Top 5 Hong Kong Stocks Traded on POEMS in October 2020 November 10, 2020

At a glance

- Tech companies are thriving during COVID-19, especially those in China

- New innovative businesses are forging ahead to exploit opportunities in online businesses

- Physical retail stores have stayed depressed while online shopping continues to surge

Here are October’s top 5 Hong Kong stocks on Phillip’s Online Electronic Mart System (POEMS), based on gross market values traded. Tech held steadfastly to its top spot in October, on the back of demand for more services and new innovative gadgets amid COVID-19.

From the 5th position up are:

5th: Semiconductor Manufacturing International Corporation (Hong Kong: 0981)

Source: Bloomberg

Source: Bloomberg

SMIC is a semiconductor foundry. It provides services such as chip testing, development, design, manufacturing and packaging. Think about it. Chips are ubiquitous in everyday life. They are found in all sorts of devices indispensable to modern living such as smartphones, smart watches and computers. They are also found in super computers for AI, clouds and computing analysis. What’s more, smarter and smarter chips are transforming how we live each day.

SMIC has completed a chip tape-out and testing of its next-generation chip foundry node. This is very similar to the advanced 7nm processes used by industry stalwarts, TSMC [2330.TT] and Samsung [005930.KS]. A tape-out refers to the final phase of a chip-design process, before the chip is sent out for volume production.

This major breakthrough by SMIC has been captured in its share price. Investors sent it up to HK$22.75 from HK$17.60 between 5 and 30 October. The stock made a gain of 30% in October alone.

Investors should take heed of U.S. sanctions on SMIC, which may disrupt its chip supply from U.S. and companies that are under U.S. restriction to sell to SMIC. The short-term impact, though, may not be much given the Chinese firm’s inventories, said Ma Jihua, an industry analyst.1

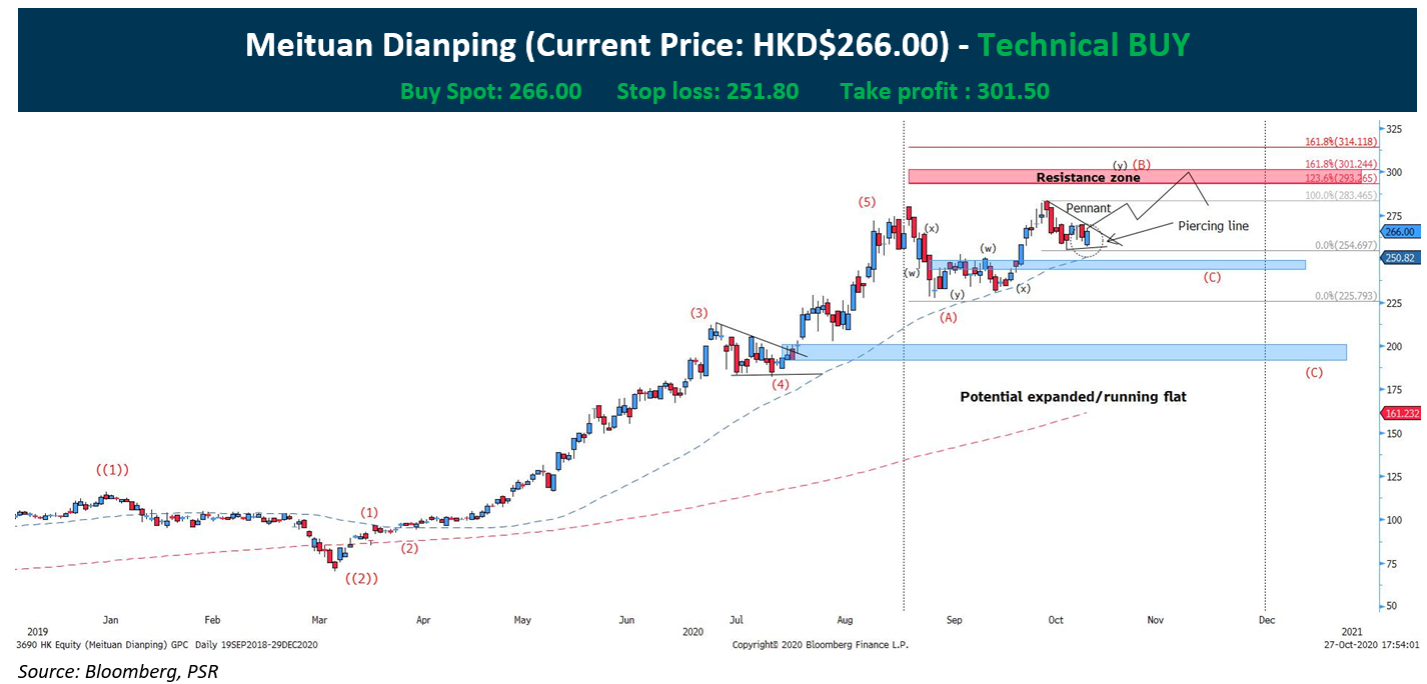

4th: Meituan (Hong Kong: 3690)

Meituan operates a web-based shopping platform for Chinese consumer products and retail services.

It unveiled livestreaming tools for the traditional educational business at a conference of school principals in the second week of October. According to the China Internet Network Information Center, livestreaming users in China reached 562 million by the end of June.

This summer, EF’s training centres adopted the livestreaming tools before their official launch. EF reported a significant increase in viewers that have bought in revenue equivalent to one year for a medium-sized school.2 EF’s training centres combine language training with cultural exchanges and educational travels to deliver courses and programmes.

Meituan released its livestreaming features amid the COVID-19 pandemic when most locations were shut. This was perfect timing as most people started working, studying and shopping from home.

3rd: Tencent Holding (HK: 700)

Source: Bloomberg

Source: Bloomberg

Tencent is the world’s largest video-game vendor. It continues to beat forecasts during the pandemic. Users across the globe have been turning to video games and smartphone-based entertainment as they hunker down at home.

WeGame, Tencent’s flagship gaming platform, boasts over 200 million active users. This makes Tencent one of the global leader in video gaming. Its 1H 2020 sales were up 28% YoY to RMB222bn. Its share price followed the trajectory, up more than 13% in October.

Faced with more lockdowns, global users are likely to continue their home entertainment. This is expected to sustain Tencent’s growth momentum.

2nd: XiaoMi (Hong Kong: 1810)

For the first time ever, Xiaomi claimed the third spot. It is one of the world’s largest smartphone producers, overtaking Apple in Q3 phone sales. Apple slipped to the fourth place in data from all three research firms: International Data Corporation (IDC), Canalys and Counterpoint. Xiaomi’s shipments jumped more than 40% to HK$46.2-47.1mn. Sales of its smartphones and smart hardware reached a record high.

Xiaomi looks set to maintain its foothold in smartphones, as the company relentlessly builds products at honest prices to improve lives through innovative technologies. It has established the world’s largest consumer IoT platform with more than 213.2 million smart devices connected to its platform.4,5

1st: Alibaba Group Holding Limited (Hong Kong: 9988)

Source: Bloomberg

Source: Bloomberg

In the Internet Society of China’s recent “China Internet Enterprise Comprehensive Strength Research Report (2020)”, Alibaba topped a new list of China’s top 100 companies by Internet reach and capability. According to the report, the combined operating revenue of China’s top 100 Internet enterprises reached RMB3.5tr, up 28.2% YoY. Alibaba led the pack, followed by Tencent, Meituan, Baidu and JD.com.

Investors have been glued to the IPO of the Ant Group. Ant’s dual listing was earlier expected to raise more than US$34.4bn, backed by its parent, Alibaba. Ant holds the record for the number and value of retail subscriptions in Hong Kong’s IPO history. Banks and brokerages lent HK$500bn in total margin financing for the retail portion of the IPO.

A sudden twist of events, however, saw the suspension of the IPO a few days ago, until further notice. Apparently, the company failed to meet all the listing qualifications or disclosure requirements.

Since the start of the year, many companies have been affected by COVID-19. Tech companies, however, have defied the trend. They are showing consistent growth as they continue to invest, innovate and expand in the digital world. Going by current trends, the above Chinese businesses could continue to outperform this year, especially as China may be the only economy to eke out GDP growth in 2020.

You can now enjoy low brokerage rates from 0.08% when you trade Hong Kong shares through POEMS. Terms and conditions apply. Refer to details here.

Have personal views on the above companies? Join our global investment community on Telegram and leave us your comments!

Reference:

- [1] https://news.cgtn.com/news/2020-10-14/Chinese-chipmaker-SMIC-makes-breakthrough-in-7nm-like-process–UAB4lvKpag/index.html

- [2] https://kr-asia.com/meituan-rolls-out-livestreaming-tools-for-educational-businesses

- [3] http://www.aastocks.com/en/stocks/news/aafn-con/NOW.1053057/company-news

- [4] https://dailytimes.com.pk/684313/xiaomi-overtakes-apple-as-3rd-largest-smartphone-maker/

- [5] https://www.mi.com/global/about/

- [6] https://www.brecorder.com/news/40029977/mom-and-pop-investors-bid-record-3trn-for-ant-groups-ipo

- [7] https://www.scmp.com/business/banking-finance/article/3107754/worlds-largest-stock-sale-ant-draws-record-us1677-billion

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chen Jin Hui

Equities Dealer

Chen Jinhui deals in global market equities, which encompasses markets from Malaysia, Thailand, Indonesia, Hong Kong and more. He has 4 years of dealing experience and currently support traders, dealers and fund managers on dealing activities. He graduated with a Bachelor of Science in Finance from the Singapore Institute of Management.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!