Daily Morning Note – 12 April 2022

Stocks to watch: Singapore Exchange

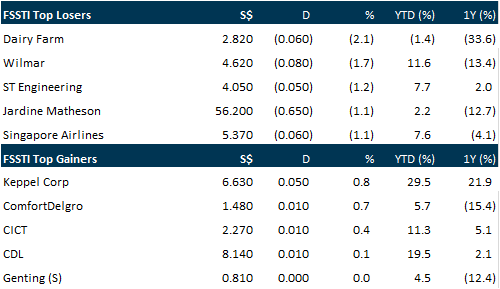

Local shares ended the first trading day of the week in the red. Like regional stock markets, the Singapore bourse took a cue from a rise in China’s inflation data. China’s March producer price index (PPI) also rose 8.3 per cent year-on-year, official data showed. In Singapore, the benchmark Straits Times Index fell 0.6 per cent or 19.72 points on Monday (Apr 11) to close at 3,363.56. Daily turnover came in at 1.74 billion securities worth a total of S$1.28 billion. Decliners outpaced advancers 336 to 150. It was also a sea of red across the region. The KLCI fell 0.2 per cent; the Kospi shed 0.3 per cent, and the Hang Seng Index fell 3 per cent. The Nikkei 225 and the SSE Composite Index lost 0.6 per cent and 2.6 per cent respectively.

Wall Street closed sharply lower on Monday (Apr 11) as investors started the holiday-shortened week in a risk-off mood, as rising bond yields weighed on market-leading growth stocks ahead of crucial inflation data. All 3 major US stock indexes ended deep in negative territory, with tech and tech-adjacent stocks pulling the Nasdaq down 2.2 per cent. The Dow Jones Industrial Average fell 413.04 points or 1.19 per cent to 34,308.08, the S&P 500 lost 75.75 points or 1.69 per cent to 4,412.53 and the Nasdaq Composite dropped 299.04 points or 2.18 per cent to 13,411.96. All 11 major sectors in the S&P 500 ended the session in the red, with energy shares suffering the biggest percentage losses.

SG

OCBC Securities and Lion Global Investors will list a new exchange-traded fund (ETF) on April 28 that focuses on Singapore companies with low carbon intensity. The ETF, which will be listed on the Singapore Exchange (SGX), will track the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index, OCBC said in a statement on Monday (Apr 11). OCBC, together with bourse operator SGX, had launched the new index earlier in March, to track the top 50 Singapore companies by free-float market capitalisation with low carbon intensity. The carbon intensity of each of the companies in the index are verified by Sustainalytics, an investment research firm specialising in environmental, social and governance (ESG) research, ratings and data, the bank said.

Total market turnover value on the Singapore Exchange (SGX) reached S$35.7 billion in March 2022, down 8 per cent on the year but up 21 per cent from the month before. Volumes were 44 per cent higher month on month at 38.1 million shares but down 29 per cent year on year, SGX said in its monthly market statistics report on Monday (Apr 11). Gains in derivatives volume drove performance for the first 3 months of 2022. Securities turnover also rose as the Straits Times Index (STI) was the top-performing stock benchmark in the Asia-Pacific, with a 9.1 per cent price return and 9.6 per cent total return. The securities daily average value (SDAV) for March stood at S$1.6 billion, down 5.4 per cent on the month and 8 per cent lower year on year. SDAV for the January-to-March period jumped 32 per cent quarter on quarter to S$1.46 million amid “a flight to quality” and expectations of higher interest rates. Derivatives daily average volume (DAV) hit a 2-year high in March, with 1.2 million contracts. This came as total traded volume advanced 42 per cent month on month to 26.3 million contracts.

United Overseas Bank expects “limited” impact in the near term from competition from new digital banks – with about 5 per cent of its revenue at risk – as it believes the Singapore banking market is highly penetrated and incumbent banks are “well trusted” by consumers. The bank, founded in 1935, was responding to questions from shareholders and investor watchdog, the Securities Investors Association (Singapore), prior to its Apr 21 annual general meeting, with the responses filed on Saturday (Apr 9) with the bourse. Singapore has issued the consortium made up of mainboard-listed Singtel and Nasdaq-listed Grab Holdings, and NYSE-listed consumer Internet company Sea each a full digital bank licence, allowing them to take deposits from and provide banking services to retail and non-retail customer segments. Two digital wholesale bank licences went to an Ant Group unit and a consortium comprising Greenland Financial Holdings Group Co, Linklogis Hong Kong and Beijing Co-operative Equity Investment Fund Management Co, for them to take deposits from and provide banking services to small and medium enterprises and other non-retail customer segments. These digital banking players could be beginning their operations in 2022, and a recent study by the Institute of Service Excellence (ISE) at the Singapore Management University showed that 40 per cent of bank customers were willing to try out the digital banks. The take-up rate was noted to be pretty consistent among the different age groups, from those in their twenties to those in their sixties.

Capitaland Investment Limited’s (CLI) unit The Ascott has set a target to sign 150 properties with over 30,000 units under its lyf co-living brand by 2030, the mainboard-listed property manager announced at the official opening of lyf one-north Singapore on Monday (Apr 11). There are currently 17 lyf properties with over 3,200 units in 14 cities and 9 countries. The apartments, social spaces and experiential programmes are designed for guests to forge connections and nurture a strong sense of community, its media statement said. CLI’s CEO for lodging, Kevin Goh, said: “We see the potential to expand our lyf portfolio to 150 properties by 2030. In addition to growing the lyf brand via management contracts, we also see attractive opportunities for our private funds and Ascott Residence Trust to deploy more investments into this product class.” Presently, 2 lyf properties – lyf Funan Singapore as well as lyf Gambetta Paris, Ascott’s first lyf-branded property in Europe slated to open in 2023 – are owned by the Ascott Serviced Residence Global Fund.

US

Apple faces an additional EU antitrust charge in the coming weeks in an investigation triggered by a complaint from Spotify, a person familiar with the matter said, a sign that EU enforcers are strengthening their case against the US company. The European Commission last year accused the iPhone maker of distorting competition in the music streaming market via restrictive rules for its App Store that force developers to use the Apple in-app payment system and prevent them from informing users of other purchasing options. Such requirements have also come under scrutiny in countries such as the United States and Britain. Extra charges set out in a so-called supplementary statement of objections are usually issued to companies when the EU competition enforcer has gathered new evidence or has modified some elements to boost its case. The Commission declined to comment. Apple had no immediate comment. Under new EU tech rules called the Digital Markets Act (DMA) agreed last month, such practices are illegal. However Apple and other US tech giants targeted by the rules will have a couple of years before the crackdown starts.

Twitter Inc’s investors were left bewildered after Elon Musk decided not to join the company’s board, leading to a share price swing and increased speculation that the world’s richest person could mount a takeover of the social media platform. Following discussions with management, Musk decided against joining Twitter’s board over the weekend, a dramatic reversal that also ends a previous agreement to keep his stake at no more than 14.9 per cent. Twitter shares initially fell over 7 per cent in pre-market trading on Monday in New York, before paring losses and recovering slightly. At 9:50 am ET (9.50 pm Singapore time), the stock was up nearly 3 per cent to US$47.51. The initial drop erased part of a week of gains after he revealed he had taken a stake, with investors seeming to welcome his investment. Musk has gone from “helping move Twitter strategically forward to likely a ‘Game of Thrones’ battle between Musk and Twitter”, said Dan Ives, analyst at Wedbush, “with the high likelihood that Elon takes a more hostile stance towards Twitter and further builds his active stake in the company”.

Tesla exported only 60 China-made cars in March, a trade body said on Monday (Apr 11), with the domestic market absorbing most of its production while virus curbs in areas like Shanghai and Jilin hurt deliveries in the auto industry. Shanghai is home to Tesla’s multibillion-dollar “giga-factory”, which the company calls its main export hub and has the capacity to produce hundreds of thousands of vehicles per year. But the factory – like much of the country’s auto industry – has been hit by pandemic-related disruptions. While Tesla China delivered 65,814 cars at its factory last month, only 60 were exported, the China Passenger Car Association (CPCA) said Monday, without giving further details. In comparison, the company had exported 33,315 vehicles in February. Tesla’s slump is part of a wider trend across China, where car sales fell 10.5 per cent from a year ago to 1.6 million vehicles on the back of strict measures to curb renewed virus flare-ups that have hit logistics and retail sales.

Oil prices fell about 4 per cent on Monday (Apr 11), with Brent crude tumbling below US$100 a barrel on worries that the Covid-19 pandemic will cut demand in China and as International Energy Agency (IEA) countries plan to release record volumes of oil from strategic stocks. US West Texas Intermediate (WTI) closed at its lowest since Feb 25, the day after Russian forces invaded Ukraine, an action Moscow calls a “special military operation”. Brent futures fell US$4.30 or 4.2 per cent to settle at US$98.48 a barrel, while WTI crude fell US$3.97 or 4 per cent to settle at US$94.29. It was the lowest close for Brent since Mar 16. Fuel consumption in China, the world’s biggest oil importer, has stalled with Covid-19 lockdowns in Shanghai, analysts at the Eurasia Group consultancy said. Shanghai, China’s financial centre, started easing lockdowns in some areas on Monday despite reporting a record of more than 25,000 new Covid-19 infections.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Click the link to join: https://t.me/stocksbnb

Date: 11 April 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.