DAILY MORNING NOTE | 29 September 2022

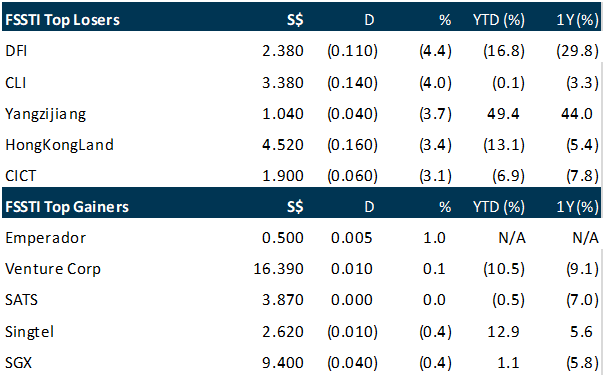

The Straits Times Index (STI) fell 1.6 per cent or 49.19 points to close at 3,116.31 on Wednesday (Sep 28). Across the broader market, losers beat gainers 430 to 171, with 1.63 billion securities worth S$1.75 billion traded. Regional markets also closed in the red. Hong Kong’s Hang Seng Index declined 3.4 per cent; South Korea’s Kospi fell 2.5 per cent and Japan’s Nikkei 225 shed 1.5 per cent. The Kuala Lumpur Composite Index declined 0.6 per cent and the Jakarta Composite Index fell 0.5 per cent. IG market strategist Yeap Jun Rong noted that weak performance in the region continues as markets take cues from the global risk-off environment. “A stark warning by the International Monetary Fund on the UK government’s tax plans also provided additional cause for worry about the global landscape, with markets struggling to find any positive catalyst to drive a recovery,” he said. On the STI, only liquor company Emperador and electronics manufacturer Venture Corp were in the black. Emperador gained 1 per cent or S$0.005 to close at S$0.50; Venture Corp edged up 0.1 per cent or S$0.01 to close at S$16.39. At the bottom of the table was DFI Retail Group, which fell 4.4 per cent or US$0.11 to close at US$2.38. Within the broader market, Yangzijiang Financial Holdings was hotly-traded, declining 3.9 per cent or S$0.02 to close at S$0.37, with 68.7 million shares worth S$25.9 million traded.

Wall Street stocks jumped on Wednesday, shaking off a recent slump and rallying after the Bank of England’s intervention in the British bond market reassured investors. Following a historic slump in the pound, the BoE announced it was temporarily buying up long-dated UK government bonds “to restore orderly market conditions.” In both Britain and the United States the move pressured Treasury bond yields, which had risen sharply as central banks hiked interest rates. The “intervention helped calm markets and led to a reversal of a spike (in bond yields) that we had seen earlier this morning,” said Angelo Kourkafas of Edward Jones. Analysts noted that stocks were poised for an upturn after a bruising stretch since mid-August that had pushed major indices to their lowest level of 2022. The Dow Jones Industrial Average finished up 1.9 per cent at 29,683.74. The broad-based S&P 500 gained 2.0 per cent to 3,719.04, while the tech-rich Nasdaq Composite Index jumped 2.1 per cent to 11,051.64. Among individual companies, Biogen surged nearly 40 per cent after announcing positive clinical results for treatment of mild cognitive impairment due to Alzheimer’s disease. Apple fell 1.3 per cent following a Bloomberg report saying it is retreating on a plan to boost production of its new iPhone due to lackluster demand. Netflix advanced 9.3 per cent off the back of an analyst upgrade amid hopes for the streaming platform’s development of advertising-based services.

SG

Keppel Shipyard, a wholly-owned subsidiary of Keppel Corporation’s offshore and marine (O&M) arm, on Wednesday (Sep 28) announced that it has secured a repeat contract for a newbuild floating production, storage and offloading (FPSO) vessel worth about US$2.8 billion. The tender for this contract was from Brazil’s national oil company, Petroleo Brasileiro (Petrobras). The contract will see Keppel O&M undertake the engineering, procurement and construction of a P-83 FPSO vessel. This contract will be on a progressive milestone payment basis, and is scheduled for delivery in the first half of 2027, Keppel said in a press release. The contract will add approximately S$3.8 billion to Keppel O&M’s orderbook, bringing the unit’s net orderbook to some S$11.8 billion as at Sep 28, the highest since 2007. This would put Keppel O&M in a strong position to pursue new business opportunities in areas such as renewables and clean energy solutions, said the group. The P-83 will be the third FPSO that Keppel O&M is building for Petrobras for the Buzios field. In August this year, Keppel Shipyard also secured a similar contract worth about US$2.9 billion from Petrobras for the engineering, procurement and construction of P-80 FPSO. Keppel O&M is also currently working on the P-78 FPSO which was awarded in May 2021. When completed, these FPSOs will be among the largest floating production units in the world. Keppel said the P-83 has a production capacity of 225,000 barrels of oil per day and a storage capacity of 2 million barrels of oil. The P-83 also has a water injection capacity of 250,000 barrels per day, and can process 12 million cubic metres of gas per day. As a repeat order, the new P-83 vessel will be identical to the P-80 in terms of specifications and execution methodology, said Keppel. The P-83 will build on the synergies reaped from the P-80, including adapting the design and engineering, as well as leveraging economies of scale in the procurement of materials. The fabrication of the topside modules will be replicated across Keppel O&M’s facilities in Singapore, China and Brazil, while the construction of the hull and accommodation module will be done by CIMC Raffles in China. The integration of the separate components will be carried out in Singapore, with the final phase of offshore commissioning works undertaken by Keppel O&M when the FPSO arrives at the Buzios field. Keppel said its O&M arm has delivereda “significant” number of projects for Brazil and Petrobras over the years to support Brazil’s energy infrastructure – including FPOs, production platforms, floating storage regasification units, drilling rigs and accommodation vessels. BrasFELS – Keppel O&M’s yard in Angra dos Reis, Brazil – is currently also undertaking integration and fabrication work for 2 other FPSOs that will operate in the Sepia field and the Buzios field. Chris Ong, chief executive of Keppel O&M, said: “We are able to draw insights from the first of our newbuild FPSOs, the P-78, which is progressing well and contributing to Keppel O&M’s earnings. “As the P-83 and P-80 are identical units, greater economies of scale and productivity gains can be expected as we are able to further optimise the engineering and construction process, as well as fully leverage technology and the seamless coordination with our partners in the execution.” The new contract is not expected to have a material impact on the net tangible assets or earnings per share of Keppel for the current financial year. Shares of Keppel closed on Wednesday at S$6.76, down 3 per cent or S$0.21, prior to the announcement.

A subsidiary of Nanofilm Technologies has entered into a joint venture with 2 Chinese companies to provide coating solutions for advanced battery components and systems in electric vehicles, as well as energy-storage applications in China. The joint venture will be named Sichuan Apex Technologies (ApexTech) and have an initial registered capital of 50 million yuan (S$10 million). This will be subscribed in cash and held by the subsidiary, Nanofilm Vacuum Coating (Shanghai), Shenzhen Everwin Precision Technology and Shanghai Hongshi Enterprise Management Partnership, in proportions of 60 per cent, 30 per cent and 10 percent respectively. ApexTech aims to develop proprietary coating solutions to replace electroplating, which is “extremely pollutive”, Nanofilm said in a statement on Wednesday (Sep 28). The electroplating industry has come under stringent environmental-protection laws in China and other countries, the group said. To maximise production and customer synergies with Everwin, ApexTech will set up its production facilities near Everwin’s facility in Sichuan province. ApexTech is targeting initial production in the first half of 2023, with pilot lines designed and built in-house by Nanofilm. It plans to reach industrial-scale mass production in 2024. ApexTech will also leverage Nanofilm’s capabilities through the provision of proprietary equipment and technologies for coating development and mass production. ApexTech’s board will include 5 directors, 3 to be nominated by Nanofilm Vacuum Coating and 2 to be nominated by Everwin. Nanofilm said the proposed investment in the joint venture is not expected to have a material impact on net tangible assets and earnings per share of the group for the financial year ending Dec 31, 2022. Based on figures from the International Energy Agency (IEA)and Nanofilm’s internal estimates, the total addressable market of advanced batteries for electric vehicles in China exceeds 6.5 million units, estimated to be worth US$79 billion in 2023. It is projected to grow at a compounded annual growth rate of 10 per cent to reach US$156 billion in 2030. IEA estimates electric vehicle penetration in China to reach 42 per cent in 2030, up from 14 per cent in end-2021. Nanofilm shares ended Wednesday down 2.3 per cent at S$2.08.

Inflight caterer and ground handler SATS has entered into an agreement to acquire Paris-based air cargo handler Worldwide Flight Services (WFS) for a maximum total consideration of about 1.3 billion euros (S$1.9 billion), a move that will propel the mainboard-listed company into a global player in the air cargo market. In an announcement on Wednesday (Sep 28), SATS said this acquisition would result in an “unmatched global footprint” that would cover trade routes responsible for over 50 per cent of global air cargo volumes across the likes of Asia-Pacific, Europe and the Americas. Under the agreement, SATS will acquire all the interests in WFS for an enterprise value of about 2.3 billion euros. This consideration was arrived at on a “negotiated arm’s length basis” and determined after taking into account the financial performance and financial position of WFS, among other factors. SATS intends to fund the acquisition through an equity fundraising worth S$1.7 billion, with the balance amount to be funded through internal cash resources. The company said it has also obtained an acquisition bridge facility for a Singapore dollar equivalent amount of up to 1.2 billion euros. SATS said the structure and timing of the equity raising exercise has not yet been determined, but could comprise a renounceable rights issue of new shares to existing shareholders on a pro-rata basis, and could also be combined with a private placement of new shares to institutional or strategic investors. The proposed acquisition will be accretive to SATS’ earnings per share (EPS). On a pro-forma basis, the company’s 12-month EPS for the period ended Mar 31 will increase to S$0.054 excluding the effect of intangibles amortisation, and S$0.032 including the effect of intangibles amortisation, from S$0.018. Based on financial figures for the same period ended Mar 31, the acquisition is also expected to result in an increase in revenue to S$3.8 billion from S$1.2 billion. Earnings before interest, taxes, depreciation, and amortisation (Ebitda) on a pro-forma basis will be pushed up to S$445 million from S$94 million before synergies, with potential run-rate Ebitda synergies in excess of S$100 million over the medium term, the company said. Following the acquisition, SATS will become the largest global air cargo handler, and the company’s portfolio would become more geographically diversified with an increased focus on cargo handling – a sector with “proven resilience and supported by structural growth tailwinds”. The combined entity will have a total of 135 cargo stations and a total cargo volume of over 9 million tonnes. Some of the synergies that the deal will bring include e-commmerce partnerships across the world and the acceleration of cargo automation. Although the global air cargo handling market is “growing and resilient”, SATS noted that structural headwinds are present. These tailwinds include sustained e-commerce growth, a growing demand for high value cargo-handling capabilities, as well as an evolving customer mix. Temasek, which holds a stake of just under 39.7 per cent in SATS, has agreed to vote in favour of the transaction. SATS will convene an extraordinary general meeting in early 2023 for shareholders to vote on the deal. The transaction is expected to close by end-March next year. Other conditions for the deal include customary regulatory clearances and other customary closing conditions, SATS said.

US

Shares of Apple fell about 4% on Wednesday on a report that the company has told suppliers to bail on plans to increase iPhone 14 production. Demand for the new models failed to spike as high as anticipated, according to Bloomberg. Apple will no longer aim to increase production by 6 million units in the second half of the year as it had planned, according to the report. The company will strive to produce 90 million units instead, which is roughly in line with Apple’s forecast and production from last year, according to Bloomberg. The report also impacted Apple suppliers and manufacturers. Shares of key chipmaker Taiwan Semiconductor Manufacturing also fell about 3%. Shares of Hon Hai, also known as Foxconn, were down about 2.9%. Foxconn builds Apple’s iPhones. Demand for the iPhone 14 Pro is higher than for the other new phones, Bloomberg reported, leading at least one Apple supplier to shift production capacity from the lower-tier models to the premium version. An Apple representative declined to comment.

Amazon’s annual device event on Wednesday (Sep 28) showed the e-commerce giant pushing further into wellness, security and the auto industry, underscoring an effort to weave its technology into every part of consumers’ lives. The lineup unveiled at the presentation includes a bedside device called Halo Rise and an upgraded array of Echo smart speakers, as well as a new Kindle and enhanced security technology from Amazon’s Ring division. Though Amazon remains in the shadow of companies like Apple in hardware technology, it’s rapidly spreading its reach. New wellness products complement a broader expansion into the healthcare industry that already includes an online pharmacy, a wearable wellness device and a range of experiments in applying data analysis tools to medical science. The company announced plans in July to buy One Medical in a deal valued at US$3.49 billion. That company, whose parent is called 1Life Healthcare, operates 182 medical offices in 25 markets in the US. The circular bedside device, with a ring-shaped light and digital clock face, is a combination sleep tracker, lamp and alarm clock. It will be available later this year for US$140, Amazon said. The gadget uses low-power radar to analyse the person sleeping closest to it, the Seattle-based company said at the event. Unlike many of Amazon’s home electronics, it has neither a speaker nor microphone. Halo Rise can determine a user’s respiratory rate and has environmental sensors to determine temperature. The product also integrates with the Alexa voice assistant and the Echo smart speaker to play music and take commands such as dimming the lights. Wednesday’s event ranged from relatively minor upgrades to more ambitious plans, such as a pilot programme to turn Amazon’s Astro robot into a security guard for businesses. The shares gained as much as 2.8 per cent to US$117.63.

Oil prices rose on Wednesday for a second day, rebounding from recent losses as the US dollar eased off recent gains and US fuel inventory figures showed larger-than-expected drawdowns and a rebound in consumer demand. Brent crude futures settled up US$3.05, or 3.5 per cent, at US$89.32 per barrel. US West Texas Intermediate (WTI) crude futures ended up US$3.65, or 4.7 per cent, to US$82.15 a barrel. Analysts said oil prices, down more than 22 per cent during the third quarter, may be bottoming out as Chinese demand shows signs of rebounding and the US sales of strategic reserves come to a close. “I do think we are bottoming, but it is going to continue to be exceptionally volatile, and continue to be keeping easy speculative money away from this market,” said Rebecca Babin, senior energy trader at CIBC Private Wealth US. US inventory figures showed consumer demand rebounded, though refining product supplied remained 3 per cent lower over the last four weeks than the year-ago period. US crude stocks fell by 215,000 barrels in the most recent week, while petrol inventories declined by 2.4 million barrels and distillate inventories by 2.9 million barrels, as refining activity declined following several outages. Refining activity dipped, but refiners are still running at 90.6 per cent of overall capacity in the United States, the highest for this time of year since 2014, on both domestic and export demand. The dollar hit a fresh two-decade peak against a basket of currencies on Wednesday before pulling back. A strong dollar reduces demand for oil by making it more expensive for buyers using other currencies. In early afternoon US hours, the dollar index was down 0.9 per cent.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Technical Pulse: Golden Energy and Resources

Analyst: Zane Aw

Recommendation: Technical SELL

Sell limit: 0.790 Stop loss: 0.835 Take profit: 0.635

Golden Energy and Resources Ltd (SGX: AUE) A possible bearish reversal after reaching the bearish rising wedge resistance.

Upcoming Webinars

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Research Videos

Weekly Market Outlook: Adobe PropertyGuru TechnicalPulse FOMC SG Weekly Top Glove Emperador

Date: 26 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials