The 4 stages of Emotional Investing – To embrace or to avoid? May 13, 2022

I am sure by now many of us have encountered things which look simple to do but become difficult when you try to put them in action. One good example is, driving.

Say you passed your Basic Theory Test and it makes you confident about your practical test. On the day of your practical test, as you slowly usher yourself to the driver’s seat, with both hands confidently placed on the “9 o’clock and 3 o’clock” position of the steering wheel, “what-if” thoughts suddenly blur your vision and your hands start to tremble as you perspire.

A wave of emotions charges towards you, you accidentally hit the curb and there goes your free pass to driving dad’s car.

Source: I have no idea what I am doing, Imgflip,2022 [1]

Source: I have no idea what I am doing, Imgflip,2022 [1]

After being in the financial Industry for almost 5 years, I know a fair deal about investments and I too thought that I’d slay at investing. But no, with money at stake and emotions involved, I am not about to taste success.

Why?

Most of us are ruled by our emotions. As they said “An investor’s worst enemy is not the stock market but his own emotions.”

We call this, Emotional Investing.

Source: Emotional Investing, Imgflip,2022 [2]

Source: Emotional Investing, Imgflip,2022 [2]

What is Emotional Investing?

An emotion is a feeling caused by the situation that you are in or by the people you are with. In the movie Inside Out, you might recall that there were five animated characters each depicting a different emotion: anger, disgust, fear, happiness, and sadness.

Emotional investing is basically using these different emotions to make investment decisions. It is based on one’s behavioral impulses which are determined by market trends instead of fundamentals like technical analysis.

And that is why so many of us are buying at market tops and selling at market bottoms.

Source: The Mystery – Is Solved!, makeameme.org [3]

Source: The Mystery – Is Solved!, makeameme.org [3]

Well not yet! There are four stages of emotions that we go through while investing:

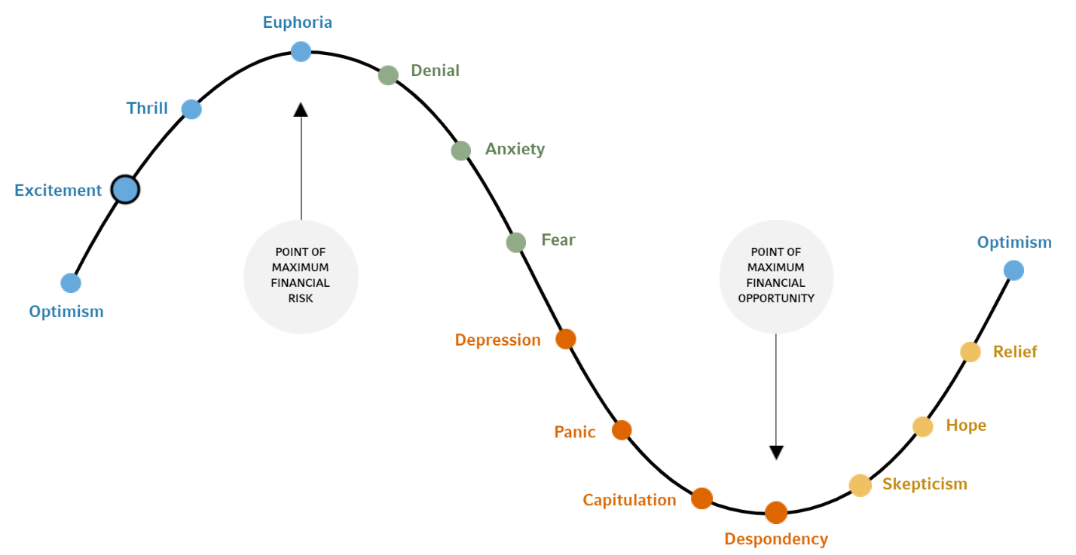

Emotional Investing Stage 1: The Optimism stage

As markets rise, a feeling of optimism, and enthusiasm takes over as I read about the market rallies. I quickly buy in and I see my account balance starting to grow. These feelings were built during a prolonged economic expansion or market rally.

“Yes! I am one step closer to getting my dream car.”

Emotional Investing Stage 2: The Anxiety stage

As markets near and peaked—a moment that is extremely difficult to pinpoint, the sudden turn of the trend triggers different decisions among investors. Some are confident that it i’s a temporary downtrend, while others simply want out.

“Is this the top, are we in a bubble, should I get out now?”

“Okay, this is only a temporary downturn. Shall I HOLD?”

Emotional Investing Stage 3: The Panic Stage

The downturn continues, and all of us begin to panic. This is when the losses will be the most severe and heart wrenching. The realities of a bear market are clear and you feel depressed. The people around you are exiting the market.

“If they are out, should I exit too?”

Emotional Investing Stage 4: The Dismay and Hope stage

At this stage, just as the market starts to rebound, investors may still be cautious and worried, wondering if the upswing will last. Some may still be reluctant to reinvest at this point, even though prices are relatively low and upside potential exists.

Eventually, the prices rise, more people are willing to join in the bull run and we start to see a glimpse of hope!

“But…I don’t have much money left to invest.”

“Will there be another low? Maybe I will just wait out for a little longer.”

And before we know it, we are all caught up in an emotional investment roller coaster ride!

Source: Russel Investments [4]

Source: Russel Investments [4]

So how can we avoid being emotional when investing?

Like how Taylor Swift taught us about love, I wished someone had taught me about Dollar Cost Averaging (DCA) during my younger days.

DCA means investing the same amount of money in a stock on a regular basis, regardless of the share price. It automatically adds a small amount of money to your portfolio according to the frequency you choose, e.g. weekly, monthly or quarterly. This will help you to eliminate the temptation to time the market, and removes the worries of investing at the wrong time.

Say you plan to invest $1,200 in ETF A at the start of this year. And you were given two choices:

1. Invest all of your money at once at the beginning or;

2. Invest $100 each month

While it might not seem like there would be much of a difference, but if you choose the latter, you may end up with more shares than you would have if you bought everything all at once.

Let’s take a look at this illustration:

| Month | (a) Investment | (b) Price per unit | Units Purchased (a÷b) |

| 1 | $100 | $10.00 | 10 |

| 2 | $100 | $8.00 | 12.5 |

| 3 | $100 | $5.00 | 20 |

| 4 | $100 | $8.00 | 12.5 |

| 5 | $100 | $5.00 | 20 |

| 6 | $100 | $4.00 | 25 |

| 7 | $100 | $2.00 | 50 |

| 8 | $100 | $4.00 | 25 |

| 9 | $100 | $5.00 | 20 |

| 10 | $100 | $5.00 | 20 |

| 11 | $100 | $8.00 | 12.5 |

| 12 | $100 | $10.00 | 10 |

| Total | $1,200 | $5.05 | 237.5 |

*For illustration purposes only.

Assuming you purchased $1,200 worth of ETF A in Month 1, you would have only had a total of 200 units. With DCA via SBP, the average unit price and cost of investment are lower as illustrated in this simple calculation:

| Without DCA | With DCA | |

| Total Units Received | $1,200 ÷ $10 = 120 units | 237.5 units | Average Cost of Investment Total cost ÷ no. of units purchased |

$10 | $1,200 ÷ 237.5 = $5.05 | Sell at $12 (Return) | 120 x $12 = $1,440 | 237.5 x $12 = $2,850 |

This means you have made almost 50% more just by Dollar Cost Averaging!

Cycle exists in all market. Therefore, it is difficult to time the market as prices fluctuate all the time. So, adopting DCA as an investment strategy helps turn market fluctuations to your benefit by managing market risk and ensures that your investment costs are spread out.

One way you can DCA your investment is via POEMS Share Builders Plan (SBP).

What is the Share Builders Plan?

The Share Builders Plan (“SBP”) is a regular fixed dollar amount investment plan which enables you to buy shares and ETFs on a consistent and incremental basis so as to build up a portfolio of securities for yourself eventually.

The Share Builders Plan presents an opportunity for you to invest in the stock market with as little as $100 per month. With discipline and consistency in your investment portfolio, it will eventually build up a portfolio of stocks at a lower average cost.

How can I join the Share Builders Plan?

You can join SBP online via poems.com.sg with just 3 steps:

1. Login to POEMS

2. Go to Acct Mgmt > Regular Savings Plan (RSP) > Share Builders Plan (SBP)

3. Complete the SBP Application Form together with the Interbank GIRO Application Form

If you do not have a trading account with Phillip Securities Pte Ltd (PSPL), you will need to open one. The purpose of the trading account is to facilitate your share liquidation from SBP in the future.

There is also a 3 months handling fee rebate when you sign up for Share Builders Plan!

Source: https://www.poems.com.sg/rsp/#promo

Source: https://www.poems.com.sg/rsp/#promo

For more information on SBP, simply visit the link provided: https://www.poems.com.sg/rsp/#sbp

Beyond SBP, and why?

Always remember that life is a marathon, not a sprint. The same goes for investing.

So embrace your emotions, but avoid emotional investing.

Start small, start your Dollar Cost Averaging with SBP today!

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Reference:

- [1]https://imgflip.com/i/6fopj9

- [2]https://imgflip.com/i/6fop7n

- [3]https://makeameme.org/meme/the-mystery-is-99302f3759

- [4]https://russellinvestments.com/us/resources/individuals/cycle-of-investor-emotions

- [5]https://www.investopedia.com/investing/dollar-cost-averaging-pays/

- [6]https://www.singsaver.com.sg/blog/emotional-investing-what-is-it-and-how-to-avoid-it

- [7]https://www.eaglestrategies.com/four-phases-emotional-investing/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Claire Tan

Claire Tan is a Business Development Assistant Manager with the Share Builders Plan Team.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!