DAILY MORNING NOTE | 17 February 2023

Singapore shares rose alongside regional bourses, as relief following a string of upbeat data from the US – the latest being strong retail sales – assuaged investors that the world’s largest economy was holding up well amid headwinds and a tightening trajectory. The key Straits Times Index (STI) snapped a three-day losing streak and jumped 30.41 points or 0.9 per cent to 3,311.23. Some 1.3 billion units worth S$1 billion were traded on the local bourse, and gainers trounced losers 327 to 226. Gains were led by all three Singapore banks UOB, DBS and OCBC, as well as Singtel and Keppel Corp. Sembcorp Marine inched up S$0.001 or 0.7 per cent to S$0.136, and was the day’s most active counter with 79.4 million shares traded. More than 95 per cent of the group’s shareholders gave their nod for a mammoth merger with Keppel Offshore & Marine. Marco Polo Marine was another active counter, with 30.3 million shares changing hands. Another actively traded counter was Singtel, with 23.3 million shares traded. The telco reported a net profit of S$532 million for Q3 FY2023 – down 28 per cent year on year.

Wall Street stocks retreated Thursday (Feb 16) on unexpectedly hot wholesale price inflation and hawkish comments from a US Federal Reserve official, reigniting jitters over the central bank’s future rate hike path. The producer price index rose 0.7 per cent in January, at a quicker pace than analysts predicted, while initial jobless claims slipped. The Dow Jones Industrial Average slumped 1.3 per cent to close at 33,696.85. The broad-based S&P 500 Index fell 1.4 per cent to 4,090.41, while the tech-heavy Nasdaq Composite Index plunged 1.8 per cent to 11,855.83.

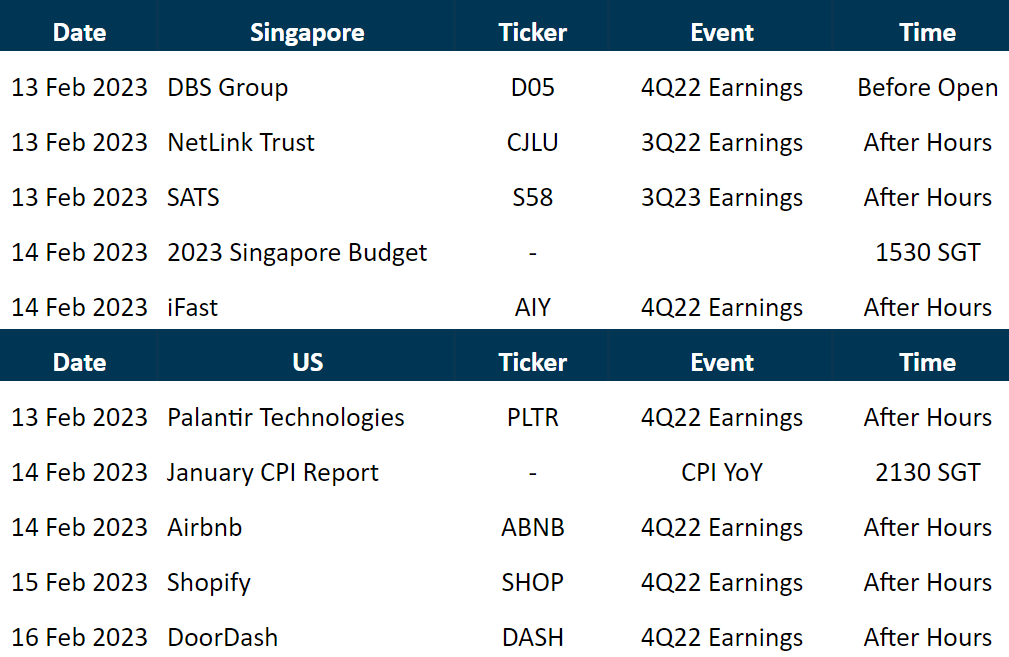

SG

Singapore’s latest six-month Treasury bill (T-bill) closed its auction with a cut-off yield of 3.93 per cent on Thursday (Feb 16). The latest tranche of T-bills were around 2.3 times subscribed for the S$4.9 billion allotment. The total value of applications in this auction was S$11 billion, down from the S$12.9 billion applied in the previous six-month T-bill auction. In the latest auction, non-competitive bids totalled S$737.3 million and were fully allotted. Those who submitted bids at the cut-off yield were allotted around 21 per cent of their application. Meanwhile, those who specified a lower yield were fully allotted, and those who specified a higher yield were not allotted.

It has been nearly a year since the proposal to merge offshore and marine (O&M) giants Keppel O&M and Sembcorp Marine (Sembmarine), but the motion took a big step forward on Thursday (Feb 16) as shareholders voted overwhelmingly in favour of amalgamating the two into one. At a fully virtual extraordinary general meeting (EGM), over 95 per cent of shareholders voted for the merger.

Singapore Telecommunications (Singtel) has reported a net profit of $532 million for the 3QFY2023 ended Dec 31, 2022, 27.6% lower than the net profit of $734 million in the same period the year before. The y-o-y decline was due to a net exceptional gain from the partial divestment of Indara, which was formerly known as Australia Tower Network (ATN). Underlying net profit for the 3QFY2023 grew by 18.2% y-o-y to $559 million mainly due to Airtel’s strong growth momentum, according to Singtel in its business update. Operating revenue fell by 5.1% y-o-y to $3.71 billion due to the absence of contributions from Amobee and the 8% decline in the Australian dollar (AUD). For the 9MFY2023, Singtel’s operating revenue fell by 5.1% y-o-y to $11.0 billion while ebitda fell by 4.5% y-o-y to $2.79 billion. Net profit for the 9MFY2023 increased by 0.8% y-o-y to $1.7 billion.

ESR-Logos REIT (E-LOG) is seeking to raise gross proceeds of around $300 million. The equity raising will be done through a private placement of between 447.8 million and 454.5 million new units and a non-renounceable preferential offering of new units. The private placement and preferential offering will raise some $150.0 million each. According to E-LOG, the proceeds raised will be used for the funding of any potential acquisitions, redevelopments and asset enhancement initiatives (AEIs) of the properties owned by E-LOG. The equity fundraising will also lower the REIT’s aggregate leverage to 38.0% from 41.8% as at Dec 31, 2022. It will also increase the REIT’s debt headroom to $1.1 billion based on a 45% aggregate leverage limit. On a pro forma basis, the REIT’s net asset value (NAV) per unit will drop to 35.9 cents from 36.4 cents before the equity fund raising.

The Securities Investors Association of Singapore (SIAS) is appealing to Boustead Singapore to improve on its 90 cent per share privatisation offer for its majority-held, separately-listed subsidiary, Boustead Projects. David Gerald, president of SIAS, acknowledges that the offer price is 7.8% over Boustead Projects’ last traded price of 83.5 cents. However, as at Sept 30 2022, the company, which focuses on real estate, had a net asset value of $1.265. Gerald calls for an offer price closer to the NAV of $1.265.

Eng Lam Contractors, the wholly-owned subsidiary of OKP Holdings , has secured a contract worth $95.9 million from the Land Transport Authority (LTA) on Feb 6. Eng Lam Contractors will be involved in the survey, construction and reconstruction of roads, kerbs, footpaths, cycling paths and other road- and commuter-related facilities along Singapore’s South East sector. The contract is expected to be completed by the first quarter of 2026. The latest contract brings the group’s net construction order book to $454.1 million with contracts extending till 2026.

Koyo International, citing higher labour costs for on-going projects that got to be worked on throughout the pandemic, warns that it will report a net loss for its FY2022. Inflationary pressures added to the woes, the company says, adding that it will report on or before March 1. For 1HFY2022 ended June 30 2022, the company had already reported a loss of just over $1 million, on revenue of $18 million.

US

Inflation rebounded in January at the wholesale level. The producer price index, a measure of what raw goods fetch on the open market, rose 0.7% for the month, the biggest increase since June. Economists had been looking for a rise of 0.4% after a decline of 0.2% in December. Excluding food and energy, the core PPI increased 0.5%, compared with expectations for a 0.3% increase. Core excluding trade services climbed 0.6%, against the estimate for a 0.2% rise. On a 12-month basis, headline PPI increased 6%, still elevated but well off its 11.6% peak in March 2022. In other economic data Thursday, the Labor Department reported that jobless claims edged lower to 194,000, a decline of 1,000 and below the Dow Jones estimate for 200,000.

On Thursday, the Chinese Commerce Ministry said it blacklisted Lockheed Martin Corp. and an arm of Raytheon Technologies Corp. over the companies’ arms sales to Taiwan. Putting the companies on its “unreliable entities list” prohibits them from export and import activities related to China. The sanctions have little real effect since American defense companies are broadly barred from making military sales to China. The sanctions come on the heels of Washington’s blacklisting of six Chinese companies it said were linked to Beijing’s surveillance-balloon program after the U.S. shot down one that had traversed the U.S.

Tesla is voluntarily recalling 362,758 vehicles equipped with the company’s experimental driver-assistance software, which is marketed as Full Self-Driving Beta or FSD Beta, in the US. Tesla will deliver an over-the-air software update to cars to address the issues, the recall notice said.

Standard Chartered Bank (StanChart) raised a key performance metric and announced a new US$1 billion share buyback on Thursday (Feb 16) after posting a 28 per cent rise in annual pre-tax profit, as global interest-rate hikes boosted its lending revenue. StanChart upgraded its performance forecast, saying it was now expecting to achieve a return on tangible equity – a key profitability metric – of 10 per cent this year and 11 per cent in 2024. It had previously targeted 10 per cent for 2024. The Asia, Africa and Middle East-focused bank reported statutory pre-tax profit of US$4.3 billion for 2022, which was below the US$4.73 billion average of analyst forecasts, but beat the US$3.35 billion it made in 2021.

Paramount Global said it saw its streaming business grow during the fourth quarter, and announced plans to increase prices for Paramount+ this year. Despite adding more streaming customers, Paramount reported its fourth-quarter revenue declined 7%, compared with last year, to roughly $5.9 billion as the weak advertising market weighed on the company. Company executives on Thursday estimated the advertising market will bounce back in the second half of 2023. The price increases will take effect when Paramount+ and Showtime combine later this year. CFO Naveen Chopra said Thursday the Paramount+ premium tier, which will include Showtime, will increase to $11.99 from $9.99, while its lower-priced tier, without Showtime content, will increase by $1 to $5.99. The price increases and combination with Showtime will take place in the third quarter.

Doordash reported better-than-expected sales for the fourth quarter and gave upbeat guidance for the current period. The company recorded a loss per share of $1.65 per share vs. 68 cents, as expected by analysts, and revenue of $1.82 billion vs. $1.77 billion expected. DoorDash said the total number of orders it delivered in the fourth quarter grew 27% to 467 million, which topped analysts’ projections. For the current quarter, DoorDash said it expects marketplace gross order volume to be between $15.1 billion and $15.5 billion. Analysts were looking for $15 billion in marketplace gross order volume.

Shopify Inc. produced a better holiday quarter than expected according to a Wednesday earnings report, but a forecast for slowing revenue growth. In their forecast, Shopify executives guided for revenue to grow “in the high-teen percentages” in the fiscal first quarter, while Analysts on average were projecting first-quarter revenue of $1.48 billion, which would be revenue growth of more than 23%. For the fourth quarter, Shopify reported a loss of $623.7 million, or 49 cents a share, on revenue of $1.73 billion, up from $1.38 billion a year ago. After adjusting for stock-based compensation, gains on investments and other costs, the company reported earnings of 7 cents a share. Analysts on average expected an adjusted loss of a penny a share on sales of $1.65 billion

Hasbro forecast annual sales and profit below analysts’ estimates on Thursday (Feb 16), slammed by a sharp decline in demand for its toys and games from customers reeling with rising prices. Both Hasbro and its rival Mattel had seen a steep drop in consumer spending in the crucial holiday season. It lost the highly-lucrative licence to make Disney Princess toys to Mattel last year. The overall revenue is projected to be down low-single digits, while analysts were expecting a 2.5 per cent increase to US$6 billion. Hasbro expects 2023 adjusted per-share earnings in the range of US$4.45 to US$4.55 compared with estimates of US$4.88 per share.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Keppel Corporation – SMM shareholders clear way for divestment

Recommendation: BUY (Maintained), Last Done: S$7.14

Target price: S$9.54, Analyst: Terence Chua

– Sembcorp Marine (SMM) shareholders have cleared the way for the proposed combination of Keppel O&M (KOM), voting overwhelmingly in favour of the acquisition.

– We believe the focus will now shift towards transforming its Urban Development business towards an asset-light model with a focus on growing its recurring income.

– Maintain BUY with unchanged SOTP TP of $9.54. Our TP translates to about 1.2x FY23e book value, a slight premium to its historical average as the Group’s transformation plans gain traction. Catalysts expected from a further transformation of its business towards an asset-light model.

PRIME US REIT – Strong rental reversions to drive growth

Recommendation: BUY (Maintained), Last Done: US$0.44

Target price: S$0.70, Analyst: Darren Chan

– FY22 DPU of 6.55 US cts was slightly below our estimates, mainly due to higher interest expense (+27.2%) and lower occupancies (89.1%).

– Despite portfolio valuation declining 6.7% on higher discount and cap rate assumptions, gearing at 42.1% and interest coverage at 4.1x remains well within regulatory limits.

– Maintain BUY, DDM-TP lowered from US$0.88 to US$0.70 as we lower our FY23e-FY25e DPU forecasts by 12-15% due to lower occupancy and higher financing costs. Our cost of equity increased from 10.55% to 11% as we roll forward our forecasts. PRIME is our top pick in the US office sector for greater tenant exposure to STEM/TAMI sectors. Catalysts include improved leasing and a greater return to office. Prime is currently trading at 0.6x P/NAV and below pandemic lows, and we believe that most of the negatives are already priced in. The current share price implies FY23e/FY24e DPU yield of 13.6/14.7%.

Airbnb Inc – Impressive earnings on strong travel demand

Recommendation: ACCUMULATE (Downgraded); TP: US$149.00

Analyst: Ambrish Shah

– FY22 revenue was in line with expectations at 101% of our forecasts, but PATMI exceeded at 110%. 4Q22 revenue grew 24% YoY to US$1.9bn despite 7% FX headwinds. PATMI spiked 480% YoY driven by a strong jump in travel demand that led to more bookings and higher operating leverage.

– Gross booking value (GBV) grew 20% YoY to US$13.5bn mainly driven by growth in nights and experiences booked (up 20% YoY to 88.2mn), with momentum continuing into 1Q23e.

– We downgrade to ACCUMULATE from BUY after the recent jump in its stock price. We raise our DCF target price to US$149.00 (prev. US$128.00) with a WACC of 7% and terminal growth of 4%. We increased our FY23e Revenue/PATMI by 1%/15% due to continued travel demand and lower expenses. While consumer discretionary spending is being squeezed, we believe Airbnb is well-positioned as the platform offers better non-urban location listings versus hotels, benefits travellers looking for long-term stays, and is more family and group travel-friendly.

FAANGM Monthly January 23 – Strong start to the year

Recommendation: NEUTRAL (Maintained); Analysts: Jonathan Woo, Maximilian Koeswoyo, Zane Aw, Phillip Research Team

– The FAANGM was up 11.3% in January, beating both the S&P 500 and Nasdaq, which were up 6.2% and 10.6% respectively. We suspect that this could be a bear market rally given the lack of any catalysts for FAANGM growth.

– META, AMZN, and NFLX were the biggest gainers, all up more than 20%; with META and AMZN buoyed by higher-than-anticipated holiday sales (8.3% YoY) and cooling goods inflation, and NFLX 4Q22 subscriber additions surprising to the upside of 3.2mn. MSFT was the laggard, up only 3.2%.

– We expect the near-term slowdown in digital advertising, weakness in consumer tech demand and pullback in Cloud spending to weigh on FAANGM price performance, with FAANGM LTM P/S trending in a similar direction. FY23e revenue growth for FAANGM is expected to be in the mid-high single digits (roughly half its 5-yr CAGR of 15% and similar to FY22). We remain NEUTRAL on FAANGM.

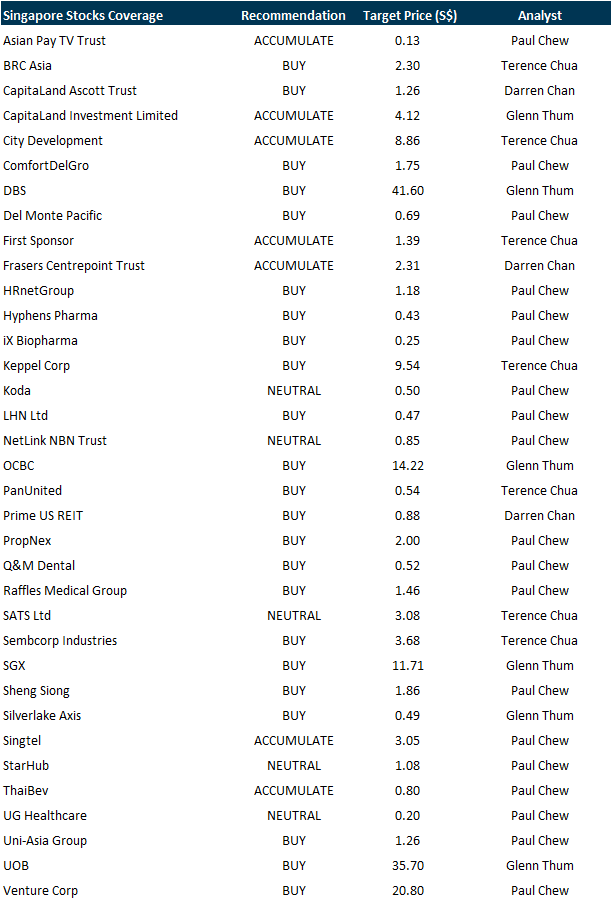

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Guest Presentation by First REIT Management Limited [NEW]

Date: 23 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Guest Presentation by Cromwell European REIT[NEW]

Date: 28 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3xw5GYW

Research Videos

Weekly Market Outlook: Alphabet Inc, Amazon Inc, SGX, Starhub Ltd, Tech Analysis & More

Date: 13 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials