Small Steps to Grow Your ETF Portfolio April 23, 2018

Many investors are intimidated by the idea of investing a lump sum of money into any particular financial asset. The fear of market crashes or the lack of financial knowledge may drive potential investors away from making their first step in investment, which delays the laying of the foundation for their investment portfolio.

There are however specific investment products that allow one to take a conservative investment approach in terms of smaller capital outlay while achieving diversification at the same time. The Phillip Share Builders Plan (SBP) is an investment plan that allows for small initial capital outlay (with just $100 a month), ability for diversification and takes advantage of the Dollar Cost Averaging (DCA) investment technique that ignores market timing and volatility.

Before we go into further details about using the Share Builders Plan to construct your ETF Model Portfolio. Let us examine what DCA is and how it aims to turn market fluctuations in favour of investors.

What is Dollar Cost Averaging (DCA)?

DCA is an investment technique of investing a fixed amount of capital into buying a particular financial asset on a regular schedule. With this technique, you would be acquiring larger units of share when prices are low and buy fewer units of shares when prices are higher. Instead of investing with a lump sum of capital, you can start with a small but regular investment over a long-term period.

It allows investors to average out the cost of investing in a particular financial asset and minimise the chances of investors entering the market when financial assets are overvalued.

For example: An investor invests $100 per month into buying ABC ETF

|

Time |

ABC ETF Price |

Number of Units Purchased |

|---|---|---|

| January | $2.50 | 40 |

| February | $2 | 50 |

| March | $2.25 | 44 |

| April | $3 | 33 |

| May | $3 | 33 |

| Total Units Purchased | 200 | |

Figures used are fictitious and for illustration purposes only

The investor paid a total of $500 on 200 units of ABC ETF, which averages out to $2.50 per unit spread over a five months’ period.

If the investor is to pay $500 of lump sum money during May to purchase the ABC ETF priced at $3 per unit, he will only receive 166 units of ABC ETF instead of 200 units.

Benefits of Dollar Cost Averaging

There are several benefits of Dollar Cost Averaging

- Investors need not require a large sum of initial capital

- Requires less time from investors to monitor the performance of their financial assets

- By spreading investment over a longer term period, it minimises the chances for investors to enter the market when financial assets are overvalued

- Allows investors to purchase odd lots with their available budget

Model Portfolio

A Model Portfolio may consist of different asset classes; equities, bonds, commodities, REITs, gold, etc. Each asset class has its own unique risk and return characteristics that will behave differently over time to different stimulus. By tailoring the weightage of each of the asset classes in a portfolio, investors can customise the risk and return profile of their portfolios to be in line with their investment objective and risk tolerance. A risk-taker will want to assign more weightage towards equities whereas a risk-averse investor will want to assign a higher weightage towards bonds. Investors can even further customise their investment portfolio by allocating different sectors and themes (e.g. Industrials, Financials, Consumer Staples etc.) within each asset classes.

How to Build a Model Portfolio with SBP

Assembling a Portfolio Model may sound like a daunting task, but investors can build up a simple Model Portfolio with the use of Share Builders Plan.

There are 29 counters available in Phillip Share Builders Plan. The latest inclusion being the Lion-Phillip S-REIT ETF.

REITs have unique characteristics that make them a great portfolio diversifier. The addition of the new Lion-Phillip S-REIT ETF into SBP offers a cost-effective way for investors to be vested in the Singapore properties market and an extra option to diversify their portfolio asset allocation.

You can learn more about the benefits of REIT ETF at The Best of Both Worlds: REIT + ETF = REIT ETF.

All in all, there are three Exchange Traded Funds (ETFs) in SBP for investors to choose from. By subscribing to the three ETFs, a greenhorn investor can assemble his ideal portfolio to suit his investment needs and risk profile. Furthermore, each ETF contains a basket of securities of its respective asset class, which in turn provides the benefit of diversification for investors.

The 3 ETFs Available in SBP

| Asset Class | Equity | REIT | Bond |

| SGX Ticker | ES3 | CLR | A35 |

| Number of Holdings | 30 | 26 | 43 |

| Inception Date | 11 Apr 2002 | 30 Oct 2017 | 31 Aug 2005 |

| Annualised return since inception | 7.52% | -0.78% | 2.43% |

| Expense Ratio | 0.30% | 0.50% (Management Fee) Expense Ratio Capped at 0.65% |

0.25% |

| Board Size | 100 | ||

| Trading Currency | SGD | ||

| Dividend Frequency | Semi-annually | Semi-annually | Annually |

| Dividend yield | 2.83% | 1.66% | 2.33% |

Information is accurate as of 23 April 2018 and subject to changes in the future

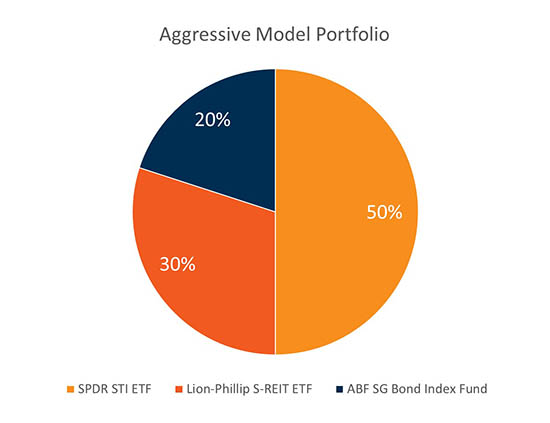

To embark on your investment journey, you will first need to identify your risk profile and allocate the asset classes for your investment portfolio accordingly. For example, an aggressive strategy will yield higher returns, but the increased volatility may also spell a possibility of higher losses.

Examples of Model Portfolio You Can Build with SBP

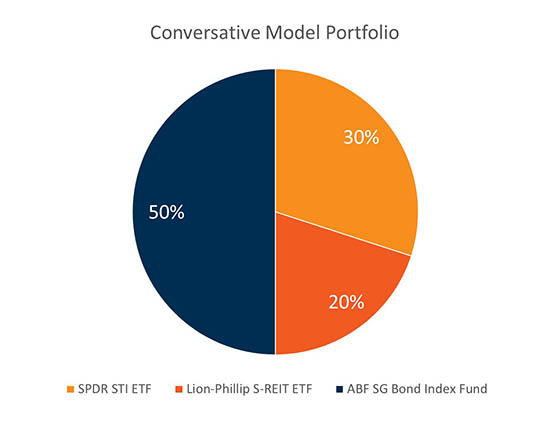

Conservative Model Portfolio

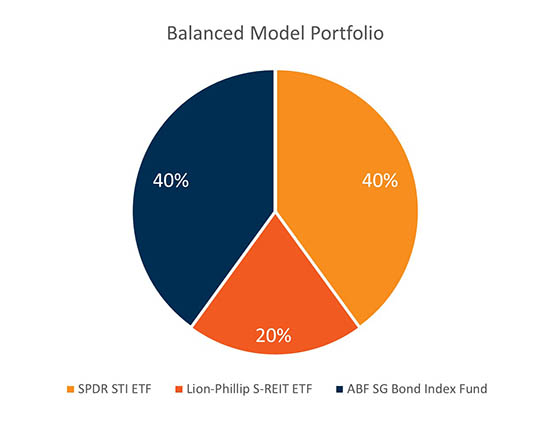

Balanced Model Portfolio

Aggressive Model Portfolio

Conclusion

Contrary to popular belief, investing does not require the commitment of a large sum of capital. SBP presents an opportunity for investors to invest in selected financial assets at a smaller capital outlay, on a consistent basis every month. The investment technique of Dollar Cost Averaging is especially useful in hedging against market volatility where it lessens the risk of investing a large amount of capital in a single investment.

Besides the benefits of DCA with SBP, the index tracking strategy of ETF allows investors to adopt a passive approach towards investing and gain a comprehensive exposure to the Singapore market via Equities, Bonds and REITs.

In conclusion, investors can start sowing the seeds for their ETF portfolio with the use of SBP every month and reap the harvest of their investment efforts in the future.

For more information on Shares Builder Plan, please call 6531 1555 or email us at rsp@phillip.com.sg

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It