DAILY MORNING NOTE | 27 October 2022

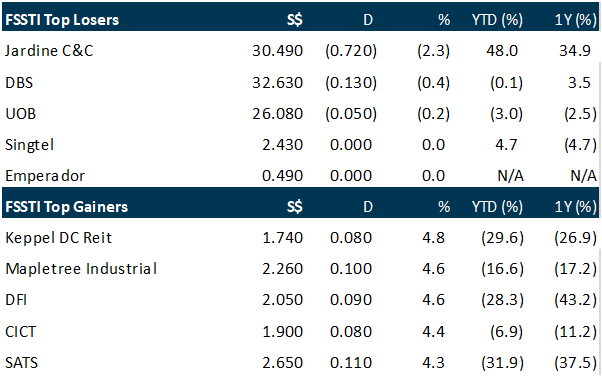

Local shares ended Wednesday (Oct 26) on a more upbeat note, as traders took advantage of market hopes that the Federal Reserve could start adopting a less aggressive monetary tightening stance. The Straits Times Index (STI) advanced 0.8 per cent or 24.23 points to close at 3,008.38. Across the broader market, winners outpaced losers 309 to 191, after about 1.4 billion securities worth a total of S$1.1 billion changed hands. SGX market strategist Geoff Howie said real estate investment trusts (Reits) on Wednesday booked their strongest session since May 2020. The FTSE ST Reit Index was up 3.5 per cent for the day, he noted. Reasons for the strong showing, he said, are earnings expectations and less hawkish predictions for interest rates in the US at year-end. “Majority expectations (are) now seeing a 50 basis point hike on Dec 14, rather than a 75 basis point hike as expectations suggested last week,” he said. Jardine Matheson Holdings was the biggest advancer on Wednesday, gaining 2.5 per cent or US$1.13 to close at US$46.20. Jardine Cycle & Carriage was the biggest loser, shedding 2.3 per cent or S$0.72 to S$30.49. Two of the three lenders also closed lower – DBS lost 0.4 per cent or S$0.13 to S$32.63, while UOB fell 0.2 per cent or S$0.05 to S$26.08. OCBC, meanwhile, eked out a 0.3 per cent or S$0.04 gain to S$11.74.

The tech-rich Nasdaq suffered a drubbing on Wednesday following disappointing results from Microsoft and Google parent Alphabet, but the Dow ended flat on hopes for a moderation in monetary policy. Shares of Microsoft and Alphabet both dropped more than 7 per cent after Microsoft offered a lackluster forecast, while Alphabet was hurt by a pullback in online advertising. Dow member Boeing was another big loser, slumping nearly 9 per cent as it reported a hefty loss due to rising costs in its defence contract business. The Dow Jones Industrial Average managed to finish flat at 31,839.11. The broad-based S&P 500 dropped 0.7 per cent to 3,830.60, while the Nasdaq tumbled 2.0 per cent to 10,970.99. Stocks had risen the last three days on greater confidence that the Federal Reserve will soon pivot from its policy of aggressive interest rate hikes to counter inflation. That view was bolstered Wednesday by the latest retreat in the yield of the 10-year US Treasury note and by the Bank of Canada’s decision to raise interest rates by 0.5 percentage point, less than expected. “Financial markets closely watched the Bank of Canada decision that delivered a clear message that they are getting close to being done with tightening,” said Oanda’s Edward Moya. “Wall Street is hoping the Fed will follow the Bank of Canada’s lead in expecting inflation to ease further by year end.” Among individual companies, autonomous car technology company Mobileye surged 38 per cent in its Wall Street debut following a spinoff from Intel.

SG

Suntec REIT (Non-rated) reported net property income rising 12% YoY to S$77mn. However, distributable income of S$60mn was 5.8% lower YoY, weighed down by interest rate and softer UK Pound and Australian dollar exchange rates.

Meeting highlights: 1) 3Q22 DPU declined 6.6% YoY to 2.084 cents (of which 0.2 cent was capital DPU), impacted by a $8mn rise in interest. A 100bps rise in interest rates will cause a 10.2% decline in DPU. ; 2) Interest coverage ratio *was 2.5x, running the risk that gearing ratio is capped at 45%. Gearing is now 43.1%; 3) Raising capital, if necessary, can be via rights issue or selling Suntec office units. The book value of these units is S$2200-2300 psf compared to recent transaction of S$3300 in Jun22. 4) Rent reversion for Singapore office and retails assets is around 5% in 3Q22.

*EBITDA/Interest expense and Hybrid distribution

Paul Chew,

Head Of Research,

paulchewkl@phillip.com.sg

UOB is to report their 3Q2022 results on Friday, 27 Oct 2022, morning. Consensus estimates for 3Q22 has forecasted net income to grow by 14% YoY to S$1.19bn, backed by net interest income growing 25% YoY to S$2.01bn and NIM continuing to improve to 1.82% (3Q21: 1.55%). Net fee income is expected to turn the tide and grow by 6% YoY to S$627.1mn in 3Q22.

Glenn Thum,

Research Analyst,

glennthumjc@phillip.com.sg

The manager of Frasers Centrepoint Trust (FCT) said that its average cost of borrowing is expected to rise by at least 50 basis points to above 3 per cent in FY2023, which could put a dent in distribution per unit (DPU) growth next year. FCT on Wednesday (Oct 26) reported a DPU of S$0.06091 for the second half of FY2022 ended September – just a whisker above the DPU of S$0.06089 in the corresponding period a year ago. Distribution to unitholders for H2 edged up 0.2 per cent to S$103.8 million, despite a 7.9 per cent increase in gross revenue to S$180.7 million and a 6 per cent rise in net property income (NPI) to S$128.1 million. In a media briefing on Wednesday following the results announcement, the real estate investment trust (Reit) manager said the muted DPU growth and reduced overall distribution income for H2 was “largely” due to rising interest rates. “Our operating performance has proven to be very resilient and did pretty well, but we are all familiar and recognise that interest rates have gone up,” said Richard Ng, chief executive officer of FCT’s manager. “We can’t control interest rates, but what we can control is how we manage it… to mitigate or cushion the increase in costs.” As at end-September, FCT’s average all-in cost of debt rose 10 basis points to 2.5 per cent, from 2.4 per cent at the end of the preceding quarter.

Comment: We continue to be underweight S-REITs as we can see from their latest results that they are all negatively impacted by rising interest rates. The impact will be even greater when they start to refinance their expiring loans. We maintain our accumulate call on FCT with an unchanged TP of S$2.38.

Darren Chan,

Research Analyst,

darrenchanrx@phillip.com.sg

Mapletree Industrial Trust posted a 3.2 per cent loss in distribution per unit (DPU) to 3.36 Singapore cents in the second quarter of its financial year (FY) ended on Sep 30, from 3.47 cents a year ago, said its manager via a bourse filing on Wednesday (Oct 26). On a quarter-on-quarter basis, the DPU also fell from 3.49 cents in the previous quarter. The total DPU of 6.85 cents for the first half of its FY, however, is a slight 0.4 per cent increase from the 6.82 cents over the same period last year. Net property income rose 8.3 per cent to S$130.3 million in Q2, from S$120.3 million a year ago. Gross revenue grew 12.8 per cent to S$175.5 million from S$155.6 million over the same period. The amount available for distribution to unitholders for the quarter increased by 0.7 per cent year-on-year to S$89 million.

The manager of data centre-focused Keppel DC Reit on Wednesday (Oct 26) announced a 5 per cent increase in distribution per unit (DPU) to S$0.02585 for the third quarter ended September, from S$0.02462 in the corresponding period a year ago. Distributable income was 9 per cent higher at S$46.9 million, from S$43.1 million in Q3 last year. The real estate investment trust (Reit) manager attributed the increase to contributions from new acquisitions and completed asset enhancement initiatives (AEIs), as well as renewals and income escalations, among others. Q3 gross revenue rose 1.4 per cent to S$70.3 million, while net property income (NPI) was 0.5 per cent higher at S$64.1 million. The increase in gross revenue was partially offset by net lower contributions from some of the Singapore colocation assets, the depreciation of the euro, Australian dollar and British pound against the Singapore dollar, and the divestment of iseek Data Centre.

US

Meta Platforms gave a forecast for revenue in the fourth quarter that was on the low end of analysts’ estimates, showing the social media platform continues to struggle with a weak advertising market amid an economic slowdown. The owner of Instagram and Facebook said it sees US$30 billion to US$32.5 billion in revenue in the last three months of the year. Analysts had been expecting US$32.2 billion, according to estimates compiled by Bloomberg. The shares tumbled more than 12 per cent in extended trading and are down more than 55 per cent this year through Wednesday’s (Oct 26) close. Meta, which makes most of its revenue from advertising, is grappling with a decline in marketers’ budgets due to economic uncertainty and a recent change in Apple’s privacy rules that made social media ads less effective. The company has cut costs by slowing hiring and narrowing priorities to focus on keeping its social media platforms relevant and expanding virtual reality offerings. But with Meta in a revenue slump potentially for the long haul, chief executive officer Mark Zuckerberg said the company is making “significant changes across the board to operate more efficiently”, and has “increased scrutiny on all areas of operating expenses”. This year, Meta has transformed a number of key parts of its business. As ByteDance’s popular TikTok app has won users’ time and accustomed them to a feed of vertical videos based on users’ interests, Meta has changed Facebook and Instagram’s experiences to show more algorithmically-chosen content and less from the people you follow. Its short-form videos, called Reels, are meant to increase user engagement and revenue opportunities on the app. The company, which changed its name from Facebook to Meta a year ago, is also betting big on the metaverse, virtual-reality-fuelled gathering places that thinks will host the future of work and communication. The effort is losing Meta billions, and the company expects to lose more money on the metaverse bet next year.

Spotify Technology tumbled as much as 10 per cent in late trading after the company, the leader in music streaming, said profit margins may narrow this quarter because of programming costs, and that it’s considering raising prices in the US. Shares of Spotify fell as low as US$87 after reporting results on Tuesday (Oct 25) before partly rebounding. The stock rose 2.5 per cent to US$97.05 at the close on Tuesday. The sell-off shows how investors have become less interested in the pace of subscriber growth and more focused on whether Spotify becomes profitable. That has put pressure on management to make a strong case for investments in newer businesses like original podcast programming. On a conference call with investors Tuesday, chief executive officer Daniel Ek said he was mulling a price increase for its streaming product in the US, but wanted to first discuss the move with the record labels that provide the company’s music. Apple, a rival in music streaming, raised the price of its service this week by US$1 to US$10.99 a month for individuals, citing costs. Spotify, based in Stockholm, charges US$10. Earlier, Spotify reported third-quarter ad revenue increased 19 per cent but said sales were slower than expected due to a “challenging macro environment”. The company joins other tech giants, including Alphabet and Snap, in reporting slower ad sales. On the call, Ek said he wasn’t worried about ad sales slowing because the business is still a small one for Spotify. Spotify’s gross margin in the quarter failed to meet the average 25.2 per cent estimate of analysts, coming in at 24.7 per cent, which Spotify attributed to the ad slowdown and increased content spending – like its recent move into audiobooks. The company forecast a gross margin of 24.5 per cent in the fourth quarter, and an operating loss of 300 million euros, both below consensus expectations.

South Korean chipmaker SK Hynix said it will cut its capital expenditure for next year by half after reporting a 60 per cent decline in third-quarter profit as memory chip demand plunged. Hynix’s dramatic cut affirms growing pessimism about the outlook for electronics demand in the face of a potential recession as well as enormous uncertainty over the extent of fallout from Washington’s campaign to smother China’s tech industry. It adds to the downbeat outlooks that have come from companies such as Micron Technology and Texas Instruments (TI). Operating profit declined to 1.7 trillion won (S$1.7 billion) in the three months ended September, the Apple supplier said on Wednesday (Oct 26), missing analyst estimates of a 2.5 trillion won profit. Revenue was 11 trillion won, missing the estimated 12.2 trillion won. “SK Hynix diagnosed that the semiconductor memory industry is facing an unprecedented deterioration in market conditions,” the company wrote in its earnings announcement. “Shipments of PCs and smartphone manufacturers, which are major buyers of memory chips, have decreased.” Global chipmakers and PC suppliers have warned that the semiconductor market is in a severe downturn that’s likely to continue at least until the first half of next year. Chip demand cooled dramatically in recent months as soaring inflation and interest rate hikes forced consumers and enterprise clients to cut spending. Hynix shares have declined 29 per cent this year. US supplier Texas Instruments dropped as much as 6 per cent in the hours before Hynix’s release after reporting its own underwhelming projections. TI has the largest customer list in the semiconductor industry, making it a bellwether for the overall sector.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Technical Pulse: CapitaLand Ascott Trust

Analyst: Zane aw

Recommendation: Technical BUY

Market buy: 0.910 Stop loss: 0.880 Take profit: 0.995

CapitaLand Ascott Trust (SGX: HMN) A potential bounce to retest the resistance zone at 0.960-0.995 in the current downtrend.

Upcoming Webinars

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Weekly Market Outlook: PayPal, Keppel Corp, SPH, Fortress Minerals, SGBanking, SG Weekly & more…

Date: 17 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials