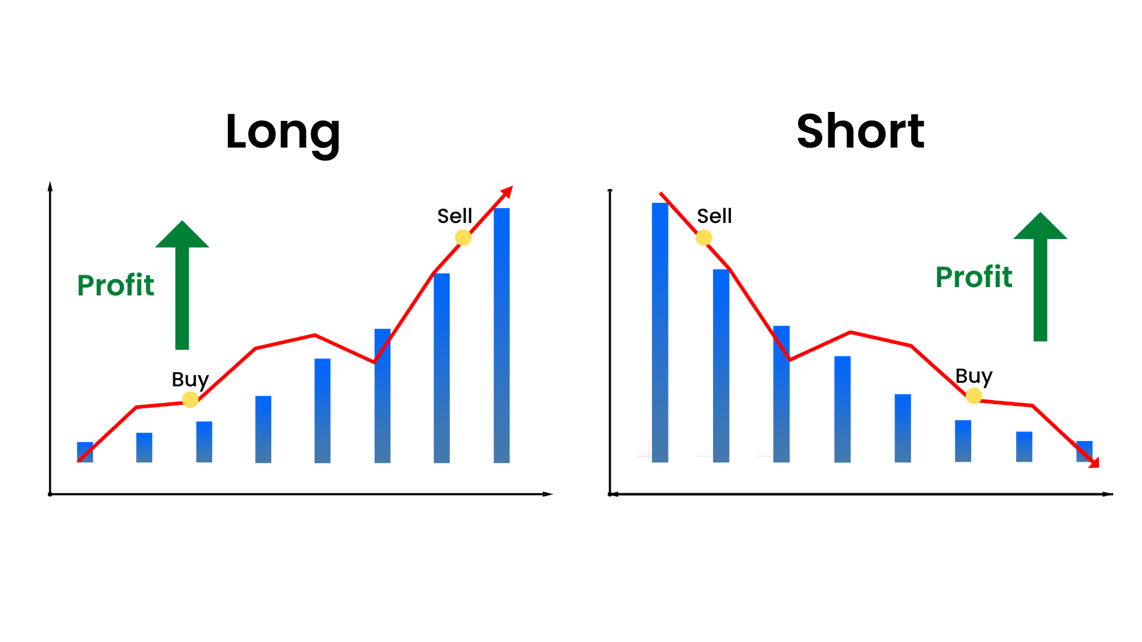

“Buy Low, Sell High”, a commonly heard strategy based on taking advantage of the appreciation / depreciation in price of the underlying asset. Let’s take it a notch up, and review a strategy that functions on the fall in price of the underlying asset, “Selling High first, Buying Back Low”. Are you familiar with this trading strategy?

The idea of short selling is to borrow the underlying asset, sell it and buy the underlying asset in the future at a lower price to return it, benefitting from the difference in the selling price and buying price [1]. The maximum potential profit of a short position is 100% (when the underlying asset goes to a price of $0). However, the maximum potential loss is infinite as there is no upper cap to limit how high the underlying asset price can go.

Legendary Short Sellers & Stigma

Many consider short selling a taboo.

In 2008, the Securities and Exchange Commission (SEC) reactively enforced 2 temporary riles to constrain short sellers who were blamed for some of the patterns in the stock price movements during the financial crisis that began in March that year. As the market deteriorated that year, short sellers were blasted for thriving while everyone else was at its wit’s end. Short sellers benefit from the collapse in the prices of the underlying, ranging from a company’s stock price to a nation’s currency.

For example, the most Legendary Currency Short Seller George Soros, also known as “The man who broke the Bank of England”, raked in $1 billion pounds in profits by shorting the British Pound heavily, forcing the British Government to withdraw from the ERM (European Exchange Rate Mechanism) [2]. The chart below shows the magnitude of the drop of GBP/USD between late 1992 till early 1993.

Source: https://www.gffbrokers.com/black-wednesday/

Source: https://www.gffbrokers.com/black-wednesday/

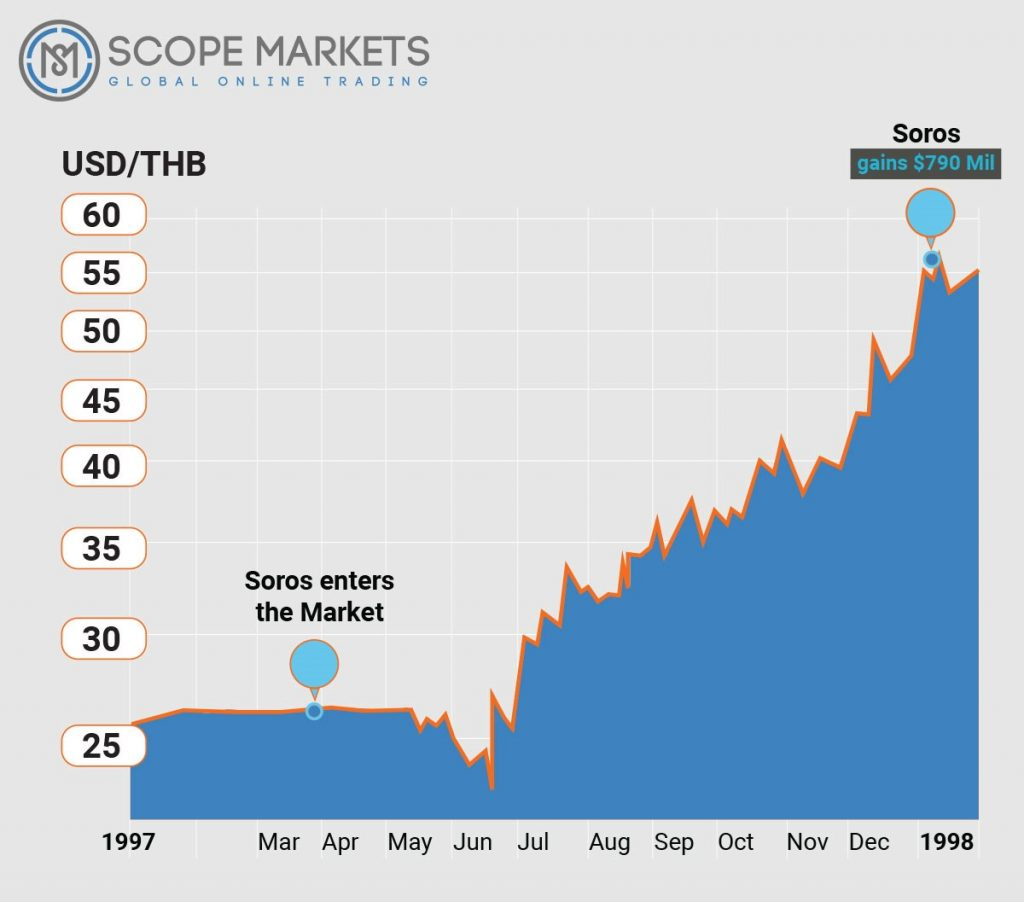

From 1997 to late 1998, Asian countries like Thailand, Indonesia and South Korea were hit badly by hedge funds led by George Soros’s Quantum Fund, Julian Robertson’s Tiger Fund and other hedge funds that joined the speculation [3]. At first , the Bank of Thailand (Central Bank of Thailand) attempted to stabilise its currency (Baht) by using a foreign currency like the US dollar to purchase Baht in the foreign exchange market. This would have increased the value of the Baht artificially by causing an increased demand. Furthermore, this would have increased interest rates for the Baht and restricted foreigners’ access to the Baht to fight speculators. In the short run, this strategy pumped the value of Baht up. However, as the Bank of Thailand’s foreign reserves dried up, it attracted more hedge funds and speculators to short the Thai Baht even more. Without foreign reserves to defend the Thai Baht, the bank devalued the currency while the hedge funds profited, leaving Thailand in a currency and financial crisis. This signalled the start of the Asian Financial Crisis, which spread to other emerging Asian markets around the region.

Source: Scope Markets

Source: Scope Markets

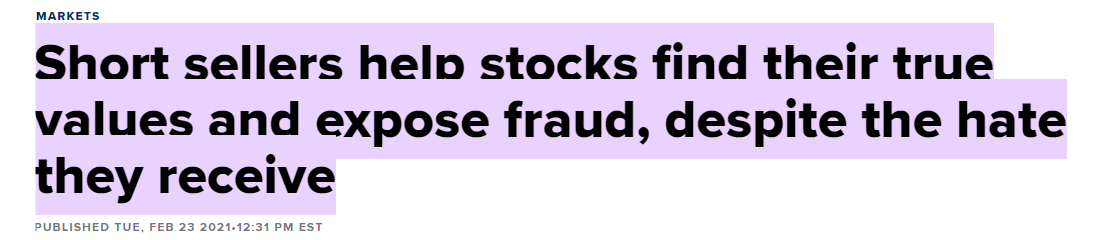

Importance of short selling

Even though short selling benefits from the drop in the underlying price, it is necessary for more efficient price discovery. Short selling allows downward pressure from sellers to be represented in price discovery as it is one of the key functions of a market. Buyers and sellers can influence the underlying price to better reflect their view on the fundamental price. This is compared to markets that ban short selling, so that only the buy side influences the price, causing the underlying price to be skewed and biased. It is shown that in markets that allow short selling, asset prices are closer to their fundamental value compared to exchanges that do not allow short selling [4].

Source: CNBC [5]

Source: CNBC [5]

Furthermore, short sellers are incentivised to identify malpractice and fraud in companies, engaging in due diligence, auditing and investigative work, identifying companies that are defrauding investors and customers such as Enron, Wirecard AG and Valeant just to name a few [6].

While overall markets were obsessed with Wirecard and wanted a piece of it, Safkhet Capital (a short-only fund) found that it (Wirecard) was actually indulging in illegal practices and deciding to short their stock. However, regulators such as BaFin did not look into the allegations of illegal practices in Wirecard. Instead, they went after the short sellers for possible market manipulation; they even went to the extent of banning short-selling in Wirecard entirely [7].

These are regular occurrences in hedge funds for short-sell as well as major short-selling players, as they face criticism and are blamed for crashes and the failure of companies. However, without short sellers revealing fraudulent businesses, they would be akin to parasites to the market, causing more harm to the investing community in the long-run.

Strategies that short sellers utilise

Hedge funds that specialise in short-selling do their fundamental analysis to determine if the underlying company is overvalued. The hedge fund will then publicly announce their short position and publish a short report stating their underlying reason for going short [9]. The short report will cover the bearish outlook and any negative aspect of the company in an attempt to convince other market participants to sell their shares, or go short as well to push prices down to the fundamental price that the hedge fund desires. This is a more public approach as hedge funds are not required to disclose short positions in their quarterly filings. Therefore, publicly announcing their short positions and publishing the short report can help push prices down, but can also cause the hedge fund to be the target of a short squeeze.

Source: The Business Times : https://www.businesstimes.com.sg/companies-markets/nio-shares-plunge-short-seller-allegations-company-says-report-without-merit

Source: The Business Times : https://www.businesstimes.com.sg/companies-markets/nio-shares-plunge-short-seller-allegations-company-says-report-without-merit

Strategies against short sellers

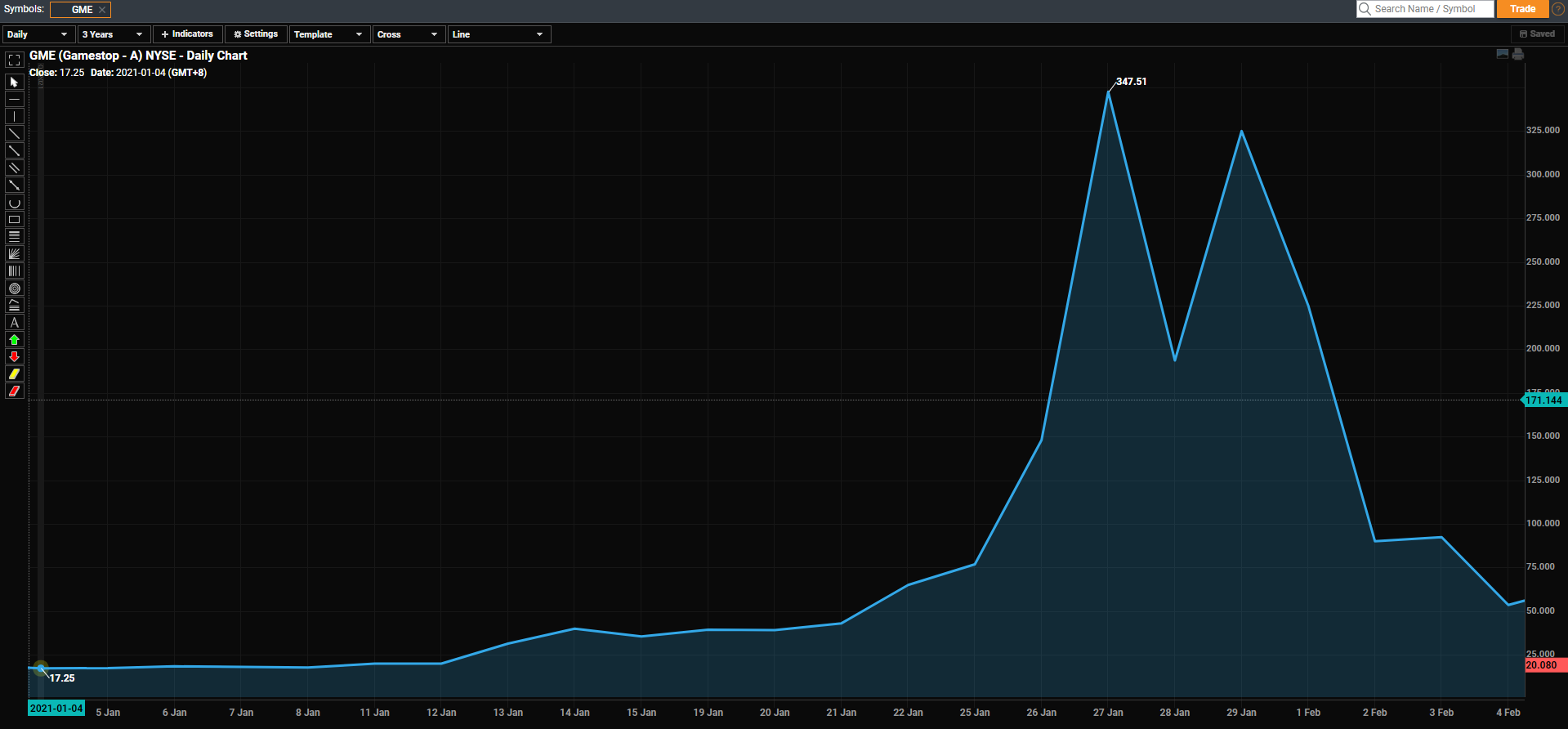

A short squeeze is a strategy that aims to put pressure and ultimately force the short seller to cover his position by increasing the price of the shorted company’s shares. As short positions are generally traded on margin, a significant increase in the share price will cause the short-seller to get a margin call forcing him to cover his short position by buying back shares in the open market, further pushing prices up even more. A short squeeze on illiquid counters that have a large amount of short interest can cause the system to collapse.

The best example for this is the short squeeze on GameStop in January 2021, where the short interest for the GameStop stock was at a record 140% of the total public float. Individual investors and some hedge funds decided to short squeeze the short sellers of GameStop by purchasing and pushing the price up, resulting in an explosion in stock price from $17 USD (at the start of the month) to a pre-market price of over $500 USD [10]. This is seen in the graph below.

Source: POEMS Platform

Source: POEMS Platform

This shows the risk of using short sell as a strategy, namely the risk of being short squeezed and being forced to close the trade at a loss.

Which products allow you to gain short exposure?

There are multiple ways to gain short exposure to the underlying asset.

Short selling

Clients are required to locate and borrow the underlying asset (usually shares) before selling them in the open market. This may require some time and cost as well.

Inverse Exchange Traded Funds (ETFs)

Clients can purchase an inverse ETF to gain a short exposure on the underlying asset. An Inverse ETF tends to compound daily returns and the lowest price an inverse ETF can go to is $0.

Contract For Difference (CFD)

Clients can purchase a short contract using CFDs. They are not required to locate/borrow any shares as the contract is cash settled. Furthermore, they will enjoy the benefits of leverage and a wide selection of counters such as FX, index, equities and even commodities to choose from.

Daily Leverage Certificate (DLC)

A Structured Financial Instrument offers investors 3x to 7x of the daily performance of the underlying asset (compounded daily) and has a finite lifespan.

The table below outlines both the advantages and disadvantages of each method.*

| Product | Leverage | Margin | Mechanics | Life Span | Settlement |

| CFD | Up to 20x | As low as 5% | Difference in Opening and Closing | No Fixed Date | Broker Specific |

| Inverse ETF | 1-3x | No | Daily Compounded | No Fixed Date | Exchange |

| DLC | Up to 7x | No | Daily Compounded | Finite | Exchange |

| SBL | ~3x | 30% of the Market Value of borrowed Securities | Difference in Opening and Closing | No Fixed Date | Broker Specific |

*Based on products that are available for purchase on the POEMS platform, other platforms may vary.

Conclusion

For market participants interested in short selling, CFD offers the ease and access to higher leverage to fit most trading strategies. CFD also offers counters ranging from Indexes and Equities to FX and even commodities, allowing market participants to gain both long and short exposure to fit their needs.

Want to kickstart your CFD journey? Here is a promotion for you! *

From now till 31 January 2023, get a free PlayMade bubble tea worth S$5 when you open a CFD account with us! Additionally, you can stand a chance to win a 3D2N staycation when you open an account, fund and trade with us! For more information, click here to learn more.

*Terms and Condition Apply.

Reference:

- [1] https://www.kenan-flagler.unc.edu/news/dont-blame-the-short-sellers/

- [2] https://www.schwab.com/learn/story/ins-and-outs-short-selling#:~:text=Short%20selling%20involves%20borrowing%20a,after%20repaying%20the%20initial%20loan

- [3] https://www.investopedia.com/ask/answers/08/george-soros-bank-of-england.asp#citation-1

- [4] https://www.businessinsider.com/how-george-soros-broke-the-bank-of-thailand-2016-9

- [5] https://www.sciencedirect.com/science/article/pii/S2214845020300533#:~:text=Their%20main%20finding%20is%20that,the%20existence%20of%20short%20sales

- [6] https://www.cnbc.com/2021/02/23/short-sellers-help-stocks-find-their-true-values-and-expose-fraud.html#:~:text=Markets-,Short%20sellers%20help%20stocks%20find%20their%20true%20values%20and%20expose,despite%20the%20hate%20they%20receive&text=Short%20selling%20plays%20several%20important,and%20early%20detection%20of%20fraud

- [7] https://www.promarket.org/2021/02/22/fahmi-quadir-short-sellers-boogeyman-wirecard-gamestop-fraud-germany/

- [8] globalcapital.com/article/28mu8rfi95i1lnqpog6bk/equity/what-wirecard-put-its-critics-through-is-heinous-fahmi-quadir-safkhet-capital

- [9] https://blog.scopemarkets.com/en/legendary-forex-traders-george-soros/

- [10] https://www.daytradetheworld.com/trading-blog/day-trading-short-seller-reports/

- [11] https://abcnews.go.com/Business/gamestop-timeline-closer-saga-upended-wall-street/story?id=75617315

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Sam Hei Tung

Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  Playing Defence: Diversification in Forex Trading

Playing Defence: Diversification in Forex Trading