DAILY MORNING NOTE | 12 August 2022

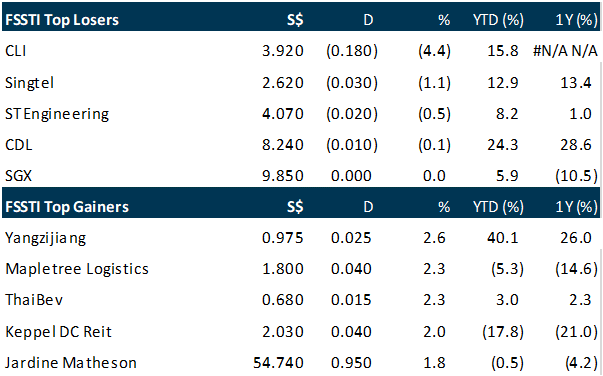

Singapore stocks were up for a second day running on Thursday (Aug 11) amid a regional rally, as traders found relief in news that inflation is decelerating in the US. The US inflation data fuelled bets that the Federal Reserve could pivot to a less aggressive pace of hikes. The benchmark Straits Times Index (STI) closed 0.5 per cent or 15.63 points higher at 3,301.96, while major indexes in Hong Kong, Australia and South Korea rose between 1.1 and 2.4 per cent. Japan’s market is closed for a holiday. Most STI constituents rallied along with the sentiment, but not Capitaland Investment Limited, which took a drastic turn from being among Wednesday’s top performers to shed 4.4 per cent after posting a dismal set of financial results. Singtel, ST Engineering and City Development Limited were the 3 other STI counters that closed lower, slipping between 0.1 and 1.1 per cent. The top performers were Yangzijiang Shipbuilding, Mapletree Logistics Trust and Thai Beverage, which closed up between 2.3 and 2.6 per cent. The trio of banks traded up between 0.7 and 1 per cent. In the broader market, Yangzijiang Financial was the most actively traded counter by volume. The counter closed down 1.3 per cent at S$0.39 after 89.5 million of its shares worth S$35.3 million exchanged hands.

A rally in US stocks petered out on Thursday, with markets ending mixed as analysts weighed encouraging inflation news against expectations that the Federal Reserve will continue to raise interest rates. Americans received a much-welcomed sign that some inflation relief is in store early in the day when a Labor Department report showed that wholesale prices cooled sharply in July. The producer price index (PPI) fell 0.5 per cent compared to June, on a nine percent drop in energy prices. The news came just a day after data showed consumer price inflation also slowed last month, pulling back from a 40-year high that has left many families struggling to make ends meet. The widely anticipated CPI report prompted a Wall Street rally that carried over into Thursday. But the upward momentum had mostly ebbed by the session’s close. The broad-based S&P 500 closed down 0.1 per cent at 4,207.27. But the Dow Jones Industrial rose 0.1 per cent to end the day at 33,336.67, while the tech-rich Nasdaq Composite Index dropped 0.6 per cent to end at 12,779.91. While “the market has been on a tear,” eventually the “reality does settle in” that the Fed will continue to lift interest rates based on persistently high inflation, said Patrick O’Hare of Briefing.com. As for individual stocks, news that activist investor ValueAct Capital Partners has taken a 6.7 per cent stake in The New York Times lifted shares of the newspaper company by 10.6 per cent. Disney, meanwhile, was up 4.7 per cent after reporting better-than-expected quarterly earnings, as well as a leap in paying subscribers for its streaming service.

SG

CITY Developments Limited (CDL) on Thursday (Aug 11) posted a record net profit of S$1.1 billion for the first half ended Jun 30, reversing from a net loss of S$32.1 million recorded in the same period last year. This was mainly due to the divestment gains from the sale of Millennium Hilton Seoul (S$496.2 million) and Tagore 23 warehouse in Singapore (S$27.3 million), as well as the total gain of S$492.4 million (inclusive of negative goodwill) from the group’s deconsolidation of CDL Hospitality Trusts (CDLHT), which resulted from the distribution in specie of CDLHT units in May 2022. Excluding the above 3 items, net profit for H1 2022 would have been S$110.3 million. The S$1.1 billion net profit was the highest net profit achieved since CDL’s inception in 1963, it said in a statement. The results translate to earnings per share of S$1.235, against a loss per share of S$0.042 in the corresponding period a year ago. Revenue was up 23.5 per cent to S$1.5 billion, from S$1.2 billion. CDL said the increase in revenue was mainly due to the hotel operations segment, although the group’s property development segment continued to lead contributions.

Mainboard-listed Nanofilm Technologies posted a 5.1 per cent year-on-year increase in net profit to S$18.8 million from S$17.9 million previously, according to its results filing on Thursday (Aug 11). Revenue for the group rose 15.2 per cent to S$111.3 million, up from S$96.6 million in the year-ago period. Earnings per share stood at S$0.0286, up from S$0.0271 previously. The group has proposed an interim dividend of S$0.011 per share after considering its well-capitalised balance sheet and cash-generating operations. In H1 2022, the group’s production capacity in Shanghai was hampered by a lack of labour and logistics flow and as a result, there was an estimated S$8 million revenue loss from these restrictions. The nanotechnology solutions provider noted that despite the challenging operating environment caused by Shanghai’s Covid-19 lockdown, the group was still able to grow its revenue and profit, underscoring its unique deep-technologies reach in multiple growth avenues across vast industries and its strong business foundations put in place by management. The counter closed 2.4 per cent or S$0.05 higher at S$2.11 on Thursday, before the results announcement.

Industrial conglomerate Hong Leong Asia’s net profit rose 4.5 per cent year on year to S$42.6 million for the first fiscal half ending Jun 30, up from S$40.7 million in the year-ago period. However, revenue was down 26.1 per cent to S$2.1 billion from S$2.84 billion previously, as the group’s key business segment – diesel engines in China – recorded lower sales volume and revenue for H1 2022, Hong Leong Asia noted in its bourse filing on Thursday (Aug 11). Earnings per share stood at S$0.057 against H1 FY2021’s S$0.054. The group attributed this to renewed Covid-related lockdowns in cities across China which had impacted commercial vehicle demand. Although the diesel engine market conditions remain challenging in China, Yuchai is focused on making available its portfolio of Tier-4 compliant off-road engines for implementation as China transitions towards a more stringent emissions standard in late-2022. It will also develop “New Energy” solutions, the group added, citing its hydrogen engine development and range extender ventures as recent examples. The building materials unit (BMU) revenue increased 26.5 per cent to S$282 million with reportable segment net profit of S$28.7 million, compared with S$10.7 million previously as construction activities in Singapore and Malaysia continue to recover, driving demand for concrete and related products. Hong Leong Asia said it is cautiously optimistic that the main business units will continue to demonstrate their resilience in a difficult operating environment in the second half of 2022.

US

Apple is close to erasing its losses for the year as softer-than-expected inflation data fuelled a risk-on rally in the stock market on Wednesday (Aug 10). The iPhone-maker edged 2.6 per cent higher to US$169.24 as investors piled back into stocks on bets the Federal Reserve could dial back the size of future interest-rate hikes after the July consumer price index showed a deceleration in growth from the prior month. Megacap tech stocks all rallied with Meta Platforms and Netflix leading the pack on a more than 5.8 per cent gain each, while the Nasdaq 100 Index advanced 2.9 per cent. The tech-heavy benchmark closed 20 per cent higher from its June low. Since bottoming in mid-June, Apple’s shares have surged about 30 per cent, outpacing the S&P 500 Index and the Nasdaq 100. That’s put the tech giant back on top as the world’s most valuable company and within reach of turning positive for the year. It is now down just 4.7 per cent in 2022, compared with a drop of 18 per cent for the Nasdaq 100. Apple, which has a market value of about US$2.7 trillion, surpassed oil giant Saudi Aramco again in July to become the world’s largest company. The recent surge puts its shares back in the expensive camp, trading at 26.4 times profits projected over the next 12 months, well above its 10-year average at 16.7 times. That compares with the Nasdaq 100 which is priced at 23 times earnings and the S&P 500 at 17.8. About 96 per cent of analysts covering the stock recommend investors buy or hold on to their positions, according to data compiled by Bloomberg, with an average forecast of a 6.9 per cent gain in its shares over the next 12 months.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Pan-United Corporation – Construction recovery hit slight snag in 1H22

Recommendation: BUY (Maintained), Last Done: S$0.45

Target price: S$0.54, Analyst: Terence Chua

• 1H22 revenue in line with our expectations, at 51%. Profit however, came in lower at 34% as result of higher staff and materials costs.

• Net profit grew 83% YoY driven by higher ASP of ready-mixed concrete (RMC) +18% YoY, higher GPM +1.4% and a higher share of results from associates of $3.6mn.

• Workplace fatalities and dengue hampered recovery. Volumes declined 10-15% as a result of the spate of stop-work orders issued by the authorities to construction sites.

• Maintain BUY with lower target price of S$0.54, from S$0.68. We trim FY22e/FY23e earnings by 26%/11% respectively on account of higher staff, utilities and materials costs. Our TP is based on 12x FY22e P/E, a 20% discount to its 10-year historical average P/E on account of the still uncertain business environment.

FAANGM Monthly July 22 – Strongest month of this year

Recommendation: OVERWEIGHT (Maintained); Analyst: Jonathan Woo, Maximilian Koeswoyo

• The FAANGM gained 13.4% in July, modestly better than the Nasdaq’s gain of 12.6%. The S&P 500 also gained 9.1% for the month. July saw its largest monthly gains for the year. FAANGM and Nasdaq remain down 20.7% YTD, while the S&P 500 is down 13.3%.

• META and GOOGL were the laggards – down 2.0% and up 5.7% respectively, hurt by the pullback in economic sensitive advertising spend. AMZN and NFLX were the best performers, jumping 27.2% and 28.7% respectively, largely due to better-than-expected revenue/subscription numbers.

• We remain OVERWEIGHT on FAANGM as we continue to believe that they will be long-term winners. Secular tailwinds remain intact for streaming, cloud, and digital advertising.

Upcoming Webinars

Guest Presentation by Marathon Digital Holdings

Date: 16 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Research Videos

Weekly Market Outlook: AirBnb, Apple, Amazon, DBS, OCBC, First Sponsors, Starhub, SG Weekly & More

Date: 8 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials