DAILY MORNING NOTE | 15 December 2022

**Do note that the last day of Morning Note Issuance is on 15 December 2022. Morning Note will resume in January 2023**

Singapore shares rose marginally on Wednesday (Dec 14), the Straits Times Index (STI) gained 7.29 points or 0.2 per cent to stand at 3278.57. Turnover on the Singapore bourse came in at 1.2 billion units worth S$1.3 billion. Gainers outnumbered losers 310 to 196. Gains at OCBC and Genting Singapore led the day’s rise.

Wall Street stocks fell on Wednesday after the Federal Reserve sketched out plans for additional interest rate hikes despite recent data showing a moderation in inflation. Fed Chair Jerome Powell said he was encouraged by the latest consumer price data, but that the central bank’s policy was “still not restrictive enough” in light of too-high inflation. The Dow Jones Industrial Average finished down 0.4 per cent at 33,966.35. The broad-based S&P 500 shed 0.6 per cent lower to 3,995.32, while the tech-rich Nasdaq Composite Index declined 0.8 per cent to 11,170.89.

SG

Glove manufacturer Top Glove Corporation could take up to a year to return to profitability, founder and executive chairman Lim Wee Chai said on Wednesday (Dec 14), after the group posted a net loss of RM168.2 million (S$51.6 million) for the first fiscal quarter of the year ended November. Losses for the quarter were more than triple the net loss of RM52.6 million in the previous quarter, and a reversal from earnings of RM185.7 million in the year-ago period. Lim estimated that Top Glove’s losses will narrow in the next three months. He added that the group should break even six months from now, but profitability would come only nine to 12 months later. Top Glove executives said they have observed an “aggressive price competition” in the industry. Glovemakers exiting the market are selling gloves at an “exceptionally low” price, which has caused price disruption. Lim noted that Chinese glovemakers are also cutting the prices of gloves to as low as US$14 per 1,000 pieces of gloves. In comparison, glove prices were sold at prices higher than US$100 per 1,000 pieces during the pandemic. Top Glove’s revenue for the period was down 60.7 per cent to RM632.5 million from RM1.6 billion, the company said. Sales volume for Q1 eased roughly 48 per cent.

Samudera Shipping Line has entered an agreement to purchase the 25 per cent stake held by a joint-venture (JV) partner in LNG East-West Shipping Company (Singapore) (LNG EW) for US$14.8 million, the company announced in a Wednesday (Dec 14) bourse filing. The deal will raise Samudera’s interest in LNG EW from 25 per cent to 50 per cent. The seller, Nippon Yusen Kabushiki Kaisha, will still own the remaining 50 per cent of LNG EW. Samudera said that it wants to raise its stake in LNG EW to better realise value from the company, which is engaged in liquefied natural gas transportation. The acquisition is expected to be completed by mid-December and not seen to materially impact Samudera’s earnings per share for the current financial year.

A unit under CDL Hospitality Trusts (CDLHT) has inked a new 10-year lease agreement with a unit of Banyan Tree Holdings for the Angsana Velavaru resort in the Maldives. The existing lease in place expires on Jan 31, 2023, CDLHT said in a Wednesday (Dec 14) bourse filing. The rental formula and management fee terms under the new lease are the same as the existing one entered into in January 2013. Under the agreement, the lessor will be entitled to receive rent payments equivalent to the resort’s gross operating profit less management fees retained by the lessee, subject to a minimum rent. The lessee will pay a top-up amount to make up for any shortfall in rent below the minimum rent for each year.

US

The Federal Reserve raised interest rates by half a percentage point on Wednesday and projected at least an additional 75 basis points of increases in borrowing costs by the end of 2023 as well as a rise in unemployment and a near stalling of economic growth. The US central bank’s projection of the target federal funds rate rising to 5.1 per cent in 2023 is slightly higher than investors expected heading into this week’s two-day policy meeting and appeared biased if anything to move higher. Only two of 19 Fed officials saw the benchmark overnight interest rate staying below 5 per cent next year, a signal they still feel the need to lean into their battle against inflation that has been running at 40-year highs. “The (Federal Open Market) Committee is highly attentive to inflation risks … Ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 per cent over time,” the Fed said in a statement nearly identical to the one it issued at its November meeting. The new statement, approved unanimously, was released after a meeting at which officials scaled back from the three-quarters-of-a-percentage-point rate increases delivered at the last four gatherings. The Fed’s policy rate, which began the year at the near-zero level, is now in a target range of 4.25 per cent to 4.50 per cent, the highest since late 2007.

Delta Air Lines says the travel boom isn’t over. The airline expects its adjusted earnings to nearly double to as much as $6 per share next year, above analysts’ estimates. It forecast a 15% to 20% jump in revenue in 2023 from this year, which is expected to bring in roughly $45.5 billion. Free cash flow will likely rise from more than $2 billion next year to more than $4 billion in 2024, a sharp turnaround from 2020 when Delta posted a record loss. Delta is planning to pay down more of its debt over the next two years. Delta and other airline executives in recent weeks have been upbeat about travel demand, despite warnings from other industries about economic weakness ahead. Delta on Wednesday raised its fourth-quarter earnings forecast to a range of $1.35 to $1.40 a share, up from its previous outlook of $1 to $1.25 per share. It expects total revenue to come in 7% to 8% higher than the fourth quarter of 2019, before the Covid pandemic.

The chief executive of ASML Holding NV, the Dutch semiconductor equipment maker, on Tuesday questioned whether a U.S. push to get the Netherlands to adopt new rules restricting exports to China make sense. “Maybe they think we should come across the table, but ASML has already sacrificed,” CEO Peter Wennink said in a newspaper interview. He said that following U.S. pressure, the Dutch government has already restricted ASML from exporting its most advanced lithography machines to China since 2019, something he said has benefited U.S. companies selling alternative technology. He said that while 15% of ASML’s sales are in China, at U.S. chip equipment suppliers “it is 25 or sometimes more than 30%”. A spokesperson for ASML confirmed the remarks in the interview were accurate but declined further comment. The Biden administration issued new export rules for U.S. companies in October aimed at cutting off China’s ability to manufacture advanced semiconductor chips in a bid to slow its military and technological advances. Washington is urging the Netherlands, Japan and other unspecified countries with companies that make cutting edge manufacturing equipment to adopt similar rules. The Dutch trade minister has confirmed talks are ongoing.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

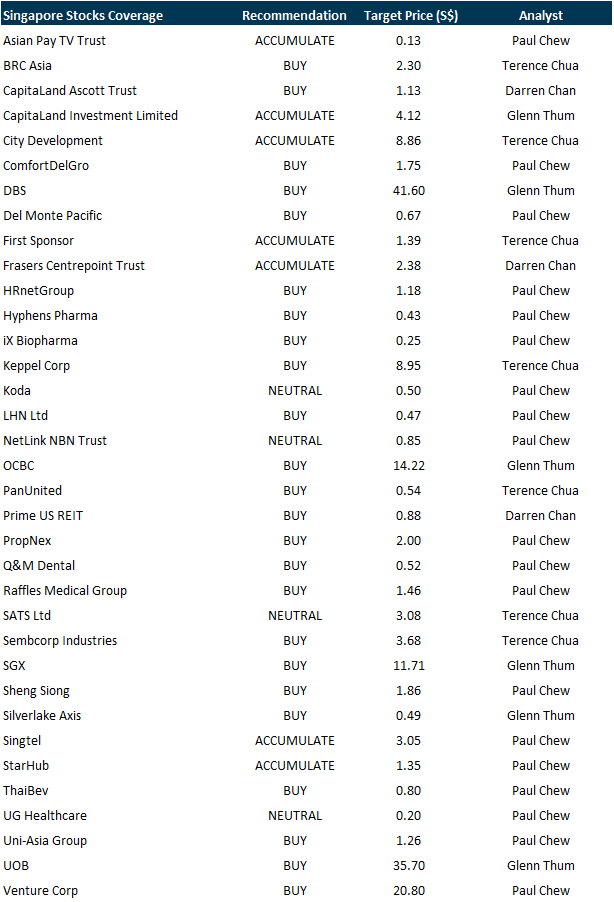

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Keppel Infrastructure Trust ( KIT) [NEW]

Date: 15 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UBLxd4

Guest Presentation by iWoW Technology

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: SGX, DelMonte, LHN, Zoom, City Developments, Zoom, Starhub, SG Weekly & More!

Date: 12 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials