Thailand’s Economic Outlook 2019: Marching on from Political and Global Risks March 20, 2019

Thailand’s Year-on-Year (YoY) Gross Domestic Product (GDP) Annual Growth Rate came in at 4.1% for the year 2018 as compared to 2017’s 4% – marking 2018 as the year which saw the paciest growth since 2012.1 Economists had earlier expected growth to recover in 4Q18 after a sharp slowdown in 3Q18. According to a Bloomberg survey, GDP was projected to have expanded 3.6% YoY in 4Q18, with the actual figure coming in at 3.7%. Thailand’s Deputy Prime Minister Somkid Jatusripitak had shared that the positive turn in negotiations between China and the US aided their exports; helping to propel GDP in the fourth quarter, and ultimately full-year GDP growth for 2018.

Image 1: Thailand’s GDP Growth

(Source: Bloomberg)

(Source: Bloomberg)

Beyond the country’s economic health, Deputy Prime Minister Somkid also mentioned that more than 2 Trillion Baht of state funds will be invested into mega projects such as an urban high speed railway, dual railways and energy production.2

5 years on from a military coup, Thailand is set to hold its first general election on 24 March 2019. The political divisions continue to emerge as a threat to Thailand’s economic drivers. However, we believe that Thailand’s combined public and private investments are a relative bright spot amidst the threats.

Below is a summary video of Thailand’s outlook and potential investment opportunities which investors may explore.

Eastern Economic Corridor Development Project

Thailand’s parliament approved the law for trade and investment in the Eastern Economic Corridor (EEC) on 1 February 2018, hoping that the EEC will help to develop its eastern provinces into a leading ASEAN economic zone.

The EEC extends across Thailand’s eastern provinces of Chonburi, Rayong, and Chachoengsao that are off the coast of the Gulf of Thailand, spanning a total of 13,285 square kilometers. The government hopes to complete the EEC by 2021, which will potentially turn these provinces into a technological manufacturing and services hub with strong connectivity to its ASEAN neighbours by land, sea and air.

The government expects to invest 1.5 Trillion Baht (USD48 billion) for the realization of the EEC over the next five years, with the following four “core areas” identified as being vital in making the EEC a renowned economic zone:

(1) Increased and improved infrastructure;

(2) Business, industrial clusters, and innovation hubs;

(3) Tourism and;

(4) The creation of new cities through smart urban planning.

The image below shows a greater overview of the four areas mentioned above.

Image 2: Eastern Economic Corridor Overview

(Source: eeco.or.th)

(Source: eeco.or.th)

The EEC focuses on uplifting cities, communities and the environment to become “Cities of Future”, creating a better quality of life with a modern living standard for everyone. Thailand’s government predicts that through the EEC, it will create 100,000 jobs a year in the manufacturing and services industry.3

Thailand’s First General Election since 2014

Thailand’s political divisions have engendered uncertainty, with the country’s first general election scheduled to be held on 24 March 2019 since a coup in May 2014. Voting will take place under a military-backed charter, ending one of the longest periods of rule by a junta in Thailand’s modern history.

The military government has repeatedly pushed back the election timeline over the past few years after seizing power following a period of unrest that included bloody street protests. The looming vote now puts the focus back on political risk in a country with a history of polls followed by demonstrations and coups.4

Although Thailand industrialised earlier than a number of other Southeast Asian nations, its economy has failed to reach its full potential, partly due to repeated political turmoil. The country’s on-again, off-again democratic process has delayed the government from addressing important economic and social issues such as underdeveloped infrastructure and economic inequality between the urban and rural areas.

This election will test Thailand’s ability to return to a stable democracy after nearly five years of military rule. Since embracing a constitutional monarchy in 1932, Thailand has since had more than 20 coups, with these coups tarnishing Thailand’s reputation. The question now is whether the kingdom can break the cycle of elections, civil unrest and coups.

Risks and Opportunities Ahead

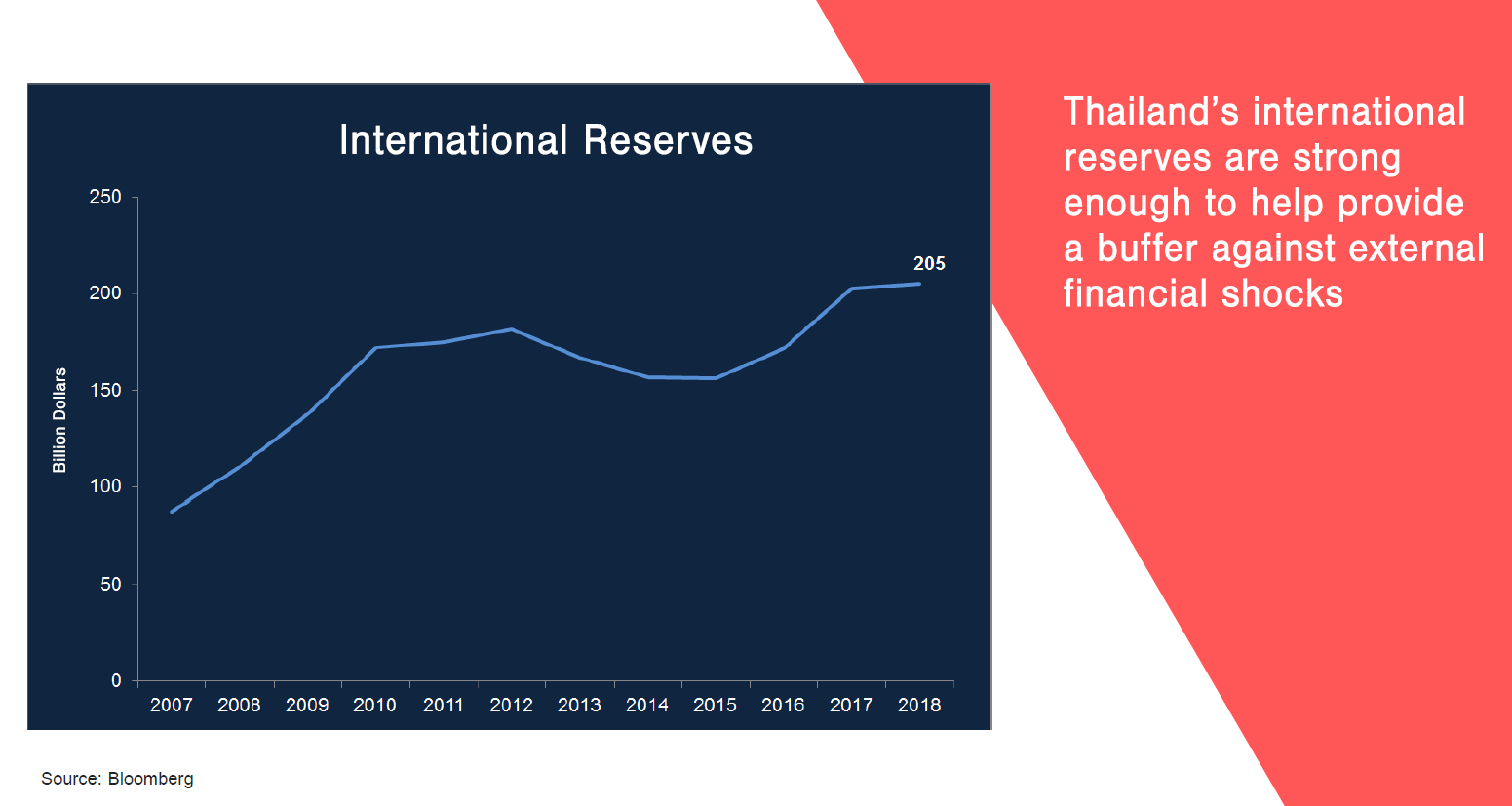

Thailand’s high current account surplus, and lofty foreign reserves as shown below could place the country in a better position than most of its regional peers to weather external financial shocks within the global economy.

Image 3: Thailand’s International Reserves

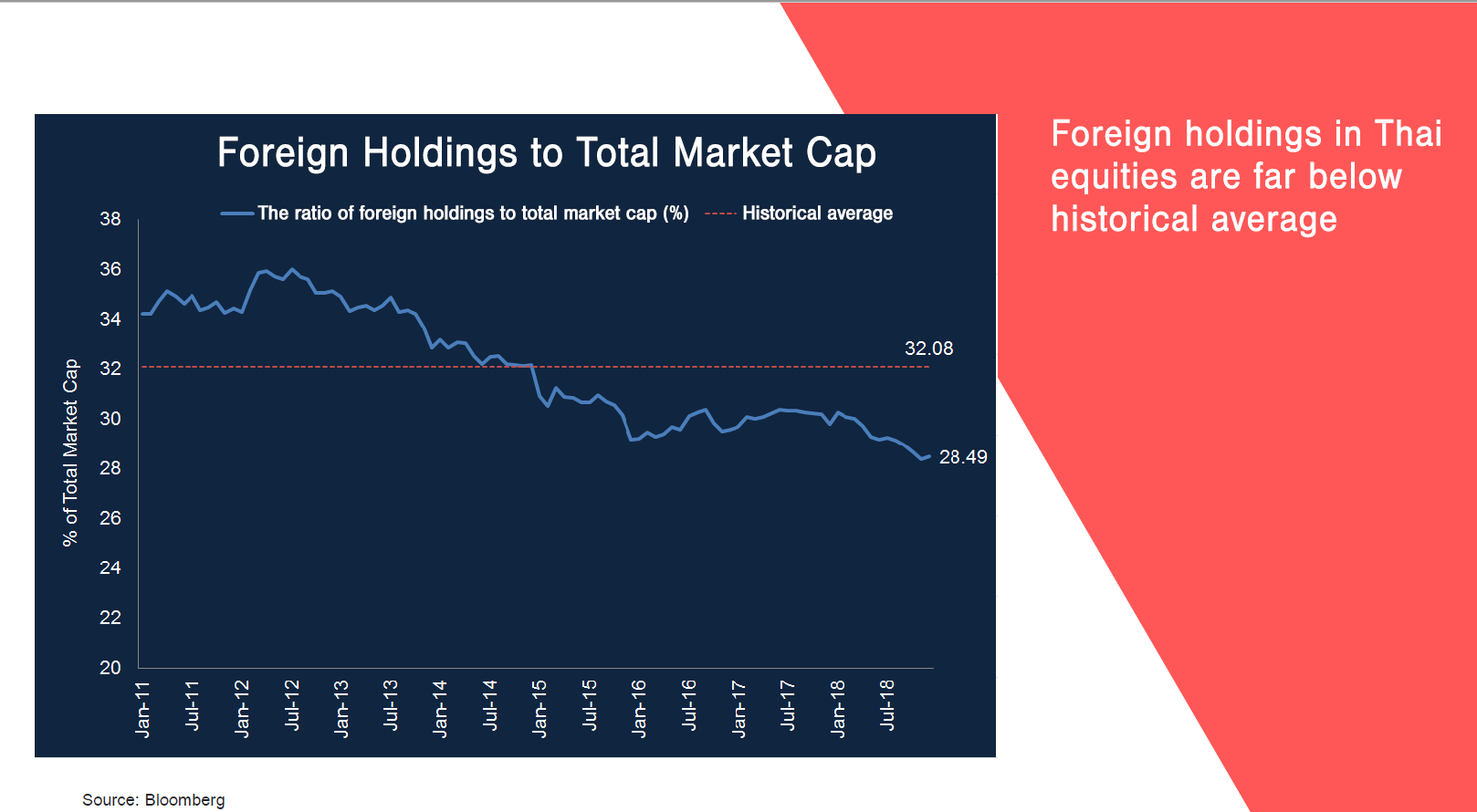

Thailand’s long-term economic potential is promising as it stands to benefit from its 20-year national strategy and EEC development project. In terms of capital market development, Thailand is now the second-biggest stock market in the region by capitalisation, after Singapore.

Foreign investors’ holdings of Thailand’s shares are also at historical lows as seen in Image 4 and this should attract foreign funds to flow back once the domestic political dust settles.

Image 4: Foreign Holdings to Total Market Capitalisation

Amidst global and political risks, Thailand’s domestic growth emerges as a key issue.

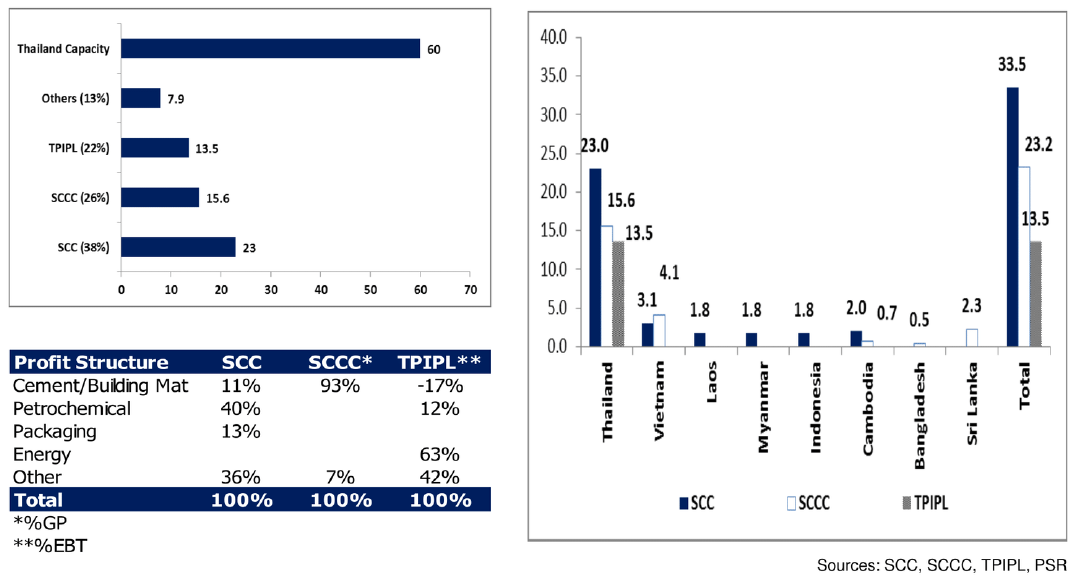

The infrastructure story will be prominent for many years to come for Thailand as government infrastructure projects in the pipeline worth hundreds of billions of baht will breathe a new lease of life into the construction, transportation and banking sectors. Siam Cement PCL (SCC) and Siam City Cement (SCCC) are excellent investment choices for investors to benefit from Thailand’s infrastructure ambitions.

Image 5: Key Figures of Thailand Stocks

(Source: Bloomberg)

(Source: Bloomberg)

Siam Cement PCL (SCC)

Siam Cement is the biggest cement company in Thailand and the leading supplier for Thailand’s infrastructure projects. Its major competitors include Siam City Cement and TPI Polene.

The company’s 2019 earnings growth will rely on its chemicals business and recovering cement demand in Thailand, fueled by infrastructure and property projects. Infrastructure projects should pick up, with the demand being driven by the government’s 1.5 Trillion Baht (USD48 billion) five-year construction plan from 2017-2021 ahead of the general election scheduled for March 2019.

The firm’s chemicals business accounted for 46% of total revenue in 2018, but faces volatility risk due to fluctuating naphtha prices. Still, this segment’s demand will likely increase and be a key focus for the company in the coming years. Beyond local demand, Siam Cement also has plans to expand in Southeast Asia, with chemical projects in Vietnam and Thailand.

Thai Cement Demand to Ride on Infrastructure and Property Recovery

With the demand for infrastructure and property showing signs of recovery after a sluggish market in the past few years, there is an opportunity for cement demand to pick up in Thailand, especially since the infrastructure and property segments account for half of the country’s cement consumption.

Government projects made up 35% of the country’s total cement consumption in 2017, compared to housing and commercial projects which came in around 50% and 15% respectively. Cement demand from the government increased 12% in the first nine months of 2018 from a year earlier and contributed to about 30-35% of cement volume.

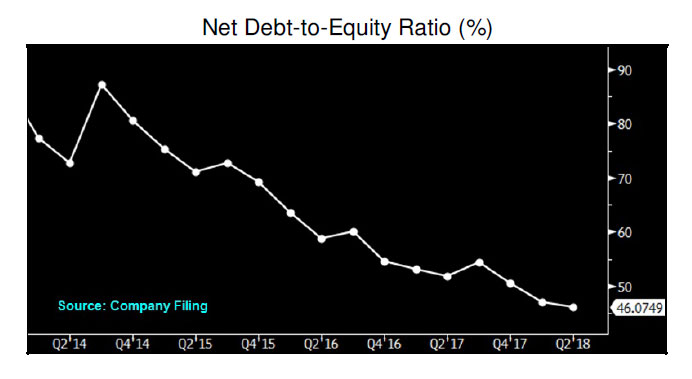

Net-Debt Ratio May Drop as Past Investments Pay Off

Siam Cement’s net debt-to-equity ratio has gradually declined over the years as seen in Image 6. This is due to the pay-off from investments in petrochemicals made in 2014. The drop in the ratio may offset the company’s capital requirement for upcoming expansions.

Image 6: Siam Cement Net Debt-to-Equity Ratio

(Source: Bloomberg)

(Source: Bloomberg)

The consensus target price on Phillip Stock Analytics as of 7 March 2019 is 504.96 Baht, with an 8.4% upside. To use Phillip Stock Analytics, right click the desired stock within the POEMS 2.0 platform and select “Stock Analytics”. For more information, please visit https://www.poems.com.sg/stockanalytics/

Image 7: Phillip Stock Analytics Data

(Source: Thomson Reuters)

(Source: Thomson Reuters)

Siam City Cement (SCCC)

Siam City Cement is the second largest cement company by market capitalisation, just behind Siam Cement PCL in the cement and aggregates industries. Large cement players are likely to reap windfalls from the government’s infrastructure ambitions due to the structure of Thailand’s cement market – an oligopoly made up of the three biggest companies as seen in the below image.

Image 8: Thailand’s Cement Industry

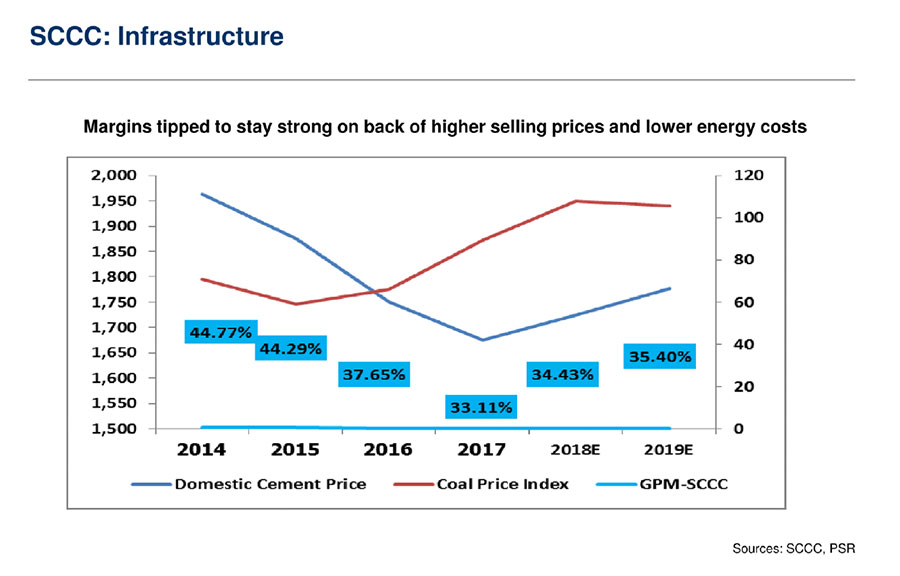

Pure cement firms like SCCC look to be a good play on the back of recovery of the cement industry in Thailand and the promising outlook in Vietnam. The continual rise of the industry as a result of numerous infrastructure construction projects and resumption of private investments which creates stronger demand for cement should foster a further increase in cement prices. This, coupled with efficiency improvements and cost reductions on SCCC’s side, would also continue to improve margins for SCCC.

Image 9: SCCC Margins

We believe that SCCC’s overseas business will kick off from 2019 onwards, and expect to see higher growth for the company on the back of a robust performance in Vietnam.

The consensus target price on Phillip Stock Analytics as of 7 March 2019 is 293.667 Baht, with a 32.9% upside. To use Phillip Stock Analytics, right click the desired stock within the POEMS 2.0 platform and select “Stock Analytics”. For more information, please visit https://www.poems.com.sg/stockanalytics/

Image 10: Phillip Stock Analytics Data

(Source: Thomson Reuters)

(Source: Thomson Reuters)

Do Investment Opportunities Abound In Thailand?

Thailand’s economy grew at its best pace in six years in 2018. The better-than-expected GDP growth in 4Q18 strengthened our belief that Thailand will continue to outperform. Drivers like the EEC project and pick-up in infrastructure investments will help to propel Thailand’s economic growth in the upcoming years.

Interested to learn more? Watch our Thailand Outlook and Stock Pick Webinar, presented by guest speakers from Phillip Securities (Thailand) Public Co., Ltd, over at our Facebook page.

(https://www.facebook.com/phillipcapital/videos/2511788815714734/)

If you haven’t already heard, the Thailand market is available for trading on POEMS 2.0 and POEMS Mobile 2.0! Check out the recommended stocks over at the platform!

Information is accurate as of 7 Mar 2019.

Reference:

- [1] https://tradingeconomics.com/thailand/gdp-growth-annual

- [2] https://news.thaivisa.com/article/29141/dpm-somkid-sees-strong-year-end-economic-growth

- [3] https://www.aseanbriefing.com/news/2018/06/29/thailand-eastern-economic-corridor.html

- [4] https://www.businesstimes.com.sg/government-economy/thailand-to-hold-first-general-election-since-coup-in-2014

- [5] https://asia.nikkei.com/Politics/Turbulent-Thailand/5-things-to-know-about-Thailand-s-long-awaited-election

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jason Chan

Senior Dealer

Jason holds a Bachelor’s Degree in Banking and Finance from Singapore Institute of Management, University of London and has previous experience in advisory services for investment and insurance products.

He is currently part of the Global Markets Day Trading Team, providing trade execution support to both internal and external customers for the Asian Markets.

Aside from assisting with trade execution, Jason is also involved in business development projects such as bringing in new products and markets, with the latest being the Vietnam market.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It