The Intricate Dance of Forex Trading: Unveiling the Psychological Game February 2, 2024

Understanding the forex market

The foreign exchange market, also known as the forex market, is a global financial marketplace where currencies are bought and sold. It stands as the largest and most liquid financial market in the world, boasting a daily trading volume that exceeds US$6 trillion. A critical yet often underappreciated aspect of the forex market is the impact of trading psychology. In this article, we will explore the intricacies of the forex market, and highlight the pivotal role trading psychology plays alongside traditional trading strategies.

Source: Forexlive

Source: Forexlive

To comprehend the role of trading psychology, it is essential to first understand the dynamics of the forex market. Unlike traditional stock markets, the forex market operates across major financial centres across the globe, 24 hours a day, five days a week. The primary objective of forex trading is to exchange one currency for another, capitalising on exchange rate fluctuations to make profits.

Major participants in the forex market include central banks, financial institutions, corporations, and individual traders. The market is characterised by currency pairs, with the most traded being the Euro/US Dollar (EUR/USD) and the US Dollar/Japanese Yen (USD/JPY). Prices are influenced by various factors such as economic indicators, geopolitical events, and market sentiment.

The Psychological Landscape of Forex Trading

Forex trading is not merely a game of numbers; it is in reality, a psychological battle. Forex traders are constantly exposed to a barrage of emotions, ranging from greed and fear to excitement and despair. The ability to manage and control these emotions is paramount for success in the highly volatile and unpredictable forex market.

1. Greed and Fear

Greed and fear are two powerful emotions that can cloud a trader’s judgment. Greed may drive traders to take excessive risks in the pursuit of larger profits, while fear can lead to premature exits or hesitancy in entering potentially lucrative trades. Striking a balance between these extremes is crucial for taking a rational and disciplined approach to trading.

Source: iStock

Source: iStock

2. Overcoming Loss Aversion

Loss aversion is a cognitive bias where individuals feel the pain of losses more intensely than the joy of gains. It is a common psychological hurdle in forex trading. Traders must learn to accept losses as a part of the game and avoid making impulsive decisions fuelled by the desire to recover losses quickly. A well-thought-out risk management strategy can help mitigate the impact of losses on a trader’s psyche.

3. Patience and Discipline

The forex markets often exhibit periods of high volatility followed by extended periods of consolidation. Patience is a virtue in trading, as impulsive actions during quiet market conditions can lead to unnecessary losses. Discipline is equally vital, ensuring that traders adhere to their strategies and do not deviate from their predefined risk tolerance levels.

Source: Pexels

Source: Pexels

4. Confirmation Bias

Traders may fall victim to confirmation bias, where they selectively interpret information that confirms their existing beliefs or biases. This can lead to overlooking crucial data and decisions based on flawed analysis. The key is to be open-minded and objective, and to consider all market data in a balanced way for informed decisions.

Impact of Trading Psychology on Decision-Making

Successful forex trading hinges not just on analytical skills or knowledge; it heavily depends on the trader’s ability to make sound decisions under varying circumstances. Trading psychology can profoundly influence decision-making processes in the following ways:

1. Risk Management

Effective risk management is the cornerstone of successful forex trading. Traders must determine the optimal position size, set stop-loss orders, and establish risk-reward ratios based on their risk tolerance. The fear of losing money can prompt traders to deviate from their risk management plans, leading to significant losses.

Source: iStock

Source: iStock

2. Trade Execution

The process of entering and exiting trades requires a level-headed approach. Impulsive actions, driven by emotions such as excitement or anxiety, can result in poor trade execution. Traders who succumb to emotional impulses may enter trades prematurely or exit profitable positions too early, missing out on potential gains.

3. Adaptability to Market Conditions

The forex market is notably dynamic, with conditions changing rapidly. An effective trader needs to adapt to evolving market scenarios by adjusting their strategies accordingly. Failure to do so may result in missed opportunities or holding onto losing positions for too long, amplifying losses.

4. Learning from Mistakes

Mistakes and setbacks are inevitable in trading.. It is the ability to learn from these experiences that distinguishes successful traders from those who struggle. Recognising losses as valuable learning opportunities and avoiding the repetition of past errors is crucial for continuous growth and improvement.

Source: Pexels

Source: Pexels

The Crucial Role of Trading Psychology in Forex

While trading strategies and technical analysis are undoubtedly essential components of a trader’s toolkit, the real game-changer often lies in the mindset and emotional resilience of a trader. This aspect can make the difference between success and failure in the competitive and dynamic world of forex trading.

1. Developing a Trading Plan

A comprehensive trading plan outlines a trader’s goals, strategies, risk tolerance, and contingency plans. Having a well-defined plan helps traders stay focused and disciplined, reducing the influence of emotions on decision-making. The plan should include not only technical parameters but also guidelines for managing psychological aspects.

2. Embracing a Growth Mindset

Adopting a growth mindset involves viewing challenges and setbacks as opportunities for learning and improvement. Traders with a growth mindset are more likely to adapt to changing market conditions, continuously refine their strategies, and persevere in the face of adversity. This mindset extends beyond the technical aspects of trading to encompass psychological resilience.

Source: Pexels

Source: Pexels

3. Regular Self-Assessment

Periodic self-assessment allows traders to evaluate their performance objectively. Reflecting on past trades, identifying areas for improvement, and recognising emotional response patterns can contribute to a trader’s personal and professional development. This self-awareness is a key component of effective trading psychology.

In conclusion, achieving success in forex trading goes beyond analysing charts and understanding economic indicators. Trading psychology plays a pivotal role in shaping the decisions and outcomes of traders. Recognising and managing emotions such as greed, fear, and impatience is essential for taking a rational and disciplined approach to trading.

Traders who prioritise developing strong psychological resilience, coupled with a well-structured trading plan and continuous self-assessment, are better positioned to navigate the challenges of the Forex market. By emphasising the importance of trading psychology alongside technical strategies, traders can unlock their full potential and increase their likelihood of achieving sustainable success in this dynamic and ever-evolving financial landscape.

Promotions

Get a S$30 Cash credits Welcome Bonus when you open a POEMS CFD MT5 account and fund S$2000 into the account!

*T&Cs Apply.

For more information, click here.

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offer investors and traders more than 40,000 financial products across global exchanges.

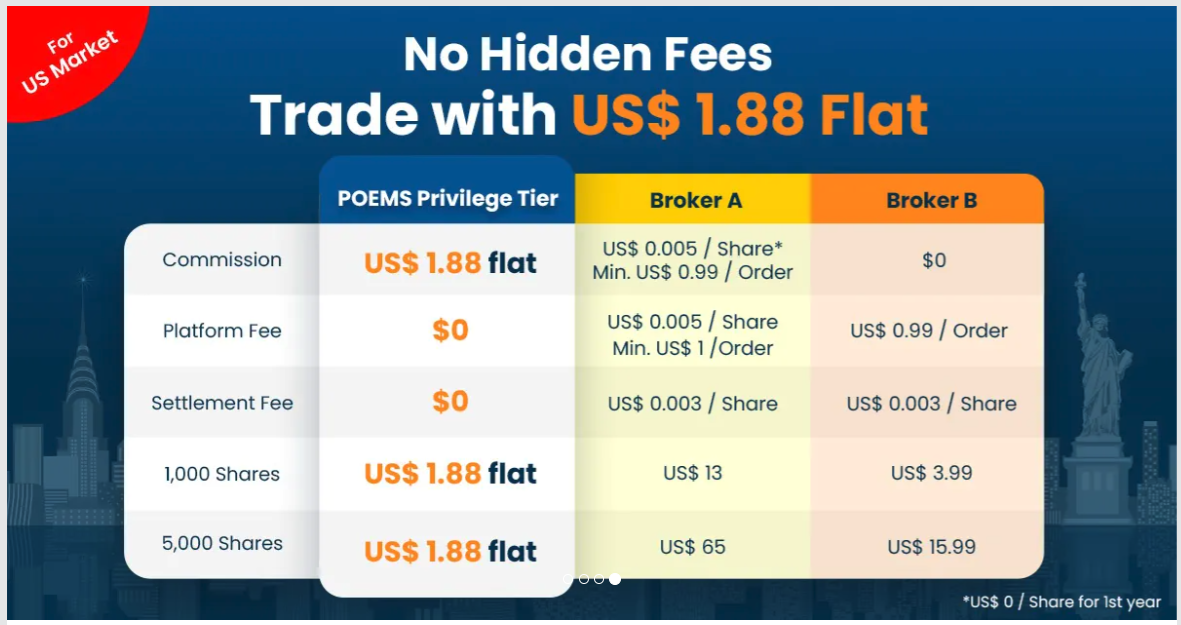

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value in reading this article. If you do not have a POEMS account, you may visit here to open one with us today.

Lastly, investing in a community can be a highly rewarding experience. Here, you will have the opportunity to interact with us and other seasoned investors who are enthusiastic in sharing their experience and expertise whether it’s through listening or answering questions.

In this community, you will also gain exposure to quality educational materials and stock analysis, to help you appreciate the mindset of seasoned investors and apply concepts you have learned.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

References:

- 1 https://www.forexlive.com/Education/!/trading-in-a-crisis-six-expert-tips-for-trading-a-volatile-forex-market-20200727

- 2 https://www.shutterstock.com/image-photo/fear-greed-anxiety-financial-market-concept-1141340993

- 3 https://www.pexels.com/photo/pile-of-rock-near-lake-355863/

- 4 https://ipkeys.com/wp-content/uploads/2022/08/RMF-7-Steps-1024×576.jpeg

- 5 https://www.pexels.com/photo/bearded-man-in-white-button-up-shirt-sitting-in-front-of-laptop-feeling-excited-7567444/

- 6 https://www.pexels.com/photo/clear-light-bulb-planter-on-gray-rock-1108572/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Tan Peng Chien

Dealer

Phillip Securities Pte Ltd

Peng Chien graduated from the University of London with a Bachelor’s Degree in Banking and Finance. As a dealer, it is essential that he keeps up with all aspects of the markets and therefore spends most of his time exploring new strategies and analyzing the financial markets.

On his free days, Peng Chien likes to spend some quiet time fishing.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  Playing Defence: Diversification in Forex Trading

Playing Defence: Diversification in Forex Trading