DAILY MORNING NOTE | 30 August 2022

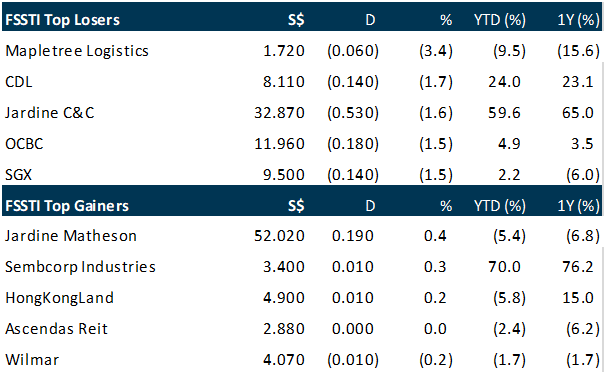

Singapore shares finished lower on Monday (Aug 29) amid broad losses across most major Asian markets, as trading sentiments were battered by US central bank chief’s remarks that more rate hikes are to be expected given stubborn inflation. The key Straits Times Index slipped 27.27 points or 0.84 per cent to 3,222.26. Elsewhere, key indices from Japan, Hong Kong and Taiwan to South Korea finished lower. China and Malaysia bucked the trend with marginal gains. Some 1.34 billion units worth S$975.18 million were traded on the Singapore bourse as losers outpaced gainers with 349 counters down and 159, up. Losses were led by Singapore’s banking trio DBS, OCBC, and UOB, as well as Singtel and the Singapore Exchange.

US stocks ended Monday’s session with more losses, as investors continued to grapple with the fears about looming economic “pain” stemming from the Federal Reserve’s aggressive interest rate hikes. After losing more than 1,000 points on Friday following tough talk from Fed chief Jerome Powell, the Dow Jones Industrial Average lost another 180, falling 0.6 per cent to finish Monday at 32,098.99, a decline of 0.6 per cent. The broad-based S&P 500 dropped 0.7 per cent to close at 4,030.61, while the tech-rich Nasdaq Composite Index slumped 1.0 per cent to 12,017.67.

SG

Enterprise technology, software and services company Silverlake Axis (SAL) reported a 30 per cent year-on-year increase in profit-after-tax to RM47.9 million (S$14.9 million) for the fourth quarter ended June 30, 2022, in line with higher revenue. Revenue increased 16 per cent to RM205.2 million thanks to higher contributions from project related revenue segments as well as a resurgence in insurance ecosystem transactions and services. For the 12 months ended June 30, net profit was up 27 per cent year-on-year to RM182.15 million, while revenue rose 18 per cent to RM736.54 million on the back of higher revenue across its business activities. The mainboard-listed group recorded a gross profit of RM418.6 million in FY22, 11 per cent higher from a year ago, although its gross profit margin was lower at 57 per cent in FY2022, compared with 60 per cent in the prior year. SAL has declared a final dividend of 0.7 Singapore cent per share, up from 0.52 cent a year ago.

ESR-logos Reit (E-LOG) is planning to acquire a 5-storey modern logistics asset in Tokyo for 17.8 billion yen or S$183.5 million (inclusive of rental support), which is expected to be distribution per unit (DPU) accretive to unitholders. The transaction is the first direct asset acquisition, post the merger with ARA Logos Logistics Trust, from sponsor ESR Group’s pipeline of logistics assets. Including fees and expenses, the total acquisition cost is about S$187 million. Located in Sakura City, Chiba Prefecture, the freehold asset has a total land area of 41,658 square metres (sq m), net lettable area of 81,507 sq m and a weighted average lease expiry (WALE) of 2.9 years, as at Jun 30, 2022. ESR Sakura DC will be acquired at a net property income yield of 4.35 per cent. The acquisition is expected to be DPU accretive to unitholders on a pro forma basis, assuming the acquisition was completed on Jan 1, 2021. DPU would increase by 2.9 per cent if it is 100 per cent funded by debt, and by 0.5 per cent, if it is 60 per cent funded by debt and 40 per cent equity funded. As at Jul 12, 2022, the Reit’s manager has received committed debt financing term sheets of up to 17.6 billion yen from banks to fund the proposed acquisition.

Catalist-listed developer Hatten Land swung into the black for the fourth quarter ended June 30 with a net profit of RM26.45 million (S$8.22 million), versus a loss of RM90.81 million a year ago. The bottom line was strengthened by higher revenue, lower operating expenses, a reversal of provision for income tax and lower non-recurring items of impairment losses and write-downs during the financial period. Revenue for the period came to RM49.81 million, versus negative revenue of RM61.34 million a year ago. The increase in revenue was due to higher sales from completed projects now that movement restrictions have been lifted. The corresponding quarter in Q4 FY21 also saw a provision of about RM65 million for liquidated damages arising from late delivery and handover of property units. Earnings per share came to 1.5 RM cents, versus losses per share of 5.8 RM cents a year ago. For the full year ended June 30, losses narrowed to RM36.78 million from RM168.67 million a year ago, while revenue worked out to RM73.27 million. In comparison, Hatten Land reported negative revenue of RM33 million in the previous financial year. Shares of Hatten Land closed at S$0.031 on Monday (Aug 29), down S$0.001 or 3.1 per cent.

US

The dollar shot higher on Monday (Aug 29), briefly scaling fresh 20-year highs against a basket of other currencies, as Federal Reserve chairman Jerome Powell signalled interest rates would be kept higher for longer to bring down uncomfortably high inflation. The dollar index, which measures the currency’s value against a basket of peers, scaled a fresh 2-decade peak of 109.48 before pulling back slightly as the European session wore on. It held around 0.5 per cent firmer against Japan’s yen, while China’s yuan breached the key threshold of 6.9 per dollar and Britain’s pound hit a fresh two-and-a-half year low. The euro managed to claw back some ground and was last up 0.3 per cent at US$0.9993 as hawkish European Central Bank comments lifted expectations for a supersized September rate hike.

Pinduoduo Inc reported quarterly revenue above the street’s estimates on Monday (Aug 29), as a strict lockdown in several Covid-hit Chinese cities kept up demand for online shopping. US-listed shares of the Shanghai-based company rose nearly 7 per cent in trading before the bell. “We saw a recovery in consumer sentiment in the second quarter, especially during the 618 shopping festival,” said chief executive officer Lei Chen. The company, which encourages users to share their purchases on messaging platforms to get lower prices, is also increasingly focusing on international expansion, with its plans to launch a cross-border e-commerce platform targeting the United States as its first market, reported Reuters. Peers JD.com Inc, and Alibaba, also beat expectations earlier this month. Pinduoduo’s total revenue stood at 31.44 billion yuan (S$6.35 billion) in the quarter ended Jun 30, compared with the street’s estimate of 23.68 billion yuan, according to Refinitiv.

Bitcoin is hovering at around US$20,000 as risk appetite wavers after Federal Reserve chairman Jerome Powell stressed that interest rates may have to stay elevated to stamp out inflation. The largest token rose as much as 0.8 per cent on Monday to US$20,142 after trading below that key round-number threshold over the weekend. Other cryptocurrenices dropped, with Avalanche seeing one of the biggest moves within the space with a near -6 per cent decline. Equities also slumped across Asia and Europe as well as in the US, with the S&P 500 shedding 0.5 per cent as of 9:51 am in New York. Money is flowing out of risky assets, and crypto followed the sharp adjustment of the US stock market after Powell’s remarks, said Cici Lu, chief executive officer at consulting firm Venn Link Partners. “Markets didn’t like what he had to say, and Bitcoin is resuming as a high-beta asset.” The US$20,000 level acted as support for Bitcoin when it hit lows in recent months, but the cryptocurrency had worked its way higher in recent weeks. Before Saturday, it hadn’t been below that mark since Jul 14, and had even crossed above US$25,000 earlier in August. That mini-rally was cut short as rate-hike concerns intensified, and Bitcoin has fallen around 20 per cent since Aug 15. The gyrations have come amid uncertainty about the path and magnitude of Fed rate hikes, and the effect they could have on riskier assets.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Technical Pulse: Ford Motor Co

Analyst: Zane Aw

Recommendation: Technical SELL

Sell limit: 15.41 Stop loss: 16.70 Take profit 1: 13.20 Take profit 2: 10.60

Ford Motor Co (NYSE: F) Price is likely to head lower after hitting the downtrend channel resistance.

Upcoming Webinars

Guest Presentation by Halcyon Agri Corporation Limited [NEW]

Date: 31 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3pjErMM

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: TDCX, City Dev, SingTel, Hyphens Pharma, Phillip On The Ground, SG Weekly….

Date: 29 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials