DAILY MORNING NOTE | 06 October 2022

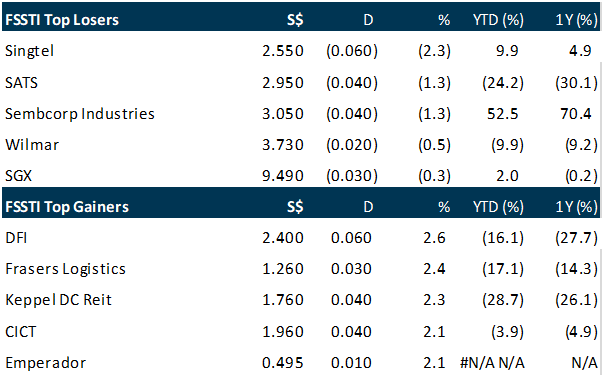

With Wall Street in a rally after a significant drop in the number of US job openings, the Singapore stock market and its regional counterparts closed higher on Wednesday (Oct 5), as investors believed that the Federal Reserve might now become less hawkish. Singapore’s blue-chip barometer, the Straits Times Index (STI), rose 14.33 points or 0.46 per cent to 3,153.23 points, with only five of the 30 constituents in the red: Singtel (-2.3 per cent), Sats (-1.3 per cent), Sembcorp Industries (-1.3 per cent), Wilmar International (-0.5 per cent) and SGX (-0.3 per cent). A day after local banks stated their mortgage rates had been raised to as high as 3.85 per cent, their stock prices rose in tandem; UOB, OCBC and DBS jumped 1.3 per cent, 0.5 per cent and 0.1 per cent respectively to S$26.50, S$11.99 and S$33.42. Earlier, CLSA stated in its note that banks were the only clear sector beneficiary of the rate hikes by the Fed.

Wall Street stocks finished a volatile session modestly lower on Wednesday (Sep 5), snapping a two-day winning streak following solid US economic data. US private employment increased by 208,000 last month as schools reopened and pandemic concerns receded, with hiring accelerating after a slowing in August, according to data from payroll firm ADP. The report comes ahead of Friday’s key government jobs release, which will be scrutinised for its implications for Federal Reserve interest rate hikes. The Dow Jones Industrial Average slipped 0.1 per cent to close at 30,273.87. The broad-based S&P 500 declined 0.2 per cent to 3,783.28, while the tech-rich Nasdaq Composite Index dropped 0.3 per cent to end the session at 11,148.64. The Fed has been aggressively hiking interest rates to combat elevated inflation, a dynamic that has seen equity investors welcome signs of slower US growth.

SG

Sembcorp Marine (Sembmarine) on Wednesday (Oct 5) said its subsidiary won a US$3.1 billion engineering, procurement and construction contract via an international tender from Brazilian state-owned oil and gas producer, Petroleo Brasileiro (Petrobras). This is for a P-82 floating, production, storage and offloading (FPSO) vessel, which will be one of the largest vessels to be deployed in the Buzios field – an 853 square kilometre ultra-deepwater oil and gas field about 180 kilometres off the coast of Rio de Janeiro in Brazil. The vessel is scheduled for delivery in the first half of 2026 and is expected to start commercial operations in the same year, Sembmarine said in a bourse filing. The P-82, part of Petrobras’ new generation of production facilities, is characterised by its high production capacity and technologies which reduce CO2 emissions. The P-82 contract is also the largest one obtained by Sembmarine from Petrobas to date, adding about S$4.3 billion to Sembmarine’s order book, which stands at S$2.5 billion as at end-June 2022. The group does not expect the contract to have a material impact on its net tangible assets or earnings per share for the current fiscal year. Shares of mainboard-listed Sembmarine closed 4.59 per cent or S$0.005 higher at S$0.114 on Wednesday.

Catalist-listed Chaswood Resources has killed its deal to acquire battery maker HK Aerospace Beidou New Energy Technology. The deal, proposed last December, would have resulted in a reverse takeover (RTO) of the Malaysian restaurant operator. Having consulted its acquisition’s full sponsor, Chaswood would be voluntarily seeking delisting by initiating exit offer proposals with its major shareholders and other possible parties, said the company in a filing to the Singapore Exchange on Wednesday (Oct 5). In its statement, Chaswood noted that anti-Covid movement restrictions implemented by the Chinese government have made it difficult for due diligence and restructuring for the RTO to be carried out – and so the parties have mutually agreed to axe the deal. The RTO costs incurred, Chaswood noted, were borne by the vendor as per the agreement, and therefore its net tangible assets and earnings per share for the fiscal year to December 2022 would not be materially impacted. Trading of Chaswood shares has been suspended since mid-2018.

Best World International, known for its direct selling business of health and beauty products, has received a “no-objection” from SGX RegCo to resume trading. The company’s shares have been suspended since 2019, after questions were raised over the legality of its business model in China, one of its key markets. The issue came amid short selling attack by a set up called Bonitas Research. However, before the shares can resume trading, there are a few other conditions to be met, with a clear onus on the company’s audit committee. Best World is to obtain an updated independent legal opinion on the legality of the company’s sales and distribution business model in China within 4 months after its financial year-end on an annual basis and announcing. In the event the company’s own audit committee believes such a legal opinion is no longer required, the committee is to consult SGX RegCo. Next, Best World is to announce the audit committee’s assessment of whether it is satisfied that the concerns raised on the legality of the company’s sales and distribution business model in China have been addressed and the bases for such an assessment. The company is to also get the RegCo’s greenlight before any changes made to its board of directors for the coming three years. Best World is to also announce its board can confirm if sufficient information has been disclosed to enable trading of its shares to resume in “a fair and orderly manner.”

US

The US dollar rose on Wednesday (Oct 5), a day after suffering its biggest one-day drop in more than two years, as the excitement of the previous day’s rally in stocks and risk-friendlier currencies wore off. The US dollar index was last up 0.64 per cent to 110.87, after tumbling 1.3 per cent on Tuesday. The index, which measures the greenback against a basket of major currencies, has fallen just under 4 per cent since touching a 20-year high of 114.78 last week. The euro fell 0.67 per cent to US$0.9921 after rising 1.7 per cent on Tuesday. Sterling was down 1.08 per cent to US$1.1352, after rising for six straight sessions. Its fall extended slightly as UK Prime Minister Liz Truss pledged to bring down debt as a share of national income, just over a week after the government’s plans to slash taxes and ramp up borrowing spooked markets. Recent gains for most major currencies against the US dollar have been underpinned by hope among investors and traders that the US Federal Reserve will raise interest rates by less than previously expected. A bigger-than-anticipated fall in the number of job openings in August was the latest evidence that the US economy is gradually slowing. The US benchmark S&P 500 stock index jumped more than 3 per cent on Tuesday.

OPEC+ agreed to cut its collective output limit by 2 million barrels day, delegates said, as the group seeks to halt a slide in oil prices caused by the weakening global economy. It’s the biggest reduction by the Organization of Petroleum Exporting Countries and its allies since 2020, but will have a smaller impact on global supply than the headline number suggests. Several member countries are already pumping well below their quotas, meaning they would already be in compliance with their new limits without having to reduce production. A cut of 2 million barrels a day in the group’s output target, shared pro rata, would require just eight countries to curb actual production and deliver a real reduction of about 880,000 barrels a day, according to Bloomberg calculations based on September output figures. Oil prices fell in London, dropping 0.4 per cent to US$91.35 a barrel as of 3.05 pm. Even so, the cartel’s decision risks adding another shock to a global economy that is already battling inflation driven by high energy costs. The move would also irk the US – and potentially trigger a response from Washington. President Joe Biden visited Saudi Arabia earlier this year in search of higher production and lower pump prices for Americans ahead of midterm elections in November. Earlier on Wednesday (Oct 5), US officials were making calls to counterparts in the Gulf trying to push back against the move to cut production, according to people familiar with the situation. Already, the White House had asked the US Energy Department to analyse whether a ban on exports of petrol, diesel and other refined petroleum products would lower prices, Bloomberg reported on Tuesday. It’s a controversial idea but one that’s gaining traction in some corners of the Biden administration.

US Mortgage rates jumped to a 16-year high of 6.75 per cent, marking the seventh-straight weekly increase and spurring the worst slump in home loan applications since the depths of the pandemic. The contract rate on a 30-year fixed mortgage rose nearly a quarter percentage point in the last week of September, according to Mortgage Bankers Association (MBA) data released on Wednesday (Oct 5). The steady string of increases in mortgage rates resulted in a more than 14 per cent slump last week in applications to purchase or refinance a home. Over the past seven weeks, mortgage rates have soared 1.30 percentage points, the largest surge over a comparable period since 2003 and illustrating the abrupt upswing in borrowing costs as the Federal Reserve intensifies its inflation fight. The effective 30-year fixed rate, which includes the effects of compounding, topped 7 per cent in the period ended Sep 30, also the highest since 2006. MBA’s index of applications to purchase a home plummeted 12.6 per cent to 174.1, the lowest level since 2015, while the gauge of refinancing dropped 17.8 per cent to a 22-year low. Prospective homebuyers may soon experience some respite in the rapid upturn in borrowing costs given the US 10-year Treasury yield has eased so far this week. Other measures of mortgage rates also put the cost of borrowing around 6.7 per cent. Last week, Freddie Mac’s data, which is released on Thursdays, showed that the average for a 30-year loan climbed to 6.7 per cent, the highest since 2007, in the week ended Sep 29. Mortgage News Daily, which updates more frequently, puts the 30-year rate at 6.65 per cent on Tuesday. The MBA survey, which has been conducted weekly since 1990, uses responses from mortgage bankers, commercial banks and thrifts. The data covers more than 75 per cent of all retail residential mortgage applications in the US.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Technical Pulse: Lucid Group, Inc

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 15.40 Stop loss: 13.50 Take profit: 17.65

Lucid Group, Inc (NASDAQ: LCID) A potential bullish reversal to the upside after breaking out of the downtrend.

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Research Videos

Weekly Market Outlook: Spotify, SATS, Nanofilm, Technical Pulse, SG Weekly

Date: 03 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials