DAILY MORNING NOTE | 18 April 2024

Trade of The Day

iFAST Corporation Ltd (SGX: AIY)

Analyst: Zane Aw

(Current Price: S$0.141) – TECHNICAL SELL

Sell price: S$6.51 Stop loss: S$6.75 (-3.69%)

Take profit 1: S$6.10 (+6.30%) Take profit 2: S$5.45 (+16.28%)

Trades Initiated in the past week

Singapore stocks ended Wednesday (Apr 17) at 3,154.69, up 9.93 points or 0.3 per cent, signalling that a knee-jerk reaction to a potential war in the Middle East may be coming to an end. Across the broader market, however, advancers only just edged out decliners 271 to 268 – an indication that sentiment remained weak.

The S&P 500 dropped for a fourth consecutive session on Wednesday, as Nvidia and other struggling technology names put downward pressure on the market. The broad index lost 0.58% to 5,022.21, while the technology-heavy Nasdaq Composite slid 1.15% to 15,683.37. The Dow Jones Industrial Average fell by 45.66 points, or 0.12%, to 37,753.31, despite rising nearly 238 points at its high of the day.

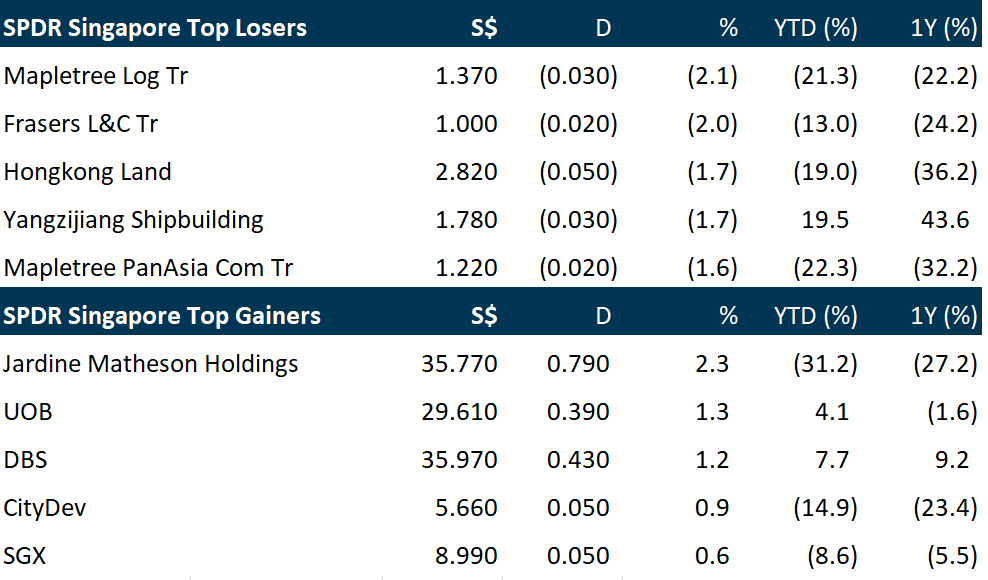

Top gainers & losers

Events Of The Week

SG

Cordlife Group is proposing to raise S$8.2 million by issuing a total of 51.2 million new ordinary shares at S$0.16 apiece. On Wednesday (Apr 17), the cord-blood bank said it entered into two separate subscription agreements with Charming Global Enterprises (CGE) and Darren Ng, a high-net-worth individual based in Singapore. CGE is owned by Jiao Shuge, who co-founded Beijing-based private equity and venture capital firm CDH Investments.

Keppel Pacific Oak US Reit (Kore) posted a distributable income of US$11.9 million for its first quarter ended Mar 31, down 8.8 per cent from US$13.1 million the previous year. The fall was mainly due to increased financing costs resulting from higher interest rates, said the manager of the office-focused real estate investment trust (Reit) in a business update on Wednesday (Apr 17). Gross revenue for Q1 stood at US$37.1 million, unchanged from the year before. Net property income for the quarter declined 0.8 per cent to US$21 million, from US$21.2 previously.

iWOW Technology has announced that its wholly-owned subsidiary, Roots Communications, has secured a contract worth up to approximately $10.7 million on April 17. The mobile engineering works contract, awarded by a major telecommunications service provider in Singapore, is in relation to the provision of engineering works for the expansion, safety enhancement, recovery works, relocation and retrofitting of radio base stations or other mobile network site infrastructures in Singapore. The contract is expected to be fulfilled over the next 36 months, and brings the group’s current order book to approximately $93.5 million.

US

Abbott Laboratories beat Wall Street estimates for quarterly profit on Wednesday (Apr 17) and raised the lower end of its forecast, as robust demand for medical procedures boosted sales of its devices, including its glucose-monitoring products. The company recorded medical device sales of US$4.45 billion, of which its glucose monitor, FreeStyle Libre, generated US$1.5 billion. Analysts, on average, had estimated Abbott’s medical device sales at US$4.30 billion, according to LSEG data. The company recorded US$9.96 billion in sales, compared to analysts’ estimate of US$9.88 billion. On an adjusted basis, it reported first-quarter profit of 98 cents per share, compared with analysts’ estimate of 95 cents per share, according to LSEG data.

ASML, which supplies chip-making machines to the semiconductor industry, on Wednesday (Apr 17) reported a drop in net profits and orders amid a high-tech trade spat between China and the West. Net profits came in at 1.2 billion euros (S$1.7 billion) in the first quarter of the year, compared to two billion euros in profit the firm reported in the fourth quarter of last year. Bookings slumped to 3.6 billion euros, a sharp decline from the 9.2 billion euros reported in the fourth quarter. Overall sales in the first quarter came in at 5.3 billion euros, lower than the 7.2 billion euros from the fourth quarter but in the range the company had forecast.

Oil prices slipped more than US$1 on Wednesday as US commercial inventories rose, while weaker economic data from China and dimmed prospects of interest rate cuts stoked worries about global demand. Brent futures for June were down US$1.01, or 1.32, to US$89.01 a barrel at 11.19 am EST, while US crude futures for May were down 88 cents, or 1 per cent, at US$84.48 a barrel. Both were on track for their biggest fall since March 20. Oil prices have softened this week as economic headwinds curb gains from geopolitical tensions, with markets eyeing how Israel might respond to Iran’s weekend attack.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

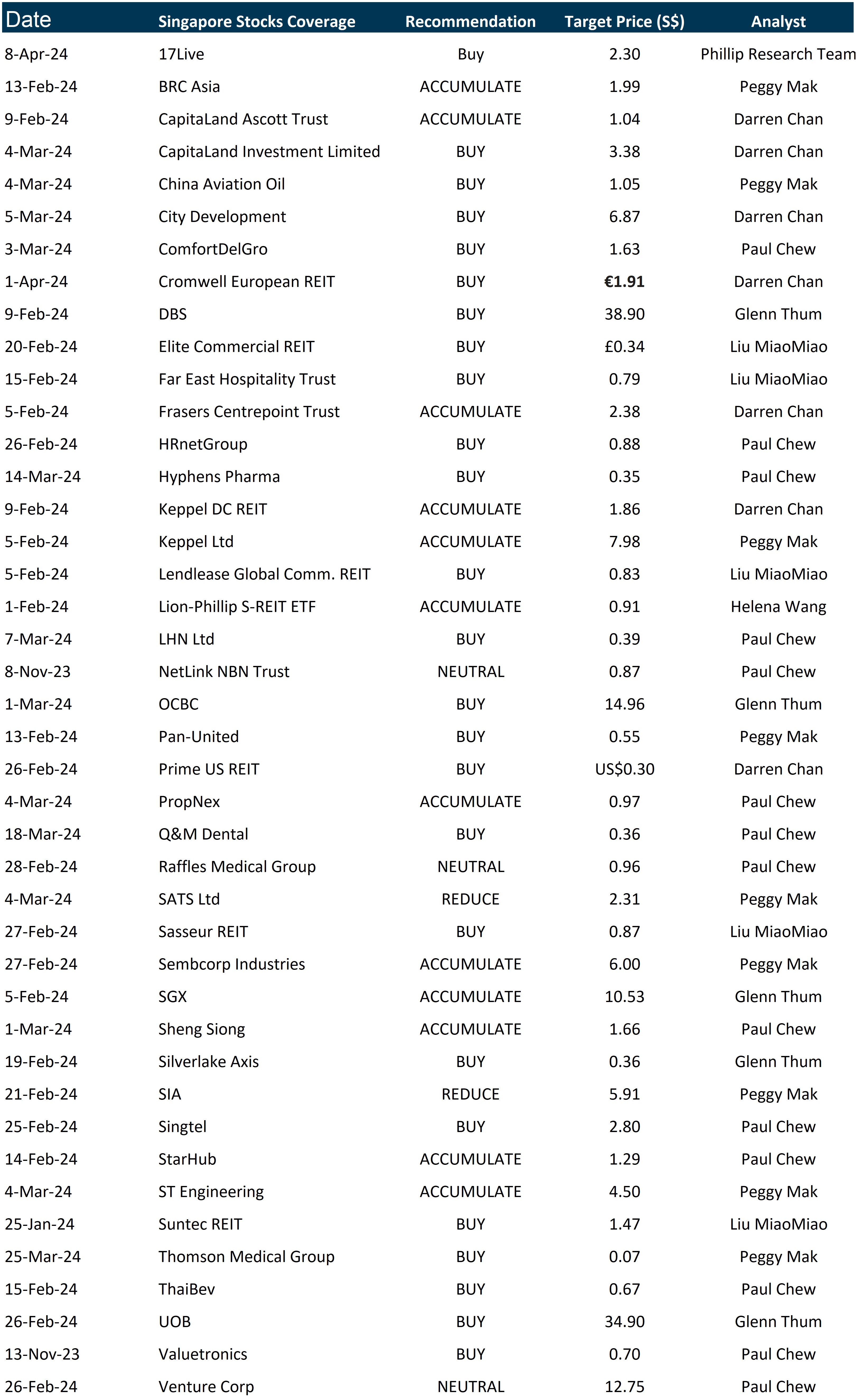

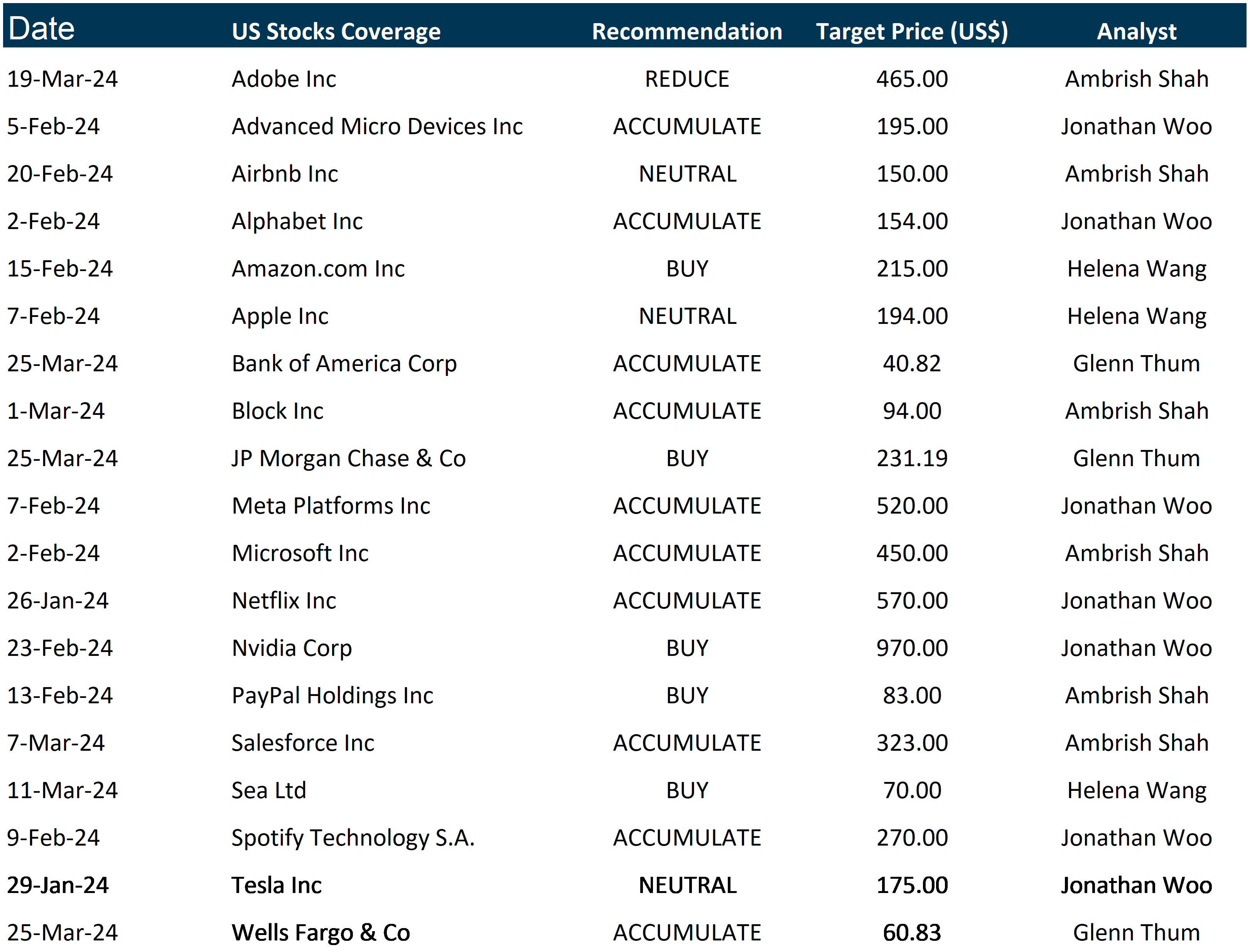

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Mermaid Maritime

Date & Time: 18 Apr 2024 |12pm – 1pm

Register: https://tinyurl.com/kjdxpuke

Strategy & Stock Picks 2Q2024 (US Market)

Date & Time: 18 Apr 2024 |7.30pm – 9.30pm

Register: https://tinyurl.com/4xak5epx

Strategy & Stock Picks 2Q2024 (SG Market)

Date & Time: 20 Apr 2024 |10am – 12pm

Register: https://tinyurl.com/wx22brkx

Corporate Insights by Hyphens Pharma International Limited

Date & Time: 30 Apr 2024 | 12pm -1pm

Register: https://tinyurl.com/3z5hhbet

Research Videos

Weekly Market Outlook: Magnificent-7, SG Banking, SG REITs, Tech Analysis, SG Weekly & More!

Date: 15 April 2024

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials