DAILY MORNING NOTE | 2 September 2022

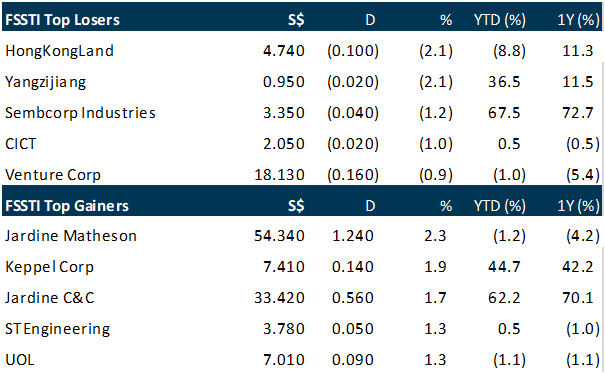

Singapore shares managed to buck the trend of losses in the region to finish higher on Thursday (Sep 1), following a day of see-saw trading, even as caution reigned amid what pundits called the start of a “bear market rally” in Wall Street. The key Straits Times Index rose 2.41 points or 0.07 per cent to 3,224.08 following overnight dips in US key stock indices, which closed in the red for the fourth consecutive session on aggressive rate-hike fears. Elsewhere, key gauges in Japan, China, Hong Kong, Taiwan, South Korea, Australia and Malaysia finished lower on more hawkish Fed-speak. The broad losses in the region come ahead of a key US labour market report. Over in Europe, the central bank there could be poised to raise rates by 75 basis points in more than a week from now, after the eurozone’s inflation hit another record high.

The Dow and S&P 500 snapped a four-day losing streak on Thursday ahead of jobs data expected to strengthen the Federal Reserve’s commitment to monetary tightening. Stocks were in the red most of the trading day, but rallied in the final hour in an apparent round of bargain hunting. The Dow Jones Industrial Average ended up 0.5 per cent at 31,656.42. The broad-based S&P 500 gained 0.3 percent to 3,966.85, while the tech-rich Nasdaq Composite Index shed 0.3 per cent to 11,785.13. Among individual companies, Nvidia slumped 7.7 per cent after the chip company disclosed that the US government restricted exports of processing equipment to China and Russia to prevent their militaries from using them.

SG

PUB has issued S$800 million worth of green bonds with a 30-year tenor, and these have been priced to yield 3.4 per cent. The national water agency’s first green bonds will mature on Aug 30, 2052, and its first coupon payment will be made on Feb 28, 2023, with subsequent payments made once every 6 months, according to Bloomberg. The bonds were priced on Aug 24, with DBS Bank and United Overseas Bank as its bookrunners, though PUB has not released information on its subscription rate yet. These green bonds are the first issuances of a new S$10 billion multi-currency medium-term note (MTN) programme by PUB.

Three berths are now in operation and about 500 people are working in Tuas Port, which is set to be the world’s biggest fully automated port when completed in the 2040s. With work mostly done by unmanned machines that run on cleaner electricity, the S$20 billion facility is set to be a “game changer” in Singapore’s port and supply chain operations, operator PSA said at the official opening of the new port on Thursday (Sep 1). The port’s eventual handling capacity of 65 million twenty-foot equivalent units (TEUs) – a unit of measurement for containers – will make it the world’s biggest – a one-third increase from Singapore’s current capacity and larger than ports operated by competitors in Shanghai, Hong Kong and Amsterdam.

Transport company ComfortDelGro has been dropped from the Straits Times Index (STI) in the latest quarterly review, with recently-listed Emperador replacing it on the benchmark index. The change to the STI, which tracks the performance of the 30 largest and most liquid companies listed on the Singapore Exchange (SGX), takes effect at the start of business on Sep 19, FTSE Russell said in a statement on Thursday (Sep 1). Companies gain entry into the STI at quarterly reviews if they rank 20th or higher among eligible securities by full market capitalisation; conversely, those that rank 41st or below among all eligible securities are deleted from the list. Emperador, which is primary-listed on the Philippine Stock Exchange and a subsidiary of Filipino billionaire Andrew Tan’s Alliance Global Group, carried out a secondary-listing on the SGX mainboard in July. It is the largest liquor company in the Philippines, and its portfolio includes whiskey brands such as The Dalmore and Jura, as well as brandy under the Fundador and its eponymous Emperador brands.

US

Applications for US unemployment insurance fell for a third week to a 2-month low, suggesting healthy demand for labour even as economic growth moderates. Initial unemployment claims decreased by 5,000 to 232,000 in the week ended Aug 27, Labour Department data on Thursday (Sep 1) showed. The median estimate in a Bloomberg survey of economists called for 248,000 new applications. Continuing claims for state benefits rose to 1.44 million in the week ended Aug 20 from 1.41 million. The level of first-time claims, in addition to a still-low number of Americans already on unemployment benefit rolls, underscores tightness in the broader labour market. A separate report on Tuesday showed that job openings surged in July, near the highest level on record. “These timely data show that labour market conditions are not weakening dramatically, with lay-offs not yet picking up in a sustained way in response to Fed tightening,” Rubeela Farooqi, chief US economist at High Frequency Economics, said in a note.

Amazon.com introduced a new service on Wednesday (Aug 31) to help its sellers store bulk inventory and ease distribution to tackle supply chain issues, the company said in a blog post. In 2023, sellers will be able to use the new service called Amazon Warehousing & Distribution (AWD) to send their inventory to any location, including to wholesale customers or brick-and-mortar stores, the online retailer said. The pay-as-you-go service will also help sellers significantly cut logistics costs, the e-commerce platform said, without disclosing specifics. “Amazon Warehousing & Distribution addresses critical supply chain challenges and helps sellers grow and manage their business while significantly cutting costs,” Gopal Pillai, vice-president of Amazon Distribution and Fulfilment Solutions, said in the blog post. The development comes after Amazon said that it has started slowing warehouse openings to rein in costs.

3M plans to eliminate jobs as part of a broader cost-cutting drive in response to the slowing economy, according to internal communications. Michale Vale, head of 3M’s safety and industrial division, disclosed the plans in a message to employees of the unit. “The business can’t avoid this tough necessity,” he said in the communication, which was reviewed by Bloomberg News. The scope of the cuts couldn’t be immediately determined. 3M, which makes everything from dental adhesives to Post-it notes, employed about 95,000 people at the end of 2021, according to securities filings. “3M is taking decisive actions to position the company for continued growth, while also adjusting to the challenging macroeconomic environment,” the company said in a statement, without being more specific. “As we prioritise our investments and resources, we will be adjusting on an ongoing basis the roles and responsibilities needed for future growth.” 3M has underperformed in recent years amid supply-chain snags, currency fluctuations and rising costs. The company said in July it will spin off its healthcare operation, which accounted for almost a quarter of sales. Management also cut its full-year sales and profit outlook.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by Credit Bureau Asia [NEW]

Date: 14 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Rj2MP4

Guest Presentation by AIMS APAC REIT [NEW]

Date: 15 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3KAETjD

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: TDCX, City Dev, SingTel, Hyphens Pharma, Phillip On The Ground, SG Weekly….

Date: 29 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials