DAILY MORNING NOTE | 26 September 2022

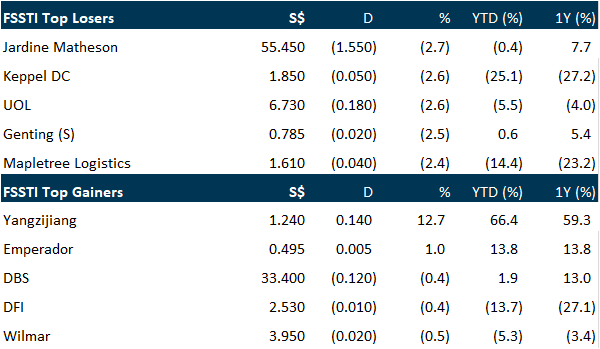

The Straits Times Index (STI) tumbled 1.1 per cent or 35.97 points to close at 3,227.10 on Friday (Sep 23), as Singapore’s higher-than-expected headline inflation figures for August caught market watchers by surprise. This brought the benchmark index down a total of 1.3 per cent for the week. In the broader Singapore market, losers outnumbered gainers 340 to 179 on Friday, with 1.33 billion securities worth S$1.41 billion traded. Apart from “broad-based price pressures” that lifted Singapore’s headline inflation, OCBC chief economist Selena Ling noted that core inflation had also accelerated, reflecting a stronger pickup in prices of services and food. “It underpins our belief that core inflation may not have peaked yet for the Singapore economy as domestic drivers for inflation are becoming more prominent,” Ling said. Yangzijiang Shipbuilding was the biggest gainer on the STI, closing 12.7 per cent or S$0.14 higher at S$1.24, triggering a query from Singapore Exchange Regulation. The counter was also the most actively traded in the Singapore market, with 153.7 million shares changing hands. Emperador was the only other gainer among the constituent stocks. The liquor company rose 1 per cent or S$0.005 to end at S$0.495. At the bottom of the table was Jardine Matheson Holdings, which fell 2.7 per cent or US$1.55 to US$55.45. The trio of local banks all finished lower. DBS slipped 0.4 per cent or S$0.12 to S$33.40, OCBC fell 1.9 per cent or S$0.23 to S$12.08, while UOB lost 1.4 per cent or S$0.39 to S$27.14. Most key Asian markets ended lower on Friday, as several central banks ramped up interest rates amid decades-high inflation. South Korea’s Kospi, Japan’s Nikkei 225, Hong Kong’s Hang Seng and the FTSE Bursa Malaysia KLCI shed between 0.6 per cent and 1.8 per cent.

Wall Street stocks finished decisively lower Friday (Sep 23), falling for the fourth straight session as markets bet on the rising risk of a recession due to interest rate hikes. All 3 major indices dropped more than 1.5 per cent, adding to the week’s losses after Wednesday’s big Federal Reserve rate increase spurred similar moves by other central banks in response to elevated inflation. “What looks like the proverbial ‘sell now and ask questions later’ downdraft in today’s market is just that: raise cash as uncertainty and volatility climbs,” said Quincy Krosby of LPL Financial. “Credit markets globally, along with currency and equity markets are not certain that central banks will be able to restore price stability as easily as their rhetoric suggests.” The Dow Jones Industrial Average tumbled 1.6 per cent to 29,590.41, its lowest closing value since November 2020. The broad-based S&P 500 fell 1.7 per cent to 3,693.23, while the tech-rich Nasdaq Composite Index sank 1.8 per cent to 10,867.93. The drop came after the Federal Reserve Wednesday enacted a third straight interest rate increase of 0.75 percentage point as Fed Chair Jerome Powell warned that countering inflation could not be “painless.” That move was followed Thursday by rate hikes from the Bank of England among other central banks, boosting the odds of a global recession.

SG

Embattled entertainment group mm2 Asia announced Sunday (Sep 25) it has entered into a bond subscription agreement with brokerage UOB Kay Hian for a S$54 million bond deal that is exchangeable for shares of mm2’s cinema business, mm Connect. The exchangeable bonds bear a coupon rate of 5 per cent per annum, payable on a semi-annual basis, with a tenure of 3 years. Should the bondholder elect to exchange at the end of the second year, the bondholder will receive shares of mm Connect constituting 60 per cent of the share capital, at a base valuation of S$90 million. The exchange ratio is subject to adjustment, with the valuation potentially raised to S$105 million if certain benchmarks are met. The group said the benchmarks are in relation to mm Connect group’s earnings before interest, taxes, depreciation and amortisation (Ebitda) performance for the 24-month period ending Sep 30, 2024. At the valuation cap of S$105 million, the bondholder will invest an additional S$9 million, or exercise the exchange right at 51.4 per cent of mm Connect shares. Bonds that are not exchanged into mm Connect shares will be fully redeemed in cash. mm2 Asia may also choose to satisfy the S$54 million redemption obligation by delivering the entire equity of mm Connect at the end of the tenure. Additionally, the bonds are issued together with 250 million detachable warrants. Each warrant will carry the right, for a period of 5 years from the issue date, to subscribe for 1 new share of mm2 Asia at the exercise price of S$0.065 apiece. If fully exercised, mm2 Asia will raise additional gross proceeds of S$16.25 million. The exercise price for the warrants represents an 8.9 per cent premium to the volume-weighted average price of S$0.0597 per share for trades done in mm2 Asia on Jun 16 – the market day the term sheet was signed. Trading in shares of mm2 Asia was halted before market open on Sep 23, pending the announcement. The counter last closed at S$0.048 on Sep 22.

Real estate management services provider LHN announced on Friday (Sep 23) that indirect wholly owned subsidiary Coliwoo West is acquiring a property at Arab Street in Singapore for S$6.4 million. The property, located at 48 Arab Street, has a total land area of 122.9 square metres with a remaining lease of about 29 years. The group said it intends to operate the property – which currently houses a backpacker hostel – as a co-living space under its co-living brand Coliwoo. “Once the Arab Street property commences operations, it will expand the group’s portfolio of properties under the co-living business in Singapore, increase brand value of Coliwoo, provide potential capital appreciation to the group and provide additional opportunities to generate revenue,” it said in a bourse filing. Shares of LHN closed 1.8 per cent or S$0.005 lower at S$0.28 on Friday, before the announcement.

Grab, South-east Asia’s biggest ride-hailing and food delivery firm, does not envisage having to undertake mass layoffs as some rivals have done, and is selectively hiring, while reining in its financial service ambitions. Chief operating officer Alex Hungate said that earlier in the year, Grab had been worried about a global recession and was “very careful and judicious about any hiring” and, as a result, it had not got to the “desperate” point of a hiring freeze or mass layoffs. “Around mid-year, we did some kind of specific reorganisations, but I know other companies have been doing mass layoffs, so we don’t see ourselves in that category,” Hungate, 56, told Reuters in his first interview since joining Singapore-based Grab in January. The company was hiring for roles in data science, mapping technology and other specialised areas, though every hire was a much bigger decision than it used to be, he said. “You want to make sure that we’re conserving capital. The hurdle for making a hire has definitely been raised.” Decade-old Grab, a household name in South-east Asia, had about 8,800 staff at the end of 2021. Like its rivals, it has benefited from a boom in food services during the Covid-19 pandemic, while ride-hailing suffered.

US

Boeing will pay $200 million to settle SEC charges that it made misleading claims about the safety risks of its 737 MAX jet after two of the planes were involved in fatal crashes. Former CEO Dennis Muilenburg will pay $1 million as part of the settlement, with both parties neither admitting nor denying wrongdoing. Boeing stock fell 5.4 per cent on Friday.

Oil prices plunged about 5 per cent to an eight-month low on Friday (Sep 24) as the US dollar hit its strongest level in more than 2 decades and on fears rising interest rates will tip major economies into recession, cutting demand for oil. Brent futures fell $4.31, or 4.8 per cent, to settle at $86.15 a barrel, down about 6 per cent for the week. US West Texas Intermediate (WTI) crude fell $4.75, or 5.7 per cent, to settle at $78.74, down about 7 per cent for the week. It was the fourth straight week of declines for both benchmarks, the first time this has happened since December. Both were in technically oversold territory, with WTI on track for its lowest settlement since Jan 10 and Brent for its lowest since Jan 14. US gasoline and diesel futures were also down more than 5 per cent. The US Federal Reserve raised interest rates by a hefty 75 basis points on Wednesday. Central banks around the world followed suit with their own hikes, raising the risk of economic slowdowns. “Oil tanks as global growth concerns hit panic mode given a chorus of central bank commitments to fight inflation. It seems central banks are poised to remain aggressive with rate hikes and that will weaken both economic activity and the short-term crude demand outlook,” aid Edward Moya, senior market analyst at data and analytics firm OANDA. The US dollar was on track for its highest close against a basket of other currencies since May 2002. A strong dollar reduces demand for oil by making the fuel more expensive for buyers using other currencies.

Gold sank to the lowest level since the early days of the pandemic, caught up in a broad selloff after a slew of central banks followed the Federal Reserve in raising interest rates to cool inflation. Bullion flirted with slipping into a bear market, closing nearly 20 per cent below the all-time high reached in March amid a broad retreat in everything from commodities to stocks as the dollar climbed to a record. Investors shed risky assets for cash after the UK’s economic plan reignited concerns that central banks’ aggressive interest-rate hikes may lead to a recession. Weakness in bullion is “very likely to persist” due to “monetary tightening that makes gold costlier to hold,” said Gnanasekar Thiagarajan, director at Commtrendz Risk Management Services. “However, recession fears and any escalation in the Russia and Ukraine conflict could support prices.” Central banks in Switzerland, Norway and Britain followed the Fed’s lead in announcing interest-rate hikes to curb price increases. Gold, which doesn’t bear interest and is priced in the US currency, usually has a negative correlation with the dollar and rates. Outflows from exchange-traded funds have continued, with holdings now close to the lowest this year. US business activity contracted in September for a third straight month, though at a more moderate pace as a pickup in orders and a further softening of inflation allayed concerns of a more-pronounced pullback. Spot gold declined 1.6 per cent to US$1,643.94 an ounce, capping a second weekly loss. Bullion for December delivery fell 1.5 per cent to settle at US $1,655.60 on the Comex. The Bloomberg Dollar Spot Index climbed 1.3 per cent to a record high. Silver, platinum and palladium all tumbled.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

PropertyGuru Group Ltd. – Dominant Property Platform

Recommendation: BUY (Initiation); TP: US$5.73

Analyst: Maximilian Koeswoyo

– Dominant market presence in Singapore/Vietnam/Malaysia. Around 41% of revenue is from current agent subscription fees with a 82% renewal rate.

– Pricing power and increasing customer spend through premium products are drivers for the expected revenue CAGR of 37% over the next two years.

– Initiate coverage with a BUY recommendation and DCF-based target price (WACC 10.1%, g 3.0%) of US$5.73.

Upcoming Webinars

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Research Videos

Weekly Market Outlook: Prime US REIT, Frasers Centrepoint Trust, Sembcorp Industries, SG Weekly…..

Date: 19 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials