Traders’ Must Know: Chinese New Year Effects January 25, 2022

Introduction to CNY

Chinese New Year, also known as Lunar New Year or Spring Festival, is the biggest festival of the year for every Chinese around the world and has been celebrated in China for thousands of years.

Apart from China, the holiday is also celebrated and observed in Asian countries with large Chinese populations such as Singapore, Indonesia, Malaysia, South Korea and the Philippines.

The festival is centred on removing the bad and the old as well as welcoming the new and the good.

It is also an important family reunion occasion where Chinese families come together to usher in a new year.

The celebrations usually last two weeks in total, taking place from Chinese New Year’s Eve to the Lantern Festival, held on the 15th day of the Chinese lunar calendar.

As the date of the Chinese New Year is determined by the Chinese lunar calendar (rather than the Gregorian one used by the West), the date changes each year, usually falling either in January or February.

Each Chinese New Year is also championed by one of the 12 animals in the Chinese Zodiac as illustrated in the picture below, in the order Rat, Ox, Tiger, Rabbit, Dragon, Snake, Horse, Goat, Monkey, Rooster, Dog, Pig, and 2022 is a year of the Tiger.

For 2022, the eve of Chinese New Year falls on January 31, Monday, and on this day as well as the rest of the festive season, we often see partial or full-day market closure across Chinese populated markets.

The table below outlines the dates and the markets that are closed during the Chinese New Year period.

Chinese New Year Effects

Impact on China Economy

Chinese New Year, being one of the most important and widely celebrated festivals in China, brings about several notable impacts on China’s economy during this period which we will be discussing in this section.

In 2021, retail sales, a key gauge of consumption, over the seven-day holiday hit 821 billion yuan according to China’s Commerce Ministry. The figure, equivalent to about $127 billion, represented a 29% jump from 2020 pandemic-disrupted holiday, and a 4.9% increase from the same period in 2019, long before the coronavirus swept across China [1].

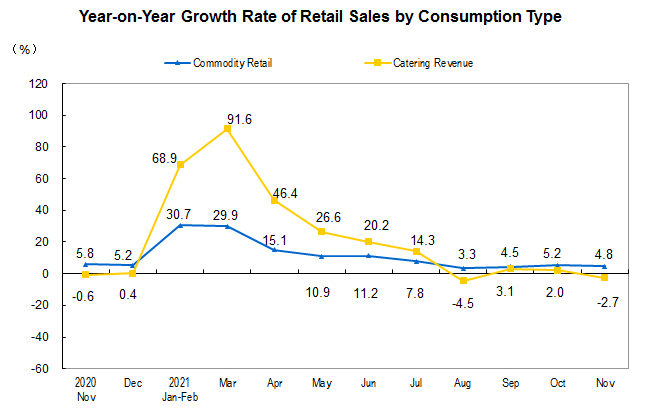

The sharp rise in private consumption during the festive period over January and February as shown above was mainly due to the tens of millions of Chinese residents who heeded the authorities’ call to avoid travelling during the holiday because of the coronavirus.

Data showed that travel by rail, air, road and other modes of transport fell 77% from pre-coronavirus levels, denting what is traditional the busiest travel season of the year, also known as Chunyun [1].

Instead, the Chinese redirected their disposable income to gifts, food, entertainment and other sectors that suffered during the height of the pandemic last year.

Additionally, box-office revenues also saw a holiday record of 7.5 billion yuan, while jewellery and fashion outlets reported year-on-year sales jumps of 161% and 107% respectively during the weeklong holiday in China [1].

Meanwhile, the rapid spread of the Omicron variant across the globe and the continued spread of the Delta variant has led China’s National Health Commission to impose travel restrictions for the upcoming Chinese New Year holiday, as it doubles down on its “zero-Covid” strategy.

The restrictions also take into consideration the fact that Beijing is hosting the Winter Olympics in February which will open doors to foreign athletes even as the Omicron variant is still surging in many parts of the globe.

Under the travel restrictions, people from medium or high-risk areas are prohibited from travel [3]. Under the rules, “medium risk” areas are those with less than 10 reported cases in the last two weeks. And “high risk” areas have more than 10 reported cases.

As of 14th January, China had 19 high risk areas and 59 medium risk areas [4].

That being said, domestic consumption in the retail and service sector will likely be the main driver for China’s economy during this upcoming Chinese New Year as domestic tourism may not be as strong as pre-COVID-19 levels.

Apart from retail sales, there has been a strong positive sentiment on the China economy in the run-up to the festive season over the past few years. This is likely since domestic tourism and retail industries tend to receive a significant boost during the festive season.

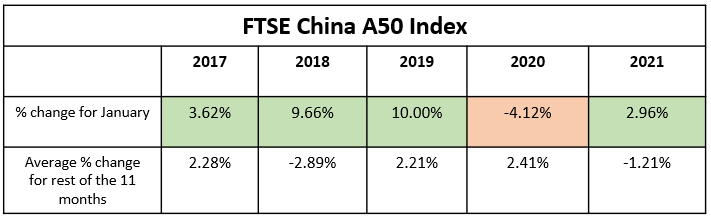

Using the FTSE China A50 Index as a gauge, we can see that based on the past 5 years data, the index has performed significantly better in January except for January 2020 which had a worse performance than the average of the other 11 months, likely due to the first global case of COVID-19 discovered in Wuhan China in December 2019.

Cash is King

Cash is king during the Lunar New Year holiday due to several reasons.

1. Closure of businesses and stock markets: Given that the stock markets and businesses are closed during the week of the holiday, liquidity is a key concern and we tend to see Chinese traders profit-take from their financial holdings in the financial markets and withdraw vast sums of cash, causing fluctuations in the stock markets. This is similar to how people in the US take profit from their stock holdings before Christmas.

2. Early crediting of salaries and bonuses: In China as well as most Chinese populated Asian countries, it is a common practice for companies to credit salaries to their employees prior to Chinese New Year. Most companies in China also tend to make a 13th month salary payment/bonus to their employees prior to the holiday.

3. Chinese tradition of red packets: Red envelopes are a traditional gift of money to friends and family members during Chinese New Year in China and most Asian countries. These envelopes are filled with money and symbolise good wishes and luck for the new year ahead. As such, this tradition tends to lead to higher demand for cash during this festive period.

4. Tourism and retail industries: During the holiday, domestic tourism and retail industries tend to receive a significant boost. Moreover, China receives a huge influx of tourists during this time. These trends influence CNY (yuan) trading, which in turn affect the offshore renminbi trading, the CNH.

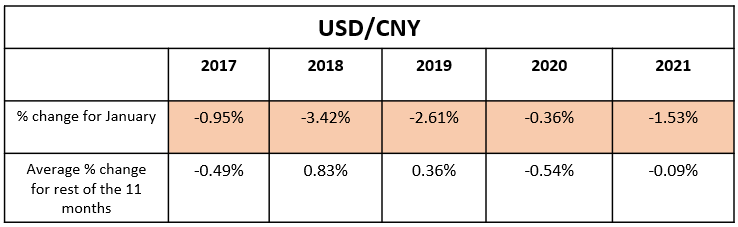

In China, the aforementioned four factors tend to result in a higher demand for cash, leading to a seasonal strengthening effect of the Chinese yuan during the period prior to the holiday. As the Chinese New Year usually falls in late January or in February, we can look at the performance of the USD/CNY pair for the month of January to verify this seasonal strengthening effect.

Indeed, as shown in the table below, for the past five years the Chinese yuan has been strengthening against the USD for January as illustrated by the negative percentage change. On top of that, when compared with the average percentage change for the remaining 11 months, we can see that the Chinese New Year effect on the Chinese yuan remains strong except in 2020 where the average performance of the Chinese yuan was stronger in the remaining 11 months, mainly attributed to the first global case of COVID-19 discovered in Wuhan China in January 2020.

Seasonal Effect on Gold

In our previous article published on World Gold Day, I had discussed the supply and demand of gold being one of the factors that influences the price of gold. The demand for gold mainly comes from four areas: jewellery, technological uses, central banks and investment vehicles (such as Exchange Traded Funds, or ETFs, that specialise in gold and its currency). Jewellery accounts for more than half of the aggregate demand for gold based on the past 10 years data as shown below.

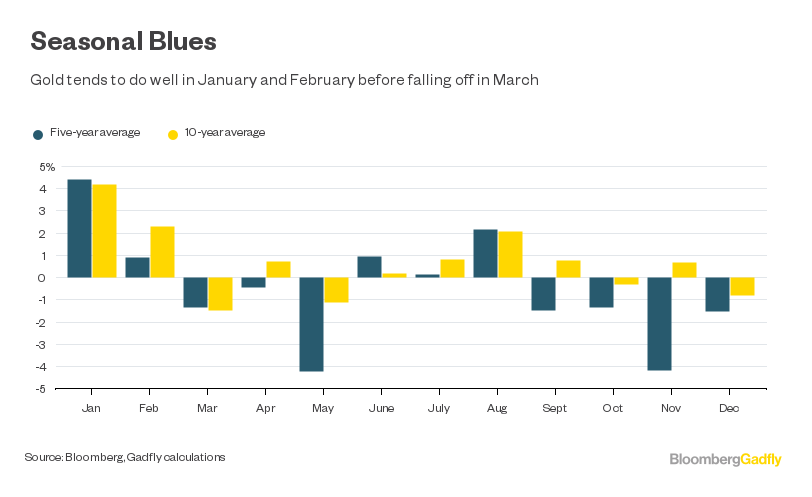

In 2020, China was the largest consumer of gold for jewellery, accounting for 413.8 tonnes of gold [11], and Chinese New Year pushes demand up, as people look to give gold and jewellery as gifts. The influence this has on gold prices early on in the calendar year is notable, specifically in January for the past 10 years as shown below.

This could possibly also be due to the Diwali-Christmas-Lunar New Year peak buying period for jewellery. Nonetheless, regardless of the reason, the seasonal effect on gold is consistent enough over the year that it is starting to become a self-fulfilling prophecy such that traders’ beliefs have a way of driving their buy and sell orders, and ultimately the market since the demand of gold from investment vehicles also accounts for a relatively huge portion of the aggregate demand for gold as shown in the chart from Goldhub earlier on.

All in all, demand from both jewellery and investment vehicles could well explain the Chinese New Year effect on gold prices.

Plan the Trade and Trade the Plan

How can we take advantage of this yearly situation? In this section, we will be doing technical analysis on three relevant CFDs that can be used by traders to take advantage of the three Chinese New Year effects that have been explained earlier on. Lastly, we will be ending off with a step by step guide on how you can execute a CFD trade on POEMS 2.0 platform. However, if you are not familiar with CFDs, you may want to read our article on “Understanding Contracts for Differences” before proceeding.

1. Bullish bias on China Index (China A50 Index USD1 CFD)

2. Bearish bias on USDCNH (USD/CNH FX CFD)

3. Bullish bias on gold (Gold USD1 CFD)

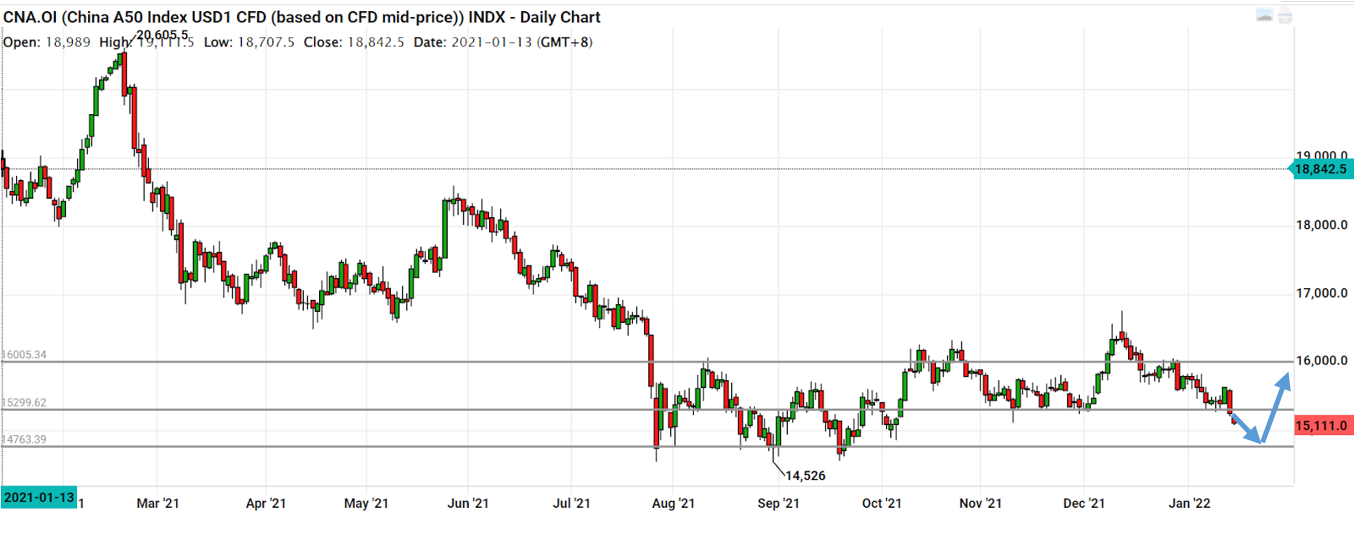

Bullish bias on FTSE China A50 Index

To take advantage of the Chinese New Year effect on the China A50 Index as explained earlier under “Impact on China Economy”, we can hold a short term bullish bias on the index using the China A50 Index USD1 CFD.

3 key levels are plotted. Prices are moving sideways and are moving toward the lowest key level. Being bullish, we would want to trade when prices rebound at that key support level.

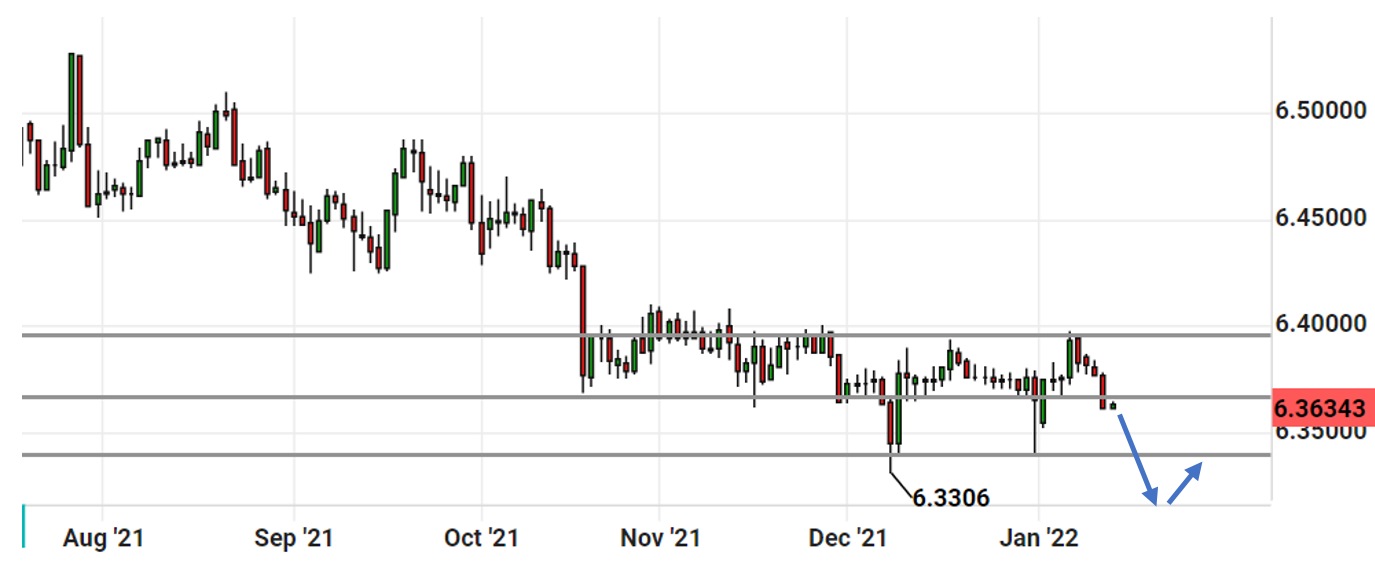

Bearish bias on USD/CNH

To take advantage of the Chinese New Year strengthening effect on the Chinese yuan as explained earlier under “Cash is King”, we can hold a short term bearish bias on the USD/CNH pair using the USD/CNH FX CFD as CNH is the offshore currency that traders can trade in.

Prices are trending downwards with 3 levels of support and resistance that we can look out for. Below are 2 possible scenarios we can trade.

Scenario 1:

Prices move to the top resistance, get resisted, and head back down to the 2 lower key levels.

Scenario 2:

Prices break below the lowest key level and retrace back to get resisted at that level. We short and prices go lower in our favour.

Bullish bias on Gold

To take advantage of the Chinese New Year effect on gold as explained earlier under “Seasonal Effect on Gold”, we can hold a short term bullish bias on gold using the Gold USD1 CFD.

If gold prices break the resistance level and retrace to prove to us that resistance becomes support, we can long Gold USD1 CFD to the higher key level.

Now that you have an idea on how to take advantage of this information, let’s walk through execution.

Execution Example

*Do note that this is not a call to buy or sell USDCNH now (because we do not know when you would be reading this article). Rather, this is an example of how you can execute short trades on CFDs.

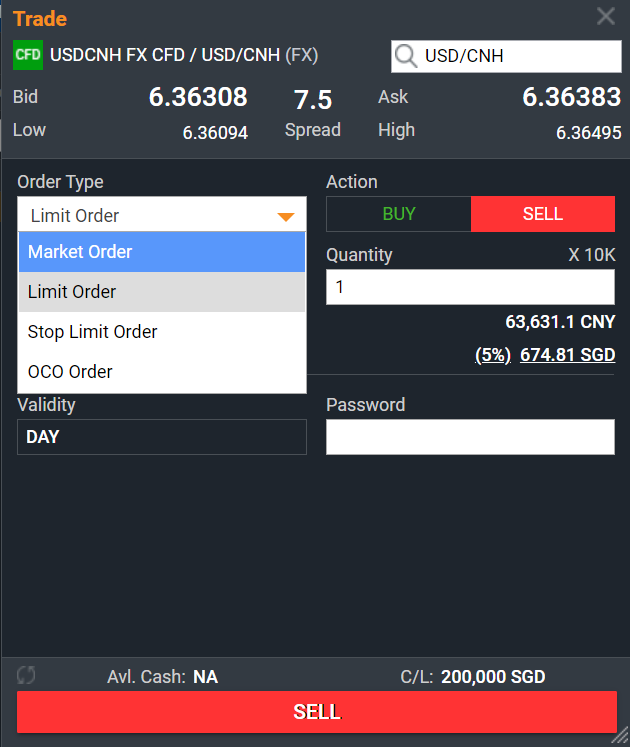

We will use scenario 2 of USD/CNH as an execution example on how to short CFDs.

Prices break below the lowest key level and retraces back to get resisted at that level. We short and prices go lower in our favour.

What are the key levels?

They are 6.40, 6.37, and 6.34.

What can these levels do for us?

They can help us in planning our short term trade.

As we are trading on the phenomenon, we are looking to exit within the week or even within the day. We are required to be nimble in this case. Once we spot the rejection at the resistance level, we can take action by placing a market order type. Market order types allow us to enter a position at the current available price.

For example, prices break below 6.34 and retrace back to get resisted at that level. We short and prices go lower. Bearing in mind the risk to reward, a good level where we cut our losses would be 6.38. If we short at 6.33, we risk 0.05, and aim for a reward of 0.05 (take profit at 6.28). That gives us a risk to reward of 1:1.

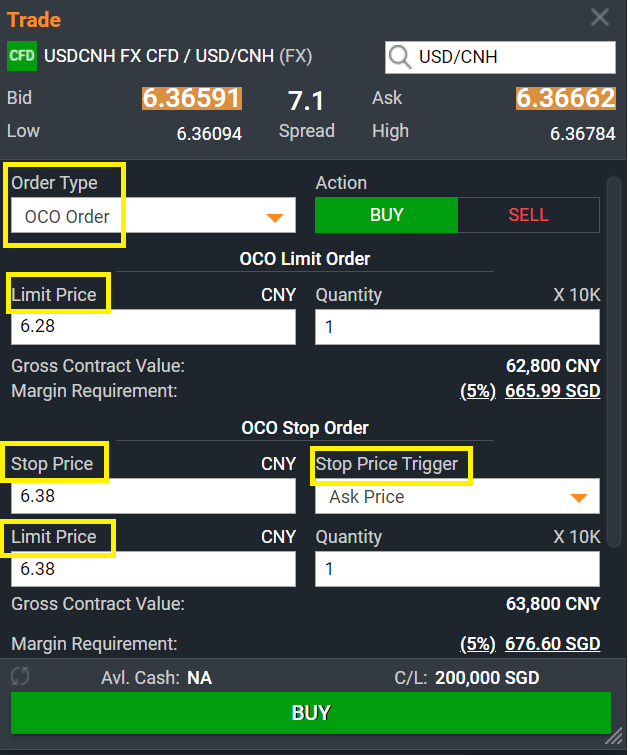

Once we are filled, we can place our stop loss and target profit using an OCO order type.

An OCO stands for One Cancels the Other. This means if we hit our target price, we take profit and cancel the stop loss order. If we hit our stop loss, we cut the position and take our losses, and the order to take profit will be cancelled.

Essentially this means that if one part of the order is executed, the other is automatically cancelled. A Limit Order can only be filled if the stock’s market price reaches the limit price. While limit orders do not guarantee execution, they help ensure that an investor does not pay more than a predetermined price for a stock.

Using scenario 2 as an example, I would have entered at 6.33.

After double clicking on USDCNH on the poems 2.0 platform, the order ticket pops up as above. The first section which says limit price is the price where we would want to take profit, and that would be 6.28. The lower section is the stop loss section. Stop price tells the system when to send in the order to cut losses. The stop price trigger is the Ask price. Once the ask price reaches 6.38, the system will send in a limit order to buy at 6.38. Either the target profit or stop loss level will be filled and the other order will get cancelled, hence the term OCO.

Low Margin Requirement

Above is an image of the margin requirement for 1 short contract. Using Phillip CFD, you only need a cash outlay of 5% for 1 contract, allowing you to leverage your position. Of course, leverage is a double-edged sword as it not only has the potential to magnify your profits but also your losses as well, so always trade with a stop loss.

Conclusion – Grabbing the Opportunity with CFD

To wrap up, we have covered:

- The three Chinese New Year effects that have been consistently influencing the financial markets over the past years prior to the holiday, particularly in January.

- How traders can take advantage of the three short term Chinese New Year effects using CFDs based on technical analysis.

- How to execute the trades with CFDs on POEMS 2.0 platform.

- How CFD can help us to maximise the use of our cash.

Lastly, do note that while this festive season presents short-term opportunities for you to take advantage of, it is also important to take into consideration other fundamental factors that could possibly affect market sentiment and hence deviate from the aforementioned effects. For instance, in the case of 2020, the Chinese New Year effect did not apply to the China A50 index and the USD/CNY pair due to the outbreak of the coronavirus which resulted in poor market sentiment and outlook.

How to get Started

Trade equities, world indices, commodities and FX CFDs, with or without leverage

Before being able to trade CFDs on POEMS, you would need to have an existing POEMS account such as a Cash Plus Account which allows you to trade an array of US shares as low as US$ 1.88 flat. Find out more here. T&Cs apply.

For existing POEMS account holders, you can activate your CFD trading facility through the following methods:

- POEMS 2.0: Login to POEMS 2.0 > Acct Mgmt > CFD > Online Account Opening

- POEMS Mobile 2.0: Login > Click on the menu button on the top left of the screen > “Portfolio” > “Activate CFD Trading” Link.

- POEMS Pro: Login > Acct Mgmt > CFD Acct Mgmt> CFD Account Opening

Investors and traders with a bigger risk appetite may consider using Contracts for Differences (CFDs) to invest or trade. CFDs are versatile tools for investors, particularly those who take an active approach to investing.

CFDs can be used for hedging, short-selling and even leveraged trading. They only require minimum investments upfront, which are known as the margin requirement and are also ideal tools for people with less capital but who wish to capitalise on the growth potential of certain industries. Or they may simply want to take advantage of the latest market movements regardless of direction.

CFDs, however, may not be suitable for investors whose investment objective is to preserve capital and/or whose risk tolerance is low.

We hope that you found value reading this article! If you do not have a POEMS account, you may visit this link or scan the QR code below to open one with us today!

Open a POEMS account within minutes and trade instantly!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

Reference:

- [1]https://www.wsj.com/articles/chinese-consumers-were-big-spenders-during-the-lunar-new-year-holiday-11613650350

- [2]http://www.stats.gov.cn/english/PressRelease/202112/t20211216_1825426.html

- [3]https://edition.cnn.com/2021/12/18/world/covid-chinese-new-year-travel-restrictions-intl/index.html

- [4]https://www.xjtlu.edu.cn/en/novel-coronavirus-pneumonia/government-notices/notification-of-domestic-medium-high-risk-areas

- [5]https://www.investing.com/indices/ftse-china-a50

- [6]https://www.who.int/news/item/29-06-2020-covidtimeline

- [7]https://www.reuters.com/article/us-china-retail-idUSKCN1Q0019

- [8]https://www.financedigest.com/the-hidden-dragon-what-do-chinese-new-year-and-golden-week-mean-for-financial-markets.html

- [9]https://www.investing.com/currencies/usd-cny

- [10]https://www.gold.org/goldhub/data/gold-supply-and-demand-statistics

- [11]https://www.gold.org/download/file/16156/gdt-q2-2021-statistics_EN.xlsx

- [12]https://economictimes.indiatimes.com/markets/commodities/news/four-reasons-why-you-shouldnt-count-gold-out-just-yet/articleshow/62020621.cms

- [13]https://finance.yahoo.com/news/why-chinese-sell-off-may-204422054.html

- [14]https://p2.poems.com.sg/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jeremy Chua (Dealing) & Chua Minghan (Assistant Manager, Dealing)

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business and is a member of the largest dealing team in Phillip Securities. He strongly believes in the importance of staying invested in the financial markets and evaluates stocks using fundamentals to make informed investment decisions.

In his free time, he enjoys researching on market events and disruptive investment themes to generate new investment ideas for the short and long term.

Chua Minghan graduated from the National University of Singapore with a Bachelor’s degree in Economics. He is passionate about education and went on to get a post-grad Diploma in teaching. His vision is to educate clients to make informed decisions for their trading and investments.

Minghan enjoys learning fundamental analysis, technical analysis, and strives to use data analysis to improve his trading skills.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?