DAILY MORNING NOTE | 5 August 2022

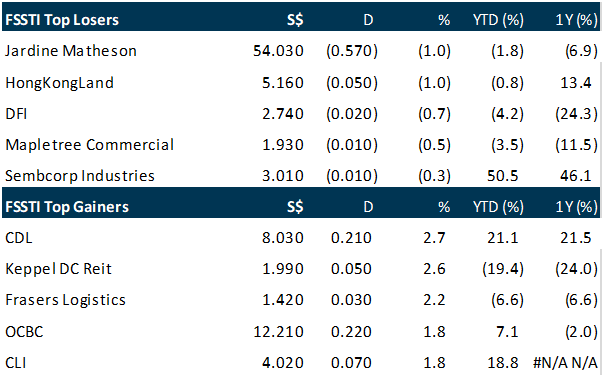

Asian markets rallied on Thursday (Aug 4) as Wall Street finished higher overnight on robust economic data and earnings. The Straits Times Index (STI) closed at 3,269.86, 0.6 per cent or 17.8 points higher, with 21 of the 30 stocks that make up the benchmark registering gains. The banking trio were all up, after DBS released its better-than-expected financial results before market open. DBS, UOB and OCBC rose 0.3 per cent, 0.2 per cent and 1.8 per cent respectively to S$32.41, S$27.84 and S$12.21. Decliners trailed gainers 185 to 295 in the broader market on a turnover of 1.29 billion securities with a total value of S$1.19 billion.

Wall Street stocks finished mixed on Thursday ahead of key US labour data and after the Bank of England became the latest central bank to tighten monetary supply due to inflation. The BOE raised its key interest rate by 0.5 percentage points to 1.75 per cent, its biggest rate hike since 1995. The central bank also forecast a lengthy recession amid uncertainty over energy supply due to the Russian invasion of Ukraine clouds. The move follows a series of similar steps by other central banks, including the Federal Reserve, which will be scrutinizing Friday’s official government jobs data for July. Uncertainty about the Fed’s plans at its Sept 21 meeting is keeping investors on guard. “Wall Street has heard enough from the Fed to know that we are stuck in wait-and-see mode for the next 48 days,” said Oanda’s Edward Moya. The Dow Jones Industrial Average finished down 0.3 per cent at 32,726.82. The broad-based S&P 500 slipped 0.1 per cent to 4,151.94, while the tech-rich Nasdaq Composite Index advanced 0.4 per cent to end the day at 12,720.58.

SG

Singapore banking chiefs expect the sector and broader Asian markets to remain resilient for the rest of the year, although they foresee slower growth amid macroeconomic uncertainties. The trio of Singapore banks saw their net profits jump and logged upward swings in net interest margins (NIMs) for the second quarter of 2022. UOB’s net profit for the second quarter rose 11 per cent, OCBC’s rose 28 per cent, and DBS’s was up 7 per cent, compared with the year-ago period. Profits at OCBC and DBS came in ahead of analysts’ estimates, while UOB’s were in line with consensus forecasts. NIMs rose across the board, amid interest rate hikes. The banks also logged stronger net interest incomes, more than offsetting fee declines due to weaker market conditions. Net interest income is expected to continue benefiting from rate hikes for the rest of this year, even as 2 banks dialed down their full-year loan growth forecasts. OCBC and UOB cut their forecasts to a mid-single-digit percentage, down from the mid-to-high single digits. DBS maintained its forecast at a mid-single digit.

Ascendas Real Estate Investment Trust (A-Reit) has proposed the acquisition of the Philips Asean Pacific (APAC) Centre from Philips Electronics Singapore for S$104.8 million. A-Reit’s manager said on Thursday (Aug 4) that the proposed deal is “well-aligned” with the Reit’s strategic intention, and will strengthen both its portfolio and customer base. The manager is also targeting to attain a Building and Construction Authority (BCA) Green Mark GoldPlus certification for the property after the completion of the proposed acquisition. As at Jun 30, 2022, the property, located in Toa Payoh in Singapore, was leased to 4 tenants; it has an occupancy rate of 95.7 per cent and a long-weighted average lease expiry (WALE) of 4.5 years. Upon completion of the proposed acquisition, Philips will enter a multi-year leaseback of more than two-thirds of the property’s gross floor area, which spans 37,975 square metres. The property is now its APAC headquarters, with a focus on its healthcare and technology business. The purchase consideration of S$104.8 million was negotiated on a willing-buyer, willing-seller basis. As at May 31, 2022, the independent market valuation of the property was S$111.5 million. The manager expects the total acquisition cost to be about S$110.04 million, including stamp duty, professional and other fees and expenses of about S$4.2 million, and the acquisition fee of S$1.048 million payable to the manager. The proposed acquisition will be funded by A-Reit through internal resources and/or existing debt facilities. The pro forma impact on the distribution per unit (DPU) for the financial year Jan 1, 2021 to Dec 31, 2021 is expected to be an improvement of 0.045 Singapore cents, assuming the proposed acquisition was completed on Jan 1, 2021.

StarHub on Thursday (Aug 4) posted a 10.3 per cent drop in net profit to S$60.9 million for its half year ended Jun 30, 2022, from S$67.9 million a year ago. This was despite higher revenue for the half year, which rose 8.7 per cent to S$1.1 billion from S$973.7 million a year ago, the group said in a regulatory filing. The gain in revenue was mainly due to higher contributions from mobile, broadband, entertainment and enterprise business, offset by lower sales of equipment, it added. StarHub’s total operating expenses in the first half of 2022 was 10.5 per cent higher at S$967 million from S$875.5 million a year ago. This was mainly due to the consolidation of JOS SG and JOS MY (under regional ICT services) and MyRepublic Broadband, as well as higher cybersecurity services operating expenses, the group said. Earnings per share fell to 3.3 Singapore cents for the half year, from 3.7 cents a year ago.

US

Global oil prices dropped on Thursday to their lowest levels since before Russia’s February invasion of Ukraine, as traders fretted over the possibility of an economic recession later this year that could torpedo energy demand. Benchmark Brent crude futures settled down US$2.66, or 2.75 per cent, at US$94.12, the lowest close since Feb 18. West Texas Intermediate (WTI) crude futures settled down US$2.34, or 2.12 per cent, at US$88.54, the lowest close since Feb 2. The fall in oil prices could come as a relief to large consumer nations including the United States and countries in Europe, which have been urging producers to ramp up output to offset tight supplies and combat raging inflation. Oil had surged to well over US$120 a barrel earlier in the year. A sudden rebound in demand from the darkest days of the Covid-19 pandemic coincided with supply disruptions stemming from sanctions on major producer Russia over its invasion of Ukraine.

Virgin Galactic Holdings shares plunged after the space tourism company again delayed its commercial service, calling for a launch in the second quarter of 2023. The company had previously disappointed investors by pushing back the launch, once planned for the third, then fourth quarter of 2022. In May, Virgin Galactic delayed it to the first quarter of 2023. On a conference call Thursday (Aug 4) to discuss quarterly results, chief executive officer Michael Colglazier cited supply-chain disruptions and labour constraints as pressures on its operations. Virgin Galactic shares fell 9 per cent to US$7.45 as of 5.51 pm after the close of regular trading in New York. The stock dropped about 39 per cent this year through Thursday’s close. The company, founded by entrepreneur Richard Branson, last month said it was contracting with Boeing’s Aurora Flight Sciences to design and build 2 motherships. The twin-hulled aircraft carry its passenger spaceships to about 50,000 feet and release them to travel into space.

BlackRock is partnering with Coinbase Global to make it easier for institutional investors to manage and trade Bitcoin, marking a major push into cryptocurrencies for the world’s largest asset manager. Top clients will be able to use BlackRock’s Aladdin investment-management system to oversee their exposure to Bitcoin along with other portfolio assets such as stocks and bonds, and to facilitate financing and trading on Coinbase’s exchange, said a statement on Thursday (Aug 4). The focus of the partnership with Coinbase, the biggest US crypto-trading platform, “will initially be on Bitcoin”, BlackRock said. The move underscores how Wall Street’s traditional financial players are expanding deeper into crypto and related technologies, even after this year’s meltdown in such assets. Bitcoin has lost about half of its value in 2022, while the collapse of the Terra ecosystem and Three Arrows Capital have raised questions about the resilience of the market and prompted increased regulatory scrutiny. Coinbase is facing a probe by the US Securities and Exchange Commission into whether the company let Americans trade digital assets that should have been registered as securities. BlackRock chose to partner with Coinbase because of its scale in the market and role in providing trading, custody services, prime brokerage and reporting capabilities. The services will be available for clients of both companies.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

First Sponsor Group – Property Development outlook turn positive

Recommendation: Accumulate (Upgraded), Last Done: S$1.24

Target price: S$1.39, Analyst: Terence Chua

• 1H22 profit of $71.3mn was above our estimates, at 60.5%. The beat came from Property Holding (PH).

• Housing policy relaxation measures in Dongguan drove sales higher. Sales accelerated in the 1.5 months after the implementation of the relaxation measures.

• RMB271.6mn (S$55mn) in net auction proceeds recovered from RMB330mn in defaulted loans. The potential disposal of Pudong Mall, which we estimate in FY23 could see a further recovery of the defaulted loans.

• Upgrade to ACCUMULATE from NEUTRAL with unchanged SOTP target price of S$1.39. Catalysts for a TP upgrade are a recovery in the Chinese property market and its China hotel portfolio.

BRC Asia – Construction sector recovery remains on track

Recommendation: Buy (Maintained), Last Done: S$1.70

Target price: S$2.26, Analyst: Terence Chua

• 9MFY22 revenue and net profit was in line with our expectations at 75%/75% of FY22e. 3Q22 net profit spiked 113.4% YoY driven by the continued recovery in the construction sector and the moderation of steel prices.

• Construction order books inched up slightly to $1.135bn from ~$1bn in the previous quarter. Strong demand for public housing and infrastructure projects in Singapore continued to drive up the Group’s order books.

• Construction site activity levels adversely affected by workplace fatalities and dengue for 1H22, impeding construction progress.

• Maintain BUY with an unchanged target price of S$2.26. Our TP is based on 8x FY22e P/E, still at a 15% discount to the 10-year historical average, on account of the uncertain external environment. We kept FY22e and FY23e earnings unchanged as we expect construction activity to continue its recovery in the next two years. Stock is now trading at 10.7% dividend yield.

Oversea-Chinese Banking Corp Ltd – Growth in NIMs lifts profits

Recommendation: Buy (Maintained), Last done: S$12.21

TP: S$14.22, Analyst: Glenn Thum

• 2Q22 earnings of S$1.48bn were in line with our estimates, from higher net interest income and non-interest income, and lower allowances. 1H22 PATMI is 47% of our FY22e forecast. 2Q22 DPS rose 12% YoY to 28 cents.

• NII grew 16% YoY underpinned by loan growth of 8% YoY and NIM increasing 13bps YoY to 1.71%. Total non-interest income grew 6% YoY due to higher trading and insurance income offset by lower fee income. Allowances fell 69% YoY to S$72mn.

• Maintain BUY with an unchanged target price of S$14.22. Our FY22e estimates remain unchanged. Catalysts include lower provisions and higher interest income as economic conditions improve. OCBC is our preferred pick amongst the three banks due to attractive valuations, upside in dividend from a 15% CET 1 and lower provisioning as the Indonesian and Malaysian economies recover.

DBS Group Holdings Ltd – Higher net interest income support profits

Recommendation: Buy (Maintained), Last done: S$32.41

TP: S$41.60, Analyst: Glenn Thum

• 2Q22 earnings of S$1.82bn in line with our estimates due to higher net interest income offset by lower fee income and other non-interest income. 1H22 PATMI is 47% of our FY22e forecast. 2Q22 DPS up 9% YoY at 36 cents.

• NIM increased 13bps YoY to 1.58% and loan growth of 7% YoY lifted NII. NIM grew 12bps QoQ. Fee income fell 12% YoY and other non-interest income dropped 10% YoY due to weaker market sentiment.

• Maintain BUY with an unchanged target price of S$41.60. Our FY22e estimates remain unchanged. For FY22e, management guided benign provisions, stable growth in loans and improved NIMs. We believe there is upside to the NIM guidance. A 50bps move in interest can raise earnings by 13%.

Upcoming Webinars

Guest Presentation by Pan-United Corporation Limited

Date: 5 August 2022

Time: 11am – 12pm

Register: https://bit.ly/3OFbJ41

Guest Presentation by A-Sonic Group

Date: 11 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3PmoIrl

Guest Presentation by Marathon Digital Holdings

Date: 18 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Research Videos

Weekly Market Outlook: Microsoft, Meta Platforms, Alphabet Inc, UOB, Keppel Corp, Sheng Siong & More

Date: 1 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials