USD – Undisputed King of all Currencies October 30, 2023

The Global Dominance of the US Dollar (USD)

The US Dollar (USD), often referred to as the “greenback” due to the distinctive green ink used on earlier US paper money, holds a paramount position in international trade and finance.

The USD is the most actively traded currency in today’s Forex(FX) market. This includes popular currency pairs such as the EURUSD, GBPUSD and USDJPY.

In addition to serving as the primary reserve currency for many central banks and governments worldwide, the USD plays a pivotal role in cross-border transactions. Its widespread acceptance and popularity also extends to its use as a reference for the value of various asset classes. Notably, the prices of energy products, precious metals, commodities, and even digital assets are often quoted in USD in the context of international trade and finance.

Though the USD’s dominance is beyond question, for further persuasion, let’s examine the history of the greenback.

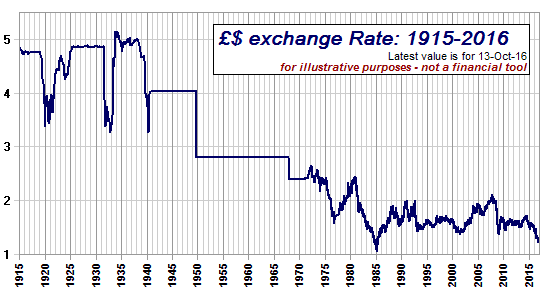

Source: http://www.miketodd.net/encyc/dollhist.htm

The Rise of the USD Post-World War II(WWII)

Before the 1940s, the British Pound reigned as the global dominant currency. However, the outbreak of WWII led to a substantial decline in the British Empire’s power and shifted the global economic landscape. The United States (US), initially hesitant to directly involve itself in the conflict, still provided essential military aid to Allied nations.

The turning point came with the unexpected Japanese attack on Pearl Harbor in 1941, prompting the US to declare war on Japan and its allies, Germany and Italy. Bolstered by the world’s largest Gold reserves and military might, the US was a formidable force, contributing significantly to the victory of the Allied forces made up of the US, Great Britain and the Soviet Union. The US’ leadership was further solidified with the D-Day invasion of Normandy Beach in 1944 and the deployment of atomic bombs in Hiroshima and Nagasaki in 1945.

After WWII, the US assumed a leading role in rebuilding war-torn Europe and Japan and played a crucial role in establishing international organisations like the United Nations, the North Atlantic Treaty Organization (NATO), and the Bretton Woods System.

Adoption of the Bretton Woods System

In the aftermath of WWII, a pressing need for economic stability and order emerged. In July 1944, representatives from 44 Allied nations convened in Bretton Woods, US. At the conference, an agreement was reached to peg the USD to Gold at a fixed rate of US$35 per ounce, with other major currencies subsequently pegged to the USD. The decision for this was due to the US’s growing economic and military might. This system became known as the “Bretton Woods system.”

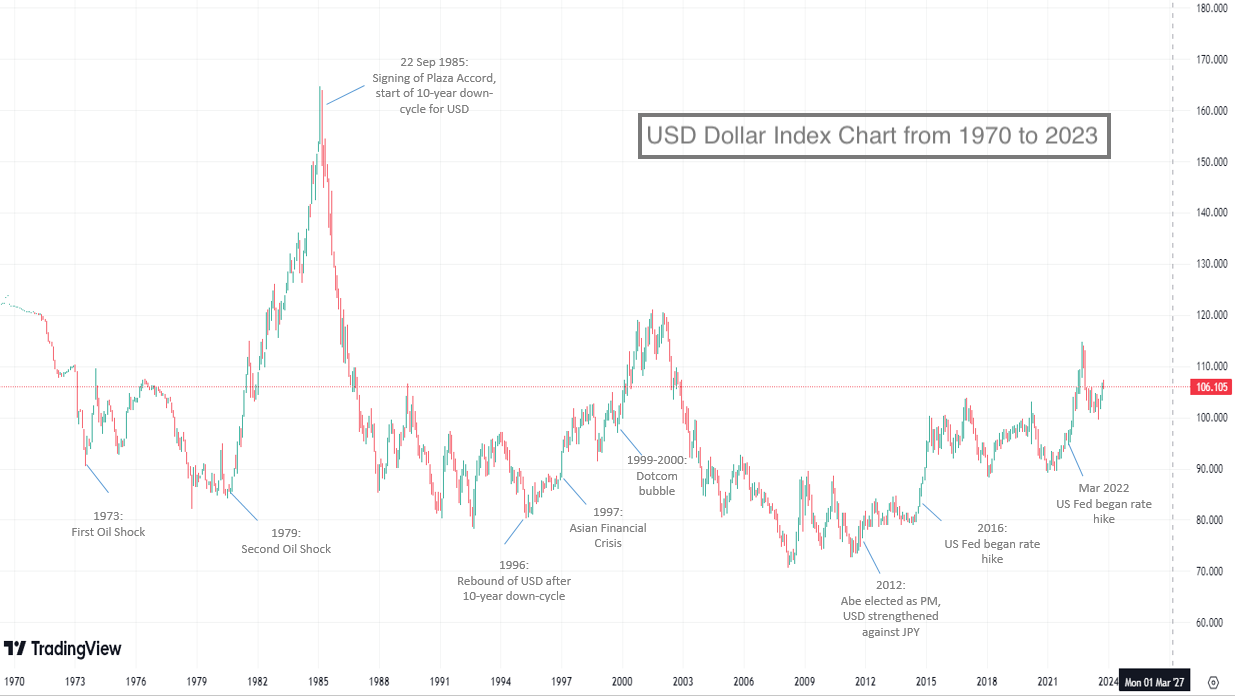

Source: http://www.tradingview.com

The Free-Floating USD

In the 1960s and 1970s, the US faced challenges, including rising inflation, trade deficits, and the financial burden of the Vietnam War. These issues compelled President Richard Nixon to announce the suspension of USD’s convertibility into Gold on 15 August 1971, marking the USD’s exit from the Bretton Woods system. This decision resulted in a devaluation of the USD and ushered in a new era of floating exchange rates.

The Plaza Accord of 1985

The early 1980s witnessed a significant appreciation of the USD, making American exports less competitive and causing global trade imbalances. To address this issue, the five major economies – the US, UK, West Germany, France, and Japan – signed the Plaza Accord in 1985. Their goal was to deliberately weaken the USD, particularly against the Japanese Yen and German Mark. The Plaza Accord succeeded in devaluing the USD, making American goods more competitive globally.

USD as a Safe Haven

The US global leadership has solidified the USD’s status as a “safe” currency, especially during financial and economic crises. This was evident by the influx of funds from investors as they sought safety throughout the first oil shock of 1973, second oil shock of 1979, the Asian financial crisis of 1997, the dot-com bubble of 1999, and the global financial crisis of 2008.

Unusual USD Strength Amid Unusual Times

The COVID-19 pandemic was a unique global crisis that prompted unprecedented fiscal and monetary measures from the US government and Federal Reserve to support individuals and corporations. The resulting inflationary pressures led to increased interest rates by the Federal Reserve, attracting money from other currencies and asset classes into USD and US Treasuries. Since March 2022, the strength and appeal of the USD have grown significantly. At the time of this writing, although US inflation is trending down, Fed officials have indicated a commitment to maintaining higher interest rates for longer. Against the current economic backdrop, it is likely that the current strength of the USD will persist for a while more.

In summary, the strength and dominance of the USD have been consistently demonstrated throughout time. The Bretton Woods system laid the foundation, cementing the USD as a pillar of global financial stability. Events such as the suspension of USD’s convertibility to Gold and the deliberate weakening through the Plaza Accord underscored the USD’s enduring strength. Furthermore, its role as a safe haven asset during past crises and present challenges, such as the Asian financial crisis and COVID-19 respectively, exemplifies the world’s unwavering confidence in the currency. Hence it’s justifiable for the USD to assert itself as the undisputed king of all currencies.

Promotions

From 2 October to 29 December 2023, enjoy up to S$120 cash credits every month and earn up to S$360 cash credits when you trade FX CFDs for 3 consecutive months (October, November and December). Start trading today!

*T&Cs Apply.

For more information, click here.

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offer investors and traders more than 40,000 financial products across global exchanges.

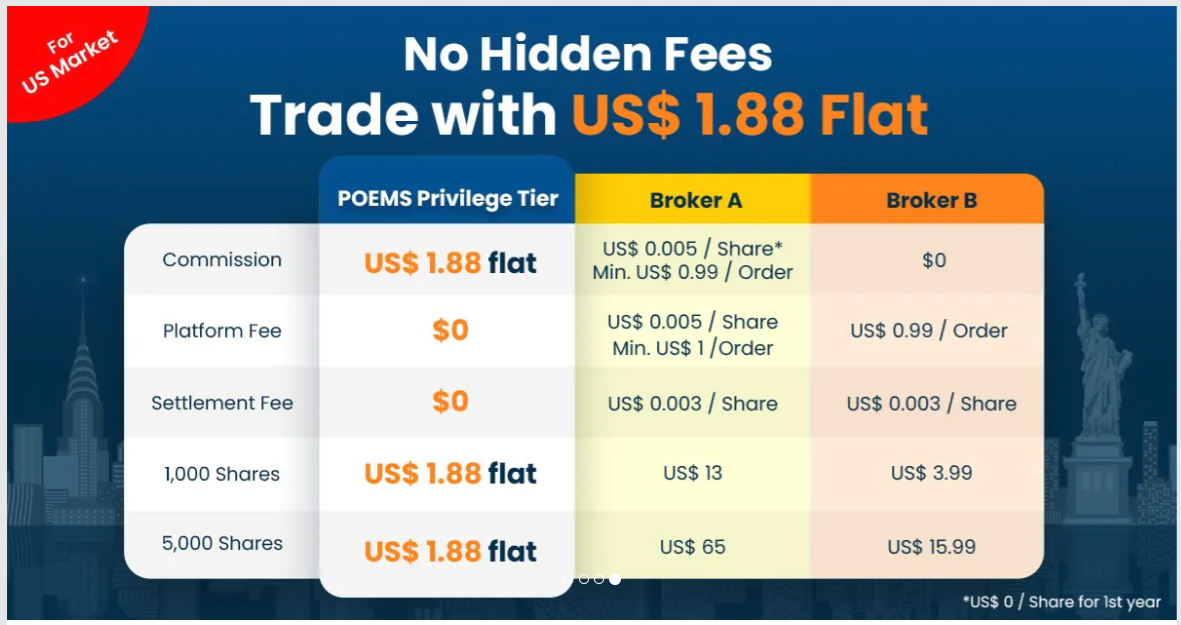

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here(terms and conditions apply).

We hope that you have found value in reading this article. If you do not have a POEMS account, you may visit hereto open one with us today.

Lastly, investing in a community is much more fun. You will get to interact with us and other seasoned investors who are generous in sharing their experience and expertise.

In this community, you will be exposed to quality educational materials, stock analysis to help you apply the concepts, unwrap the mindset of seasoned investors, and even post questions.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join usnow!

For enquiries, please email us at cfd@phillip.com.sg.

References:

- [1]https://www.investopedia.com/articles/forex-currencies/092316/how-us-dollar-became-worlds-reserve-currency.asp

- [2]https://www.investopedia.com/terms/g/greenback.asp

- [3]https://www.cfr.org/backgrounder/dollar-worlds-reserve-currency

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Yeo Sze Han

Assistant Manager

Phillip Securities Pte Ltd

Yeo Sze Han graduated from the National University of Singapore with a BSc (Hons) degree in Science. He has passed the Chartered Financial Analyst (CFA) level 1 examination and likes reading up on stock market news and updates.

Sze Han likes to incorporate fundamental and technical analysis when advising clients on stocks, ETFs and CFDs.