DAILY MORNING NOTE | 14 March 2023

Singapore stocks slid on Monday (Mar 13) amid mixed trading in the region, as investors remained cautious following the collapse of Silicon Valley Bank (SVB) in the US. The stocks slid 1.4 per cent or 45.06 points to close at 3,132.37.

Wall Street equities were mixed on Monday at the end of a volatile session as several midsized banking stocks suffered another punishing sell-off amid worries of contagion. The Dow Jones Industrial Average ended down 0.3 per cent at 31,819.14. The broad-based S&P 500 shed 0.2 per cent to 3,855.76, while the tech-rich Nasdaq Composite Index advanced 0.5 per cent to 11,188.84. The session came on the heels of emergency announcements Sunday night from US federal bank regulators to guarantee all deposits at Silicon Valley Bank and Signature Bank after the entities were seized by US officials.

SG

Coal producer Geo Energy Resources on Monday (Mar 13) said it has stopped further transactions with the third-party coal mine owner whose inability to fulfil its obligations towards the company depressed its earnings for the second half of 2022 by 56 per cent. This follows Geo Energy’s Feb 27 announcement that it had had to make US$15.4 million in allowances for expected credit losses based on dealings with this mine owner, which failed to deliver on coal which Geo Energy purchased. The mine owner had also not met the conditions for the conditional sale-and-purchase agreement for two mining concessions in 2019.

China’s reopening spurred trading activity across multiple asset classes on the Singapore Exchange (SGX) in February, the bourse operator said on Monday (Mar 13). Notably, total derivatives traded volume reached its highest in three months at 20 million contracts, up 7 per cent from the same period a year earlier. Total foreign exchange (FX) futures volumes rose 39 per cent year on year to 2.9 million contracts. Optimism over China’s outlook drove hedging demand on SGX’s currency marketplaces, adding to FX volatility.

Boustead Singapore’s bid to acquire Boustead Projects at S$0.95 a share is being met with opposition, as the Securities Investors Association Singapore (Sias) has advised shareholders to reject the listed acquirer’s offer unless the offer price is raised to a “fair and reasonable” amount.

The Singapore banking system remains “sound and resilient” amid the recent collapse of Silicon Valley Bank (SVB) and a couple of other small banks, said the Monetary Authority of Singapore (MAS) on Monday (Mar 13). In a statement on Monday, MAS said the Singapore banking system has “insignificant exposures to these failed banks in the US”. All three of Singapore’s locally listed banks confirmed they do not have direct exposure to SVB, Signature Bank or Silvergate Bank.

A lorry crane toppled onto its side at an ExxonMobil lubricant plant project site at 35 Shipyard Road on Monday (Mar 13). Images of a Huationg Holdings crane toppled on its left side were first seen on the “Complaint Singapore Unrestricted” Facebook page. The crane’s outriggers, which normally maintain the stability of the crane, did not appear to be extended.

Sembcorp Industries has clinched a contract to build, own and operate a 500 megawatt (MW) solar power plant in Oman, through an 80 per cent-owned joint venture to be set up by its wholly-owned subsidiary Sembcorp Utilities with Jinko Power Technology. In a bourse filing, Andy Koss, the chief executive officer of Sembcorp Industries’ UK & Middle East business, said the Manah Solar II Independent Power Project will mark Sembcorp’s first renewables project in the Middle East. The project is backed by a 20-year power purchase agreement, and awarded by the Oman Power and Water Procurement Company. It is expected to be operational by 2025.

Catalist-listed Metech International on Monday (Mar 13) said a lawsuit has been filed against Deng Yiming, one of the owners of its subsidiary’s former joint venture (JV) partner X Diamond Capital, over missing diamond seeds and loose diamonds. The pieces were last in Deng’s possession, and he had, to date, not satisfactorily addressed issues relating to them, Metech said in a bourse filing.

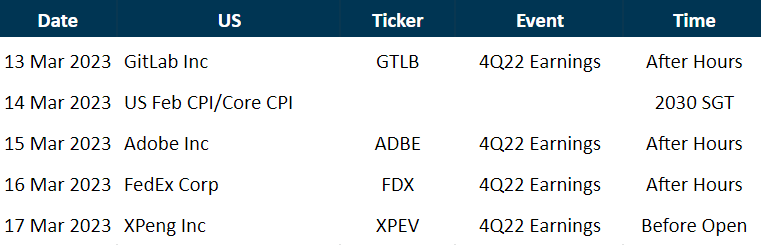

US

HSBC Holdings is buying the UK arm of Silicon Valley Bank (SVB) in a culmination of a frantic weekend when ministers and bankers explored various ways to avert the SVB unit’s collapse. In a statement on Monday (Mar 13), the London-listed lender said that its ring-fenced subsidiary, HSBC UK Bank, was acquiring SVB UK for £1 (S$1.63). The deal will be completed immediately and will be funded from existing resources.

Oil prices fell over 2 per cent in volatile trading on Monday as the collapse of Silicon Valley Bank roiled equities markets and raised fears of a fresh financial crisis, but a recovery in Chinese demand provided support. Brent crude futures settled down US$2.01, or 2.4 per cent, to US$80.77. The global benchmark earlier fell to a session low of US$78.34, its lowest price since early January.

The number of container ships in US coastal waters has fallen to less than half of the count a year earlier, in the latest ominous sign of slowing global trade. There were 106 container ships both in port and off the coastline late Sunday, compared with 218 at this time last year, a 51 per cent drop according to vessel data analysed by Bloomberg. Data from IHS Markit showed that the weekly count of port calls in US waters through March 4 had slowed to 1,105 from 1,906 the year prior. That’s the lowest level since mid-September 2020.

Treasury two-year yields plummeted to their lowest level this year as government bonds surged in a rush for havens, with investors betting that the collapse of three US lenders will compel policymakers to halt monetary tightening. Swaps now show a less than a one-in-two chance that the US Federal Reserve will implement another quarter-point hike this cycle. Yields on two-year Treasury notes – the most sensitive to changes in policy – fell as much as 60 basis points to less than 3.99 per cent, the lowest since October. The three-month London interbank offered rate for dollars, a key benchmark, dropped by 27 basis points, the most since March 2020. The US dollar also declined.

Customers Bancorp, a regional lender that rode the crypto wave last year, fell 24 per cent on Monday (Mar 13) amid a wider sell-off of financial stocks stemming from the collapse of Silicon Valley Bank. Shares of the Pennsylvania-based bank plunged by nearly 70 per cent before paring losses. They closed at US$17.43 Monday, down 38.5 per cent so far this year and more than 70 per cent from its peak in January 2022.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

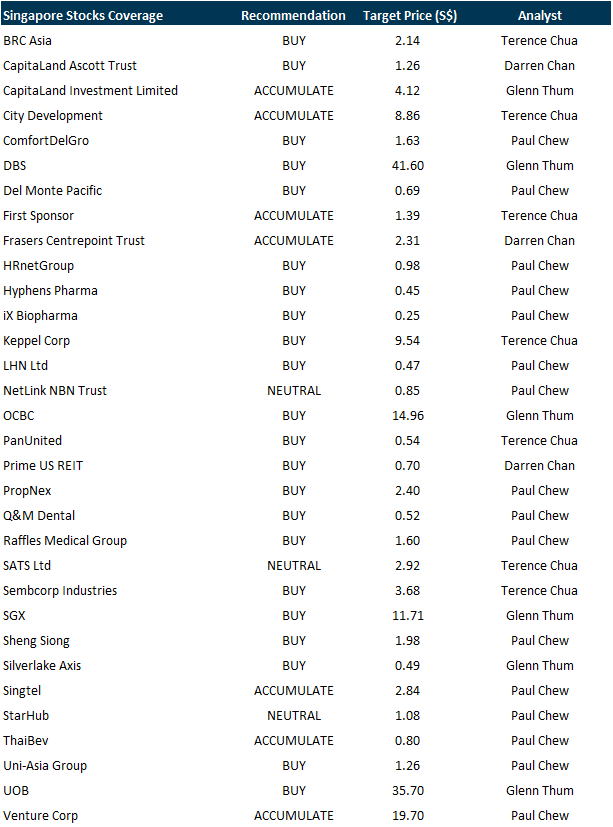

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Enviro-Hub Holdings Ltd [NEW]

Date: 14 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3KBprpA

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Salesforce, Sea Ltd, TDCX, Hyphens Pharma, Q&M, Tech Analysis & More…

Date: 13 March 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials