Why Do Bid-Ask Spread Matter in Trading? September 11, 2023

Why Do Bid-Ask Spread Matter in Trading?

The bid-ask spread is the difference between the bid and ask price for a given trading instrument. The bid price represents the highest price a buyer is willing to pay for the instrument, while the ask price represents the lowest price a seller is willing to accept. There are many ways an investor can interpret what a bid-ask spread represents for the instrument, including:

- Barometer of Liquidity: a smaller spread suggests higher liquidity, meaning more buyers and sellers are willing to negotiate in the market.

- Trading Risk: a wide bid-ask spread presents greater risk of not trading the instrument at the best prices possible.

- Guide to Type of Order to be placed: normally, if the bid-ask spreads are narrow, you can get the best price with the market order itself. However, if the spreads are wider, then a limit order will be a better choice.

- Direction or Momentum of the market: narrowing and widening of the bid-ask spread is an indication of the direction or momentum of the market movement.

Over-the-counter trading, or OTC trading, refers to a trade that is not made on a formal exchange. Instead, most OTC trades are between the investor and his broker. The broker is therefore termed as the “principal” to the trade. The most popular OTC market is forex (i.e. foreign exchange), where currencies are bought and sold via a network of banks. Forex trading is decentralised and can take place 24 hours a day, as opposed to an exchange’s open and close timing restrictions. With the broker acting as the principal, it is therefore important to understand that both the bid and ask prices are determined by the broker, a process often referred to as “market-making”. The prices determined are often based on two components, namely, (1) what the broker is able to hedge their risk at; and (2) markups. This is also why OTC products can be offered at zero commissions as the intended commissions are represented as markups in prices.

So what do these mean for you?

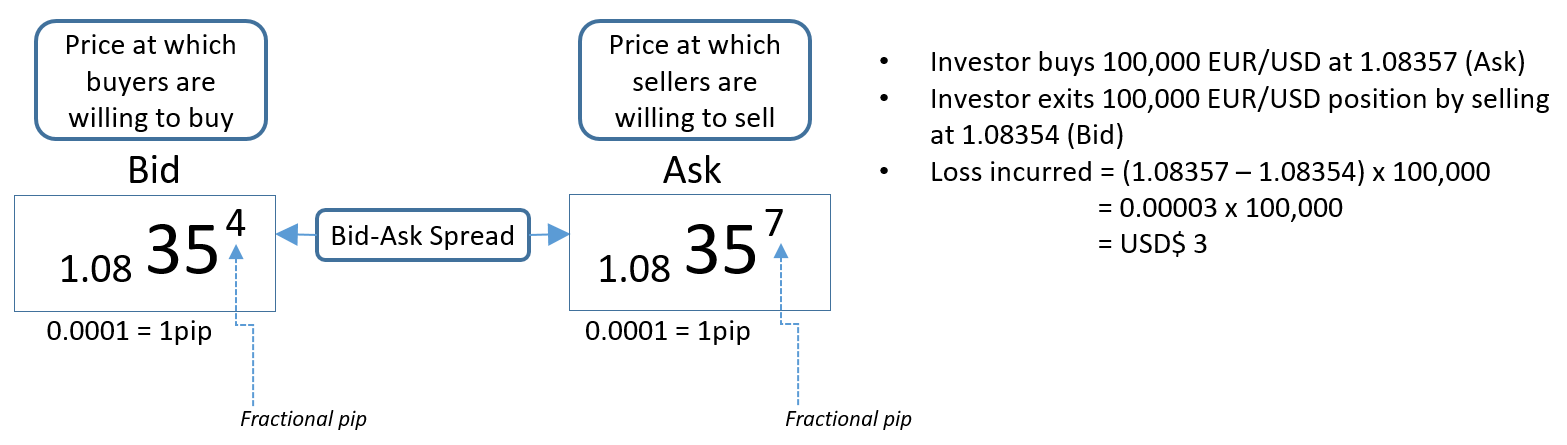

A bid-ask spread primarily represents transactional cost to an investor. Why is this so? When you enter a trade, you will eventually need to exit. The turnaround costs to an investor would therefore be buying at the ask price (where a seller is willing to sell), and selling at the bid price (where a buyer is willing to buy), even without any changes to the asset’s price. Just on this transactional operation, the investor would have incurred a cost based on how wide the bid-ask spread is.

The bid-ask spread is therefore important as an investor would not want the erosion of profits by high trading costs. Furthermore, when investors uses stop-loss type orders, they should have the assurance that the prices provided by their brokers are competitive (i.e. not a wide bid-ask spread) at least 90% of the time to prevent large slippages.

Example of how transactional costs are calculated through a forex bid-ask spread

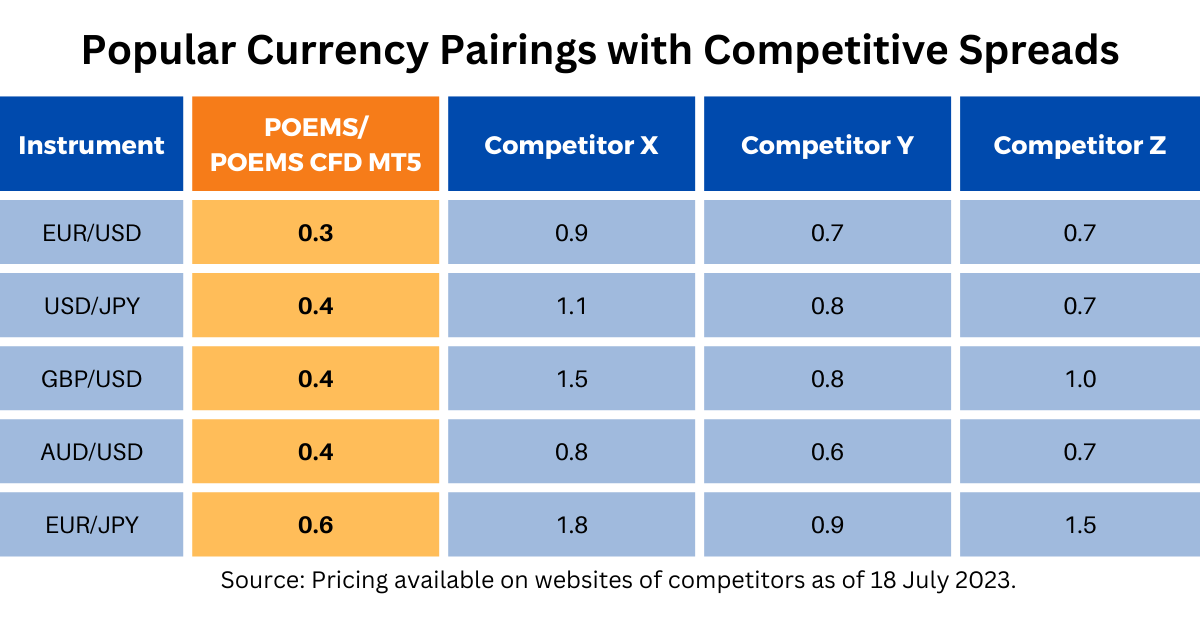

Not surprisingly, across various trading instruments, trading forex incurs one of the least transactional costs due to its extremely competitive bid-ask spread. The forex market also offers one of the highest leverage levels among all forms of investing. Therefore, adding forex into your portfolio (either for hedging or speculative purposes), is at a fraction of capital requirement and at very low transactional costs.

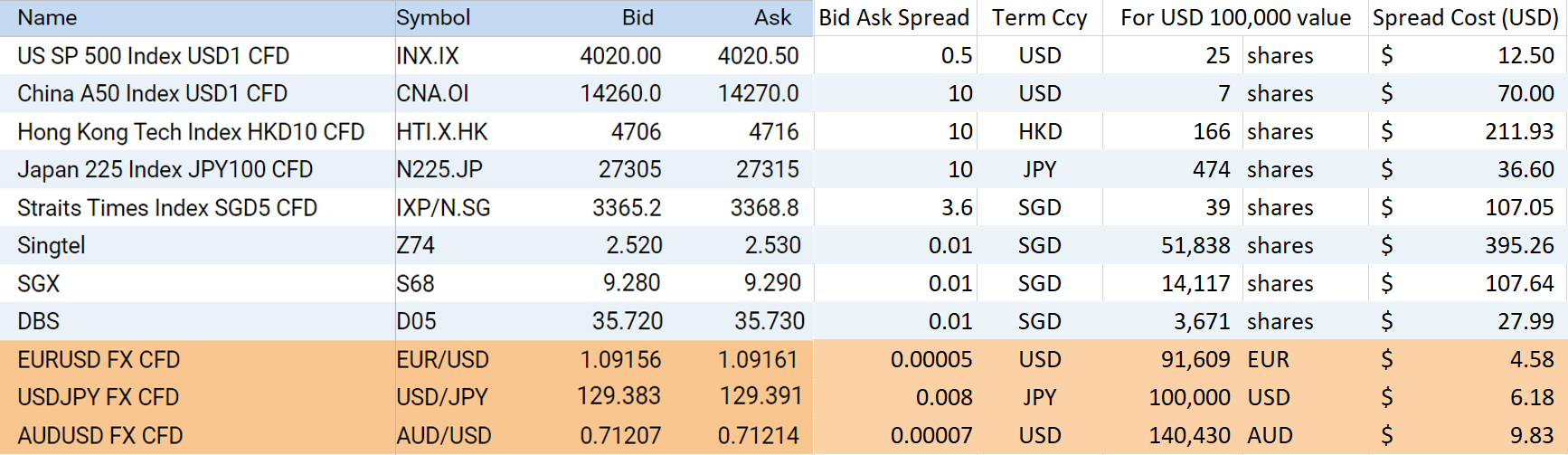

Screenshot for illustrative purposes on typical spreads provided by PhillipCapital’s POEMS platform

It is also important to choose the right broker as the counterparty and “market-maker” to your trades. It is essential to understand if your broker is providing these at zero commission with no financing charges, no platform fees, and no added market data fees.

In conclusion, it is important to understand the transactional cost involved in the trading instrument of your choice. The bid-ask spread can also be representative of how competitive your broker is.

PhillipCapital offers a wide range of forex (FX) CFDs to trade from, allowing traders to diversify their portfolio with the forex market. You can find the list of FX CFD currency pairs available here

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account, you may visit here to open one with us today.

Lastly, investing in a community is much more fun. You will get to interact with us and other seasoned investors who are generous in sharing their experience and expertise.

In this community, you will be exposed to quality educational materials, stock analysis to help you apply the concepts, unwrap the mindset of seasoned investors, and even post questions.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

Promotion

Earn up to S$360 cash credits when you trade FX CFDs!

From 3 July to 29 September 2023, enjoy up to S$120 cash credits every month and earn up to S$360 cash credits when you trade FX CFDs for 3 consecutive months (July, August and September).

*T&Cs Apply.

For more information, click here.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Kenneth Tan

Head of FX CFD

Kenneth Tan graduated from Nanyang Business School with a Master of Science in Financial Engineering. Having worked as a spot and NDF trader for a top bank in Japan and an option dealer with one of France's top five banking groups, Kenneth has devoted more than 15 years to developing the FX business and strongly believes that investing in FX instruments is essential to every investor. He enjoys learning about how automated strategies can enhance trading experience for clients.