DAILY MORNING NOTE | 13 January 2023

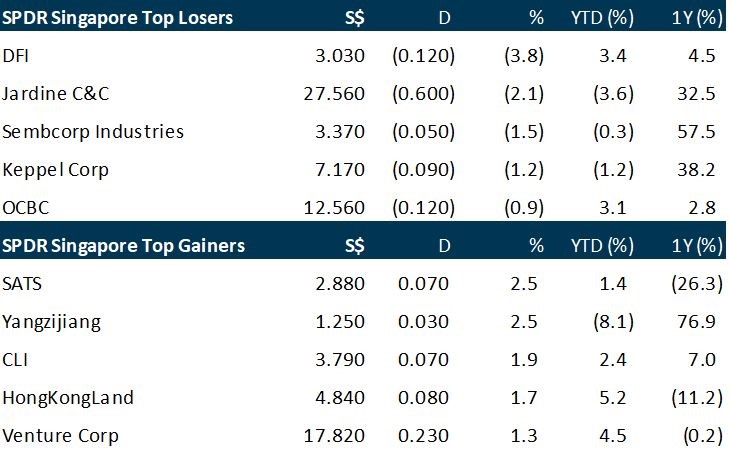

The Straits Times Index (STI) dipped 0.1 per cent or 3.73 points to 3,267.78 on Thursday (Jan 12), as the trio of Singapore banks stuttered ahead of the release of US inflation data. DBS fell 0.4 per cent or S$0.14 to close at S$34.50, UOB lost 0.6 per cent or S$0.17 to S$29.92, and OCBC ended 1 per cent or S$0.12 lower at S$12.56. In the wider Singapore market, gainers outnumbered losers 285 to 235, with 1.13 billion securities worth S$1.04 billion traded.

The S&P 500 and the Dow Jones opened higher on Thursday (Jan 12) after further evidence of cooling inflation boosted bets that the Federal Reserve will slow the pace of its future interest rate hikes. The Dow Jones Industrial Average rose 74.85 points, or 0.22 per cent, at the open to 34,047.86, and the S&P 500 opened higher by 7.96 points, or 0.20 per cent, at 3,977.57. The Nasdaq Composite dropped to 10,931.67 points at the opening bell.

Stocks to watch: Lian Beng Group

SG

Construction and property development firm Lian Beng Group on Thursday (Jan 12) posted a 48 per cent rise in earnings to S$22 million for the first half ended November. The increase was largely driven by revenue from its construction segment, which rose 14.1 per cent to S$354 million in H1, from S$310.1 million in the previous year. The group attributed this to a “general improvement in the level of construction activity” during the period. Revenue from its property development segment, however, fell 4.1 per cent to S$38.2 million.

Mainboard-listed integrated fish service provider Qian Hu Corporation has reported net profit attributable to shareholders for FY2022 ended December of $1.4 million, down 18.6% y-o-y. This was on the back of a 5.9% decline in Group revenue to $75.3 million, impacted by the Russia-Ukraine conflict and geopolitical landscape which dampened demand for its fish segment, and China’s zero-Covid-19 policy, which hampered its accessories business.

Workers at Twitter’s Singapore office were told to empty out their desks and vacate the premises, said people familiar with the situation, as Elon Musk continues to pare expenses around the globe. Twitter staff were informed via email on Wednesday (Jan 11) that they had until 5.00 pm to leave the CapitaGreen building and resume their duties remotely from Thursday, one of the people said, asking not to be named discussing private information. Singapore-based staffers have now been reassigned as remote workers in Twitter’s internal system until further notice, the person added.

Geo Energy Resources resumed its share buybacks after nearly a month. On Jan 11, the Indonesia-based coal miner acquired 500,000 shares on the open market at 32 cents each. Earlier, on Jan 9 and 10, the company had acquired 295,200 shares and 855,000 shares respectively on the open market at 31 cents each. These purchases bring the total number of shares bought back under the current mandate to more than 9.88 million shares. Before these two days, Geo Energy last bought shares on Dec 20, acquiring one million shares at 33.5 cents each.

Singapore’s GIC remained the most active state-owned investor (SOI) for the fourth year in a row in 2022, according to sovereign wealth fund (SWF) tracker Global SWF in a report released on Sunday (Jan 1). GIC completed 72 deals worth US$40.3 billion, up 17 per cent from a year earlier. Over half the capital was invested in real estate, with a “clear bias” towards logistics, the report said. Global SWF noted that there was a high level of activity among SWFs in 2022, with US$261.1 billion invested in 747 deals. The amount invested was 13.6 per cent more than in 2021.

cMainboard-listed real estate agency PropNex has urged for the additional buyer’s stamp duty (ABSD) remission treatment for married couples upgrading from HDB flats to private homes to be aligned with that of those upgrading to new executive condominiums (ECs) from developers. As part of its wish list for the Singapore Budget 2023 released on Thursday (Jan 12), PropNex suggested “some form of contractual undertaking” to ensure that the private home buyers sell their HDB flats within six months from collecting keys to their new home.

US

An expansion of Tesla’s plant in Shanghai has been delayed, according to people familiar with the matter, putting a roadblock in the way of the US electric carmaker’s ambitions to increase its market share in China. The so-called phase three expansion, originally slated to start mid-year, would have seen the plant’s capacity double to around two million cars a year, the sources said, asking not to be identified because they were not authorised to speak publicly.

The Volkswagen Group on Thursday (Jan 12) reported a 7 per cent drop in deliveries to 8.3 million vehicles in 2022, but maintained its position as Europe’s top battery-electric vehicle maker with all-electric sales up 26 per cent. Sales by the carmaker were up 12 per cent in the second half of the year but full-year output figures were dragged down by an output drop of over a fifth in the first half as the war in Ukraine upended supply chains and Covid-19 shuttered plants in China.

JPMorgan Chase has hired executives from Bank of America and Deutsche Bank to expand its corporate banking services for mid-sized companies outside the US. The Wall Street firm on Thursday named Stephanie Soybel, formerly of Bank of America, as head of Nordics payments sales for corporate client banking in Stockholm, according to an internal memo. Saskia Weller, previously at Deutsche Bank, will serve in Berlin as debt finance lead for Germany, Austria and Switzerland. Alex McCracken, previously at Silicon Valley Bank, joins as head of innovation economy for the UK, Ireland and the Nordics, corporate client banking.

Cryptocurrency broker Genesis owes creditors more than US$3 billion, prompting its owner Digital Currency Group (DCG) to explore selling assets in its venture portfolio to raise money, the Financial Times reported on Thursday (Jan 12). Citing people familiar with the matter, the newspaper said DCG is considering offloading parts of its venture-capital holdings, worth about US$500 million. The holdings include 200 crypto-related projects, such as exchanges, banks and custodians in at least 35 countries.

Billionaire Nelson Peltz on Thursday (Jan 12) launched a fight for a board seat at Walt Disney to help turnaround the company that he said was “in crisis” due to failed succession planning, mounting streaming losses and overspending on 21st Century Fox’s acquisition. The prominent activist investor’s Trian Fund Management on Thursday filed documents with the US securities regulator for his election as a director at Disney after the company denied him a board seat.

Blackrock plans to dismiss about 500 employees, roughly 2.5 per cent of its global workforce after the world’s biggest asset manager grappled with sharp declines last year in equity and bond markets. “The uncertainty around us makes it more important than ever that we stay ahead of changes in the market and focus on delivering for our clients,” chief executive officer Larry Fink and president Rob Kapito wrote on Wednesday (Jan 11) in a staff memo seen by Bloomberg.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Singapore Banking Monthly – Interest rates continue to climb

Recommendation: Overweight (Maintained)

Analyst: Glenn Thum

– December’s 3M-SORA was up by 39bps MoM to 3.08%. 4Q22 3M-SORA was up 252bps YoY.

– Singapore domestic loans grew 0.67% YoY in November, below our estimates, while Hong Kong’s domestic loans declined 3.02% YoY in November. CASA balance dipped slightly to 20.7%.

– Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5% with upside surprise due to excess capital ratios. We expect bank NIMs to rise another 34bps in 4Q22. SGX is another major beneficiary of higher interest rates [SGX SP, BUY, TP S$11.71].

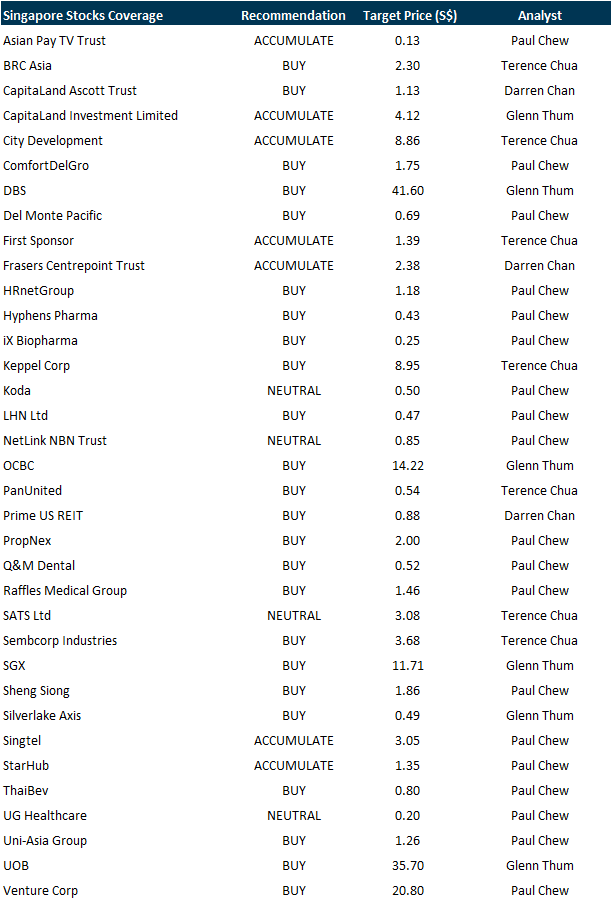

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Civmec

Date: 20 January 2023

Time: 12pm – 1pm

Register: https://bit.ly/3iwhMx1

Research Videos

Weekly Market Outlook: SG 2023 Equity Strategy, Technical Analysis

Date: 9 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials