Harvest Your Regular Income with Phillip SING Income ETF

The Phillip SING Income ETF focuses on 30 high quality Singapore Listed stocks to offer investors a cost-effective and diversified exposure to the Singapore market. By using a rule/factor-based approach for stocks selection, the ETF aims to deliver stable and quality income for investors.

The Phillip SING Income ETF provides investors with:

- Easy access to 30 high quality Singapore Listed Stocks

- Liquidity, transparency and diversification across the Singapore market

- Stable and quality income with semi-annual dividend distribution

- Strategic Beta for stocks selection with emphasis on

- Business Quality

- Financial Health

- Dividend Yield

Learn more about the ETF by watching Phillip SING Income ETF: Access High Quality Singapore Stocks.

For more information about ETFs, please visit https://www.poems.com.sg/products/etf/

Key Information

| Instrument Type: | Exchange Traded Fund (“ETF”) |

| Tracked Index: | Morningstar® Singapore Yield Focus IndexSM |

| Exchange Listing: | SGX-ST |

| EIP / SIP Classification | Excluded Investment Products (EIP). Investors can trade EIP without any prerequisite. |

| Trading Currency: | Singapore dollars (S$) |

| Estimated Gross Dividend Yield: | ~5% (Based on Index’s performance, without accounting for expenses and costs) |

| Dividend Distribution Frequency: | Semi-annual distribution. (June and December) Distributions, if any, will be payable within two months after the end of each semi-annual period of each year. However, investors should note that such distribution is not guaranteed and is subject to all times to the discretion of the Manager. There is currently no dividend reinvestment service. |

| Expense Ratio | Expense ratio is capped at a maximum of 0.70% per annum. |

| Manager: | Phillip Capital Management |

Comparisons between Traditional Market Cap ETF and Strategic/Smart Beta ETF

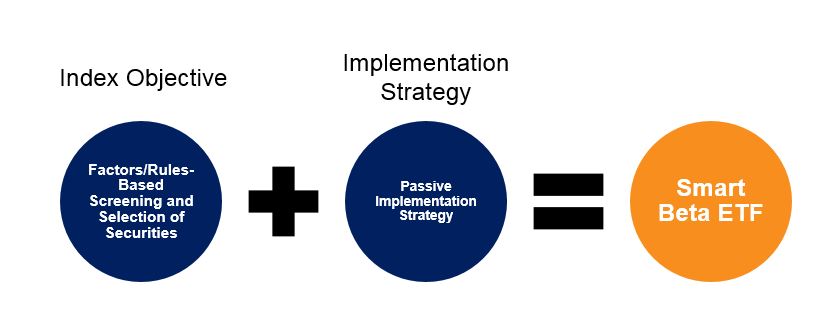

Strategic/Smart Beta ETF utilises rules/factors-based approach to achieve its investment objective.

Similar to traditional Market Capitalisation Weighted ETFs, Strategic / Smart Beta ETFs employ a passive implementation strategy to make management of the ETF transparent, systematic and quantifiable.

| Type: | Traditional Market Cap ETF | Strategic / Smart Beta ETF |

| Index Criteria: | Based on Market Capitalisation | Rules / Factors-Based Screening |

| Weighting: | Market Capitalisation Weighting | Rules / Factors-Based Weighting |

| Management Strategy: | Passive Implementation | Passive Implementation |

Figure 1: Smart Beta ETF Index Objective and Implementation Strategy

Learn more about Smart Beta ETFs at Rise of the Smart Beta ETFs

Benchmark Index Information:

| Key Attributes of the Index | |

| Index Objective | The Morningstar Dividend Yield Focus (DYF) Index Series is designed to track high-yielding companies screened for superior quality and financial health. Morningstar® Singapore Yield Focus IndexSM aims to track the performance of top 30 SGX listed companies based on a quality income strategy using the proprietary factors that underpin the successful Morningstar DYF family of indexes. |

| Underpinning Factors |

1. Business Quality The index screens for companies with sustainable competitive advantage. Competitive advantages protect income stream from erosion. 2. Financial Health The index methodology avoids companies with deteriorating balance sheets at risk of financial distress. 3. Dividend Yield The index’s weighting scheme maximises yield and anchors the portfolio in the most liquid and stable companies, while capping security weight as a risk control. Individual security weights are capped at 10% to avoid excessive security concentration and to enhance diversification. |

| Number of Stocks | 30 |

| Sector Allocation | Financial Services – 39.1% REIT – 17.45% Industrials – 16.63% Telecommunications – 16.03% Consumer – 7.37% Others – 2% Real Estate – 0.40% |

| Top 10 stocks in Index |

|