US Election 2020 – All you need to know as an investor September 22, 2020

This article is part of the US election series brought to you by POEMS. #USelection2020

Summary outline:

- Early August polls show Biden taking a huge lead. However, it has since changed drastically as the odds show an almost even chance for both Biden and Donald Trump

- The Presidential Election Cycle Theory suggests that US stock markets are the strongest in the 3rd year of an election cycle

- Find out the various sectors that may benefit from either a Biden or Trump win

- Follow us as we bring you through a detailed coverage of the different US sectors leading to US elections 2020

This will be a US Election like no other. For the first time in living memory, it will take place amid an economic crisis, a crushing debt burden and a public health emergency.1

On the Republican side, the incumbent Donald Trump is already ramping up the type of rhetoric that has made him one of the most divisive figures in American political history.

Whereas on the Democratic side, presumptive nominee Joe Biden is running on perhaps the most radical leftist platform that we’ve ever seen from a mainstream candidate.2

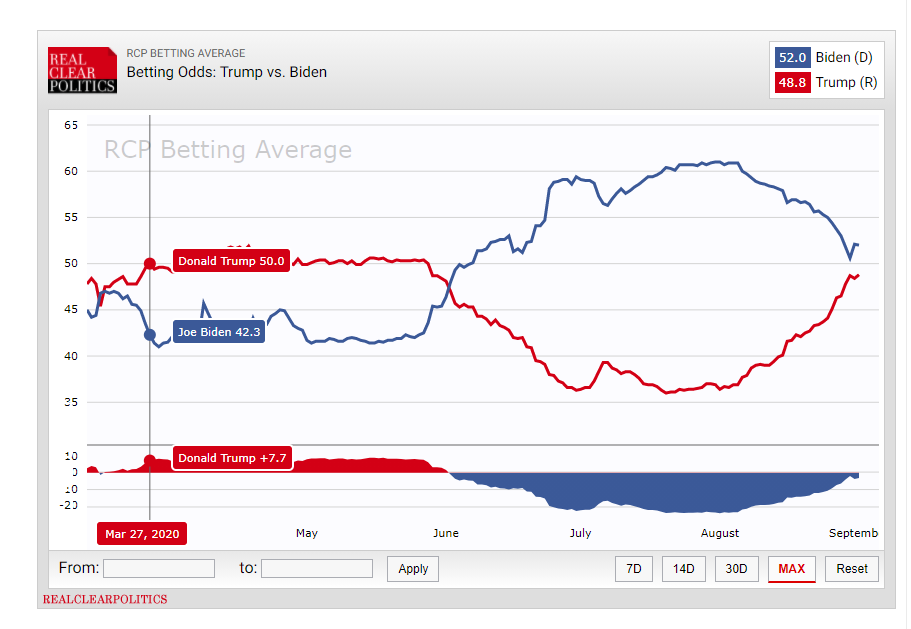

As recent as 1 August, Biden looked likely to cruise toward an easy victory over President Donald Trump. According to political website Real Clear Politics, his chances were as high as 61% compared to Trump’s 36.9%.3 However, the odds started to narrow as we move closer to the main event. As of 1 September, the gap has narrowed to roughly 52% for Biden and 48% for Trump as shown below:

Source: Political website, Real Clear Politics

With the presidential election happening in less than 2 months, investors are trying to decide which could be worse. Will the 46th US President be Republican Donald Trump’s hostile trade policy with other countries especially China and Europe or Democratic presidential candidate Joe Biden with the potential to raise taxes especially in the wake of a recovery from a global pandemic?

Either one outcome could hurt growth, both domestically and abroad. If US and China renew a whole new cycle of tit-for-tat tariffs (assuming a Donald Trump victory), it could raise prices and undermine demand for all types of goods. On the other hand, rising taxes (assuming a Joe Biden victory) would have a similar effect and likely to cause a decrease in disposable income and corporate earnings.

Setting these offsetting policies aside for now, it’s worth looking at the past presidential elections and determine how they affected the stock markets.

Let’s first examine the Presidential Election Cycle Theory.

Presidential Election Cycle Theory

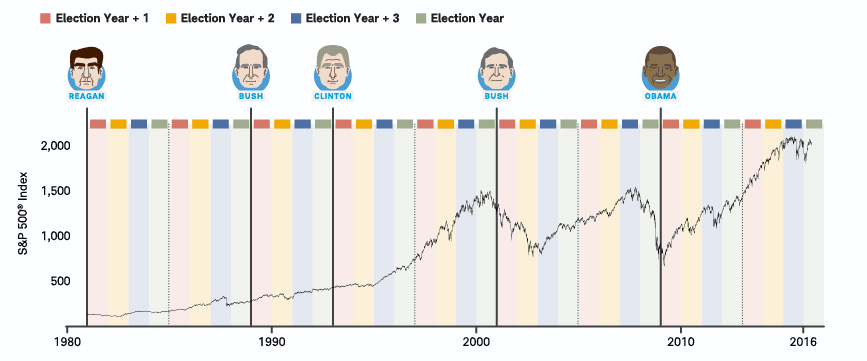

The Presidential Election Cycle Theory, developed by Yale Hirsch, suggests that US stock markets are the weakest in the year following the election of a new US President. According to this theory, after the first year, the market improves until the cycle begins again with the next Presidential Election4.

In the first one to two years of a presidential term, the President exits campaign mode and works hard to fulfil campaign promises before the next election begins. It is theorised that because of these circumstances surrounding a President’s work, the first year following the election is the weakest of any Presidential term, with second year not getting any better.

In the 3rd and 4th terms, it is presumed that the President goes back into campaign mode and works hard to strengthen the economy in an effort to earn votes with economic stimulus, such as tax cuts and job creation. The resulting fiscal stimulus will help to boost the economy in the second half of the election cycle. Based on past data, it shows the most pronounced of the return to be in the third year; with the S&P 500 rising 88% of the time and on average generating a return of more than 16%5.

It should be of no surprise that, historically in comparison, markets perform better during and before a year when an incumbent President is elected to a new administration.

Markets detest uncertainty. A new President can possibly create more unknown such as the potential for increased regulations, higher taxes and other shifts that the market perceives as anti-business.

The economy as key indicator

Further reinforcing the Presidential Election Cycle Theory, according to Dan Clifton of Strategas Research Partners6, data shows that avoiding a recession in the two years leading up to an election is a key indicator of re-election. Data going back to 100 years ago indicated that there is a higher change of re-election if a President had avoided a recession in the two years before re-election.

Conversely, each of the presidents who had a recession in the two years before re-election went on to lose, with President Calvin Coolidge the exception in the 1920’s.

The relationship between an economy and re-election becomes crystal clear. If you want to be re-elected, avoid a recession.

The stock market as key indicator

Stock market performance leading up to an election has also been a major indicator of the outcome. The performance of the S&P 500 in the three months before votes had predicted 87% of elections since 1928 and 100% since 1984.

When returns are positive, the incumbent party wins. If the index suffers losses in the three-month window, the incumbent loses.

Historically, stock market volatility has typically been higher in election years as market frequently re-prices the probability of changes in the future administration’s policies and agendas. Amid the volatility, markets also tend to underperform slightly during an election year. According to a research study from U.S. Bancorp, the stock market gains on average 6% lesser in the year leading up to a Presidential Election as compared to a returns of 8.5% in any given 12-months period7.

Current market condition

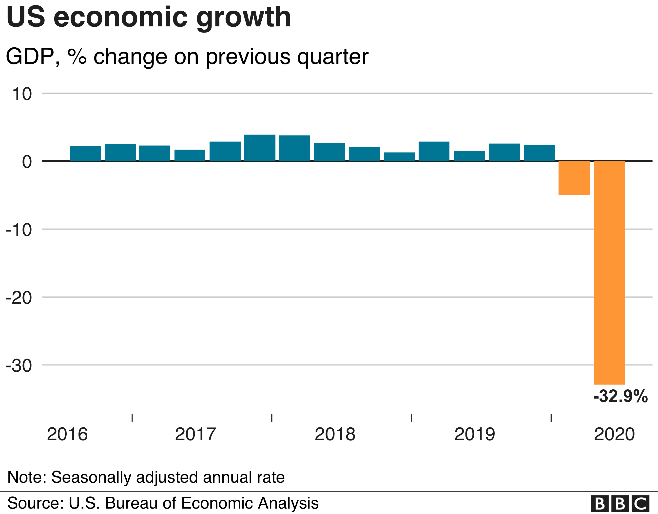

The US economy and stock market started the year 2020 full of promises with record stock market levels and a low unemployment rate. However, the COVID-19 pandemic soon struck and blindsided many countries. With the severity and speed of its spread, it reversed the economic progress made over the years. In the US, amid a euphoria of a seemingly unstoppable economy, the pandemic soon tightened its grip on the country and caused a raging spread of this deadly virus. In a bid to combat the virus, nationwide lockdown was implemented resulting in widespread unemployment and a temporary crash of the stock market from record levels, bringing the economy to a halt. The sharp decline in economic activities in February marked the end of the longest expansion in the US history and the official start of a recession. GDP growth collapsed at -32.9%, which is the deepest decline since post WWll. The ensuing unemployment rate that followed jumped to a record of 14.7% in April, the highest since post Great Depression era8. This was made worse by slow and controversial responses from the US government in containing the virus. Coupled with nationwide protests on racism and natural disasters across the country, the US economy was brought to its knee.

As US states begin to ease lockdowns, the restarting of economic activities aids the recovery of its economy. Unemployment rate soon fell to 8.4% in August. However, with the ongoing surge of COVID-19 cases coupled with limited stimulus aids, the recovery of the US economy is faltering. This puts in direct contrast with the firm postulation of numerous economists who believe the recession to be both particularly deep and exceptionally short.

Stock markets worldwide crashed with the S&P index down 32% from peak to trough9. It came roaring back however, ending the shortest bear market and hitting its all-time highs while countries continue to try to contain the impact of the virus on their economies.

President Trump

If Trump were to be re-elected, the likely combination of constitution would be a Republican Senate/Democratic House. This combination averages a return of 10.8%10.

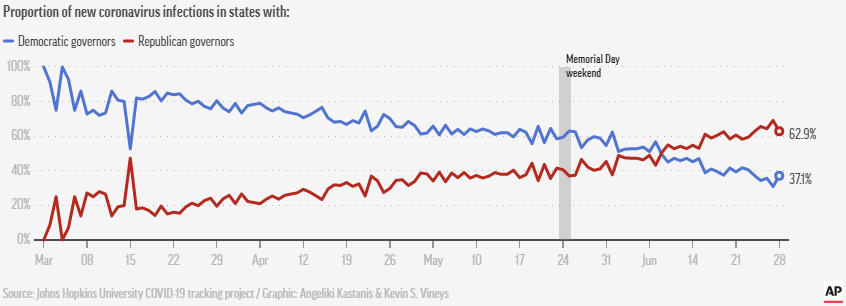

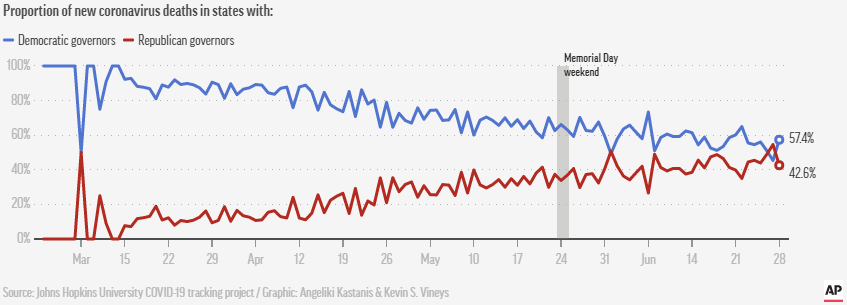

On top of the indicators, how the market/economy recovers from this pandemic would be an important factor especially when the harder-hit states by the pandemic had swayed towards the Republican controlled states as compared to the beginning of the crisis (earlier poll results were tilting towards a Trump’s victory). This may cause voters to reassess and vote otherwise.

No doubt a Trump-led White House will foresee some certainties in the market (absence of a new administration agenda) with continued deregulatory agenda and pro-policies being implemented. However, this may be offset by uncertainty on the trade front. Being empowered on trade matters, we will see Trump following through on his threats post-election and increased volatility in the market due to his trade tactics (e.g. tariffs and twitter to further his agendas).

Industries to look out for:

As President Trump favours deregulation practices, industries that flourished under Trump administration will continue to do well post-election.

Traditional energy sectors are set to continue to flourish under Trump administration as seen in his first tenure where US has become the world’s largest producer of oil.

Military companies are set to do well in the second term as well as Trump administration is deemed as more likely to spend more on military and sell military equipment to other countries such as Saudi Arabia.

The financial sector will benefit from the deregulation and see an increased in their earnings in the absence of a tax hike threat.

Due to the unpredictability of Trump’s trade policy, it is wise to avoid companies with a significant exposure to China and Europe. These companies may be caught in the middle of a trade war between US and its counterparties and suffer as a results. Examples of such companies are Estee Lauder and Nike which have close to 20% of their revenue sourced from China11.

President Biden

If Biden were to win the election, the likely constitution would be a Republican Senate/ Democratic House. This combination has not occurred before11.

On top of the indicators, it also largely depends on how the public digests his plans for tax hike amidst a recovery from a global pandemic in which US is the hardest hit.

The Democratic President would be deemed more anti-growth and pro-regulation as compared to the Republican President which introduced uncertainty into the market with new policies and agendas. However, a Democrat White House may introduce a larger fiscal stimulus which may offset the negativity of the anti-growth policies such as the tax hike. This coupled with more moderate and predictable trade policies with countries may result in better trade relations. Thus, a Biden-led White House may be positive for the economy/stock market due to a better accommodating fiscal package and certainty on trade policies. These may offset the uncertainty brought about by a newly elected government.

Industries to look out for:

Biden’s proposed policies include reversing some of the tax cuts from Trump administration and heightened regulations. In his ‘Build Back Better’ agenda, the focus is on sustainable energy and bold investment in infrastructure and manufacturing.

This set the stage for ESG investing to flourish under Biden’s presidency. The increased focus on environmental issues will bring tailwinds for companies relating to clean/renewables energy industries.

Basic materials inputs, along with construction and infrastructure building industries will have a positive effect under the Biden’s agenda.

Financial and traditional energy industries will be stressed under a Biden administration. This is largely due to the increased call for sustainable environment and heightened regulations in the financial sector.

Conclusion

The policies and agendas to be enacted under each elected President still have to go through the Congress. Thus, the effectiveness of the policies formulated by the Presidential candidates during the campaign are still very much curtailed by the authority of the Congress. The composition of both the Congress is an important factor for the overall outcome on the economy and stock market post-election.

As the outcome is uncertain, stock markets may be subject to short term volatility. However, it is advisable for investors to take a longer term stance and focus on the fundamentals which will prevail over the longer horizon period.

Follow us as we bring you through the detailed breakdown of the various sectors and topics such as Technology, Healthcare, US-China trade war and foreign policy leading up to the US election on 3 November 2020.

Reference:

- [1] https://www.straitstimes.com/world/united-states/covid-19-injects-uncertainty-into-us-presidential-election-in-nov

- [2] https://www.washingtonpost.com/opinions/2020/07/16/how-joe-biden-is-moving-left-while-still-being-seen-moderate/

- [3] https://www.realclearpolitics.com/elections/betting_odds/2020_president/

- [4] https://www.investopedia.com/terms/p/presidentialelectioncycle.asp

- [5] https://www.schwab.com/resource-center/insights/content/stock-market-and-election-cycles

- [6] https://www.etftrends.com/etf-strategist-channel/2020-outlook-preview-us-election-insights/

- [7] https://www.usbank.com/investing/financial-perspectives/market-news/how-presidential-elections-affect-the-stock-market.html

- [8] https://tradingeconomics.com/united-states/forecast

- [9] https://www.forbes.com/sites/chuckjones/2020/03/23/two-reasons-the-stock-markets-could-fall-another-20-to-40/#325a1f0777ee

- [10] https://www.forbes.com/sites/kristinmckenna/2020/08/18/heres-how-the-stock-market-has-performed-before-during-and-after-presidential-elections/#1572dd664f86

- [11] https://www.cnbc.com/2020/01/27/us-stocks-most-exposed-to-china-consumer-market-hit-by-coronavirus.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng

Dealer

Yong Heng joined Phillip Securities in June 2020 this year as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and also supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a Bachelor’s Degree in Economics & Finance. He also completed his CFA studies last year.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!