Daily Morning Note – 14 March 2022

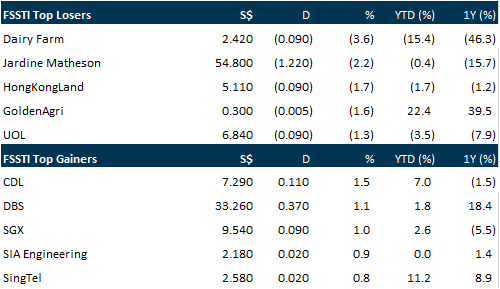

The Straits Times Index (STI) overcame weak sentiment earlier in the day to register a third straight winning session, edging up 0.3 per cent or 8.93 points to close at 3,249.66 points on Friday (Mar 11). In the wider Singapore market, gainers outnumbered losers 237 to 222, with 1.21 billion shares worth S$1.13 billion traded. Elsewhere in Asia, markets mostly finished lower. Japan’s Nikkei fell 2.1 per cent, South Korea’s Kospi lost 0.7 per cent, Hong Kong’s Hang Seng dropped 1.6 per cent and the FTSE Bursa Malaysia KLCI was down 0.8 per cent.

Major US stock indices finished trading lower on Friday (Mar 11), ending a downbeat week with further losses as investors were rattled over the fallout from Russia’s invasion of Ukraine. The US, EU and G7 countries announced they would end normal trade relations with Moscow in response to its attack on its neighbor, while Washington and Brussels also cut of exports of luxury goods to Russia. Traders are bracing for next week’s two-day Federal Reserve meeting beginning Tuesday, when the US central bank has strongly signaled it will increase interest rates for the first time since Covid-19 broke out to fight inflation. The benchmark Dow Jones Industrial Average dropped 0.7 per cent to 32,944.19, while the broad-based S&P 500 fell 1.3 per cent to 4,204.31. The tech-rich Nasdaq Composite Index fell 2.2 per cent to 12,843.81.

SG

Starburst Holdings has obtained the needed regulatory approval to delist, following its free float dipping below the required 10 per cent. The firearms training facility manager stated in a filing on Friday (Mar 11) that the Singapore Exchange (SGX) has no objection to its proposed delisting from the Catalist board. This came about as its acquirer Nordic Flow Control has managed to take over more than 90 per cent of shares in Starburst, resulting in the shares held by the public to be lower than the regulatory threshold of 10 per cent. Also, SGX has noted Nordic’s intention to exercise its right to compulsorily acquire the remaining shares that it does not already own after making the pre-conditional voluntary offer last November at S$0.0238 per share.

Kimly Limited and its convicted consultants have mutually decided not to carry on with the recent engagement of the duo, following feedback and concerns from its stakeholders, the Catalist-listed operator of coffeeshops said. In its regulatory statement it furnished on Saturday (Mar 12), Kimly said: “The board is grateful for and takes these feedback and concerns seriously, and will further evaluate and consider the matter together with its professional advisers, engage appropriately with stakeholders as well as take additional guidance from its sponsor and regulators.” Kimly had in its statement furnished on Mar 2 announced the engagement of former executive chairman Lim Hee Liat and former executive director Chia Cher Khiang as independent consultants, shortly after the duo were convicted of and fined in mid-February for breaching the Securities and Futures Act. Kimly noted that Lim and Chia’s shareholdings in the company amounted to 41.3 per cent, and that their interests are “aligned” with other shareholders in ensuring the group continues to perform well operationally and financially.

Hatten Land stated that the borrowings of RM206 million (S$66.4 million) due in a year could be repaid as its unsold, completed properties are worth a “substantial value”. In its response to queries from the Singapore Exchange (SGX), Hatten Land said on Friday (Mar 11) that the estimated market value of its development properties – excluding those of Gold Mart – stood at RM780.8 million as at Jun 30, 2021. The company said sale of its development properties to generate cash flow is its priority to repay loans and borrowings amounting to RM206 million recorded as current liabilities in the financial statements for the quarter to December 2021. The completion of the disposal of Gold Mart will also generate gross proceeds of about US$60 million, which will allow it to redeem some loans and borrowings.

US

Gold retreated on Friday (Mar 11) as safe-haven appeal for the metal dimmed after Russian President Vladimir Putin said there had been progress in talks with Ukraine, with the likelihood of a looming US rate hike adding pressure to bullion. “There are certain positive shifts, negotiators on our side tell me,” Putin said in a meeting with his Belarusian counterpart Alexander Lukashenko, but did not provide any details. Spot gold fell 0.6 per cent to US$1,984.20 per ounce by 13.45 ET (1845 GMT), but remained poised to post a weekly rise of about 0.8 per cent as concerns over the Ukraine conflict kept investors on their toes. US gold futures settled down 0.8 per cent at US$1,985. “The Russia-Ukraine crisis will continue to support the prospect for higher precious metal prices,” said Saxo Bank analyst Ole Hansen in a note, as that could mean higher inflation, slowing growth and fewer central bank rate hikes. With US inflation ballooning in February, bets that the central bank will raise its benchmark overnight interest rate by at least 25 basis points on March 16, stood at 94 per cent, according to CME’s FedWatch Tool.

The dollar rose on Friday (Mar 11), notching a 5-year high against the safe-haven yen, while commodity-linked currencies slumped after Russian President Vladimir Putin said there had been some progress in talks between Moscow and Ukraine. Russia’s Feb 24 invasion of Ukraine has roiled markets, causing volatility in commodity prices and threatening global economic growth prospects. The dollar initially declined on the news, but then gradually firmed and was last up 0.76 per cent against a basket of 6 global peers at 99.11. The index was on track for a 0.56 per cent increase for the week, following the previous week’s 2 per cent rise, which was its largest weekly percentage gain since April 2020. The greenback hit a 5-year high against the Japanese yen, which was down 1.03 per cent at 117.32 yen. The dollar has also been supported by expectations that the Federal Reserve will start raising interest rates at the end of its Mar 15 to 16 policy meeting, with inflation running hot.

Uber Technologies said on Friday (Mar 11) US customers, excluding New York City, will have to pay a fuel surcharge from Mar 16 as the ride-hailing firm tries to address concerns of drivers and couriers hit by record high gasoline prices. Customers will have to pay a surcharge fee of either 45 US cents or 55 cents on each Uber trip and 35 cents or 45 cents on each Uber Eats order, depending on their location. The money charged will go directly to the workers, Uber said. The surcharge will last for at least 60 days after which it will make adjustments based on feedback from workers and customers. The move comes as many Uber drivers have been protesting on social media over high gas costs that have been eating into their earnings even as the company raised its profitability outlook, with some asking if it was still worth getting behind the wheel.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

City Developments Limited – Promising turnaround

Recommendation: BUY (Maintained), Last Done: S$7.29

Target Price: S$9.19, Analyst: Natalie Ong

– FY21 revenue of S$2,626mn (+24.5% YoY) formed 106% of our forecast but PATMI underperformed due to higher-than-expected taxes, excluding which, performance would have been in line with our forecasts.

– PATMI in the black due to strong residential sales and recovery in the hospitality segment, which has turned EBITDA positive. CDL moved 2,185 units in FY21, exceeding our sales forecast of 1,600 units.

– Proposed DPS of 31.1 Scts (FY20: 12 Scts), comprising 12 Scts in cash and a surprise distribution in specie of CDL Hospitality Trust (CDREIT SP, not rated) valued at 19.1 Scts.

– Maintain BUY and RNAV-derived TP S$9.19 (35% discount). We view CDL as proxy for the Singapore residential market and hospitality recovery play. CDL is trading at an attractive 48% discount to our RNAV/share of S$14.14. Asset monetisation, unlocking value through AEIs and redevelopments, and faster-than-expected recovery in hospitality portfolio are potential catalyst for CDL, which could help narrow the discount between CDL’s share price and RNAV.

Pan-United Corporation – FY21 results above our expectations on construction recovery

Recommendation: BUY (Maintained), Last Done: S$0.35

Target price: S$0.46, Analyst: Terence Chua

– 2H21 revenue and profit beat expectations, at 60.7% and 76.2% of FY21e estimates respectively. The beat was driven by higher sales from its concrete and cement business which recovered faster on the back of the faster pace of recovery in the construction sector.

– Net gearing was 22% lower than our forecasts; FY21 DPS 0.6 cents higher than our expectations. Full-year 2021 dividend at 1.6 cents, represented a 60% payout, signalling confidence in the near- and mid- term outlook.

– Manpower shortages, supply-chain disruptions and volatile freight costs continue to hamper growth recovery. We tweaked our GP margin expectations lower for FY22e/FY23e in anticipation of higher raw materials cost and supply-chain disruptions.

– Maintain BUY with higher target price of S$0.46, from S$0.44. We raise FY22e earnings by 11% on account of the higher demand for ready-mixed concrete brought about by the construction recovery. Our TP is based on 16x FY22e P/E, a 15% discount to its 10-year historical average P/E on account of the still uncertain environment.

Click the link to join: https://t.me/stocksbnb

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.