Daily Morning Note – 25 March 2022

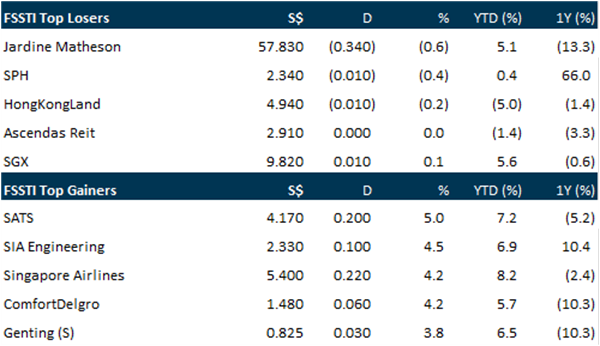

Singapore stocks were up on Thursday (March 24) after the government announced loosened Covid-19 restrictions. The Straits Times Index (STI) climbed 1.1 per cent or 35.44 to close at 3,399.70. Across the wider market, 1.86 billion shares worth S$1.65 billion were traded, with gainers beating losers 297 to 165. In a flash report, Citi analysts said that the news should revive investor excitement in so-called “reopening plays” after the government announced the easing of Covid-19 restrictions. Across the region, market indices were mixed on Thursday. South Korea’s Kospi was down 0.2 per cent while Hong Kong’s Hang Seng Index fell 0.9 per cent. Japan’s Nikkei 225 was up 0.3 per cent while the Jakarta Composite Index rose 0.8 per cent and the Kuala Lumpur Composite Index edged up 0.1 per cent.

Technology stocks lifted US stock indexes higher at the open on Thursday (Mar 24) after a sharp fall in the previous session, with investors closely tracking a meeting of Western leaders as the Ukraine crisis enters its second month. The Dow Jones Industrial Average rose 48.31 points, or 0.14 per cent, at the open to 34,406.81. The S&P 500 opened higher by 13.74 points, or 0.31 per cent, at 4,469.98, while the Nasdaq Composite gained 78.72 points, or 0.57 per cent, to 14,001.32 at the opening bell.

SG

Shares of Olam Group fell as much as 8 per cent on Thursday (Mar 24) after the group’s food ingredients unit OFI announced a delay in its plans for an initial public offering (IPO). OFI said it no longer expects it planned IPO to take place in the second quarter of 2022 as previously anticipated. As at the open of trade, the counter plunged 8 per cent or S$0.15 to S$1.72 following a series of sell-downs as about 1 million securities were transacted. It later recovered slightly to close at S$1.77, down S$0.10 or 5.4 per cent, after 11.1 million of its shares changed hands.

Temasek-backed carbon exchange Climate Impact X (CIX) has partnered with Carbonplace, a new carbon credit settlement platform developed by 7 banks, to lower the entry barriers for organisations seeking high-quality carbon credits on the voluntary carbon market. They aim to achieve this by piloting a technical, legal and operational framework for executing carbon credit transactions on CIX’s recently launched digital platform, Project Marketplace, they said in a statement on Friday (Mar 25). Carbonplace – started by BNP Paribas, CIBC, Itau Unibanco, National Australia Bank, NatWest Group, Standard Chartered and UBS – will perform the settlements behind the transactions. The banks had conceptualised the platform to only process carbon credits verified according to internationally-recognised standards. The platform, which was launched last year and expected to be fully operational by the end of this year, will also be made to be able to provide a record of ownership and enables reliable, secure, and scalable trading of certified carbon credits.

Singapore Press Holdings (SPH) on Thursday (Mar 24) launched a consent solicitation and tender offer exercise to buy back its outstanding S$500 million 3.2 per cent notes due 2030, issued under the group’s S$1 billion multicurrency debt issuance programme. Noteholders are invited to sell back their notes to the company, in cash, at a purchase price of 100.75 per cent of the principal amount from Mar 24 until the expiration deadline at 2 pm on Apr 18. Those who deliver their consent by 5 pm on Apr 7 will receive an early consent fee equal to 0.25 per cent of the principal amount. Consent received after this deadline will entail a normal consent fee of 0.15 per cent. DBS has been appointed by SPH as its dealer manager for the exercise.

US

Crude prices slid 2 per cent on Thursday (Mar 24) after the European Union (EU) could not agree on a plan to boycott Russian oil and on reports that exports from Kazakhstan’s Caspian Pipeline Consortium (CPC) terminal could partially resume. European Union leaders are set to agree at a 2-day summit starting on Thursday to jointly buy natural gas as they seek to cut reliance on Russian fuels, with some saying they would not comply with Moscow’s demand to buy oil and gas using roubles. But EU countries remain divided on whether to sanction Russian oil and gas directly, a move already taken by the United States. Brent futures fell US$2.57 or 2.1 per cent to settle at US$119.03 a barrel, while US West Texas Intermediate (WTI) crude fell US$2.59 or 2.3 per cent to settle at US$112.34.

Apple is working on a subscription service for the iPhone and other hardware products, a move that could make device ownership similar to paying a monthly app fee, according to people with knowledge of the matter. The service would be Apple’s biggest push yet into automatically recurring sales, allowing users to subscribe to hardware for the first time – rather than just digital services. But the project is still in development, said the people, who asked not to identified because the initiative hasn’t been announced. Apple shares climbed to a session high after Bloomberg reported on the news Thursday (Mar 24) and closed up 2.3 per cent at US$174.07. Though the stock is still down 2 per cent for the year, Apple has now posted 8 straight days of increases – its longest streak since November.

Meta Platforms will make it easier for brands to run 3-dimensional ads on Facebook and Instagram through a new partnership with an ecommerce technology firm. The integration with VNTANA will allow brands to upload the 3D models of their products to the social media platforms and easily convert them into ads, VNTANA said on Thursday (Mar 24) in a press release. The move is a stepping stone into advertising in the metaverse, said VNTANA chief executive Ashley Crowder, referring to the futuristic idea of a collection of virtual worlds that can be accessed through different devices such as headsets. Meta has staked its future on contributing to the building of the metaverse, which it has said could take up to a decade to be realised.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Click the link to join: https://t.me/stocksbnb

Date: 21 March 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.