Daily Morning Note – 5 May 2022

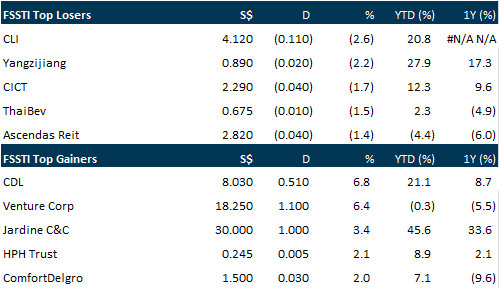

Singapore shares fell marginally on Wednesday (May 4) on muted trading after a 2-day public holiday break and ahead of the Federal Open Market Committee (FOMC) decision on a rate hike tonight. The key Straits Times Index (STI) retreated 7.63 points or 0.2 per cent to 3,349.27, snapping a winning streak over two straight days last week. Trading was muted following a choppy session overnight in Wall Street as investors mostly stood in the sidelines as they awaited the FOMC move.

US stock indexes inched higher at open on Wednesday following positive earnings from companies including Starbucks and Advanced Micro Devices, while investors braced for the biggest U.S. interest rate hike since May 2000. The Dow Jones Industrial Average rose 43.01 points or 0.13 per cent at the open to 33,171.80. The S&P 500 opened higher by 5.70 points or 0.14 per cent at 4,181.18, while the Nasdaq Composite gained 10.97 points or 0.09 per cent to 12,574.73 at the opening bell.

SG

Shares of Yangzijiang Financial Holding continued their downward trend for the third day after the stock’s lacklustre trading debut on Thursday (Apr 28). The counter traded as low as S$0.455 at 1.33 pm on Wednesday, down 16.5 per cent or S$0.09, with around 111 million shares changing hands. One married deal was recorded at 11.52 am, with 600,000 shares traded at S$0.545, according to ShareInvestor data. YZJFH later called for a trading halt at 1.50 pm, pending the release of announcements. Its shares had recovered slightly to trade at S$0.465 then, down 14.7 per cent or S$0.08. Some 114.6 million shares worth S$56.6 million changed hands before the trading halt. The shares were down for the third day since the company was spun off and listed on the Singapore Exchange mainboard last Thursday. The Singapore market was closed on Monday and Tuesday for public holidays.

Shares of mainboard-listed Dyna-Mac Holdings jumped as much as 17.1 per cent on Wednesday (May 4) after the group announced a S$180 million contract win. The counter reached a high of S$0.144 on Wednesday, up 17.1 per cent or S$0.021. This was higher than the 2-year high of S$0.138 it reached on Apr 27 after news of the proposed merger of Keppel Offshore & Marine and Sembcorp Marine. By the midday trading break, shares of Dyna-Mac were up 12.2 per cent or S$0.015 to S$0.138. Around 29.7 million shares changed hands, pushing Dyna-Mac to be among the most actively traded by volume on the Singapore bourse. Dyna-Mac, which fabricates topside modules and structures for the offshore oil and gas industry, announced on Wednesday morning that it obtained a firm contract with a provisional sum of S$180 million from a long-time repeat customer. The new order win brings the company’s net order book to-date to a record high of S$641.1 million, with deliveries stretching into 2024, the group noted.

Ascendas Reit reported positive rental reversion of 4.6 per cent for lease renewals in its first quarter ended Mar 31, with its portfolio occupancy standing at 92.6 per cent, down from 93.2 per cent in the last quarter. Rental reversion for FY2022 is expected to be in the “positive low single-digit range” in view of current market uncertainties, the manager of the real estate investment trust (Reit) said in a quarterly business update on Wednesday (May 4). The manager also noted that 79.1 per cent of the Reit’s borrowings are on fixed rates with an average term of 3.7 years, though it warned that distribution per unit (DPU) could decline by 0.06 to 0.29 cent if interest rates went up by 20 to 100 basis points. Occupancy in Singapore held steady at 90 per cent for the first quarter, it said. It noted that the Reit’s multi-asset portfolio in Singapore worth S$10 billion comprises properties in the business space and life sciences, logistics, and industrial and data centres segments, allowing it “to serve a wide range of customers” across industries. In addition, the recent completion of several asset enhancement initiatives and redevelopment as part of the Reit’s asset rejuvenation plan are expected to generate higher returns for it, the Reit manager added. Units of Ascendas Reit ended Wednesday 1.4 per cent or S$0.04 lower at S$2.82, before the business update release.

US

eBay Inc on Wednesday became the latest e-commerce retailer to give a gloomy revenue forecast as growth slows in the sector after two years of rapid expansion during the pandemic, sending its shares down 6 per cent in extended trading. The company projected second-quarter revenue between US$2.35 billion and US$2.40 billion, compared with the average analyst expectation of US$2.54 billion, according to Refinitiv IBES data. Its full-year forecast was also below market estimates. The dour view reflects the expected hit from a return of pre-pandemic shopping habits and stubbornly high inflation, which is likely to curtail consumer spending. It also mirrors weakness seen at larger rival Amazon.com Inc and arts-and-crafts marketplace Etsy Inc. In the first three months of the year, Ebay’s gross merchandise volume – a widely watched figure for the e-commerce industry’s performance – slumped 20 per cent to US$19.4 billion.

Uber Technologies on Wednesday (May 4) beat expected operating earnings and forecast a strong second quarter, saying it had no need to offer extra incentives to boost its driver supply, unlike its smaller rival Lyft. The ride hail giant brought forward its results to Wednesday morning from the afternoon after Lyft Inc shares sank 26 per cent on Tuesday when it said it needed to pay more to get drivers, dragging down Uber’s stock in its wake. Uber shares were down 2.1 per cent in pre-market trading, paring some of the losses made Tuesday after-hours following Lyft’s earnings release. Uber reported a dip in monthly active users in the first 3 months of the year from the previous quarter, a common trend in the industry during the colder winter months, but was keen to set itself apart from its smaller competitor. “Our driver base is at a post-pandemic high and is more engaged on Uber than on other platforms. Importantly, we expect this trend to continue without significant incremental incentive investments,” Uber chief executive Dara Khosrowshahi said in prepared remarks. Uber reported first-quarter adjusted Ebitda, which excludes stock-based compensation and other expenses, of US$168 million. That surpassed the average analyst expectation of US$132 million, according to IBES data from Refinitiv.

The Federal Reserve on Wednesday announced its biggest rate hike since 2000, with a half percentage point increase as it works to crush soaring US inflation. With inflation at the highest rate in four decades, Federal Reserve Chair Jerome Powell sent a message directly to the American people, expressing concern for the pain caused by rising prices, and pledging to use all available tools to bring them down. But he told reporters he remains confident the economy is strong enough to withstand rate increases without tipping into a recession. After a quarter-point hike in March, the US central bank’s policy-setting Federal Open Market Committee (FOMC) pushed the benchmark interest rate above 0.75 per cent as it works to cool the economy, and confirmed more increases “will be appropriate.” The hike will raise the costs of all types of borrowing, from mortgages to credit cards to car loans, cooling demand and business activity. Inflation has become an overriding concern after the world’s largest economy saw annual consumer prices surge 8.5 per cent over the 12 months to March – the biggest jump since December 1981.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

DBS Group Holdings Ltd – Earnings in line despite lower fee income

Recommendation: Accumulate (Maintained), Last done: S$34.05

TP: S$41.60, Analyst: Glenn Thum

– 1Q22 earnings of S$1.80bn in line with our estimates. 1Q22 PATMI is 24% of our FY22e forecast. 1Q22 DPS stable QoQ at 36 cents.

– NIM fell 3bps YoY to 1.46% but loan growth of 8% YoY cushioned NII. NIM grew 3bps QoQ. Fee income grew 9% QoQ but fell 7% YoY due to weaker market sentiment.

– Maintain ACCUMULATE with unchanged target price of S$41.60. Our FY22e estimates remain unchanged. For FY22e, management guided benign provisions, continued growth in loans and stable NIMs. We believe there is upside to NIM guidance. A 50bps move in interest can raise earnings by 13%.

United Overseas Bank Limited – Let down by weaker fee and non-interest income

Recommendation: Accumulate (Maintained), Last done: S$30.24

TP: S$35.70, Analyst: Glenn Thum

– 1Q22 earnings of S$906mn were lower than our estimates due to lower-than-expected fee and other non-interest income. 3M22 PATMI is 19% of our FY22e forecast.

– NII was up 1% QoQ from an NIM increase of 2bps QoQ to 1.58% and loan growth of 3% QoQ. Fee income was flat QoQ while other non-interest income was down 43% QoQ. Management guidance of single-digit loans growth with stable NIMs and provisions remains unchanged.

– Maintain ACCUMULATE with unchanged target price of S$35.70. Our FY22e estimates remain unchanged. We assume 1.46x FY22e P/BV and ROE estimate of 11.5% in our GGM valuation. There is upside to our estimates from further GP write-backs and higher NIMs. Every 25bps rise in interest rates can raise NIM by 0.04% and PATMI by 4.3%.

Meta Platforms Inc – Earnings beat, with user growth rebounding

Recommendation: BUY (Maintained); TP US$312.00,

Last close: US$223.41; Analyst: Jonathan Woo

– 1Q22 earnings in line with expectations. 1Q22 revenue/PATMI at 21/22% of our FY21e forecasts. EPS beat consensus estimates of by 6% as a result of lower than expected total expenses.

– Positive user growth across all metrics for 1Q22, with Facebook DAU rebounding from negative QoQ growth in 4Q21.

– Continued negative impact on revenue from suspending operations in Russia, and from strengthening US dollar.

– We maintain a BUY recommendation with a DCF target price of US$312.00 (WACC 6.6%, g 3.5%).

Company ESG Report – Tesla Inc

Author: Phillip Capital Management

– We rate Tesla’s overall ESG risk management as 3.78/10, comprising Environment (6.88/10), Social (3.52/10) and Governance (3.85/10).

– Tesla meets our double materiality objectives but lacks disclosure on measurable targets and sustainability commitments.

– EVs have a green standing, but the manufacturing process is not so green. Despite its efforts, it is necessary for Tesla to reduce consumption and emissions from production.

Click the link to join: https://t.me/stocksbnb

Date: 25 April 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.