DAILY MORNING NOTE | 12 October 2022

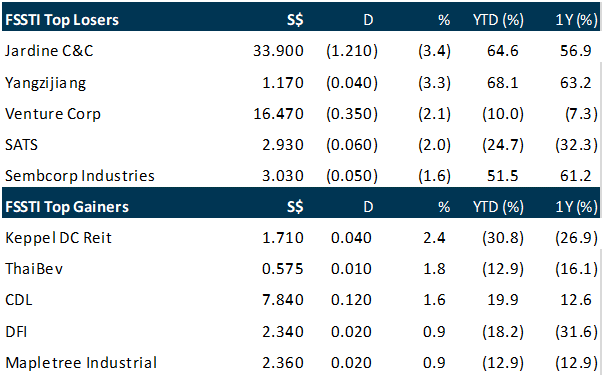

Singapore stocks closed lower for the fourth consecutive day on Tuesday (Oct 11) tracking a decline in most Asian markets following a negative session overnight on Wall Street. The benchmark Straits Times Index (STI) fell 0.1 per cent or 2.47 points to close at 3,105.00. Across the broader market, decliners outnumbered gainers 314 to 199 after 1.4 billion securities worth S$1.1 billion were traded. Venture Corporation was one of the bottom three STI performers on Tuesday, after its shares slipped 2.1 per cent to close at S$16.47. Jardine Cycle & Carriage shares finished at the bottom of the index performance table after falling 3.4 per cent to S$33.90. Meanwhile, units of Keppel DC Reit climbed 2.4 per cent to close at S$1.71 ending the day as the top index gainer.

Wall Street stocks finished a volatile session mostly lower on Tuesday (Oct 11) following a downcast IMF economic forecast, as investors gird for a difficult earnings season. The International Monetary Fund projected 2023 growth of 2.7 per cent, 0.2 points down from July expectations in light of rising inflation, toughening actions from central banks and uncertainty after the Russian invasion of Ukraine. Despite the forecast, major indices pushed into positive territory in the afternoon but weakened again following comments by Bank of England governor Andrew Bailey that the central bank would end emergency bond-buying efforts on Friday, rebuffing calls for a longer programme to allow markets to stabilise. The Dow Jones Industrial eked out a 0.1 per cent gain to 29,239.19. The broad-based S&P 500 fell for a fifth straight session, losing 0.6 per cent at 3,588.84, while the tech-rich Nasdaq Composite Index slid 1.1 per cent to 13,608.09. The forecast comes ahead of critical US inflation data and third-quarter earnings season, which investors fear may reveal the growing risk of a recession.

SG

Total securities turnover on the Singapore Exchange (SGX) in September gained 6 per cent from the previous month to S$25.8 billion while the total market turnover volume fell to 28.8 billion shares compared to 31.6 billion shares in August. Year on year, total securities turnover shed 5 per cent. Total market turnover volume likewise dropped 23 per cent from 37.4 billion shares. In SGX’s monthly market statistics report released on Tuesday (Oct 11), the bourse operator attributed the rise in securities market turnover value to the strong performance of Straits Times Index (STI) constituent stocks and real estate investment trusts (Reits). SGX said that STI’s constituent stocks saw over S$300 million in net institutional flows, with the largest inflows to DBS, OCBC Bank and Singtel. Dual-listed liquor company Emperador, which debuted on SGX Securities with a secondary listing in July, was recently included as an STI constituent. Securities daily average value (SDAV) stood at S$1.2 billion in September, 5 per cent lower year on year but 6 per cent higher on the month. This came as securities average daily volume declined 23 per cent year on year, and 8.8 per cent month on month, to 1.3 billion securities. Derivatives activity also saw an all-time high in September. Derivatives daily average volume (DDAV) rose 14 per cent month on month in September to 1.05 million contracts, achieving a single-day record of 2.97 million contracts on 27 September.

In a midday bourse filing on Tuesday (Oct 11), the Australian unit of Singtel, Optus and some of its wholly-owned subsidiaries have received notices of intention to commence formal investigations by the Office of the Australian Information Commissioner (OAIC) and Australian Communications and Media Authority (ACMA). Optus said it remains committed to working with governments and regulators as it responds to the impact of the cyberattack. In its press statement on the same day, OAIC said it was investigating whether the Optus companies took reasonable steps to protect customer data and comply with privacy laws. It also indicated the possibility of forcing Optus to take steps to ensure the breach cannot be repeated in the event of discovering that “interference with the privacy of one or more individuals has occurred”. On the other hand, ACMA said it was investigating whether Optus met its industry obligations as a telecommunications provider in terms of the keeping and disposing of personal data. The authority added that it was working in conjunction with OAIC and the Department of Home Affairs to “ensure effective information-sharing across the respective jurisdictional investigations”.

Trek 2000 International’s founder Henn Tan was sentenced to 16 months’ imprisonment on Tuesday (Oct 11) for engaging in conspiracies to falsify accounts, forge documents and deceive external auditors of the firm that developed the ubiquitous thumb drive. The 66-year-old former chief executive of mainboard-listed Trek 2000 has been in remand since June, and this period will count towards his jail term. Asking the court to sentence the accused to at least one year and seven months’ jail, the prosecution said his crimes “made a mockery of corporate governance in Singapore”. Offences that affect the integrity of the financial markets therefore warrant a generally deterrent sentence, argued the prosecution. The Singaporean, who shot to prominence as inventor of the revolutionary thumb drive that made the floppy disk obsolete, had earlier pleaded guilty to five charges of engaging in conspiracies to falsify accounts, forging documents to cover his tracks as well as cheating the external auditors, with four other similar charges considered by the court when deliberating on his sentence. From as far back as between 2006 and 2011, Tan had conspired with then chief financial officer Gurcharan Singh to make false entries in the firm’s financial statements over some licensing income. Then, when he realised it would be a dismal fiscal year 2015 for Trek, he conspired with a few senior officers to inflate revenue and pre-tax operating profit by plucking a US$3.2 million sale from thin air, using false documents to support this. When auditor Ernst & Young confronted Tan and his co-accused about the financial statements, they were deceived and told the sale was genuine and the financial statements had been drawn up properly. Trek’s share price was down 12.3 per cent or S$0.01 to S$0.071 at market close on Tuesday.

US

General Motors Co. is starting an energy business to sell power-storage units and services to homeowners and commercial clients, an offshoot of the auto maker’s battery-development work for electric vehicles. GM said the new division, called GM Energy, will help customers transfer electricity from an EV or battery-storage box to a home or building, as a way to protect against power outages and transfer electricity to the grid during off-peak times. For instance, for customers who have bought EVs, GM will offer a special charger to enable the vehicle to power the home during an outage. It will also sell large, stand-alone batteries to commercial customers to store and manage power. Travis Hester, head of GM’s EV growth initiatives, said the company sees a chance to generate revenue from its investment in battery technology beyond the sale of EVs. He declined to offer a revenue target but said executives may outline goals to investors at some point.

Delta Air Lines Inc. is betting on flying-taxi rides to and from airports, announcing a $60 million investment in Joby Aviation Inc. and plans to offer service in New York and Los Angeles. Delta’s investment will give it a 2% stake in Joby, which also has been backed by Uber Technologies Inc. and went public last year. Delta said its investment could grow up to $200 million if certain milestones in the development and delivery of the service are reached. Delta Chief Executive Ed Bastian said: “I’m optimistic that there are better ways, and certainly more sustainable ways, to get to the airport than sitting in one to two hour traffic jams on the way to JFK or LaGuardia or LAX.” He added that there could be more markets “down the road.” Air taxis are not allowed to fly paying passengers right now in the U.S., or elsewhere. Companies involved in the nascent industry have been working to obtain certification for their aircraft and how those vehicles are flown, among other permissions, executives and air-safety officials have said. Earlier this year, the Federal Aviation Administration said it would require air-taxi pilots to have what is called a powered-lift rating, given how the proposed vehicles are expected to vertically take off and land. Delta’s strategy is slightly different from its rivals. It is not planning to buy Joby’s electric vehicles or use its own pilots to fly them, but will outsource and offer the service as an add-on that its customers will be able to book through Delta’s website or app.

Paypal Holdings said it has no intention of fining customers for spreading misinformation, after attracting criticism for publishing a new user agreement outlining such a plan. The issue gained traction over the weekend after the company published policy updates prohibiting users from using the PayPal service for activities identified by the company as “the sending, posting, or publication of any messages, content, or materials” promoting misinformation, in an Acceptable Use Policy due to kick in on Nov 3. A penalty of US$2,500 could be imposed for each violation, according to the update. The notice included “incorrect information”, a spokesperson for PayPal said in a statement to Bloomberg News. “PayPal is not fining people for misinformation and this language was never intended to be inserted in our policy.”

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Singapore Banking Monthly – Interest rates and loans still expanding

Recommendation: Overweight (Maintained)

Analyst: Glenn Thum

– September 3M-SORA/3M-SIBOR was up by 42bps/32bps MoM to 2.31%/2.85%, the highest in more than a decade. 3Q22 3M-SORA average in 2.31%, up 218bps YoY.

– Singapore domestic loans grew 6.7% YoY in August, tracking our estimates, while Hong Kong’s domestic loans declined 0.97% YoY in August.

– Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5% with upside surprise due to excess capital ratios. Stable economic conditions and rising interest rates remain tailwinds for the banking sector. SGX is another beneficiary of higher interest rates [SGX SP, BUY, TP S$11.71].

PayPal Holdings Inc – Two-sided network effect getting stronger

Recommendation: BUY (Initiation); TP: US$116.00

Analyst: Ambrish Shah

– Total payments volume spiked >3x in last 5 years, with the company adding over 200mn active accounts. Powerful two-sided network effect, increasing digital payments and growth of online shopping to drive revenue growth of 13% over the next 2 years.

– PayPal is a compelling business partner as it boosts conversion rates/sales for merchants. Customers are more likely to complete a purchase when core PayPal checkout is available than those using credit cards due to stored credentials.

– PayPal benefits from newer consumer-to-consumer payment trends through its peer-to-peer (P2P) Venmo payment service. Venmo’s total payments volume surged 45% YoY to US$230.1bn in FY21. Venmo will also be available on Amazon later this year.

– We initiate coverage with a BUY recommendation and DCF-based target price (WACC 7.0%, g 4.0%) of US$116.

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 123.42 Stop loss: 115.40 Take profit 1: 144.50 Take profit 2: 156.00

Moderna, Inc (NASDAQ: MRNA) A potential bullish reversal to the upside.

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Research Videos

Weekly Market Outlook: Technical Pulse, 4Q22 SG Strategy & Stock Picks

Date: 10 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials