Why Us?

We are a leading online trading platform offering a comprehensive suite of products and services for investors of all levels. Access products like stocks, ETFs, bonds, options across multiple markets. With POEMS, you can access over 26 exchanges, enjoy $0 platform fee on all markets, and get support from our dedicated customer service team.

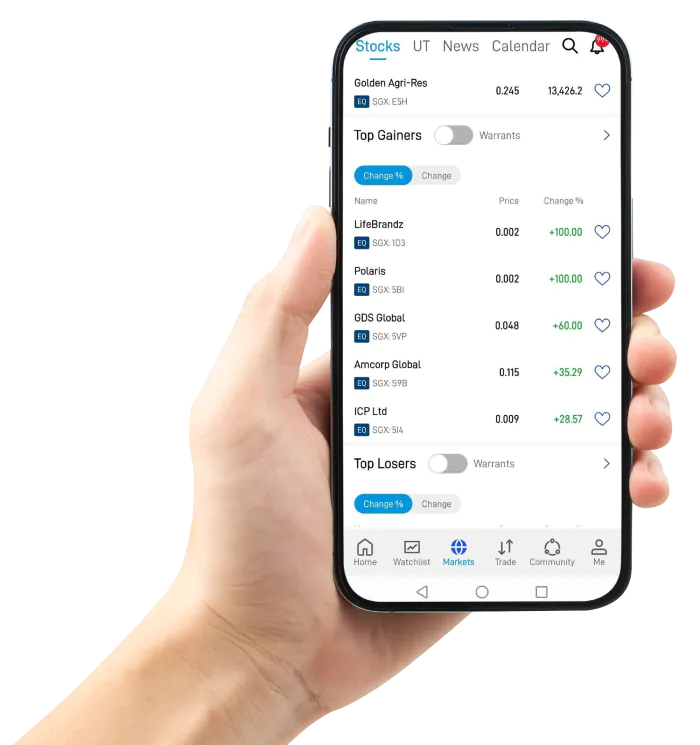

Complimentary Live Prices

SGX, US (NASDAQ, NYSE, AMEX, US Asian Hours), MYR (BURSA), THAI (SET) & US Options

Dedicated Trading Representatives

Dedicated Trading Representatives/Dealers to Assist You with Call Center and ChatBot.

Access Global Exchanges at Competitive Rates

Choose your perfect Account to meet your needs from our various Account types. Access global exchanges at competitive rates. Enjoy $0 platform fee across all markets and complimentary live prices for global markets. You can also grow your idle cash with us at SGD 3.379% p.a., US$ 4.000% p.a.

Rates updated as of 26 Jun 2023

#Based on the average rate of annualised returns over the last rolling one week.

Past performance is not necessarily indicative of future performance. View disclaimer

Tools

FAQs

After submission of orders, you may proceed to [Order Status] to check if the orders are on queue, done, or rejected. All orders will be issued with an order number for easy tracking. You are required to check on the orders status for any possible trade correction before market opens on the next trading day.

You may request an increase in trading limit by calling your Dealing Representative.

Order must be

- done in a market that is eligible for order amalgamation. Please check the ‘Settlement’ section of the individual markets.

- done on the same trading day,

- for the same stock,

- of the same action (BUY or SELL e.g. A buy action can be amalgamated with another buy action),

- executed via the same platform,

- done through the same account,

- paid through the same payment mode (cash or CPF or SRS),

Phillip Securities do not have the obligation to provide tax claim services. You are advised to consult your personal financial advisor or tax advisor.

You may check your trade limit on any POEMS platforms by clicking on any stock counter. Open the trade ticket box and select your account Buy Limit (B/L) and Sell Limit (S/L), you trading limit will be appear.

You may also contact your Trading Representative (TR) to check your trading limit.