DAILY MORNING NOTE | 5 September 2022

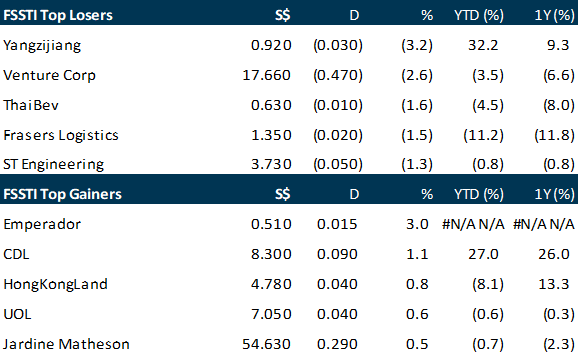

Singapore shares wrapped up the week’s trading on a low note, following the “Sell in September” theme, as caution ruled ahead of a key risk trigger – the release of US labour market data. If favourable, it could indicate that the US Federal Reserve has more room to aggressively raise rates. The Straits Times Index (STI) retreated 18.39 points or 0.57 per cent to 3,205.69, finishing lower week-on-week by 43.84 points or 1.35 per cent. Equity gauges in Japan, Hong Kong, Taiwan, South Korea and Australia slipped while Malaysia and China finished higher. Concerns persisted over the tightening trajectory with more hawkish talk from the US Fed while a string of data this week cemented fears over surging prices and slowing economic activity.

Wall Street stocks ended the week with losses on Friday (Sep 2) as an early-session rally fizzled following government data indicating employers slowed the pace of hiring in August. Data showed the US economy added 315,000 jobs last month, which was in line with what economists were expecting, but lower than the 526,000 posted in July. Stocks initially rose on the report as markets bet the moderating employment situation would ease pressure on the Federal Reserve to hike interest rates. But markets reversed course midday after Russia’s move to halt natural gas deliveries to Germany sharpened worries over a European recession. The Dow Jones Industrial Average ended 1.1 per cent lower at 31,318.44.

Stocks to watch: Axington

SG

Axington has entered into a conditional sale and purchase agreement (SPA) with Serial I-Tech (Far East) to acquire Achieva Technology in a deal that would result in a reverse takeover (RTO). Serial I-Tech is is a wholly-owned subsidiary of mainboard-listed , while Achieva is in the business of distribution of information technology, computer peripherals, parts, software and related products in Malaysia. Achieva’s combined net asset value and net tangible assets were at S$3.3 million as at Dec 31, 2021. Under the SPA, the consideration payable by Axington will be the lower of either a sum of S$27 million, or the valuation ascribed to the sale shares, based on an independent valuation. Axington, which does not have any revenue-generating business and faces delisting if it does not acquire a new business, said that the proposed acquisition would enable shareholders to participate in business areas that have potential for significant growth.

More than 20 Axa Singapore employees have been told their roles have become redundant and will be terminated, The Straits Times has learnt. The last day of their employment with HSBC, Axa Singapore’s parent company, will be Nov 30, the affected staff were informed on Thursday. ST understands the retrenchment exercise continued on Friday. Many of those laid off would not speak on the record because they had signed a non-disclosure agreement. ST understands that the affected employees were given three business days to consider the terms of the severance payment offered.

Renwable energy infrastructure company Metis Energy has entered into a sale and purchase agreement with Kaiyi Investment to sell shares in Manhattan Property Development (MPDPL) for US$45.7 million. Metis Energy, formerly known as Manhattan Resources, currently holds 30.2 per cent shareholding interest in MPDPL, while Kaiyi, an investment holding firm, holds 69.8 per cent. The company had agreed last Friday (Sep 2) to sell all its remaining shares in the capital of MPDPL to Kaiyi, which had agreed to purchase, Metis Energy said in a bourse filing on Sunday. In 2014, Metis Energy had entered into a joint venture agreement with Kaiyi in connection with the incorporation of MPDPL. The principal asset of MPDPL is its wholly-owned subsidiary, Manhattan Resources (Ningbo) Property, which carries out the group’s property development business in China, primarily the development of the Ningbo Yinzhou Manhattan Tower.

US

Warren Buffett’s Berkshire Hathaway trimmed its stake in BYD even further, offloading another 1.72 million shares as of Sep 1, according to an exchange filing Friday, just days after the legendary US investor began reducing his holding in China’s biggest maker of electric vehicles. Berkshire’s interest in BYD’s Hong Kong-listed shares has now fallen to 18.87 per cent from 19.02 per cent, with the latest securities sold for an average of HK$262.72 apiece, giving the stake a value of around HK$450.8 million (S$80 million). That takes Berkshire’s total shares jettisoned to 3.05 million, or 1.4 per cent of Buffett’s known 225-million-share holding. Theories about Buffett’s plans for the bellwether Chinese electric car company have swirled since a 20.49 per cent stake – identical to the size of Berkshire’s last reported BYD position in Hong Kong as of the end of June – entered the Central Clearing and Settlement System in July, a sign to investors a sale may be imminent. That triggered the biggest slump in BYD stock in nearly 2 years.

A big pandemic-era distortion in the world of finance is well and truly over – and the new normal is helping fuel the worst cross-asset sell-off in decades. After being trapped in negative territory during the lockdown days, inflation-adjusted Treasury yields are again breaking out, with 5- and 10-year measures back near multi-year highs. In another sign that the free-money era is no more, short-dated real rates suddenly jumped last week to the highest since March 2020 after finally turning positive in early August. All this is bad for news for money managers across the board, with rate-sensitive allocations harder to justify from tech stocks to long-maturity corporate bonds. Rising real yields – seen as the true cost of money for borrowers – are rippling through the economy as mortgage rates soar while corporate America adjusts to the higher cost of doing business.

Citigroup on Friday (Sep 2) said it has slightly trimmed its mortgage workforce, due to an internal streamlining of functions. Fewer than 100 positions were affected, according to Bloomberg News, which first reported the layoffs. “We are doing our best to support each individual by helping them to find new employment opportunities within Citi or outside the firm,” a spokesperson for Citi said in a statement. After hiring tens of thousands of staff between 2018 and 2020 to handle surging mortgage originations and refinancings driven by low interest rates, the mortgage sector is downsizing.

The Biden administration said on Friday (Sep 2) it will keep tariffs on hundreds of billions of dollars’ worth of Chinese imports in place while it continues a statutory review of the duties imposed by former president Donald Trump. The US Trade Representative’s (USTR) office said in a federal notice that it received requests from companies and other interested parties to maintain the “Section 301“ tariffs imposed in 2018 and 2019. The comments were collected during the spring and summer. Based on the 1974 trade law under which the duties were imposed, USTR will move on to a formal review of whether to keep the tariffs in place, a process that could take months.

The United States on Friday (Sep 2) announced a US$1.1 billion arms package for Taiwan, vowing to keep boosting the island’s defences as tensions soar with Beijing, which warned Washington of “counter-measures”. The sale comes a month after House Speaker Nancy Pelosi defiantly visited Taiwan, prompting mainland China to launch a show of force that could be a trial run for a future invasion. The package – the largest for Taiwan approved under President Joe Biden’s administration – includes US$665 million for contractor support to maintain and upgrade a Raytheon early radar warning system in operation since 2013 that would warn Taiwan about an incoming attack.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Singapore Telecommunications Ltd – Momentum in mobile prices

Recommendation: ACCUMULATE (Maintained); TP S$3.05, Last close: S$2.60; Analyst Paul Chew

• At the recent investor day, a key highlight was the recovery in mobile prices in Singapore, Australia, India and Indonesia from the benign competition and the return of roaming revenue.

• Business segments with softer outlooks include AIS and NCS. Softer AIS outlook is due to intense competition, and for NCS it is the near-term ramp-up in headcount and staff cost.

• Our ACCUMULATE and SOTP TP are maintained at $3.05. The group aims to raise ROIC from 5.4% to a high single digit in the mid-term, essentially doubling earnings. The tailwinds for the group include rising mobile prices and the disposal of loss-making subsidiaries. Other drivers such as 5G monetization, cost optimisation and IT services, will be more elusive, in our opinion.

Koda Ltd – Demand lull in the near term

Recommendation: NEUTRAL (Downgraded), Last Done: S$0.50 Target Price: S$0.50, Analyst: Paul Chew

• FY22 PATMI was within expectation, excluding the losses from the Vietnam plant fire incident. FY22 revenue and PATMI were 107%/97% of our forecast. Final dividend was cut 25% YoY to 0.75 cents.

• The outlook is cautious. Furniture inventories in the US are piling up from overstocking triggered by supply chain worries and softer consumer demand which is shifting to services.

• Our FY23e earnings is cut by 54% to US$4.6mn. We downgrade our recommendation from BUY to NEUTRAL. The target price is lowered to S$0.50 (prev. S$1.10). Our TP is pegged to 5x ex-cash FY23e PE, in tandem with historical PE (ex-cash).

Upcoming Webinars

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by Credit Bureau Asia [NEW]

Date: 14 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Rj2MP4

Guest Presentation by AIMS APAC REIT [NEW]

Date: 15 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3KAETjD

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: TDCX, City Dev, SingTel, Hyphens Pharma, Phillip On The Ground, SG Weekly….

Date: 29 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials