DAILY MORNING NOTE | 24 November 2022

Trade of The Day – Technical Pulse: ASML Holding N.V.

Analyst: Zane Aw

(Current Price: US$596.21) – TECHNICAL BUYBuy price: US$596.21 Stop loss: US$568.00 Take profit: US$700.00

The price formed a bullish consolidation pennant following a breakout of the long-term downtrend channel. We are likely to see follow through of the bullish momentum to drive the stock price higher to retest the next key horizontal resistance level at US$700.

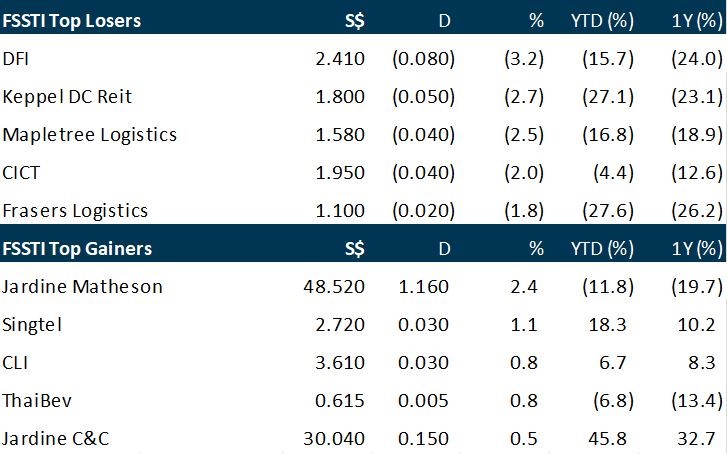

Singapore stocks have dipped at the closing bell on Wednesday (Nov 23), even as most Asian indices experienced a mid-week rebound. The Straits Times Index (STI) fell 0.1 per cent or 3.57 points to end the day at 3,255.99. Advancers beat decliners 282 to 240 in the broader market, after 1.1 billion securities worth S$822.8 million changed hands. Regional markets mirrored Wall Street gains ahead of the holiday shopping season. Japan’s Nikkei 225 continued its climb through the week, gaining 0.6 per cent, Hong Kong’s Hang Seng Index also climbed 0.6 per cent, while South Korea’s Kospi rose 0.5 per cent. The Jakarta Composite Index added 0.3 per cent while the Kuala Lumpur Composite Index edged up 0.2 per cent.

Wall Street’s main indexes opened lower on Wednesday (Nov 23), as Apple shares fell, while investors awaited the minutes of the Federal Reserve’s November meeting for a clearer picture of its monetary tightening policy. The Dow Jones Industrial Average fell 6.5 points, or 0.02 per cent, at the open to 34,091.57. The S&P 500 fell 3.3 points, or 0.08 per cent, at the open to 4,000.3, while the Nasdaq Composite dropped 0.2 points to 11,174.612 at the opening bell.

SG

Certificate of entitlement (COE) prices for commercial vehicles ended at a historic high at the close of the tender on Wednesday (Nov 23), while the premium for smaller cars finished close to an all-time high. COE premiums for cars up to 1,600cc and 130bhp and electric cars up to 147bhp closed 3.8 per cent higher at S$90,589. This is a whisker away from the all-time high of S$92,100 recorded in January 2013, which had been followed by cooling measures from the authorities. COE prices for commercial vehicles chalked the biggest increase of the day of 7.2 per cent to hit a new record of S$81,802. The other categories ended lower. COE premiums for cars above 1,600cc or 130bhp or electric cars above 147bhp closed 1.3 per cent lower at S$113,881. The Open category, which can be used for any vehicle type but ends up almost exclusively for bigger and more powerful cars, closed 2.2 per cent lower at S$114,009. The motorcycle COE premium ended 4.5 per cent lower at S$12,589. The spike in commercial vehicle COE prices raised eyebrows among motor traders. Trade sources said the rush to register electric and petrol light commercial vehicles ahead of a reduction in tax incentives for such models was largely responsible for pushing up prices. Speculators are also said to be taking advantage of the smaller COE quota to push up the resale value of Early Turnover Scheme (ETS) papers. ETS is an incentive scheme where fleet owners who switch to newer, cleaner models get a COE concession.

AusGroup has applied to the Singapore High Court to be placed under judicial management, the mainboard-listed integrated service solutions provider said in an announcement on Wednesday (Nov 23). Tan Wei Cheong, Matthew Stuart Becker and Lim Loo Khoon of Deloitte & Touche have been proposed as joint and several interim judicial managers and judicial managers of the company, it added. On Nov 17, AusGroup updated that it was formulating and progressing with a restructuring plan for the financial obligations of the company with Deloitte. It also said that it continued to be in discussions with several parties for the potential sale of certain assets and businesses. “While some of these confidential discussions are at an advanced stage with indicative draft terms, there is no assurance that the potential transactions will materialise,” it added. The judicial management applications follow AusGroup’s trading halt called on Nov 7 and trading suspension called on Nov 10. In addition to the potential sale, AusGroup said that discussions with its management to assess the company’s financial position led to the trading suspension recommendation. AusGroup in the last month announced the resignation of Christian Johnstone as chief financial officer, effective Feb 6, 2023 and the resignation of Shane Kimpton as managing director, though Kimpton remains chief executive officer. AusGroup shares last traded at S$0.009 on Nov 4, the lowest since the company went public in 2005.

Singapore’s inflation unexpectedly eased across the board in October, from decade-high levels in the previous month, as prices rose more slowly across almost all broad categories, data from the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) showed on Wednesday (Nov 23). Headline inflation fell to 6.7 per cent year on year in October, from 7.5 per cent previously, with most categories seeing lower price increases other than accommodation and food, the authorities said. Core inflation, which excludes accommodation and private transport, was 5.1 per cent year on year last month, easing from September’s 5.3 per cent. The authorities said this was driven by smaller increases in the prices of electricity and gas, retail and other goods and services. Both sets of figures are lower than what private-sector economists polled by Bloomberg have predicted; they were expecting headline inflation to come in at 7 per cent, and core inflation at 5.3 per cent. It is also the first time both figures have dipped since February this year. Still, MAS and MTI kept their inflation outlook the same as the previous month and is sticking to a full-year forecast of 6 per cent for headline inflation and 4 per cent for core inflation. They are also maintaining their outlook at 5.5 to 6.5 per cent for headline inflation, and 3.5 to 4.5 per cent for core inflation.

US

Applications for US unemployment benefits rose last week to a three-month high amid a wave of layoffs at technology companies, a sign of cooling in a tight labour market. Orders placed with US factories for business equipment rebounded in October, suggesting capital spending plans are holding up in the face of higher borrowing costs and broader economic uncertainty. Initial unemployment claims increased by 17,000 to 240,000 in the week ended Nov 19, Labor Department data showed on Wednesday (Nov 23). The median estimate in a Bloomberg survey of economists called for 225,000. Continuing claims, which include people who have already received unemployment benefits for a week or more, rose by 48,000 to 1.55 million in the week ended Nov 12, the highest since March. That was also the sixth weekly increase in a row. The list of high-profile technology companies announcing job cuts or hiring freezes has been growing, from Amazon.com to Facebook parent company Meta and personal-computer maker HP, which said this week it would eliminate as many as 6,000 jobs. The mounting layoffs in the sector don’t necessarily portend weakness in the broader market because many tech companies had ramped up hiring during the pandemic-era e-commerce boom. Still, other industries aren’t immune. Even FedEx is furloughing workers in its freight unit ahead of what’s usually the busiest season of the year for the company. The four-week moving average, which smooths out volatility from week to week, increased to 226,750. On an unadjusted basis, initial claims rose by about 48,000 to almost 248,200 last week. The increases were spread across the states, with California, Illinois and Georgia among the largest ones.

Federal Reserve officials earlier this month agreed that smaller interest rate increases should happen soon as they evaluate the impact policy is having on the economy, meeting minutes released Wednesday indicated. Reflecting statements that multiple officials have made over the past several weeks, the meeting summary pointed to smaller rate hikes coming. Markets widely expect the rate-setting Federal Open Market Committee to step down to a 0.5 percentage point increase in December, following four straight 0.75 percentage point hikes.

Though hinting that less severe moves were ahead, officials said they still see few signs of inflation abating. However, some committee members expressed concern about risks to the financial system should the Fed continue to press forward at the same aggressive pace. The minutes noted that the smaller hikes would give policymakers a chance to evaluate the impact of the succession of rate hikes. The central bank’s next interest rate decision is Dec. 14. The summary noted that a few members indicated that “slowing the pace of increase could reduce the risk of instability in the financial system.” Others said they’d like to wait to ease up on the pace. Officials said they see the balance of risks on the economy now skewed to the downside. Markets expect a few more rate hikes in 2023, taking the funds rate to around 5%, and then possibly some reductions before next year ends.

Sales of new US single-family homes unexpectedly jumped in October, shrugging off rising mortgage rates and house prices, which have drastically eroded affordability. New home sales rebounded 7.5 per cent to a seasonally adjusted annual rate of 632,000 units last month, the Commerce Department said on Wednesday (Nov 23). September’s sales pace was revised down to 588,000 units from the previously reported 603,000 units. Sales surged 45.7 per cent in the Northeast and accelerated 16.0 per cent in the densely populated South. But they tumbled 34.2 per cent in the Midwest and fell 0.8 per cent in the West. Economists polled by Reuters had forecast new home sales, which account for about 10 per cent of US home sales, would decline to a rate of 570,000 units in October. New home sales are volatile on a month-to-month basis. Sales dropped 5.8 per cent on a year-on-year basis in October. The housing market has been hammered by aggressive Federal Reserve interest rate hikes that are aimed at curbing high inflation by dampening demand in the economy. The 30-year fixed mortgage rate breached 7 per cent in October for the first time since 2002, data from mortgage finance agency Freddie Mac showed. The rate averaged 6.61 per cent in the latest week. Sales of previously owned homes logged their ninth straight monthly decline in October, while single-family homebuilding and permits for future construction dropped to the lowest levels since May 2020, reports showed last week. The median new house price in October was US$493,000, a 15.4 per cent increase from a year ago. There were 470,000 new homes on the market at the end of last month, up from 463,000 units in September. Houses under construction accounted for 63.4 per cent of the inventory, with homes yet to be built making up 23.6 per cent. Completed houses accounted for 13 per cent of the inventory, well below a long-term average of 27 per cent. At October’s sales pace it would take 8.9 months to clear the supply of houses on the market, down from 9.4 months in September.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Uni-Asia Group Ltd – Locked in attractive freight rates

Recommendation: BUY (Maintained); TP S$1.26, Last close: S$0.79; Analyst Paul Chew

– The average charter rate in 3Q22 for Uni-Asia was US$19,609/day, an increase of 37% YoY. We believe the jump in freight rates will drive similar growth rates for charter income. Charter income is around 85% of FY22e total revenue.

– Improvement in Hong Kong property projects in terms of units sold and construction progress.

– We are maintaining our FY22e forecast. Despite the Baltic Exchange Handysize index declining 45% YoY in 3Q22, Uni-Asia has locked in attractive freight rates. Our FY23e PATMI is lowered by 13% to US$19.2mn. Unless freight rates recover in 1Q23, there is a risk the next renewal cycle will be a major drag to revenue. We maintain our BUY recommendation and target price of S$1.26. The target price is pegged to 3x P/E FY22e, in line with industry peers. The soft economic conditions in China have led to softer demand for bulk commodities. Nevertheless, supporting longer-term freight rates will be the 30-year low in new dry bulk vessels of only 7% of fleet capacity.

Phillip Securities Research has received monetary compensation for the production of the report from the entity mentioned in the report.

TDCX Inc. – Muted by macro uncertainty

Recommendation : BUY (Maintained); TP: US$15.50, Last Close: US$10.52

Analyst: Jonathan Woo

– 9M22 revenue was in line at 73% of our FY22e forecasts. PATMI was above expectations, at 84% of our FY22e forecasts due to higher interest and other operating income.

– The travel and hospitality vertical continues to provide growth tailwinds, returning to pre-pandemic levels with 29% YoY growth for 3Q22.

– We raised our FY22e PATMI by 12% to S$108mn primarily from higher-than-expected interest and other operating income, while keeping FY22e revenue unchanged. However, we cut our FY23e revenue growth forecasts by ~5% due to macroeconomic uncertainty and pullback in spending by tech companies. We maintain a BUY recommendation with a reduced DCF target price of US$15.50 (prev. US$16.39), a WACC of 10.4%, and a terminal growth rate of 3.0%.

PropertyGuru Group Ltd. – Cooling measures to affect growth

Recommendation: ACCUMULATE (Downgraded); TP: US$5.30, Last Close: US$4.99

Analyst: Maximilian Koeswoyo

– Revenue in line with expectation while earnings missed. 9M22 revenue at 66% of FY22e forecast. 9M22 Adj. EBITDA/net loss came in at 30%/125% of forecasts due to higher than expected employee compensation and other expenses.

– Vietnam revenue spiked 161% YoY while Malaysia grew 49%. Singapore remains the largest market, growing 28%. ARPA/ARPL increased by 24%/2.5% and achieved ~87% renewal rate. Government cooling measures are expected to pose headwinds in 4Q22.

– We cut our FY22e revenue by 6% and PATMI by 24% to account following management guidance of macroeconomic headwinds and increased cost assumptions. Downgrade to ACCUMULATE with a lowered DCF target price of US$5.30 (prev. US$5.73), with a WACC of 10.1% and g of 3%.

Upcoming Webinars

Guest Presentation by KTMG Limited [NEW]

Date: 24 November 2022

Time: 1pm – 2pm

Register: https://bit.ly/3TGIgbC

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Sea Ltd, Silverlake Axis, Q&M Dental, ComfortDelgro, APTT, Tech Analysis…

Date: 21 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials