DAILY MORNING NOTE | 04 October 2022

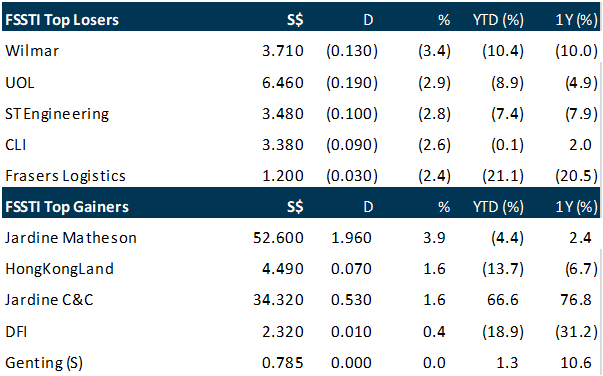

Singapore shares resumed their decline after breaking a five-day slide last Friday, as did most key regional peers on Monday (Oct 3), following Wall Street’s downward trend. The Straits Times Index (STI) fell 0.7 per cent or 23.15 points to 3,107.09, with 24 of the 30 counters that make up the benchmark down. But the stable of Jardine counters closed with gains. Jardine Matheson Holdings was up 3.9 per cent at US$52.60, Hongkong Land rose 1.6 per cent to US$4.49, and DFI Retail Group ended 0.4 per cent higher at US$2.32, while Jardine Cycle & Carriage climbed 1.6 per cent to S $34.32. Wilmar International topped the loser chart of STI stocks and hit a 52-week low at S$3.71, as the agribusiness company slid 3.4 per cent or S$0.13. PropNex International shares were down by another 4 per cent to a 52-week low of S$1.44, having lost 2.6 per cent last Friday, as the real estate agency became the property play most badly affected by the latest property cooling measures. The top traded stock was Sembcorp Marine, which logged a turnover of some 107.6 million shares by the time the counter closed flat at S$0.106.

Wall Street equities staged a stunning rebound on Monday with gains over more than 2 per cent, recouping some of the losses of the past weeks that led to the worst month for the market in 20 years. The Dow Jones Industrial Average jumped more than 760 points or 2.7 per cent to end the day at 29,490.89. The broad-based S&P 500 gained 2.6 per cent to close at 3,678.43, while the tech-rich Nasdaq Composite Index rose 2.3 per cent to 10,815.44. A key manufacturing survey showing price pressures receding and demand slowing, helped buoy market sentiment, amid resurging hopes the Federal Reserve might soon pull back on its aggressive interest rate hikes. Investors remain concerned about the Fed’s policy tightening as it battles to bring down the highest inflation in 40 years, even as a top central banker repeated the message that high costs are broad-based and will take time to bring down.

SG

Recruitment and consulting company HRnetGroup is acquiring a majority 51 per cent stake in fintech startup Octomate from both an independent seller and Octomate’s chief executive and co-founder Zoey Tong. HRnetGroup will acquire a total 49 per cent interest in the startup through a cash payment of S$650,000 to an unnamed independent seller. Another 2 per cent of the company will be sold to the group by Tong. The total consideration of the acquisition amounts to S$676,530.61. The group said it will announce the consideration paid to Tong once it enters into a sale and purchase agreement with her. Founded in 2019, Singapore-headquartered Octomate is a cloud-based workforce management software built on blockchain technology. Its solutions include the automation of salary and reimbursement of claims. In an announcement on Monday (Oct 3), HRnetGroup said its acquisition of the startup will facilitate the integration of Octomate’s instant payment solution with its own Ease Works app, which allows contractor employees to be paid instantaneously upon approval of their timesheets. HRnetGroup’s executive director and chief corporate officer Adeline Sim said the transaction will introduce a new benefit of earned wage access to contractors at “absolutely no cost to them”. The acquisition is expected to complete by Oct 10. Going forward, the group intends to develop Octomate “further as an exciting product offering”. The startup will remain an independent brand of HRnetGroup. Shares of HRnetGroup were down 0.7 per cent or S$0.01 at S$0.74 as at 1.01 pm on Monday.

Singapore Airlines (SIA) Group will ramp up its flights to Japan from Oct 30, even as the country has said it will abolish a slew of Covid border controls from next Tuesday (Oct 11). In a statement on Monday, the group said that its flagship carrier SIA will, from Oct 30, mount an additional daily service to Tokyo’s Haneda Airport – SQ636 – on top of the existing daily SQ634 service to Haneda, and daily SQ638 service to Tokyo’s Narita Airport. Oct 30 is also the day SIA will reinstate its Singapore to Osaka service, SQ618, bringing services between the two cities to twice daily. Scoot, the group’s low-cost airline, will increase its service frequencies to these Japanese cities from Oct 30 to daily as well, from four times weekly to Tokyo (Narita) via Taipei and five times weekly to Osaka. Scoot is already operating daily flights from Singapore to Narita. The announcement came as JoAnn Tan, SIA’s senior vice-president for marketing planning, said the group intends to be “nimble” in adjusting its services in response to the demand for air travel. Pointing out that the group is seeing strong demand for air travel “towards the year-end holiday season”, she added: “Many customers are especially keen on destinations that have remained largely closed over the last few years.” SIA Group on Monday also announced that it will increase service frequencies to Hong Kong, South Korea, Taiwan and mainland China to meet the buoyant demand, particularly towards the year-end holiday season and in the first three months of 2023. With the changes, SIA Group’s passenger network will cover 110 destinations in 36 countries and territories from Nov 1 onwards, it said, pointing out that it will continue to closely monitor the demand for air travel and adjust its services accordingly. Shares of SIA closed down 0.8 per cent or S$0.04 at S$5.06 on Monday.

Metro Holdings announced on Monday (Oct 3) the acquisition of a retail property in Australia and four student accommodations in the United Kingdom to deepen its presence across its key markets. The Australian property is a freehold neighbourhood retail centre called Shepparton Marketplace in Victoria, and it was bought by Metro Holdings with its joint venture (JV) partner, Sim Lian Group of Companies, for A$91 million (S$85.7 million). The UK properties, which are also freehold, were bought for about £74.4 million (about S$119 million). Releasing the information in a bourse filing, the mainboard-listed property investment and development group said that the legal completion of the UK properties’ acquisition, through its student accommodation fund, Paideia Capital UK Trust, took place on May 31. The trust is 30 per cent owned by Sun Capital Assets, a wholly-owned subsidiary of the company, with the remaining 70 per cent held by Lim Kim Tah Holdings, Aurum Investments, and a third party. Aurum is a direct wholly-owned subsidiary of Woh Hup Holdings. Metro’s group chief executive officer Yip Hoong Mun remarked that the four acquisitions’ completion “during this volatile period” is testament to the capability of its joint venture partners. Together with its two existing UK properties – Red Queen in Warwick and Dean Street Works in Bristol – Metro said its total student accommodation portfolio is now valued at £130.0 million. Metro also noted that these properties achieved a high committed average occupancy rate of 99.2 per cent as at Jun 30. Meanwhile, Metro said that the legal completion on the acquisition of Shepparton, through Sim Lian-Metro Capital, took place on Sep 30. Metro owns 30 per cent equity stake in the JV. The addition will bring its Australian portfolio to a total of 17 properties, comprising four office buildings and 13 retail centres spanning four states – New South Wales, Victoria, Queensland and Western Australia. Their total appraised value is A$1.2 billion, and occupancy is high as well, at 95.1 per cent, with Shepparton’s occupancy at 97.3 per cent, it pointed out. Metro shares closed down 1.5 per cent at S$0.665 before the announcement on Monday.

US

The US Supreme Court on Monday (Oct 3) again declined to hear Apple Inc’s bid to revive an effort to cancel three Qualcomm Inc smartphone patents, despite the settlement of the underlying dispute between the two tech giants. The justices left in place a lower court’s decision against Apple after similarly turning away in June the company’s appeal of a lower court ruling in a closely related case challenging two other Qualcomm patents. Qualcomm sued Apple in San Diego federal court in 2017, arguing that its iPhones, iPads and Apple Watches infringed a variety of mobile-technology patents. That case was part of a broader global dispute between the tech giants. Apple challenged the validity of the patents at issue in this case at the US Patent and Trademark Office’s Patent Trial and Appeal Board. The companies settled their underlying fight in 2019, signing an agreement worth billions of dollars that let Apple continue using Qualcomm chips in iPhones. The settlement included an Apple licence to thousands of Qualcomm patents, but allowed the patent-board proceedings to continue. The board upheld the patents in 2020, and Apple appealed to the patent-specialist US Court of Appeals for the Federal Circuit. California-based Apple argued it had proper legal standing to appeal because Qualcomm could sue again after the licence expires, potentially as soon as 2025. A Federal Circuit three-judge panel, in a 2-1 ruling, dismissed the case last year for a lack of standing, finding that Apple’s risk of being sued again was speculative and the challenge would not affect its payment obligations under the settlement. Qualcomm has again argued that Apple has not shown a concrete injury to justify the appeal, just like in the “materially identical” case that the high court rejected.

General Motors’ third-quarter vehicle sales increased 24% compared to a year ago, when supply chain issues weighed more heavily on the company’s output. The Detroit automaker on Monday said it sold 555,580 vehicles from July through September, up from about 447,000 a year earlier, when sales were depressed due to Malaysia-related supply issues of semiconductor chips. The increase was in line with or higher than industry analysts’ expectations of an at least 21.6% increase. Regarding electric vehicles, GM said it plans to increase production of its Chevrolet Bolt EV and EUV after the vehicles recorded their best quarterly sales ever at 14,709 units. GM intends to boost calendar-year production for global markets from approximately 44,000 vehicles in 2022 to more than 70,000 in 2023. The increase for GM’s older Bolt models is in contrast to production of the pricy GMC Hummer EV pickup. Beginning in late November, the company on Monday said it will pause production of the pickup for several weeks to pull ahead body shop upgrades for the upcoming electric Chevrolet Silverado. The company has been producing the Hummer EV pickup, which was the first vehicle to feature GM’s next-generation Ultium batteries and platform, at a snail’s pace compared to its typical output of vehicles. The automaker has only sold 782 Hummer EVs, which currently cost more than $100,000. Through the first nine months of the year, GM’s sales totaled 1.65 million, down 7.1% compared to the same time period in 2021. GM ended the third quarter with 359,292 vehicles in dealer inventory, including units in-transit, an increase of 111,453 units from the previous quarter. That’s nearly three times the inventory available at the end of the third quarter of 2021, when Covid-related supply chain issues impacted production. GM is among the first major automakers to report third-quarter sales Monday. Overall, analysts estimate automakers sold 3.4 million new light-duty vehicles in the U.S., down less than 1% from the same time last year. Automakers continue to deal with supply chain issues – from semiconductors and wire harnesses to smaller parts such as vehicle and company logos.

Peloton will put bikes in all 5,400 Hilton-branded hotels in the United States as part of a partnership announced Monday, as the bike maker pushes to expand its reach. The partnership will provide at least one bike to each hotel fitness center, including locations of the 18 Hilton brands, such as Hampton Inn, Embassy Suites and Doubletree. Hilton Honors members will also receive a 90-day free trial of the Peloton app. Hilton hotels that already have Peloton bikes will have the option to add another. The company says that rollout will begin in the coming weeks, with the majority of locations equipped by the end of the year. The partnership builds on an existing hotel footprint for Peloton, which says hotel guests have completed 1.6 million Peloton rides so far in 2022. Peloton, which began as an exclusive, direct-to-consumer brand, has shifted gears to a broader mass-market approach. Last week, the company announced that its bikes, treadmills and other hardware would be sold in Dick’s Sporting Goods locations. Peloton previously launched nationwide bike rentals, certified preowned bikes and a sales partnership with Amazon. It’s all part of a larger turnaround effort by CEO Barry McCarthy, who took the helm from co-founder John Foley in February. The company announced significant changes and layoffs during the transition of power, as it grappled with the end of pandemic-era demand. A representative from Peloton called this year “transformative” for the company and indicated that more changes to the company’s strategy are to come. Foley left his role as executive chair in mid-September alongside fellow co-founder and Chief Legal Officer Hisao Kushi and the company’s first international hire, Chief Commercial Officer Kevin Cornils. Last week, Peloton’s head of marketing Dara Treseder departed the company for an executive position at Autodesk.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Phillip 4Q22 Singapore Strategy – Hibernating for winter

Analyst: Paul Chew

• The STI was up a modest 0.9% in 3Q22. Only a third of the component stocks managed to eke out gains.

• We are bearish this quarter. We believe the US economy faces a high probability of a recession next year. Rising interest rates globally will further deflate both valuations and earnings.

• Singapore’s corporates are in much better shape, backstopped by a resilient domestic economy and rising interest rates bolstering bank margins.

Upcoming Webinars

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Research Videos

Weekly Market Outlook: Spotify, SATS, Nanofilm, Technical Pulse, SG Weekly

Date: 03 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials