The Secret to Financial Success November 10, 2020

“If you fail to plan, you plan to fail.” – Benjamin Franklin

When do you want to retire? 50? 60? 62?

Regardless of when, the more important question is: HOW?

If you want to be able to retire comfortably, you would need to plan your retirement early.

What is financial success and how do you achieve it?

Financial success is a dubious concept. To some, it may refer to the amount of money they have in their bank. To others, it conjures up the picture of a villa by the sea without money woes. You have to arrive at your personal definition so that you can work towards it. What would you consider to be “enough money” for you? Regardless of your goal and whether young or old, you should aim to have both a retirement and an investment plan.

Planning your retirement

Retirement planning is not something you look at only when you are approaching retirement. The best time to look at it, in fact, is when you are in your 20s or 30s.

Some people think that the CPF is their retirement plan. In truth, the CPF will not be enough to let you live comfortably, without supplementary income. The Economist Intelligence Unit Worldwide Cost of Living 20201 and 20192 rated Singapore as the most expensive country in the world to live in. Monthly household expenditure in Singapore in 2017/2018 averaged S$1,628 per person3. Your CPF Life payouts are designed to provide you with only your basic necessities for the rest of your life. Unless you put in extra monthly contributions, the money will not be enough to support your current or future lifestyle. And don’t forget you will need to set aside extra funds for emergencies.

When do you want to retire?

As of 23 September 2020, the retirement age and reemployment age in Singapore were 62 and 67 respectively4. Employers are not allowed to dismiss any employee below 62 years old on the basis of age. They can reemploy employees who turn 62 up to the re-employment age of 67. The government plans to raise both ages to 63 and 68 respectively from 1 July 2022 and further to 65 and 70 by 2030.

How much money should you have when you retire?

If you are worried that CPF Life’s terms will change in the future and you will receive smaller payouts, you might want to look at CPF Life payouts as just bonuses rather than your main source of income.

There are two ways to find out how much money you would need to save before you retire.

1. Replace your income. Save up enough to receive about 80% of your income, which should allow you to live the same way as now. Your food and transport costs would most likely drop after you stop working. From there, you can estimate the amount of money you will need every month.

2. Track your expenditure. Start by estimating your monthly average expenses. These include your groceries, utilities, debt/house loan repayments and other bills that you regularly pay. Your transport and food expenses will most likely decrease. If you want to take annual vacations, allocate a budget for them and split this into 12 monthly mini-budgets. Then include a buffer of about 10% for miscellaneous or unplanned expenses. This should be a sufficient budget for you, assuming you do not change your lifestyle much.

Investment planning

Now, you have your retirement goal, and you know how to achieve it.

But you might not have enough money to reach there yet. Or you might be worried that inflation will worsen, forcing you to save more for your retirement.

You would need to make your money work for you via investment planning. Investment planning means using investment vehicles like stocks, bonds, etc. to grow your money and put you on the road to your financial success.

Making money work for you via investments and other financial instruments

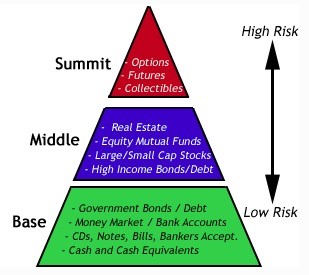

The financial instruments shown above are a few basic examples.

How much risk you are willing to take is correlated with the returns you want to get from the investment. Low-risk investments would be more suitable if you want to preserve the value of your money (beating inflation). High-risk investments would be more suitable if you want to grow your money.

In general, someone with longer investment horizon can consider an investment product with higher risk. This is because you can ride through market volatility with a longer investment horizon. Eg, for those in their 30s, they may choose to invest in Unit Trust in developing countries which is higher risk but may generate higher return in the long term (of >20 years). If you are nearing retirement, you might not want to risk your money as much as you might not have enough time to recover your losses before you retire. As you reach retirement, you most likely would want to move your investments to more defensive instruments to avoid losing your principal.

“If you fail to plan, you plan to fail,” so said Benjamin Franklin.

When you plan your retirement, you are trying to remove the uncertainty of the future by making sure you have enough to live on for the rest of your life. But investing can be complicated, with many factors influencing your decisions. How much capital do you have? Where should you invest? How much risk can you take? How long do you plan to invest? Should you create a balanced portfolio to minimise your risks? How to go about it? The list goes on and can be quite confusing.

It is highly recommended that you look for a financial adviser to help you plan your investments. Yes, it is possible to invest on your own but a good financial adviser can handhold you through the process and help you create a portfolio that matches your risk appetite and needs, without unnecessary costs or risks.

And while you’re at it, you should also look at estate planning and insurance, to develop a holistic plan.

Estate planning helps you decide how to distribute your assets after your death. It minimises the chances of disputes over their distribution.

Insurance offers you protection from financial losses arising from unexpected life events. The COVID-19 pandemic was one such event, catching us off guard and causing mayhem. It is only when bad things happen that we come to regret not having bought insurance. Too late!

Contributor:

Claudia Tan

Senior Financial Consultant

Bachelor of Business Administration BBA

Chartered Institute of Marketing CIM

Associate Estate Planning Practitioner AEPP

Society of Trust & Estate Practitioners STEP

Phillip Securities Pte Ltd

Email address: ClaudiaTan@phillip.com.sg

+65 9783 8362

References:

- [1] The Economist Intelligence Unit Worldwide Cost of Living 2020 https://www.eiu.com/n/campaigns/worldwide-costof-living-2020/

- [2] The Economist Intelligence Unit Worldwide Cost of Living 2019: https://www.eiu.com/topic/worldwide-cost-ofliving%20#:~:text=For%20the%20first%20time%20three,ranking%20from%20the%20previous%20year.

- [3] Singstat Infographic on Household Expenditure: https://www.singstat.gov.sg/modules/infographics/hes/householdexpenditure#:~:text=Households%20spent%20an%20average%20of,the%20%244%2C724%20in%202012%20%2F %2013.&text=In%202017%2F18%2C%20housing**,shares%20of%20monthly%20household%20expenditure

- [4] Gov.sg Article on retirement age and reemployment age: https://www.gov.sg/article/whats-the-difference-betweenretirement-age-and-reemployment-age

About the author

Claudia Tan

Senior Financial Consultant

Phillip Securities Pte Ltd

Claudia holds a Bachelor of Business Administration and also has a STEP Certificate for Financial Services - Trust & Estate Planning. As a Senior Financial Consultant, she advises individuals and business owners on how to use tools such as personal insurance, investments, managed accounts and legacy planning to reach their financial goals. Since 2005, Claudia has been actively promoting financial literacy as she strong believes in the benefits of financial planning.