DAILY MORNING NOTE | 05 October 2022

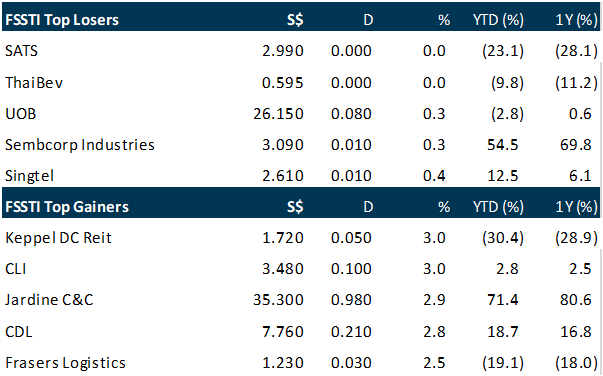

Asian equities, including Singapore’s, were cued by Wall Street’s overnight relief rally, and ended higher on Tuesday (Oct 4). Factory data from the United States last night showed that the world’s top economy had underperformed, and this made investors hopeful that the hawkish Federal Reserve might ease its interest rate hikes. While a handful of markets closed over 2 per cent higher, Singapore’s blue-chip benchmark, Straits Times Index (STI), managed to rise only 1.02 per cent or 31.81 points to 3,138.9 points, as some of the excitement had fizzled out by the time the closing bell rang. Sats shares remained sluggish despite its counterpart and key customer in the aviation sector Singapore Airlines (SIA) having said it would raise frequencies to East Asia. The inflight caterer and ground handler’s acquisition it proposed last week of air cargo handler Worldwide Flight Services led the counter to fall off the cliff. Sats shares were flat at S$2.99, compared to SIA’s 1 per cent rise to S$5.11 at market close. Sats and Thai Beverage were the only counters among the 30 STI stocks that did not finish higher.

WALL Street stocks rallied for a second straight session on Tuesday amid hopes of a US monetary policy pivot, as Twitter surged on the revived chance of Elon Musk’s takeover. The tech-rich Nasdaq Composite Index led the major indices, powering up 3.3 per cent to close at 11,176.41. The Dow Jones Industrial Average rose 2.8 per cent to 30,316.32, while the broad-based S&P 500 jumped 3.1 per cent to 3,790.93. After a bruising September ended another losing quarter for Wall Street, equities have soared the last two days as analysts point to hopes of moderating monetary policy. The Reserve Bank of Australia (RBA) raised its policy interest rate less than expected, a 0.25 percentage point hike which was half of what had been forecast, and said that while more increases will be needed to tame inflation it wanted to pause to assess the impact of rapid moves implemented this year. The yield on the 10-year US Treasury, a proxy for interest rates expectations, retreated further as investors bet that weakening economic data will prompt a similar pullback from the US Federal Reserve.

SG

Cortina Holdings will buy over the fourth level of 15 Scotts Road, a freehold commercial building, from Singapore Institute of Management Group for S$49 million, the luxury watch retailer and distributor announced on Tuesday (Oct 4). In a bourse filing, the mainboard-listed company said the proposed acquisition came as the group foresees needing more office space given that it envisages “organic growth” in the near term, but prefers to own rather than rent the space from others. Currently, the group’s offices in Singapore operate from leased premises. Some of the leases would terminate in the near term, it pointed out. “The property would be able to satisfy our group’s need for office space in the near term when the existing tenancies to which the property is subject terminate at the end of their terms,” it said. If the sale goes through, the company’s earnings per share is expected to rise to 41.7 Singapore cents, from 41.5 cents, based on the assumption that the proposed acquisition had been effected at the beginning of the 2022 financial year, Cortina pointed out. Cortina intends to pay for the property in cash. So far, it said it has paid S$490,000 to be granted the option to purchase. It now has till 4 pm on Oct 14 to exercise the option, upon which another S$1.96 million is due. The rest of the sum will be paid by Dec 1, the date of the sale’s completion, it added. Cortina shares closed 6.3 per cent or S$0.25 lower at S$3.70 on Tuesday, before the announcement.

Japan Foods Holding’s subsidiary, Japan Foods Enterprises (JFE), is suspended from applying for and renewing work passes as the Ministry of Manpower (MOM) has launched an investigation into its hiring and payroll practices involving foreigners. Announcing this in a bourse filing on Tuesday (Oct 4), the Catalist-listed restaurant operator said the company understands the investigation relates to “certain past hiring and payroll practices”, which have since ceased. To deal with the suspension, Japan Foods Holding said it would have to streamline operational work-flow at its outlets and employ more part-timers and contract staff. JFE will also work on “right-balancing” its workforce, it added. But these do not mean that any of the group’s existing operating outlets will have to be shut temporarily, it stated. It will, meanwhile, “cooperate fully” with MOM’s investigation, it said, adding that the Board will monitor its progress and update shareholders as and when material developments arise. Takahashi Kenichi founded Japan Foods Holding in 1997, and is executive chairman and chief executive officer of the group. Brands under the company include Afuri, Ajisen Ramen and Fruit Paradise. Shares of Japan Foods Holding closed flat at S$0.42 before the announcement.

Singapore’s local banks have raised the interest rates on their fixed-rate home loan packages to 3.5 per cent and above, weeks after DBS and UOB said they were reviewing their fixed-rate offerings. After hiking the interest rates on fixed-rate home loan packages in late June, DBS is raising its rates further to 3.5 per cent. This is a 0.75 percentage point rise from the earlier 2.75 per cent interest rate offered by Singapore’s largest lender. Based on DBS’ website on Tuesday (Oct 4) morning, the revised interest rate now applies across all four of the bank’s fixed rate packages with commitment periods ranging from two to five years. The move comes after fresh measures were introduced by Singapore’s government to tighten limits on housing loans with effect from Sep 30, in a bid to ensure prudent borrowing and moderate demand. DBS last raised its interest rates on all fixed-rate home loan packages to 2.75 per cent per annum, from just 1.65 per cent for a two-year fixed loan and 1.85 per cent for three-year loans previously. As at end-June, the move placed its rates as the highest among the trio of local banks. Meanwhile, UOB on Oct 4 disclosed that its two-year and three-year fixed rate home loan packages now bear per annum interest rates of 3.75 per cent and 3.85 per cent, respectively. UOB’s fixed rate for two-year home loan packages was 2.98 per cent as at Jun 29. On Sep 23, UOB temporarily ceased its two and three-year fixed rate packages as it was reviewing its offering, following news of another interest rate hike by the Federal Reserve. As for OCBC, its two-year fixed rate has been revised to 3.5 per cent, up from 2.98 per cent as at Sep 23. The lender is also relaunching a one-year fixed rate package at 3.35 per cent, it said on Oct 4.

US

Meta Platforms announced a series of new ad formats on Tuesday (Oct 4), aimed at creating new revenue streams for the short video and business messaging products that it has identified as key to growth this year. In a blog post, the parent company of Facebook and Instagram said it was starting tests for a new skippable “post-loop” video ad format to play after its TikTok-like short video product Reels, which it has been promoting heavily. Another new Reels format features horizontally scrollable carousel ads, which can display between two and 10 images at the bottom of a Reel, the post said. Describing the company’s business strategy at a press event, Meta executives said the new formats could lure Reels creators with ways to earn money from ad placements next to their videos. The executives also touted ads that open direct chats between businesses and prospective customers saying Meta can now use artificial intelligence to optimise whether the ads target new customers or those most likely to make a purchase. Artificial intelligence would, likewise, power the selection of ads shown in users’ Instagram feeds, the company said, citing internal research involving 400,000 advertisers that showed the approach produced more user purchases than other feed ads. Meta is also opening up new spaces for advertising on Instagram, including the ‘Explore’ tab that users see when they run a search in the app, the blog post said.

Micron Technology said it plans to invest as much as US$100 billion over the next 20 years to build a factory in upstate New York to boost US production of memory chips. The announcement on Tuesday (Oct 4) represents the largest private investment in New York state history, according to a statement from Boise, Idaho-based Micron. The company said the first phase investment of US$20 billion, in Clay, New York, is planned by the end of this decade. The New York site, which will generate about 50,000 jobs in the state, including about 9,000 high-paying Micron positions, adds to the company’s previously announced manufacturing facility in Boise. The company said it expects to get US$5.5 billion in incentives from the state of New York over the course of the project. The so-called megafab chip factory complex is part of Micron’s strategy to “gradually increase American-made leading-edge DRAM production to 40 per cent of the company’s global output over the next decade,” Micron said in a statement. Micron’s commitment comes after the US government passed the CHIPS and Science Act in August, providing US$52 billion to boost domestic semiconductor research and development. The bill is at the centre of the Biden administration’s effort to reduce dependence on Asian suppliers like Taiwan and South Korea, whose homegrown companies are leading the market, and to address supply-chain disruptions and resulting price hikes for certain goods containing semiconductors. The bill’s signing spurred US chip companies to plan billions of US dollars in new investments. For example, Qualcomm is partnering with GlobalFoundries, which also has a facility in New York state, in a US$4.2 billion agreement to manufacture chips. Site preparation work will start next year and construction will begin in 2024. Production output will increase in the latter half of the decade, gradually increasing in line with industry demand, according to the statement from Micron.The site, near Syracuse, New York, could eventually include four 600,000 square foot cleanrooms, accounting for a total of 2.4 million square feet of cleanroom space – the size of about 40 US football fields.

Ford Motor on Tuesday said its sales in the third quarter increased about 16% compared with a year earlier, despite a larger-than-expected decline in September. The Detroit automaker, which reports sales monthly, said it sold 142,644 vehicles last month, an 8.9% decline from a year earlier. The drop caused the automaker to miss quarterly sales expectations of Cox Automotive and Edmunds, which forecast gains of 19% and 17.8%, respectively. Ford’s stock was up about 7% in midday trading Tuesday, outpacing a broader uptick in the market. The automaker’s crosstown rival, General Motors, was also up about 7%. New vehicle demand “remains strong” with retail orders “rapidly expanding,” according to Andrew Frick, Ford vice president of sales, distribution and trucks — despite rising interest rates and fears of an economic downturn or recession. Ford’s quarterly sales outpaced the industry, which auto analysts forecast to be down by less than 1% compared with a year earlier. Automakers continue to deal with supply chain issues, from semiconductors and wire harnesses to smaller parts such as vehicle and company logos. Economic and supply chain issues caused Cox Automotive last month to lower its 2022 new vehicle sales forecast to 13.7 million, representing a decline of more than 9% from 2021 and the lowest volume in a decade. Ford’s vehicle sales through the quarter increased, but were down by about 4% compared with the second quarter, as the company manages through supply chain problems. Ford’s September sales report comes weeks after the automaker told investors that parts shortages affected roughly 40,000 to 45,000 vehicles, primarily high-margin trucks and SUVs, that haven’t been able to reach dealers. The company also said at the time that it expects to book an extra $1 billion in unexpected supplier costs during the third quarter. Sales of Ford’s profitable F-Series pickups were down by 27% last month from September 2021, contributing to a roughly 13% decline through the third quarter. The company sold 8,760 models of its all-electric F-150 Lightning pickup through September, including 1,918 vehicles last month. Ford’s 2022 electric vehicle sales totaled more than 41,200 units through September. A majority of those sales are Mustang Mach-E crossovers, which have increased 49% compared with last year to more than 28,000 units. Year-to-date sales of all of Ford’s vehicles, including its luxury Lincoln brand, totaled more than 1.38 million units through September, a 1.2% decrease from a year ago.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Research Videos

Weekly Market Outlook: Spotify, SATS, Nanofilm, Technical Pulse, SG Weekly

Date: 03 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials