DAILY MORNING NOTE | 12 December 2022

**Do note that the last day of Morning Note Issuance is on 15 December 2022. Morning Note will resume in January 2023**

Week 50 Equity Strategy: The focus this week will be the FOMC meeting. Powell has already guided 50 basis point hike. Instead, investors will be eyeballing the terminal rate or end point for the Fed Funds rate. Recent September meeting it was 4.6%. This could move a notch higher to 4.8-5%. The negative reaction in equities to modestly higher than expected PPI suggest the recent bounce on a slower Fed has ended. Risk reward does not look favourable if CPI data on Tuesday is not better than the expected 0.2-0.3% MoM rise.

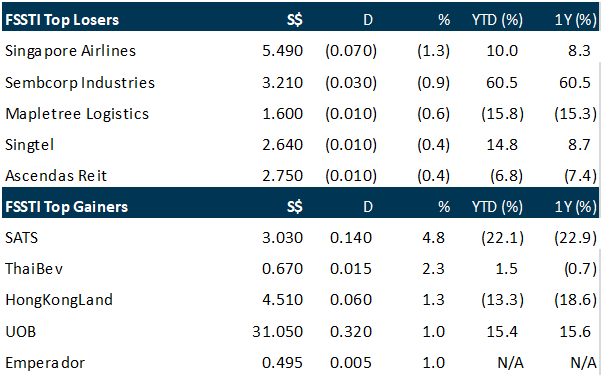

Singapore stocks rose on Friday (Dec 9), tracking a broader rally in Asian markets. The benchmark Straits Times Index (STI) rose 0.3 per cent or 9.89 points to close at 3,245.97. Sats led the STI gainers on Friday, climbing 4.8 per cent to close at S$3.03. It was also one of the top gainers for the week, rising 13.5 per cent from last Friday’s close. Hong Kong-headquartered DFI Retail Group finished at the top of the index performance table for the week, gaining 15.4 per cent over the five trading days. Meanwhile, shares of Singapore Airlines, which were trading on an ex-dividend basis, fell 1.3 per cent on Friday to close at S$5.49, the worst STI performer for the day. Yangzijiang Shipbuilding was the biggest decliner on the index for the week, falling 4.9 per cent since last Friday’s close.

Wall Street ended lower on Friday (Dec 9) as investors assessed economic data and awaited a potential 50-basis point interest rate hike by the US Federal Reserve at its policy meeting next week and consumer prices data for November due Tuesday that will provide fresh clues on the central bank’s monetary tightening plans. The S&P 500 declined 0.7 per cent to end the session at 3,934.38 points. The Nasdaq declined 0.7 per cent to 11,004.62 points, while Dow Jones Industrial Average declined 0.9 per cent to 33,476.46 points. Wall Street’s main indexes have fallen this week after logging two straight weekly gains. For the week, the S&P 500 dropped 3.4 per cent, the Dow lost 2.8 per cent and the Nasdaq shed 4 per cent.

SG

Seafood restaurant operator o Signboard has entered into an agreement to sell its intellectual property (IP) rights to controlling shareholder GuGong, for an amount not exceeding S$10,000. This includes all its rights, title and interest in the trademarks and brand insignia associated with the business. The shareholders and directors of GuGong are No Signboard’s executive chairman and chief executive officer Lim Yong Sim as well as chief operating officer and executive director Lim Lay Hoon. In a bourse filing on Friday (Dec 9), the company it intends to rebrand its casual and quick-serve restaurant outlets operating under the “No Signboard” name. Proceeds from the IP sale will go towards the rebranding exercise, it added. The IP disposal is conditional on GuGong voting in favour of proposals at an extraordinary general meeting, held on Nov 30, for share consolidation, transfer of controlling interest, and subscription shares allotment, among other things. The Catalist-listed company is in the midst of a court-supervised restructuring exercise, which is to include a scheme of arrangement with the scheme creditors to reorganise the company’s liabilities and deleverage the balance sheet of the group. As GuGong has fulfilled its voting undertaking, No Signboard is to comply with Catalist rules by – in addition to the IP disposal – appointing GuGong as a business consultant to the company for a period of no less than three years, for an annual fee to be mutually agreed by the parties. Trading of No Signboard’s shares has been suspended since Jan 24.

NoonTalk Media Limited has been awarded the project for the overall event management of the Football Mania Event by Jewel Changi Airport. The event was done in partnership with Qatar Airways. The event is held at Shiseido Forest Valley from 3 December to 18 December 2022. NoonTalk Media manages and executes the overall event programme, including any interactive elements, to engage Jewel shoppers as they enjoy the live screening of football matches. To enhance Jewel shoppers’ experience, NoonTalk will host a series of digital activities, such as a Live E-Football Tournament Games that allows shoppers to take part in a virtual football tournament. Viewers of the live matches will also be able to vote for their favourite teams and stand a chance to win attractive prizes. As a provider of end-to-end media production solutions, NoonTalk Media will also tap into its vast talent portfolio to perform as emcees at the live football screening events.

Food and beverage company Yeo Hiap Seng group chief executive officer (CEO) Samuel Koh has resigned and will hand over the helm to current chief operating officer Ong Yuh Hwang from Jan 1, 2023. Koh, who joined Yeo’s in January 2020 and became group CEO in March, will take on the role of consultant from Jan 1 to Jun 3 next year – or at an earlier date mutually agreed upon – to ensure an orderly transition. Koh resigned to pursue other interests, the company said in a statement on Friday (Dec 9). Ong served as CEO of Suntory Garuda Beverage Indonesia for over two years before joining Yeo’s as chief operating officer in September 2022. At Suntory Garuda, he was responsible for end-to-end business across all functions. He worked at Procter & Gamble from 1996 to 2020, and took on various senior appointments. These include vice-president for sales and operations at Procter & Gamble Philippines and CEO for Malaysia, Singapore, Cambodia, Brunei and Pacific Island. Daphne Heng Hee Choo, the incumbent deputy chief financial officer (CFO), has been promoted, assuming the role of CFO on Dec 9. Heng joined Yeo’s as group director for internal audit and risk management in July 2020, and was promoted to deputy CFO in June this year.

US

U.S. producer prices rose faster than expected in November, in another sign that inflation isn’t coming down as fast as the Federal Reserve would like. The producer price index rose by 0.3% from October, more than the 0.2% consensus, and October’s number was also revised up to 0.3% from 0.2%. The picture was flattered by volatile food and energy prices: without those two elements, the ‘core’ producer price index rose 0.4%, the most since June. That left the core year-on-year rate of factory gate inflation at 6.2%. While that’s the lowest reading in over a year, the result of big increases in energy prices last year passing out of the equation, analysts had forecast a steeper decline to 5.9%. More recent developments in energy markets also helped, with gasoline prices down 6.0% on the month. The headline annual PPI rate similarly declined only to 7.4% from an upwardly revised 8.1% in October. Analysts had forecast a slowdown to 7.2%.

Taiwan Semiconductor Manufacturing Co (TSMC) reported sales rose by 50 per cent in November, a month challenged by slumping consumer electronics demand and Covid disruptions in China. The world’s biggest maker of made-to-order chips reported revenue of NT$222.7 billion (S$9.8 billion) for the period, adding to a long streak of increasing sales that was supercharged by a spike in demand during the pandemic. The company is also the exclusive supplier of Apple’s silicon chips for iPhones and Macs. Hsinchu-based TSMC, Taiwan’s most valuable company, has been spending heavily to expand its production capacity and handle more orders. This week, it increased its investment in the US state of Arizona to US$40 billion and hosted President Joe Biden, Apple chief executive officer Tim Cook, Advanced Micro Devices CEO Lisa Su and other industry leaders at an event in Phoenix. TSMC is under pressure to diversify the geographic distribution of its most advanced chipmaking and is working with governments of the US and Japan on developing a more global footprint. The global economic slowdown has diminished consumer demand for many products that TSMC chips go into, but the company and its customers still expect the long-term trend in electronics demand to keep going up. TSMC has committed to spending roughly US$36 billion in capital expenditure this year.

Lululemon Athletica Inc forecast holiday-quarter revenue and profit largely below analysts’ estimates, as shoppers turn cautious about spending on higher-priced clothing amid decades-high inflation. High inflation, rising interest rates and the threat of a recession in the United States have resulted in a shift in consumer spending, impacting sales of apparel and sportswear as cash-strapped consumers focus on essentials. Lululemon lifted its full-year revenue and profit forecasts and beat estimates for third-quarter results. The holiday season is off to a good start with strong traffic over the extended Thanksgiving weekend, Chief Finance Officer Meghan Frank said on a post-earnings call. Lululemon’s inventories at the end of the third quarter rose 85% to $1.7 billion, but Chief Executive Officer Calvin McDonald said that due to supply chain constraints inventory levels were too lean last year and the company made the decision to build inventories this year. “We remain comfortable with both the quality and quantity of our inventory,” McDonald said. The company forecast fourth-quarter revenue between $2.61 billion and $2.66 billion, compared to analysts’ estimates of $2.65 billion.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Pan-United Corporation – Construction recovery slower than expected

Recommendation: BUY (Maintained), Last Done: S$0.405

Target price: S$0.54, Analyst: Terence Chua

– Workplace fatalities hampered the recovery. As a result of the Heightened Safety period imposed by the Ministry of Manpower (MOM), local construction projects are, in general, progressing slower than expected. YTD22 contracts awarded is down 9.4% YoY.

– According to data from the Building and Construction Authority (BCA), demand for ready-mixed concrete (RMC) for the first nine months of 2022 was ~8.8mn cu/m, about 8% lower than our estimate.

– Maintain BUY with unchanged target price of S$0.54. We trim FY22e/FY23e earnings by 12%/11% respectively on account of the Heightened Safety period imposed. Our TP is unchanged as we roll forward our valuations, still based on 12x FY23e P/E, a 20% discount to its 10-year historical average P/E on account of the still uncertain business environment.

PDel Monte Pacific Limited – Record margins from price increases

Recommendation: BUY (Maintained); TP S$0.67, Last close: S$0.315; Analyst Paul Chew

– The results were better than expected. 1H23 revenue and PATMI (excluding one-offs) were 49%/67% of our FY23e forecast. The continued push towards branded products drove gross margins to 29%, and is ahead of our modelled 26% from increases in selling price.

– 2Q23 earnings jumped 38% YoY to US$49.5mn supported by revenue growth (+7%) and expansion in both gross (+2% points).

– We raise our F23e earnings by 19% to adjusted US$123mn. We maintain our BUY recommendation and nudge our target price lower to S$0.67 (prev. S$0.69), pegged to 8x FY23e P/E, a huge 50% discount to the industry valuation due to its smaller market cap and higher gearing. Del Monte valuations are attractive at 4x PE FY23e and an 8% dividend yield. Multiple rounds of price increases and new products have supported gross margin expansion despite cost pressures. The drive towards more branded and new products in the US continues to bear fruit.

LHN Ltd – Co-living the growth driver

Recommendation: BUY (Maintained); Last Done: S$0.295 TP: S$0.47; Analyst: Paul Chew

– FY22 revenue and adjusted PATMI was 91%/100% of our FY22e forecasts. 2H22 adjusted PATMI declined 45% YoY to S$13.4mn due to the absence of worker dormitory earnings.

– Co-living revenue continues to grow strongly with 38% YoY growth in 2H22. Growth was driven by an estimated 25% growth in rooms and a mid-teens rise in room rates.

– Earnings in FY23e will be supported by an estimated 60% expansion in co-living capacity (under Coliwoo brand) by 600 rooms to around 1,600. The new 411 units in Mount Elizabeth will be one of the largest sites for Coliwoo. The absence of dorm earnings will be a drag in 1H23. We maintain a BUY with lower TP of S$0.47 (prev. S$0.51) due to decline in valuations of listed LHN Logistics (LHNL SP, Not Rated). Core business valuations are pegged to 6.5x FY23e P/E, while the industry is trading at 13x. Stock is also trading at 35% discount to book value of S$0.455 with a dividend yield of around 6%.

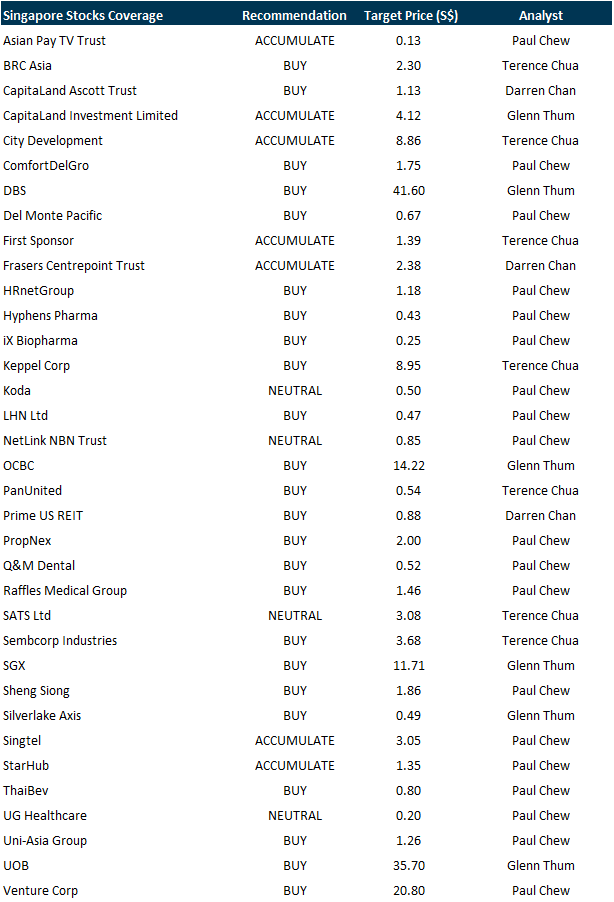

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by NoonTalk Media Limited [NEW]

Date: 13 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3gYzGI2

Guest Presentation by Keppel Infrastructure Trust ( KIT) [NEW]

Date: 15 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UBLxd4

Guest Presentation by iWoW Technology

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Salesforce Inc, ThaiBev, BRC Asia, Tech Analysis, SGBanking, SGWeekly & More

Date: 5 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials