DAILY MORNING NOTE | 2 December 2022

Trade of The Day

Analyst: Zane Aw

Recommendation: Technical BUYBuy price: $2.75 Stop loss: S$2.68 Take profit: S$2.94

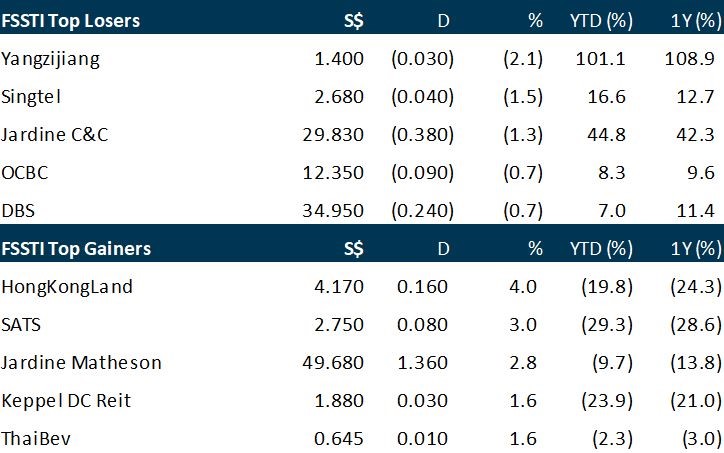

Most Asian equities cheered the less hawkish stance of the US Federal Reserve (Fed), but Singapore shares closed flattish on Thursday (Dec 1). The benchmark of 30 blue chip stocks, the Straits Times Index (STI), stood at 3,292.73 points, up only 0.1 per cent or 2.24 points, although it had opened 0.6 per cent higher. As the local banking trio account for over 40 per cent of the STI, slower rate hikes would mean limited upside for their net interest margins. DBS and OCBC closed lower, both dropping 0.7 per cent to S$34.95 and S$12.35 respectively. UOB, interestingly, managed to rise by 0.4 per cent to S$31.33. Across the broader bourse, gainers beat decliners 344 to 212, with 1.4 billion securities worth S$1.3 billion transacted. Elsewhere in Asia, most markets closed higher, boosted by Wall Street overnight gains after the US central bank said it is moderating the pace of interest rate increases.

The Dow Jones Industrial Average fell on Thursday, relinquishing some of the big gains seen in the prior session as investors awaited jobs data coming Friday that could determine the pace of the Federal Reserve’s future rate tightening. The 30-stock index dropped 194.76 points, or 0.56%, to close at 34,395.01. The S&P 500 closed down 0.09% to 4,076.57, while the Nasdaq Composite gained 0.13% to end at 11,482.45. Shares of Salesforce tumbled about 8.3% – helping to drag down the Dow – after the software company said its co-CEO would be stepping down soon. The index dropped as much as 460 points earlier in the session, a turn from the gain of more than 700 points seen Wednesday after Fed Chair Jerome Powell appeared to confirm the central bank will slow down its tightening. Costco dropped about 6.6% after the pace of November sales slowed to a 5.7% gain from the prior year. In October, sales climbed 7.7% from a year ago. The November data is an ominous sign during the peak holiday selling season. The wholesale retailer also reported a 10.1% decline in e-commerce sales during the period. Despite a bullish open on the back of a slightly better than expected inflation measure watched by the Federal Reserve, traders showed caution before the important Friday jobs report. Investors are looking to data on non-farm payrolls, the unemployment rate and hourly wages Friday for insight into the labor market, which has been relatively strong despite hopes of contraction as the Fed looks to cool inflation. Economists polled by Dow Jones expect the U.S. added 200,000 jobs in November, which would be a decrease from the 261,000 gained in the prior month.

SG

The government is watching the interest rate environment closely “to ensure that the CPF (Central Provident Fund) interest rate pegs remain relevant in the prevailing operating environment”. This was revealed in a joint news release by the Central Provident Fund Board, Housing and Development Board and Ministry of Health. The longer-term outlook will also be considered, the release added. The paragraph is an unusual addition in the quarterly release which updates on changes in the CPF interest rates. Amid a rising interest rate environment, some banks are offering promotional rates of above 3 per cent for 12-month fixed deposits of at least $20,000. The CPF Board said those aged above 55 years old can continue to earn up to 6 per cent interest per annum on their retirement balances, while the interest rate for the Ordinary Account (OA) and Special and MediSave Accounts (SMAs) remains unchanged. Currently, the floor rates for OAs and SMAs stand at 2.5 per cent and 4 per cent, respectively. The board said the OA interest rate will remain unchanged from Jan 1 to Mar 31, but did not provide further indications of the interest rates beyond Mar 31. The concessionary interest rate for Housing and Development Board housing loans, pegged at 0.1 per cent above the OA interest rate, will also remain unchanged at 2.6 per cent per annum from Jan 1 to Mar 31. However, members aged 55 and above will get an extra 2 per cent interest on the first S$30,000 of their combined balances – capped at S$20,000 for OAs – and an extra 1 per cent on the next S$30,000. The extra interest received on the OA will go into one’s Special Account or Retirement Account. If the member is above 55 and participates in the CPF Life scheme, the extra interest will still be earned on their combined balances, which include the savings used for the scheme. The adjustments made are part of the government’s efforts to enhance the retirement savings of CPF members, CPF said. Additionally, the basic healthcare sum, which is the cap applied to the MediSave Account, will be raised from S$66,000 to S$68,500 for those under 65. It will remain fixed at S$68,500 for those who turn 65 in 2023, while the sum for those aged 66 and above remains unchanged. “CPF members who have less than the basic healthcare sum are not required to top up their MediSave Account, and will still be able to withdraw from their MediSave Account to pay for approved medical expenses,” added the board.

Real median income growth rose to 2.1 per cent in 2022, as strong nominal income growth outstripped inflation, said the Ministry of Manpower (MOM) in the advance release of its annual Labour Force in Singapore report on Thursday (Dec 1). But this was still slower than in the pre-Covid years, when real median income growth averaged 3.8 per cent each year from 2014 to 2019, amid lower inflation. The figures are for the year ended June and apply to Singaporeans and permanent residents. They are based on the MOM’s mid-year Comprehensive Labour Force Survey, which looks at indicators typically not covered in the ministry’s quarterly labour market reports. Asked about the outlook for the next 12 months through June 2023, Manpower Minister Tan See Leng said he is not expecting a “significant slowdown” in real median income growth, though he noted that it is difficult to say for sure given that growth is expected to be uneven ahead. “In the sunrise sectors, for instance in healthcare, you’ll see growth. But there’ll be some sectors where, as I said, when the froth is removed, you see some rationalisation of the salaries,” he added, referring to the tech sector, which has seen layoffs making headlines. But this may not necessarily be a bad thing, said the minister, as it would mean wage growth in the sector would be more sustainable moving forward.

Inflight caterer and ground handler Sats on Thursday (Dec 1) said it would raise up to S$800 million via a renounceable underwritten rights issue to partially fund its acquisition of air cargo handler Worldwide Flight Services (WFS). The rights issue is expected to be launched in the first quarter of next year and is subject to “conducive market conditions” and the satisfaction of regulatory approvals. Details of the issue, including pricing, have not yet been finalised. But Sats chief financial officer Manfred Seah offered some comfort to shareholders, saying a massive discount would only be necessary in “distressed situations” and as a last resort. “Sats is certainly not in that position,” he said. Temasek, which holds 39.7 per cent of Sats through subsidiary Venezio Investments, has indicated its intention to subscribe for its pro-rata entitlement to the rights issue. Sats directors also intend to subscribe for their entitlements. Asked why Temasek is not underwriting the issue, as it had done for Sembcorp Marine and Singapore Airlines, Seah said if Temasek were to do so then it would trigger a mandatory general offer or have to go to shareholders for a whitewash waiver. In response to a query by The Business Times on why it had not considered raising its stake in Sats, Temasek said that it is “supportive” of Sats’ acquisition of WFS. Seah said that a panel of banks will “stand behind” the rights issue, and that it is “envisaged” that they would underwrite any entitlements not taken up by shareholders. These banks include, but are not limited to, the principal banks of Sats, he said. The rest of the funding for the S$1.8 billion acquisition will come from a term loan and internal cash balances. The term loan is a three-year euro-denominated loan of about S$700 million, with an all-in annual cost of 4-4.5 per cent based on the prevailing euro interbank offered rate. Sats said this loan is “comparable” to the terms of its existing borrowing facilities. Seah added that Sats has a bridge loan of about 1.2 billion euros (S$1.7 billion) that is “enough to cover” the acquisition if market conditions are not conducive for a rights issue.

US

Key consumer price data from the US Commerce Department showed the second-smallest increase this year amid accelerated spending, offering hope that the Federal Reserve’s interest-rate hikes are cooling inflation without sparking a recession. The personal consumption expenditures (PCE) price index, which excludes food and energy, rose 0.2 per cent in October from a month earlier. It was below forecasts. Federal Reserve chair Jerome Powell stressed this week that the PCE price index, released on Thursday (Dec 1), is a more accurate measure of where inflation is heading. From a year earlier, the gauge was up 5 per cent, but a step down from an upwardly revised 5.2 per cent gain in September. The overall PCE price index increased 0.3 per cent for a third month and was up 6 per cent from a year ago, still well above the central bank’s goal of 2 per cent. Personal spending, adjusted for changes in prices, rose 0.5 per cent in October. It was a pickup from the 0.3 per cent advance seen in the month prior, and largely reflects a surge in outlays for merchandise. Similar to consumer price index data released last month, the report shows that inflation remains too high, even though it is beginning to ease. While a deceleration is certainly welcomed, Powell said on Wednesday that the US is far from price stability and that it will take “substantially more evidence” to provide comfort that inflation is actually declining. Policymakers are expected to continue raising interest rates into next year, albeit at a slower pace, and remain restrictive for some time.

Recurring applications for US unemployment benefits rose to a 10-month high, suggesting that Americans are having more trouble finding work after losing their jobs. Such continuing claims, which include people who have already received unemployment benefits for a week or more, rose by some 57,000 to 1.6 million in the week ended Nov 19. This was the biggest jump in a year, and the highest number of continuing claims since February. Meanwhile, data from the US Department of Labor showed that initial unemployment claims decreased by 16,000 to 225,000 in the week ended Nov 26. This was lower than the median estimate of 235,000 applications in a Bloomberg survey of economists. On an unadjusted basis, initial claims fell by about 50,000 to 198,557 last week, led by California, Texas, Illinois and Georgia. Unemployment claims data tend to be more volatile around holidays; last week was Thanksgiving in the US. The four-week moving average, which smooths out such volatility, edged up to 228,750. Economists have been watching continuing claims more closely in recent weeks, as they serve as an indicator of how hard it is for people to find work after losing their jobs. Continuing claims have also been known to hint at upcoming recessions. Although the gauge had risen for the last two months, it was still near historic lows. The Federal Reserve’s aggressive course of interest-rate hikes this year has yet to significantly dent the labour market, while other parts of the economy have more obviously slowed down. Chairperson Jerome Powell said Wednesday (Nov 30) that demand for workers still far exceeded supply. He added that the central bank would prefer to resolve the imbalance by restraining payrolls growth, rather than via outright job losses. While there was a wave of layoffs at high-profile technology and banking companies, such layoffs were still largely contained to a few industries. Meanwhile, data out Wednesday showed that job openings declined and wage gains moderated in October. This suggested that demand for workers might be starting to abate.

US manufacturing activity contracted for the first time in 2-1/2 years in November as higher borrowing costs weighed on demand for goods, but a measure of prices paid by factories for inputs fell for a second straight month, supporting views that inflation could continue trending lower. The Institute for Supply Management (ISM) said on Thursday (Dec 1) that its manufacturing PMI fell to 49.0 last month. That was the first contraction and also the weakest reading since May 2020, when the economy was reeling from the initial wave of Covid-19 infections, and followed 50.2 in October. A reading below 50 indicates contraction in manufacturing, which accounts for 11.3 per cent of the US economy. Still, the index remains above the level that is typically associated with a recession in the broader US economy. Economists polled by Reuters had forecast the index sliding to 49.8. The Federal Reserve is in the midst of what has become the fastest rate-hiking cycle since the 1980s, as it battles inflation, raising the risks of a recession next year. The Fed has raised its policy rate by 375 basis points this year from near zero to a 3.75 per cent – 4.00 per cent range. Manufacturing is also being pressured by the rotation of spending back to services from goods as the nation moves away from the pandemic. The ISM survey’s forward-looking new orders sub-index dropped to 47.2, remaining in contraction territory for a third straight month. Order backlogs also dwindled further also a function of improving supply chains. The survey’s measure of supplier deliveries rose to 47.2 from 46.8 in September, which was the first decline below the 50 threshold since February 2016. A reading below 50 indicates faster deliveries to factories. With supply chain bottlenecks easing, the outlook for inflation is improving. A measure of prices paid by manufacturers fell to a 2-1/2 year low of 43.0 from 46.6 in October. The drop, which also reflected a moderation in commodity prices, offers hope that inflation has already peaked. Annual consumer prices increased below 8 per cent in October for the first time in eight months. The ISM survey’s measure of factory employment decreased to 48.4 from 50.0 in October. The decline is likely because of slowing demand for labour as manufacturers brace for economic turbulence.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

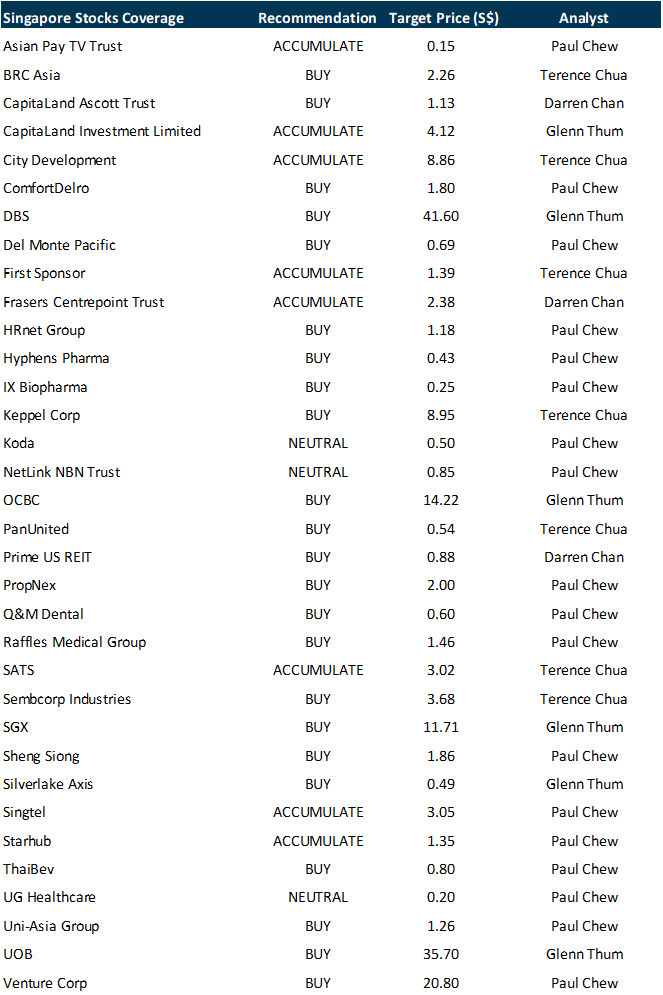

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: TDCX, PropertyGuru, NIO, SATS, SCI, Technical Pulse, Fed Speaks

Date: 28 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials