Short Selling With CFDs November 13, 2019

It is evident that financial markets move in cycles. As the saying goes “What goes up, must come down”. Investors who spend time studying the price movement and cycles of the assets they intend to invest in could be rewarded with profits earned from uptrends and downtrends.

If you have never attempted short-selling before, maybe it is time to start as you are losing out on 50% of the opportunities in the market. Should you only stick to the traditional method of going “long”? Let us take a look at some reasons to short-sell!

Benefits of Short-selling

Fig 1

As opposed to the traditional method of buying an asset at a low price and selling high, a short position is made when an investor sells a security first with the intention of repurchasing it later at a lower price.

Short-selling is a strategy that sometimes receives flak from conservative traders, citing reasons such as causing declines in asset prices and exacerbation of negative sentiments in the markets.

However, instead of simply sitting back and cutting losses during a bearish market, you can turn the situation around and profit by capitalizing on falling prices. Some long-term investors use this feature as a hedging tool to protect their profits. They establish an opposite position to what they already have on stocks to prevent any losses due to short-term downtrend in the markets.

Example of short-selling:

Fig 2

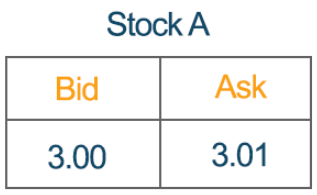

Edwin currently holds a bearish view on Stock A. As he is not able to short-sell Stock A in the cash market without having to borrow the shares, he decides to use Contracts For Difference (CFDs) instead.

Stock A is currently trading at a price of $3.00. Edwin goes SHORT on 2,000 Stock A CFD at the Bid Price of $3.00.

A week later, the price of Stock A drops to $2.50 and Edwin decides to close his contracts. He closes his CFD position (BUYBACK) on Stock A at the Ask Price of $2.50. The total profit Edwin makes from this trade is ($3.00 – $2.50) * 2,000 = $1,000.

However, if a week later the price of Stock A goes up to $3.50 and Edwin decides to close his CFD position on 2,000 Stock A CFD at the Ask Price of $3.50, he would make a loss of ($3.00- $3.50) * 2,000 = $1,000.

Major Events that Shook the Financial Markets

Markets tend to be extremely volatile whenever there is a financial crisis. The market becomes bearish and stock prices plummet. This is where you can use short-selling to hedge against your portfolio and minimize your losses. Here are some of the major events that shook the financial markets.

Fig 3

Dot Com Crash (2000)

In the early 1990’s, many tech companies were highly valued – and perhaps too much so. A tech bubble was formed when speculative investors poured money into internet-based companies without assessing their profitability. Irrational exuberance took hold with investors aggressively buying tech stocks and price-to-earnings ratio of the NASDAQ composite index rose to 200.1 When the bubble finally burst, most of the internet companies applied for bankruptcy due to their high cash burn rates and unsustainable business models.

Global Financial Crisis (2008)

The 2008 Global Financial Crisis is widely acknowledged as the worst financial crisis since the Great Depression in 1929. Due to the availability of low credit post-2000, many homeowners took mortgages to purchase and build houses due to the expected rise in housing prices hoping to reap profits from their investment. Banks took the opportunity to bundle these mortgages into mortgage-backed securities. Subsequently, homeowners started to default, causing a rapid decline in asset prices. Stock markets lost more than $8 trillion in value and unemployment rose to an all-time high.2

China Stock Market Crash (2015)

Between June 2014 and June 2015, the Shanghai Composite Index rose around 150%, reaching all-time highs. During that period, the Chinese government policy was to encourage its citizens to participate in the stock market. A lot of people started to leverage on their stock purchases – or rather commonly known as margin trading. As more leveraged money entered the Chinese stock market, the Chinese government started to introduce regulations to deleverage the market. Chaos soon ensued, with investors rushing to the exits. With stock prices crashing, margin calls inevitably happened, further exacerbating the sell-off. Even with government support and intervention, the stock market still ended 30% down after a tumultuous 3 weeks.3

Brexit (2016)

A historic referendum in which U.K voted to leave the European Union. Brexit had huge implications for businesses in the U.K especially for those in the banking and financial services sector. Some banks started to make plans to shift out of London which was once considered the financial hub of Europe. With uncertainty in the market, the pound sank to a two-year low since Boris Johnson’s victory as British Prime Minister.4

U.S China Trade War (2018)

The U.S. China Trade War is something that currently most people should be familiar with. In a bid to stop unfair trading practices with China, US President Donald Trump implemented tariffs on goods from China. China did not sit back – they retaliated with tariffs of their own5. Much of the market movements in the recent year have been due to tariff news – and it’s almost certain that if the trade war goes out of proportion, a downturn in the stock market will be imminent.

What Can I Short with CFDs?

One of the main benefits of trading Contracts for Difference (CFDs) is the ability to both long and short. Be sure to check out this article “Understanding Contracts for Difference (CFDs)” to understand the basics of CFD trading.

Here are some assets that are readily available to trade long and short on CFDs:

Stocks/Equities CFD

CFDs are commonly used by investors who want to short stocks. Most markets generally impose restrictions on short-selling for stocks – and it is inconvenient to initiate an equity short in the market. For instance, an investor would have to inform their broker of their intention to short and procure shares, and subsequently inform the broker when they have bought back the shares to settle the short.

CFDs circumvent all of these troublesome issues – all you need to do is to focus on what you want to long or short & initiate the trade. We’ll settle the rest for you. Another benefit of trading Equity CFD with us is being able to long and short more than 5,000 contracts in one account. Spreads are not quoted in addition to prevailing market prices.

For more information on Equities CFD, kindly refer to the contract specification and pricing pages.

World Indices CFD

Indices are a great way to participate in the performance of an overall market if you do not want to go through the hassle of doing research on individual stocks. An extremely popular Index that many of our clients trade is the Straits Times Index SGD5 CFD (STI CFD). The Straits Times Index is a capitalisation-weighted stock market index that is commonly regarded as the benchmark index for the Singapore stock market. STI CFD can also be an ideal tool to battle the ongoing trade wars and it is a unique CFD product that we are proud to offer.

World indices CFD are useful as they tend to react quickly to major economic news so traders can easily trade them. Additionally, from a diversification standpoint, indices are less risky than individual stocks which have unsystematic risk – this risk can be largely eliminated if you purchase an index.

For more information on World Indices CFD, kindly refer to the contract specification and pricing pages.

Commodities CFD

The commonly traded commodities are typically Gold, Silver and Oil. While most commodities are traded on futures, there are some benefits to trading commodities via CFDs. Unlike CFDs where you trade just on the price of the particular commodity, both parties on a futures contract must fulfil the conditions of the contract.

If you are not familiar with the futures contract and choose physical settlement instead of cash based settlement, you might end up with a truckload of oil barrels at your door!

For more information on our Commodities CFD, kindly refer to the contract specification and pricing pages.

FX CFD

Forex (FX) is the largest & most liquid financial market in the world. The largest volume of trades comes from traders who trade the currency pairs. The FX market is open 24 hours a day, 5 days a week.

Check out our newly launched FX CFDs where we offer very competitive spreads for some of the major currency pairs. To understand more about the basics of FX CFD trading, be sure to read our latest FX CFD article. Best of all? Zero commission and no finance charges for opening your FX CFD positions with us!

For more information on our FX CFD, kindly refer to the contract specification and pricing pages.

The Current State of The Market

Fig 4

The market in the past year can be summarized in one word, volatile.

Despite signs of slowing global growth this year, we are still increasingly seeing stock valuations rise. Slowing growth and increasing stock prices usually do not go hand in hand. However, central banks, especially the Fed, have proactively taken measures to reverse their monetary policy stance since last year, from tightening to easing rates. This measure has helped to boost asset prices across the board.

The current stock market bull run is already the longest on record in history. We are firmly in the late cycle of this bull run as exemplified by some of the economic/macro indicators such as unemployment rates and slowing corporate earnings. Investors need to remain alert and be prepared to combat a falling market when required and it would be prudent for them to have the necessary and available tools on hand to combat a falling market.

In conclusion, short-selling can be a good way to invest and trade in the market. Ready to trade CFDs? Get more information on CFDs at https://www.phillipcfd.com/products/

References:

- [1] https://www.nasdaq.com/articles/missed-internet-boom-heres-your-second-chance-2017-11-20

- [2] https://www.thebalance.com/2008-financial-crisis-3305679

- [3] https://www.theguardian.com/business/2015/jul/08/china-stock-market-crisis-explained

- [4] https://www.straitstimes.com/business/british-pound-drops-against-singdollar-amid-fears-of-no-deal-brexit

- [5] https://www.cnbc.com/2019/03/01/the-timeline-of-trump-china-tariffs-and-trade-war.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Contracts for Differences (CFD) Team

Phillip CFD offers more than 5000 CFD contracts and provides the largest number of Singapore CFDs available for shorting with round-the-clock trade support. Visit our CFD website to find out more.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  Playing Defence: Diversification in Forex Trading

Playing Defence: Diversification in Forex Trading