DAILY MORNING NOTE | 14 December 2022

**Do note that the last day of Morning Note Issuance is on 15 December 2022. Morning Note will resume in January 2023**

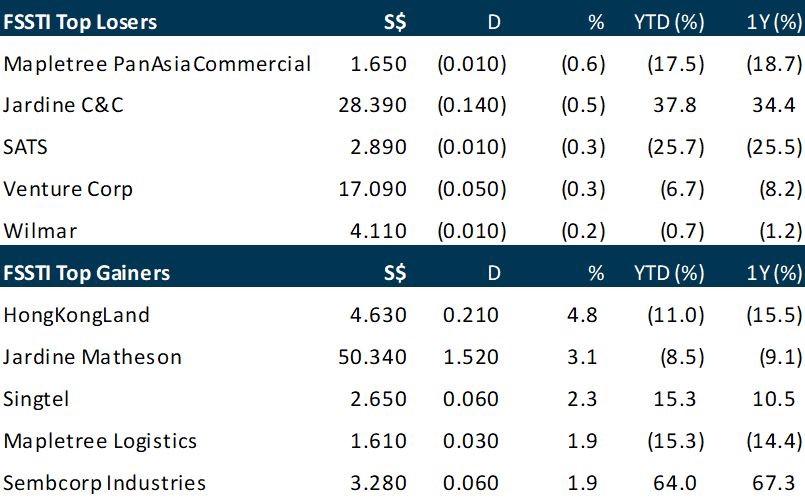

Singapore shares rose on Tuesday (Dec 13) ahead of a nail-biting inflation data release out of the US and overnight gains on Wall Street. The key Straits Times Index (STI) advanced 31.62 points or 0.98 per cent to 3271.28. Turnover came in at 1.1 billion units worth S$982.2 million. Gainers outnumbered losers with 275 counters up and 190 down. Gains in the local bourse were led by Singapore’s banking trio UOB, DBS and OCBC, as well as Singtel and Genting Singapore.

Wall Street stocks jumped on Tuesday as consumer inflation data came in better than expected, as markets shifted focus to the US central bank’s upcoming policy decision. The S&P 500 ended 0.7 per cent higher at 4,019.65, while the Dow Jones Industrial Average was up 0.3 per cent at 34,108.64. Meanwhile, the tech-rich Nasdaq Composite Index bounced 1.0 per cent as well to 11,256.81.

SG

Keppel Offshore & Marine (Keppel O&M)’s wholly-owned subsidiary, Keppel FELS Limited, has delivered the second of three dual-fuel dredgers to Dutch maritime company, Van Oord. The energy-efficient dredger is equipped with green features and has the ability to run on liquefied natural gas (LNG). The first dredger was delivered in April while the third and final dredger is slated to be delivered in 2023. “We are pleased to deliver our second dual-fuel dredger to Van Oord, extending our track record in delivering new build high quality and sustainable vessels. LNG plays an important role in the clean energy transition. Through our ongoing partnership with Van Oord, we are pleased to support the industry’s transition to a more sustainable future by delivering efficient vessels with more environmentally friendly features,” says Tan Leong Peng, managing director (new energy/business) at Keppel O&M. “Van Oord is committed to lowering its impact on climate change by reducing its emissions and becoming net-zero. We can make most progress by investing in the decarbonisation of our vessels, since approximately 95% of Van Oord’s carbon footprint is linked to its fleet. The delivery of the Vox Apolonia is another important milestone in this process. In the designing the new LNG hoppers, we focused on reducing our carbon footprint and working more efficiently by reusing energy and making optimal use of the automated systems in combination with electrical drives,” Maarten Sanders, manager newbuilding of Van Oord.

ESR Group is mulling the listing of its three logistics projects in Kunshan, Jiangsu Province, China through a publicly offered infrastructure securities fund on the Shanghai Stock Exchange. Named Jiangsu Friend I, II and III, the trio of leasehold projects are wholly owned by the group’s project company named Jiangsu Friend Warehouse. According to the group’s 2021 annual report, Jiangsu Friend I has a gross floor area (GFA) of 135,081 square metres (sq m) and its lease expiry is in 2054. Jiangsu Friend II and III have GFAs of 85,674 sq m and 206,418 sq m, respectively, and both have lease expiries in 2056. The proposed spin-off of the three projects is in line with a pilot programme launched by China’s National Development and Reform Commission and the China Securities Regulatory Commission, said the group on Tuesday (Dec 13). Formerly known as ESR Cayman, ESR Group owns a majority stake in the manager of ESR-Logos Real Estate Investment Trust (Reit). It is also the SGX-listed Reit’s largest unitholder.

Chip Eng Seng Corp will acquire the 30 per cent stake it does not already own in a Maldives joint-venture (JV) company for US$1.3 million, the property company announced in a Tuesday (Dec 13) bourse filing. The JV company, CES Tropical (Maldives), owns 99 per cent of an entity that holds the leasehold interest in a lagoon located in North Male Atoll, Maldives. Chip Eng Seng plans to develop the lagoon into a five-star resort. Under the proposed deal, CES Hotels (Maldives) (CESHM), a wholly-owned unit of Chip Eng Seng, will buy the 30 per cent stake in CES Tropical from the seller, Tropical Developments. CESHM will also take over, for cash, the shareholder’s loans granted by Tropical Developments to CES Tropical of US$3 million. With the deal, CES Tropical will be fully owned by Chip Eng Seng. The latter will have full control over the development of the lagoon and can manage the corporate affairs of CES Tropical more efficiently, the company said. The deal is not expected to have a significant impact on Chip Eng Seng’s net tangible assets and earnings per share for the financial year ending Dec 31.

US

Prices rose less than expected in November, the latest sign that the runaway inflation that has been gripping the economy is beginning to loosen up. The consumer price index, which measures a wide basket of goods and services, rose just 0.1% from the previous month, and increased 7.1% from a year ago, the Labor Department reported Tuesday. Economists surveyed by Dow Jones had been expecting a 0.3% monthly increase and a 7.3% 12-month rate. Excluding volatile food and energy prices, so-called core CPI rose 0.2% on the month and 6% on an annual basis, compared to respective estimates of 0.3% and 6.1%.

Apple said on Tuesday (Dec 13) it had invested more than US$100 billion in its Japanese supply network over the last five years, as its chief executive officer Tim Cook visited the epicentre of the country’s semiconductor industry. Cook said in a Monday tweet he visited Kumamoto prefecture in southwestern Japan, home to factories of many semiconductor and leading technology firms, including one under construction by Taiwan Semiconductor Manufacturing (TSMC). In a statement, Apple said it had boosted its spending on suppliers in Japan by more than 30 per cent since 2019, with a network spanning nearly 1,000 companies, from multi-nationals to family-run businesses. It called Sony Group one of its biggest suppliers in Japan for providing camera sensors for iPhone products, while also mentioning medium- and small enterprises including textile firm Inoue Ribbon Industry and mould manufacturer Shincron as partners. Apple said 29 Japanese suppliers have committed to converting to renewable energy for Apple-related businesses by 2030, including Sony, Murata Manufacturing, Keiwa, Fujikura and Sumitomo Electric Industries.

Oracle reported quarterly sales that exceeded analysts’ estimates on a strong effort from its Cerner digital health records unit, overcoming softer demand for information technology services in a choppy economy. Sales increased 18 per cent to US$12.3 billion in the period ended Nov 30, compared with analysts’ average estimate of US$12 billion. Profit, excluding some items, was US$1.21 a share, which included a hit of 9 US cents from currency fluctuations. Analysts, on average, projected US$1.18 a share. Cloud revenue — the highly watched segment that Oracle has been trying to expand — rose 43 per cent to US$3.8 billion in the fiscal second quarter, the Austin, Texas-based company said on Monday (Dec 12) in a statement. The segment produced 45 per cent year-over-year growth in the prior quarter. The company also is relying on its acquisition of Cerner, which was completed in June, to build inroads in health care, an industry that has been slow to move its data technology to the web. Cerner generated US$1.5 billion in the quarter, Oracle said.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

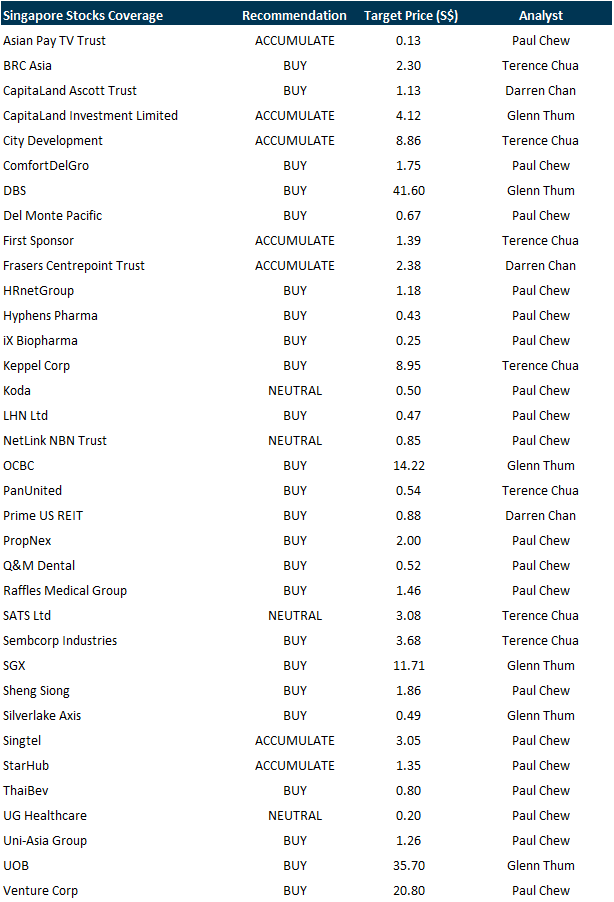

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Keppel Infrastructure Trust ( KIT) [NEW]

Date: 15 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UBLxd4

Guest Presentation by iWoW Technology

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: SGX, DelMonte, LHN, Zoom, City Developments, Zoom, Starhub, SG Weekly & More!

Date: 12 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials